💰 Introduction: The Digital Nomad’s Tax Trap

You left the office. You escaped the 9-to-5. Now you trade crypto from Bali, Lisbon, or Dubai. Freedom, right?

Wrong.

The moment you earn crypto abroad, tax authorities in multiple countries start circling. They want their cut. And if you ignore them, they will find you. Blockchain is transparent. Your transactions are not invisible. The OECD’s Crypto-Asset Reporting Framework is live in 2025. Exchanges share data. Governments compare notes.

Double taxation is real. Penalties are brutal. But here is the truth: compliance is your competitive advantage. Nomads who understand tax law keep more profit than amateurs who hide and hope.

This guide shows you how to legally minimize crypto taxes while living anywhere. No fluff. No theory. Just strategy.

🌍 What Defines a Digital Nomad in 2025?

A digital nomad earns income remotely while moving between countries. You might freelance, trade crypto, run an online business, or work for a global employer. Your office is a laptop. Your home is wherever you land.

Crypto suits this lifestyle. Wallets are portable. Transactions are borderless. You can trade Bitcoin in Bangkok and stake Ethereum in Barcelona. No banks. No borders.

But tax systems were built for people who stay put. Governments assume you live somewhere. They expect you to file. They demand their share. When you move every few months, multiple countries may claim you as a tax resident. That is where the trouble starts.

⚖️ Tax Residency: The Foundation of Everything

Tax residency determines which country can tax your worldwide income. Most nations use a 183-day rule: spend more than half the year there, and you are a resident. Some countries add domicile tests (your permanent home) or substantial presence formulas (weighted days over three years).

The US uses citizenship-based taxation. If you hold a US passport, you owe tax on global income no matter where you live. Renouncing citizenship does not erase tax obligations retroactively.

Overlapping residency is common. Spain might claim you because you rented an apartment for seven months. The UK might claim you because you kept a flat in London. The US claims you because you were born there. Now three countries want tax on the same crypto profits.

Track every day you spend in each country. Save flight tickets, hotel receipts, and entry stamps. Residency disputes are won with documentation, not arguments.

🔥 Why Crypto Complicates Tax Residency

Crypto transactions happen on global ledgers. Your wallet address is visible. Exchanges report to tax authorities under CARF. When you withdraw fiat, banks file suspicious activity reports if amounts exceed thresholds.

Governments know you earned crypto. They know you moved it. They assume you owe tax. If you cannot prove where you were a tax resident, they default to claiming you everywhere.

Privacy coins like Monero reduce traceability but increase audit risk. Mixers and tumblers trigger red flags. Using a VPN to trade does not hide your residency. It makes you look like you are evading.

The safest path is transparency. Declare income where you are legally resident. Pay what you owe. Keep records that prove compliance.

💸 Types of Crypto Taxes Digital Nomads Face

Crypto earnings attract different taxes depending on how you earn them.

Income Tax: If you receive crypto for services (freelance work, salary, consulting), it is ordinary income. Tax applies at your marginal rate in your country of residence. Staking rewards and mining proceeds also count as income.

Capital Gains Tax: Buying low and selling high creates a taxable gain. Short-term gains (assets held under one year) are taxed as income in most countries. Long-term gains get preferential rates. Germany exempts crypto held over one year from personal capital gains tax. The UAE has no capital gains tax.

Self-Employment Tax: If you trade crypto full-time or run a crypto business, you may owe self-employment tax. The US charges 15.3% on net self-employment income. Other countries apply similar social security contributions.

VAT/GST: Some jurisdictions tax crypto transactions as goods or services. Most exempt crypto-to-crypto trades, but rules vary.

Understanding crypto tax calculation methods like FIFO, HIFO, and Specific ID can reduce your liability legally.

🌐 Three Global Tax Systems Explained

Countries tax foreign income in three ways.

Territorial Tax Systems: Singapore, Hong Kong, and Panama tax only income earned within their borders. Crypto profits from foreign exchanges may be exempt. This appeals to nomads who trade remotely. But establishing territorial treatment requires proof that income originated abroad. Residency alone is not enough.

Worldwide Tax Systems: Australia, the UK, and Canada tax residents on global income. If you are a tax resident, all crypto gains are taxable regardless of where you earned them. Double Taxation Agreements (DTAs) prevent being taxed twice on the same income.

Citizenship-Based Taxation: The US taxes citizens and green card holders on worldwide income even if they live abroad. The Foreign Earned Income Exclusion (FEIE) can shelter up to $126,500 of earned income in 2025, but it does not cover capital gains or passive income. Crypto trading profits are taxed in full.

Choosing where to establish residency shapes your tax burden for years. Research before you relocate.

🛡️ Double Taxation Agreements: Your First Line of Defense

DTAs are treaties between countries that allocate taxing rights. If you qualify as a tax resident in two countries, the DTA determines which one gets to tax specific income types.

Most DTAs use tie-breaker rules: permanent home, center of vital interests, habitual abode, and nationality. If you rent an apartment in Portugal and maintain no ties to your home country, Portugal likely wins the residency claim.

DTAs do not eliminate tax. They prevent double taxation by giving one country primary rights and offering foreign tax credits in the other. You still pay tax. You just pay it once.

Not all countries have DTAs with each other. Check treaty networks before relocating. If no DTA exists, you risk dual taxation with no relief.

📜 OECD CARF and MiCA: The 2025 Enforcement Wave

The OECD Crypto-Asset Reporting Framework went live in 2025. Over 50 jurisdictions now require crypto exchanges to report customer transactions to tax authorities. This data is shared across borders automatically.

CARF covers trades, transfers, and holdings above $50,000. If you move crypto between wallets, CARF tracks it. If you cash out, your bank reports it. If you trade on a foreign exchange, CARF shares your activity with your home country.

The EU’s Markets in Crypto-assets Regulation (MiCA) standardizes crypto taxation and reporting across member states. Stablecoins, DeFi protocols, and NFT platforms all face new compliance rules.

Hiding crypto offshore is no longer viable. Crypto AML frameworks and travel rule compliance mean every large transaction is monitored.

The strategy is not to hide. The strategy is to structure income legally in low-tax jurisdictions.

🔍 Record-Keeping: The Non-Negotiable Discipline

Tax authorities demand proof. If you cannot document your trades, they will estimate your gains and add penalties.

Track every transaction: date, time, wallet address, coin, amount, USD value at time of trade, and purpose. Use spreadsheets or crypto tax software like Koinly, CoinLedger, or TokenTax.

Save screenshots of exchange statements. Export transaction CSVs monthly. Back up wallet addresses and private keys securely. Document fiat on-ramps and off-ramps.

Understanding blockchain fundamentals and wallet security protects your records and proves ownership.

If you earn income in crypto, document the service provided and the fair market value at receipt. If you mine or stake, record the block reward and date. If you participate in DeFi protocols, track deposits, withdrawals, and yield.

Poor records cost you money. Auditors default to the highest possible tax if you have no evidence.

🗺️ Tax-Friendly Jurisdictions for Crypto Nomads

Not all countries tax crypto aggressively. Strategic residency can save six figures annually.

Portugal: Zero personal income tax on crypto if not classified as a business. No capital gains tax for individuals. Residency requires 183 days or a registered address with the intent to stay.

United Arab Emirates: No personal income tax. No capital gains tax. Crypto trading is tax-free for individuals. Dubai and Abu Dhabi attract nomads seeking zero-tax environments. Residency visas are available for remote workers and investors.

Germany: Crypto held over one year is tax-free for personal capital gains. Short-term gains are taxed as income. Trading as a business triggers corporate tax.

Singapore: Territorial tax system. Crypto gains from foreign exchanges may be exempt. No capital gains tax for individuals. Corporate tax applies to crypto businesses.

Malta: Crypto held long-term for investment is tax-free. Short-term trading is taxed at 35%. Malta offers residency programs for investors.

Relocating for tax reasons requires genuine ties. Rent property. Open bank accounts. Register for local services. Tax authorities scrutinize nomads who claim residency without substance.

🚨 Common Tax Mistakes Digital Nomads Make

Assuming no tax liability: Moving abroad does not erase tax obligations. Your home country may still claim you as a resident. The US taxes citizens globally.

Failing to declare income: Crypto earnings are taxable even if not converted to fiat. Staking, airdrops, and forks all create taxable events.

Ignoring DTAs: If you qualify for treaty relief, claim it. File the required forms. Do not pay tax twice out of ignorance.

Using the wrong cost basis method: FIFO, HIFO, and Specific ID produce different tax results. Choose the method that minimizes gains legally.

Not tracking days: Residency disputes are won with travel logs. Airlines, hotels, and credit card statements prove where you were.

Mixing personal and business crypto: If you trade full-time, establish a legal entity. Corporate tax rates are often lower than personal rates. Mixing personal trades with business activity increases audit risk.

Anna, a US designer in Lisbon, avoided double taxation by claiming the DTA and proving Portuguese residency. Jake, a UK trader in Dubai, failed to document his UAE residency and paid UK tax on global gains.

Details matter. Mistakes cost you.

💼 When to Hire a Crypto Tax Professional

DIY tax filing works for simple scenarios. If you earned crypto in one country, held it, and did not sell, you can probably handle it.

But if you meet any of these criteria, hire a professional:

- You moved countries mid-year.

- You traded across multiple exchanges.

- You earned income in three or more jurisdictions.

- You face dual residency claims.

- You used DeFi protocols, staking, or yield farming.

- You received airdrops, forks, or NFT royalties.

- You hold privacy coins or used mixers.

- Your crypto holdings exceed $100,000.

Tax advisors who specialize in crypto and international tax law save you more than they cost. They structure your income legally, claim treaty benefits, and defend you in audits.

Cheap tax prep is expensive. Errors trigger penalties, interest, and audits. Professionals minimize risk.

📊 Structuring Crypto Income to Minimize Tax

Timing trades reduces tax. If you are near the one-year holding threshold in Germany, wait. Long-term gains are tax-free.

Tax-loss harvesting offsets gains. If you bought high and the market dropped, sell losers before year-end. Realized losses reduce taxable gains.

Holding periods matter. Short-term gains are taxed as income. Long-term gains get preferential rates in most countries.

Legal entity structures can lower tax. If you trade full-time, forming an offshore LLC in a territorial tax jurisdiction may reduce your effective rate. But substance requirements apply. You need real operations, not just a mailbox.

Some nomads use corporate structures in Estonia, Singapore, or the British Virgin Islands to defer or reduce tax. This requires professional setup and ongoing compliance. Done correctly, it is legal and effective. Done poorly, it triggers investigations.

Avoid aggressive schemes. If it sounds too good to be true, it probably violates anti-avoidance rules.

🛂 Exit Taxes and Substance Requirements

Leaving a high-tax country can trigger exit taxes. The US charges an exit tax on unrealized gains above $866,000 if you renounce citizenship. Canada deems you to have sold all assets at fair market value when you cease residency.

Low-tax jurisdictions require substance. Portugal and UAE residency programs demand physical presence, local ties, and proof of intent to stay. Claiming residency while living elsewhere is tax fraud.

Substance means renting property, opening local bank accounts, registering for utilities, and spending real time there. Tax authorities investigate nomads who claim zero-tax residency but live in hotels.

If you relocate for tax reasons, do it properly. Sever ties to your old country. Establish genuine ties to your new one. Document everything.

🔐 Privacy vs Compliance: Walking the Line

Crypto offers privacy. Tax authorities demand transparency. Navigating this tension requires strategy.

Privacy tools like Monero and zero-knowledge proofs protect transaction details from public view. But using them does not exempt you from tax. Governments treat privacy coin transactions as taxable events. If you cannot provide records, they estimate your gains high.

Privacy in Web3 is your right. Tax compliance is your legal obligation. Balance both by keeping private records and filing accurate returns.

Mixing services, offshore wallets, and VPNs do not hide your tax liability. They raise red flags. Auditors assume evasion when you obscure transactions.

The winning strategy is legal privacy: use privacy-preserving tools for security, but maintain records and declare income where required.

🎓 FAQs: Crypto Tax for Digital Nomads

Do I owe tax if I trade on Binance abroad?

Yes. Tax liability depends on where you are a tax resident, not where the exchange is located. If you are a US citizen, you owe US tax. If you are a UK resident, you owe UK tax. Binance’s location is irrelevant.

Can I avoid tax by moving every six months?

No. Multiple countries can claim you as a tax resident simultaneously. Moving frequently without establishing clear residency increases audit risk. You may owe tax in every country you visited.

What if I use a VPN to trade?

VPNs do not change your tax residency. Authorities trace transactions through exchanges, banks, and CARF reporting. Using a VPN to obscure your location is not tax planning. It is a red flag.

Are airdrops and staking rewards taxable?

Yes. Most countries treat airdrops as income at fair market value when received. Staking rewards are taxed as income when earned. Later sales trigger capital gains on appreciation.

What happens if I do not file?

Penalties compound. The IRS charges 5% per month for late filing, up to 25%. Interest accrues on unpaid tax. Some countries impose criminal penalties for tax evasion. CARF data-sharing means you will be caught.

🚀 Your Next Move: Trade Smarter with The Wolf Of Wall Street

Compliance protects your profits. Strategy multiplies them.

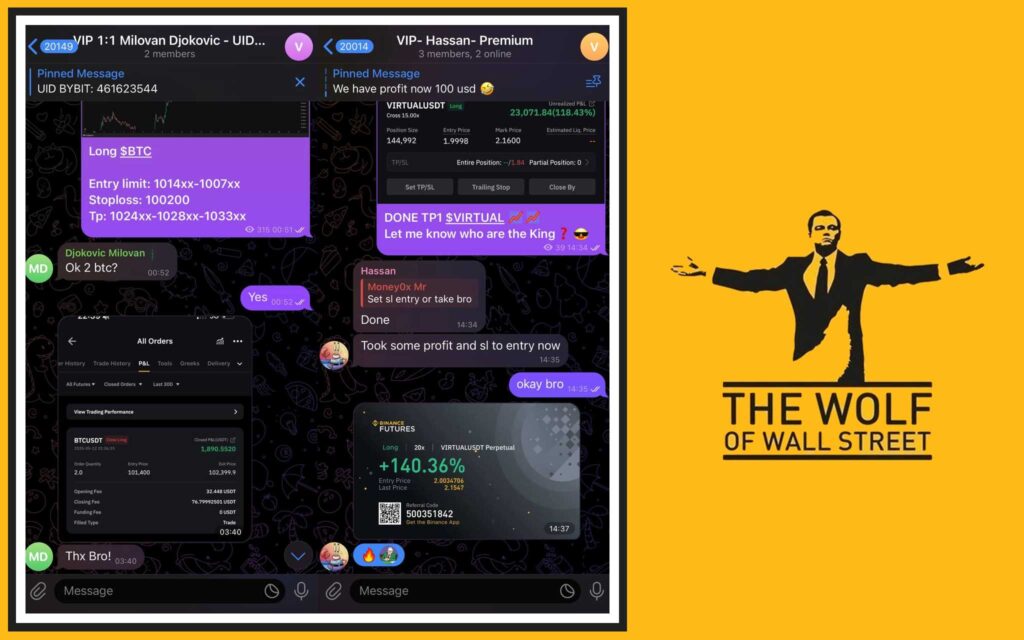

The Wolf of Wall Street crypto trading community offers what nomads need: exclusive VIP signals designed to maximize trading profits, expert market analysis from seasoned traders, and a private community of over 150,000 like-minded individuals sharing insights and support.

You also gain essential trading tools like volume calculators and resources to make informed decisions, plus 24/7 support from a dedicated team.

Empower your crypto trading journey. Visit The Wolf Of Wall Street services for detailed information. Join the active Telegram community for real-time updates and discussions. Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

📚 Conclusion: Compliance is Your Competitive Advantage

Tax law is not your enemy. Ignorance is.

Digital nomads who understand residency rules, DTAs, and crypto taxation keep more profit than amateurs who hide and hope. Compliance is not a cost. It is a competitive edge.

Track your days. Document your trades. Choose your residency strategically. Hire professionals when complexity exceeds your expertise. File accurately. Pay what you owe.

The nomad lifestyle offers freedom. Tax planning protects it. The wolves who win are the ones who play the game better than everyone else.

Now go make your move.