If you’re trading crypto in 2025, you need to understand how crypto tax FIFO vs HIFO and Specific Identification can make or break your profits. The tax method you use can legally shift thousands back into your pocket – and it’s time you learned how to play it smart.

Understanding Cost Basis: The Foundation of Crypto Taxation

Every crypto sale, swap, or spend triggers a taxable event. The gain or loss you report depends on your cost basis – what you originally paid for that crypto, plus any fees. Choosing how you calculate that basis determines which coins you’re deemed to sell first, and that choice defines how much tax you owe.

The main cost-basis methods are:

- FIFO (First In, First Out) – The oldest assets are sold first.

- HIFO (Highest In, First Out) – The most expensive assets are sold first.

- Specific Identification (Spec ID) – You choose which lots are sold.

Your method isn’t just paperwork. It’s a weapon for controlling your taxable gains – or losses – strategically.

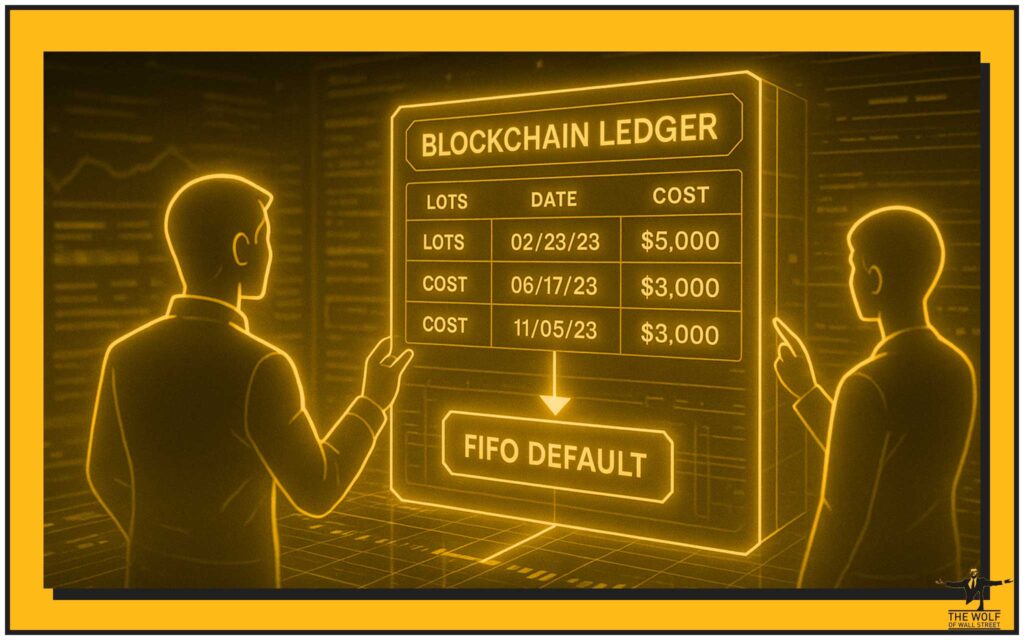

⏳ FIFO: The Default That Often Costs You More

FIFO is the standard. It assumes the first coins you bought are the first you sell. It’s simple, automatic, and – let’s be honest – often expensive when markets pump.

Example:

Buy 1 BTC for £20,000, another for £30,000, then sell 1 BTC for £40,000. Under FIFO, your cost basis is £20,000, giving you a £20,000 taxable gain.

That’s a hefty bill for not planning ahead.

Where it applies:

- US: Default under IRS rules if no specific identification is made (IRS eCFR §1.1012-1(j)).

- UK: Used indirectly via pooling rules.

- Australia: Acceptable if records are consistent.

Why it’s popular:

- Simple, universal, easy to calculate.

- Preferred by tax authorities if you stay silent.

- But in a bull market? It’s like volunteering to pay extra tax.

👉 Master crypto order types to improve timing and efficiency.

🚀 HIFO: The Legal Tax-Saving Power Play

HIFO (Highest In, First Out) flips the script. Instead of selling your oldest coins, you sell the ones you bought at the highest price. That means smaller gains and smaller tax bills when the market rises.

Example:

Using the same trades: bought 1 BTC at £20k and another at £30k, sold one for £40k. Under HIFO, you sell the £30k lot first, so your taxable gain is just £10k – half what it would be under FIFO.

The key: HIFO only works when properly documented. In the US, it’s permitted under the Specific Identification rule – but only if you can prove which assets were sold at or before the transaction.

Tips to stay compliant:

- Set a standing instruction with your broker to always sell HIFO lots.

- Maintain a record of lot selection confirmations and TXIDs.

- Document your trades meticulously before tax season.

Why traders use HIFO:

- Legally minimises taxable gains in rising markets.

- Helps align realised profits with real cash flow.

- Works perfectly when combined with solid bookkeeping tools.

⚠️ Warning: If you can’t provide records, the IRS defaults to FIFO automatically.

👉 Learn to optimise crypto profit-taking and timing.

🔍 Specific Identification (Spec ID): The Backbone of Flexibility

Specific Identification is how you tell tax authorities exactly which crypto you sold. It’s the legal backbone that allows strategies like HIFO or even LIFO.

Under IRS rules effective January 2025, if you don’t specifically identify your lots by the time of sale, your transactions default to FIFO. No exceptions.

How to comply:

- Maintain detailed records: acquisition date, cost, wallet, TXID, exchange.

- Get written confirmation of which lots were sold from your platform.

- Store all supporting evidence for a minimum of five years.

This isn’t busywork – it’s the difference between paying 10% or 30% on the same profit.

Pro insight:

If you’re a high-volume trader, use automated tax software that logs and timestamps your lot selections. From 2025, exchanges will issue Form 1099-DA – make sure your records align with theirs.

👉 Stay compliant with crypto tax and AML reporting here.

🇬🇧 The UK’s Unique System: Pooling, Same-Day & 30-Day Rules

HMRC doesn’t play by the FIFO/HIFO framework. Instead, the UK applies Section 104 pooling, a method that averages the cost of your crypto holdings.

Here’s how it works:

- Same-Day Rule: Transactions on the same day are matched first.

- 30-Day Rule: Any purchases within 30 days after the sale are matched next.

- Section 104 Pool: Everything else goes into one ongoing pool, averaged for cost.

Example:

Buy 1 ETH at £1,000, sell for £1,500, then rebuy 1 ETH at £1,200 within 30 days. HMRC matches your sale to the £1,200 purchase – not the original £1,000 – due to the 30-day rule.

Why this matters:

It prevents wash sales and ensures consistent reporting. FIFO or HIFO aren’t directly used here, but cost averaging still determines your gain or loss.

References: HMRC manuals CRYPTO22200, CRYPTO22254, CRYPTO22255.

👉 Learn more about UK crypto tax compliance and 30-day rules.

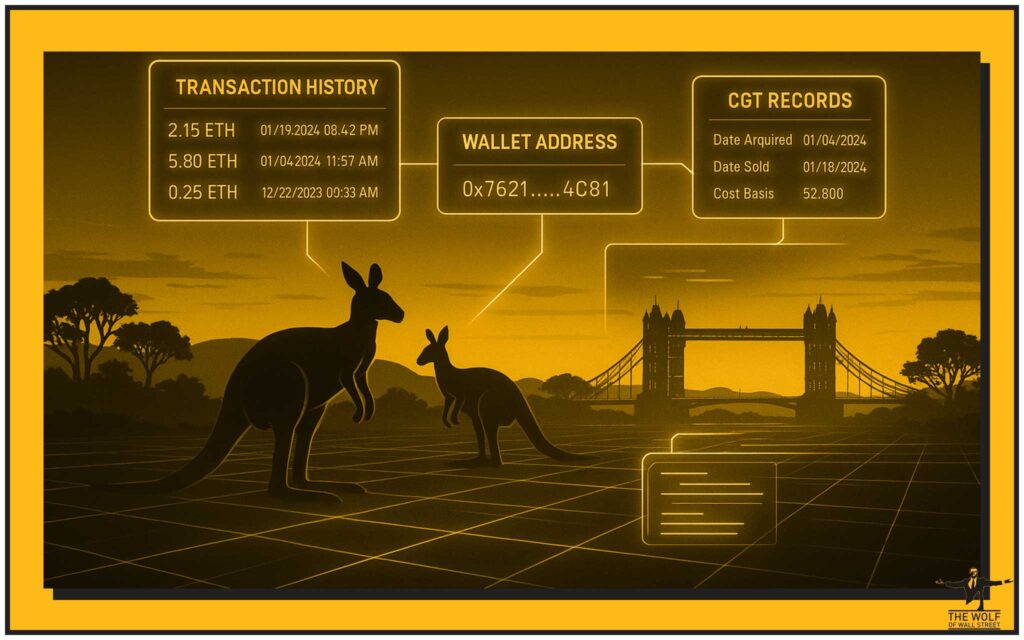

🇦🇺 Australia: The Land of Record-Keeping Discipline

In Australia, the ATO treats crypto as a Capital Gains Tax (CGT) asset. There’s flexibility to use FIFO, LIFO, or HIFO if you can specifically identify your lots – but only when records are clear and consistent.

Your must-have records:

- Date and time of each transaction.

- Market value in AUD at the time.

- Wallet addresses and exchange data.

- Purpose of the transaction (buy/sell/swap).

The ATO’s stance is simple: accuracy and proof trump method. No records, no deductions.

👉 Explore how Australian traders manage CGT in crypto markets.

🧠 Choosing Your Winning Strategy

Your best cost-basis method depends on your trading style:

- Long-term investor: FIFO is simple and transparent.

- Active trader: HIFO via Spec ID saves money when prices rise.

- UK investor: Understand the pooling and 30-day rules inside-out.

- Australian investor: Focus on record precision.

Ask yourself:

- Can I document every trade clearly?

- Does my exchange support lot selection?

- Am I willing to stick with one method per tax year?

Pro tip: In a bull run, HIFO shines. In a bear market, FIFO might help you realise losses strategically.

👉 Know when to sell crypto for maximum benefit.

💼 Real-World Example: Same Trades, Different Outcomes

Let’s make it real:

- Buy: 2 ETH at £1,000, then 2 ETH at £2,000.

- Sell: 2 ETH for £2,500 each.

FIFO: You sell the £1,000 lots → £3,000 taxable gain.

HIFO: You sell the £2,000 lots → £1,000 taxable gain.

Spec ID: You choose the outcome – control is yours.

That’s not theory; that’s strategy. The rules are the same, but your results depend on how you play the game.

🐺 The The Wolf Of Wall Street Power Move: Trade Smart, File Smarter

If you’re ready to go beyond the basics, step into the The Wolf Of Wall Street crypto trading community – where traders and analysts work together to dominate markets while staying compliant.

Here’s what you get:

- Exclusive VIP Signals: Actionable trading insights designed to maximise profits.

- Expert Market Analysis: Real-time commentary from seasoned traders.

- Private Community: Over 150,000 crypto traders sharing insights daily.

- Essential Tools: Calculators, volume indicators, and data trackers for sharper decisions.

- 24/7 Support: Around-the-clock guidance from experts who speak your language.

🚀 Empower your crypto trading journey:

- 👉 Visit The Wolf Of Wall Street Service for full details.

- 👉 Join the live community on Telegram for instant updates.

The Wolf Of Wall Street doesn’t just teach you to trade – it helps you keep what you earn.

❓ FAQs: Your Crypto Tax Questions Answered

1️⃣ Can I use HIFO for crypto taxes in the US in 2025?

Yes – via Specific Identification. You must clearly document your lot selections at or before each sale. Without that, FIFO applies by default under IRS regulations.

2️⃣ Does HMRC allow HIFO or LIFO in the UK?

No. The UK uses pooling and matching rules: same-day, 30-day, then Section 104 Pool. HIFO and LIFO frameworks don’t apply under HMRC’s system.

3️⃣ What if my exchange doesn’t support lot selection?

You can still document your trades manually or through third-party software. But if you don’t identify lots on time, FIFO is used automatically in the US.

4️⃣ Do staking rewards and airdrops affect my tax?

Yes. They’re treated as income at fair market value upon receipt and add to your cost basis for future disposals.

5️⃣ How long should I keep my records?

Most tax authorities recommend keeping data for at least five years – including TXIDs, wallet addresses, timestamps, and exchange receipts.

📊 Final Thoughts: Take Control of Your Crypto Tax Strategy

Crypto taxation isn’t guesswork – it’s a strategy. Whether you use FIFO, HIFO, or Specific Identification, the key is clarity and consistency. The smartest traders aren’t just making gains – they’re keeping them.

So, document every move, plan your disposals like a professional, and use the rules to your advantage.

Join The Wolf Of Wall Street, level up your trading, and start mastering crypto tax FIFO vs HIFO like a Wolf of Wall Street.