When the biggest whales on the corporate side of crypto suddenly go quiet, it’s not a coincidence – it’s a signal.

In the wake of October’s sharp sell-off, the so-called digital asset treasuries (DATs) – companies that hold Bitcoin (BTC) or Ethereum (ETH) on their balance sheets – have slammed on the brakes.

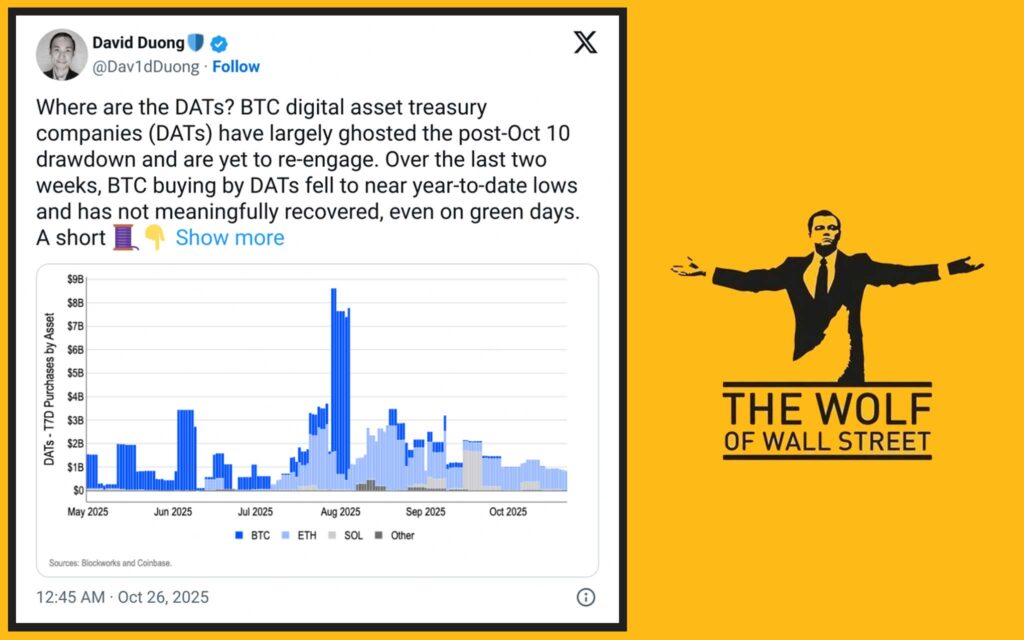

According to Coinbase Institutional’s David Duong, treasury BTC purchases have dropped to near year-to-date lows, and haven’t bounced even as prices recovered. Translation? The corporate bid that supported the market all year has ghosted.

Let’s break down what that really means – and how to trade it like a pro.

🐋 What Are Digital Asset Treasuries (DATs)?

DATs are public or private companies that strategically hold crypto assets – mostly Bitcoin and Ethereum – as part of their corporate treasury management.

Think of them as the new-age gold hoarders of the decentralised world. From MicroStrategy to Metaplanet, these entities accumulate crypto not just for speculation but for liquidity preservation, inflation hedging, and balance-sheet diversification.

When DATs buy, they soak up supply and validate the market narrative. When they stop – like they have now – liquidity thins, volatility spikes, and traders suddenly feel the floor disappear beneath them.

If you’re new to this concept, dive deeper into why corporations and even nations are adopting this model in The Treasury Model.

💥 The October Pullback: Why Treasuries Hit Pause

Bitcoin tanked roughly 9% between 10–11 October, dropping from around $121,500 to near $110,000, before stabilising near $114K. Ethereum followed suit, slipping below $3,400.

Since then, the data shows a decisive shift – DATs stopped buying. Treasury-related BTC flows dropped to their lowest levels in months.

So why the sudden freeze? It’s not panic; it’s process.

🛑 Risk Committees Hit the Brakes

After a big drawdown, risk departments clamp down on new buys until the next reporting cycle. CFOs don’t “buy the dip”; they buy approved dips. Those internal pauses can last weeks.

⚖️ Regulation Clouds the Room

From ETF approvals to central bank policy pivots, uncertainty kills aggression. Treasuries don’t act on gut – they act on clarity. When regulators send mixed signals, DATs stay in cash.

💰 Waiting for Cleaner Entry Points

For institutional buyers, timing is an allocation exercise, not an impulse trade. Some boards are simply waiting for key support zones or macro signals before they reload.

So, while retail traders scream “Where’s the bid?”, the answer is: it’s waiting for permission.

🚀 The Outlier: BitMine’s Billion-Dollar ETH Bet

Now here’s where it gets spicy. While others froze, BitMine Immersion Technologies went the other way – dropping US $1.9 billion to scoop up nearly 483,000 ETH during the downturn【source】.

This move pushed their total holdings above 3.3 million ETH, solidifying BitMine as the Ethereum treasury king.

Why ETH? Because unlike BTC, it’s a productive reserve asset – it earns staking yield, fuels DeFi ecosystems, and benefits from the growing tokenisation movement.

For a deeper look at ETH’s evolving fundamentals, check out the Ethereum Fusaka Upgrade, which highlights the chain’s next major efficiency leap.

📈 The Trader’s Playbook When Treasuries Disappear

You’re not a treasury; you’re a hunter. When the big buyers vanish, you don’t panic – you adapt. Here’s how.

1️⃣ Trade Ranges, Not Fairy Tales

Without the corporate bid, breakouts fail faster. Focus on clean range plays and confirm momentum before committing.

Use indicators like RSI and Money Flow Index (MFI) to gauge real strength.

2️⃣ Respect Liquidity Voids

With DATs sidelined, order books thin out. Watch volume heatmaps and cut position size during illiquid hours.

Learn to master Crypto Order Types to control slippage like a pro.

3️⃣ Fade the First Spike, Ride the Second

Rally-one is shorts covering. Rally-two is conviction. Without treasuries, the first move is usually fake.

Patience pays. Let price confirm – don’t front-run ghosts.

4️⃣ Track Treasury Proxies

Keep tabs on ETFs, fund inflows, and companies with BTC exposure. If their volumes tick up, the institutional bid is sneaking back in.

5️⃣ Rotate Smart

If ETH shows structural inflows while BTC stalls, a pair trade (long ETH / short BTC) captures relative strength without full market exposure. That’s how professionals stay profitable in sideways conditions.

🌍 Macro & Regulatory Context: The Invisible Hand

Corporate treasuries don’t move in isolation – they dance to the rhythm of macro.

- Interest Rates: Rising real yields tighten risk budgets. A central-bank pause could flip the switch back to accumulation.

- ETF Flows: Sustained inflows into BTC and ETH ETFs are institutional green lights.

- Policy Direction: Regulatory clarity (or even hints of it) can unleash sidelined capital.

Stay ahead by monitoring weekly ETF data and macro calendars. Confidence doesn’t return overnight – it drips in with liquidity.

🦾 The Long-Term Thesis: Setup, Not Shutdown

This isn’t the end of corporate crypto accumulation – it’s an intermission.

When balance sheets reset and auditors nod, the treasuries will come back, and when they do, they’ll buy size.

For investors with patience and conviction, this phase is a prime accumulation zone disguised as uncertainty.

If you want proof that long-term conviction wins, look at the corporate arms race in Metaplanet vs. Semler Scientific – two firms using Bitcoin to out-strategise inflation and outperform competitors.

🔥 Turn Volatility Into Opportunity

If you want to trade like the treasuries – minus the bureaucracy – join a community built for exactly this market.

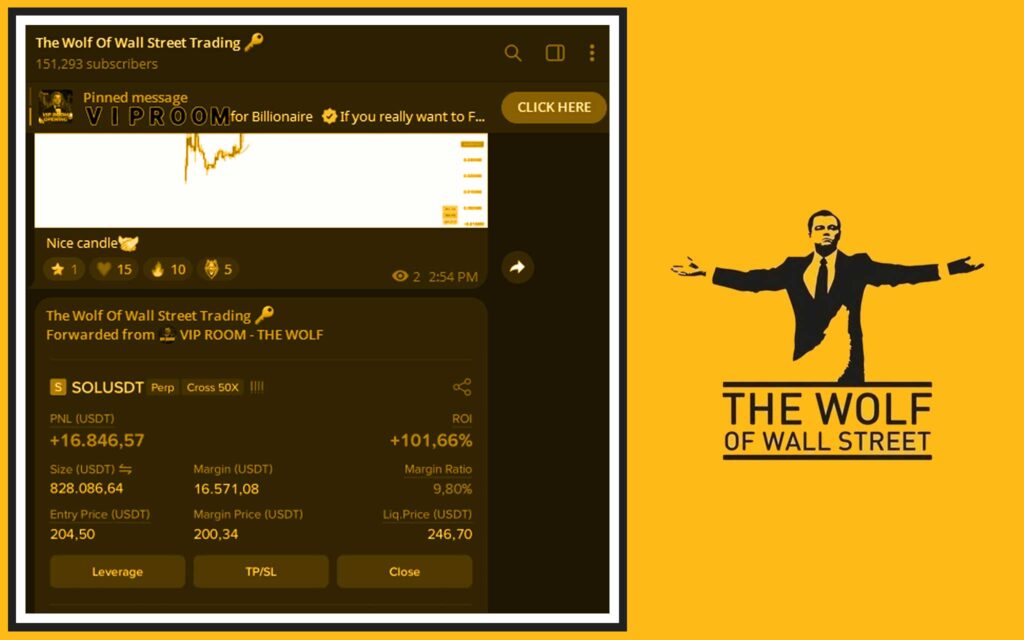

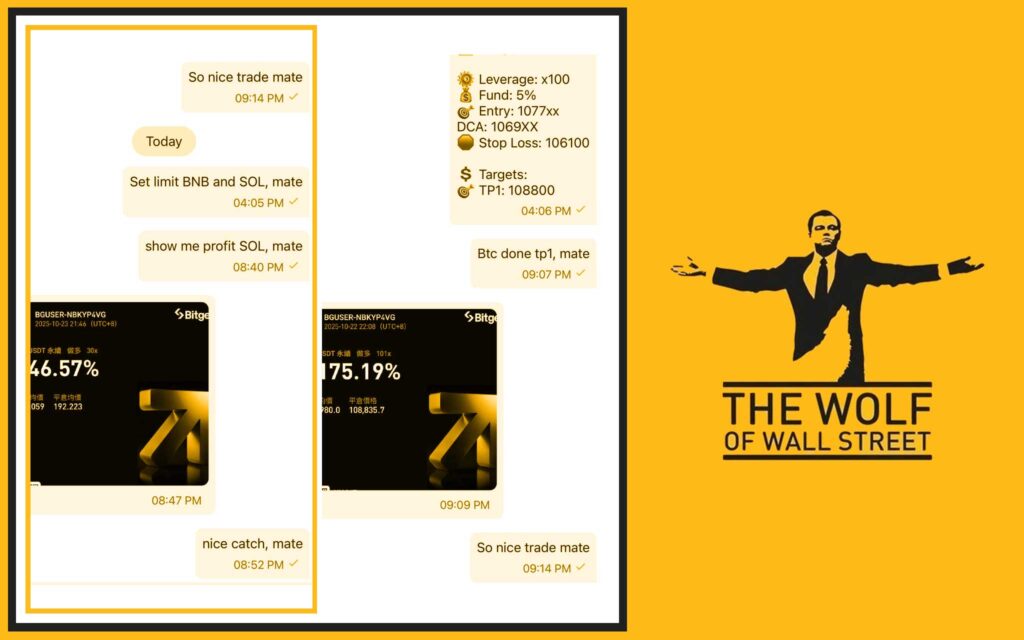

The The Wolf Of Wall Street Crypto Trading Community gives you:

- Exclusive VIP Signals engineered for asymmetric gains

- Expert Market Analysis from veteran traders

- Private Network (150,000+) sharing real-time insights

- Essential Trading Tools – from volume calculators to position-size scripts

- 24/7 Support so you’re never flying blind

Join the conversation on Telegram, plug into the energy, and start trading volatility with purpose.

You don’t need Wall Street – you need wolf street.

❓ FAQs

Is the treasury slowdown bearish short term?

It signals caution, not collapse. With DATs on hold, price discovery becomes volatile. Great for active traders; risky for leveraged dreamers.

Why is ETH attracting more treasury demand than BTC?

Yield. Staking rewards make ETH a productive asset, while BTC remains a passive store of value. Institutions love yield.

When will the corporate bid return?

Watch ETF inflows and macro policy signals. Once clarity hits, balance-sheet buyers will start cost-averaging again.

How should traders manage risk now?

Size down when volatility spikes. Use stop-losses based on invalidation levels, not emotion. Read the Money Flow Index guide to keep discipline.

Is this a good time for long-term investors to buy?

If your thesis spans years, not weeks – yes. Stagger entries, accumulate in zones, and let fear work in your favour.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market:

- Exclusive VIP Signals for profit-driven trades

- Expert Market Analysis and educational insights

- Private Community with over 150,000 members

- Essential Tools including volume calculators and tracking resources

- 24/7 Support for traders worldwide

👉 Empower your trading journey:

Visit The Wolf Of Wall Street Service | Join The Wolf Of Wall Street Telegram

References: