⚡ The Big Move – What Western Union Announced

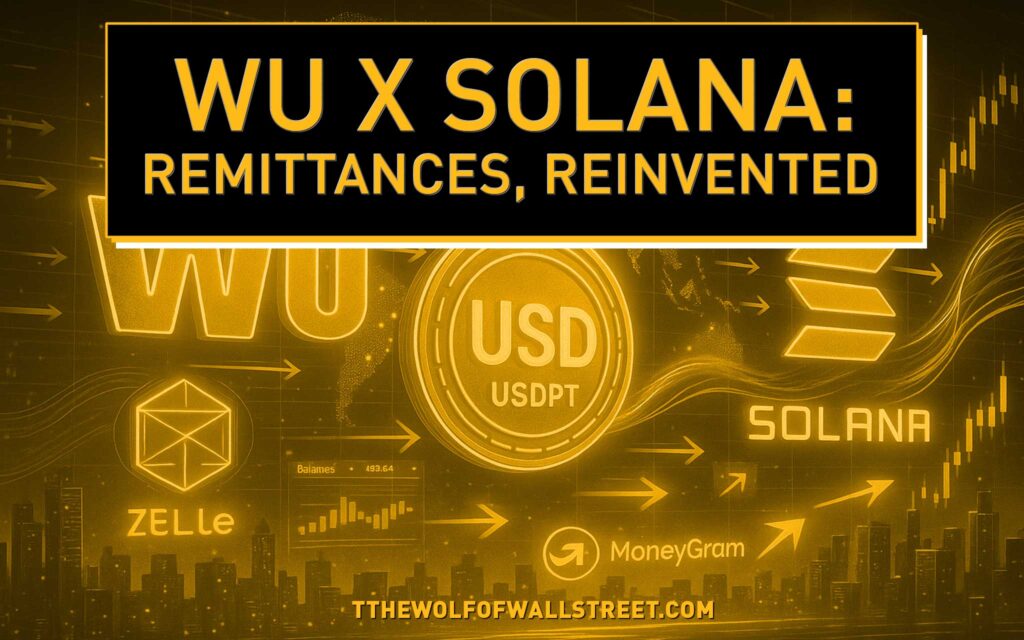

Listen up: legacy remittances just bolted a rocket to the hull. Western Union is rolling out a dollar-pegged stablecoin – the U.S. Dollar Payment Token (USDPT) – on Solana, issued by Anchorage Digital Bank, and wired into a new Digital Asset Network to stitch cash, cards, and crypto together.

Target window? H1 2026, with access funnelling through partner exchanges and Western Union’s agent footprint. That’s speed, scale, and compliance in one shot. Read the official press release here and a same-day summary from CoinDesk.

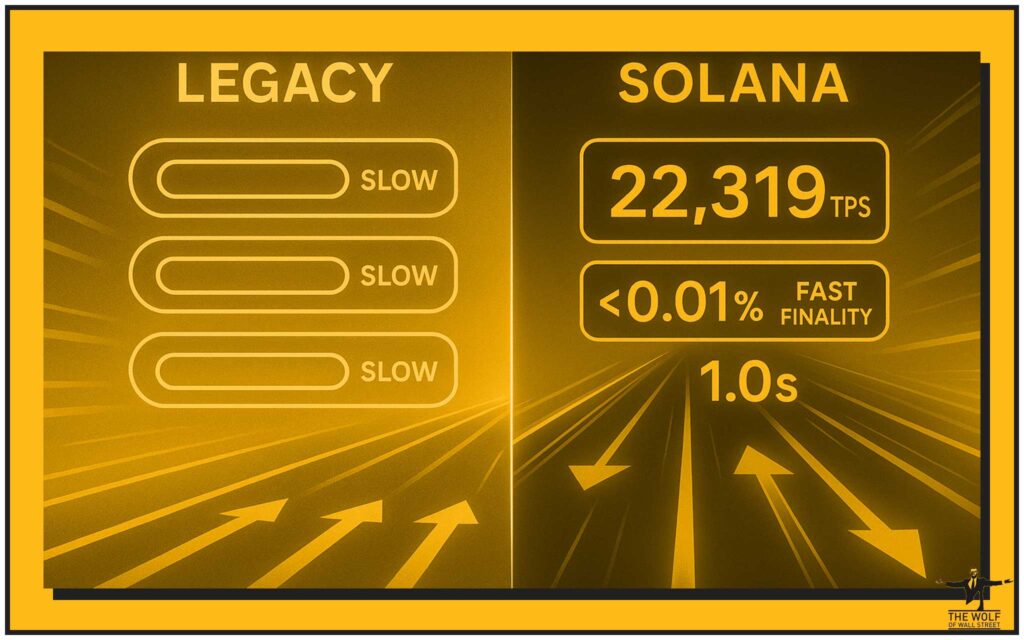

🚀 Why Solana, Not the Old Rails?

Fees that barely register, finality in seconds, and throughput built for payments – that’s why the big dogs are circling. Solana has matured from “interesting” to “industrial,” even after reliability bumps; the payments traction and dev velocity are exactly what a remittance giant needs when latency kills conversion. Keep the caveat: resilience matters, and Western Union will be judged on uptime, corridor costs, and customer UX when rubber meets road.

🧭 How USDPT + the Digital Asset Network Work

Here’s the play: customer funds hit a wallet or exchange, convert into USDPT on Solana, then move across Western Union’s rails. On the other side, users can off-ramp into local currency via agents or banking partners – the same storefronts people already trust. For corporate flows, USDPT also tightens treasury ops (faster settlements, fewer hops). Compliance isn’t an afterthought; KYC/AML is embedded where it counts.

Want a deeper dive on the rails? See our primer on the real-world uses of stablecoins and the GENIUS Act framework shaping issuance rules.

🏦 Competitors Are Moving – Zelle and MoneyGram

This isn’t happening in a vacuum. Zelle’s parent, Early Warning Services, is moving to enable cross-border transfers with stablecoins – a direct shot at the remittance pie. Meanwhile, MoneyGram lit up a stablecoin app in Colombia, leaning on USD-pegged tokens to neutralise local volatility and modernise payouts. Translation: the race is on, and Western Union just put a V12 in the chassis. See Payments Dive and Blockworks for the competitive backdrop.

For context and comparisons, scan our notes on Layer-1 networks built for payments and how policy shifts push adoption.

🔒 Regulation Is the Green Light

Why now? The GENIUS Act – signed in July 2025 – handed U.S. markets a stablecoin rulebook: high-quality reserves, monthly disclosures, and supervision. With legal clarity, boardrooms stop hand-wringing and start shipping. That’s the backdrop for Western Union’s move and why banks and fintechs will follow with their own tokens and rails. Read the coverage from Reuters, with additional context from the AP.

If you’re new to the regs, read our walk-through of the crypto AML playbook and the GENIUS vs STABLE Act comparison.

📈 What It Means for You – Consumers and Traders

Consumers: Expect faster settlement and, in competitive corridors, pressure on fees. Cash access won’t vanish; it just gets an express lane.

Active traders: This is where edge lives. New liquidity pools, new basis spreads, new catalysts: exchange listings, corridor expansions, reserve attestations, and integration milestones. If you’re serious about execution, systemise it:

- Track the H1 2026 roadmap and first exchange partners (listing = liquidity).

- Map corridor spreads and FX slippage; size positions with discipline.

- Stress-test depeg scenarios and counterparty risk.

For a broader primer, see our guides on spotting crypto opportunities and mastering order types.

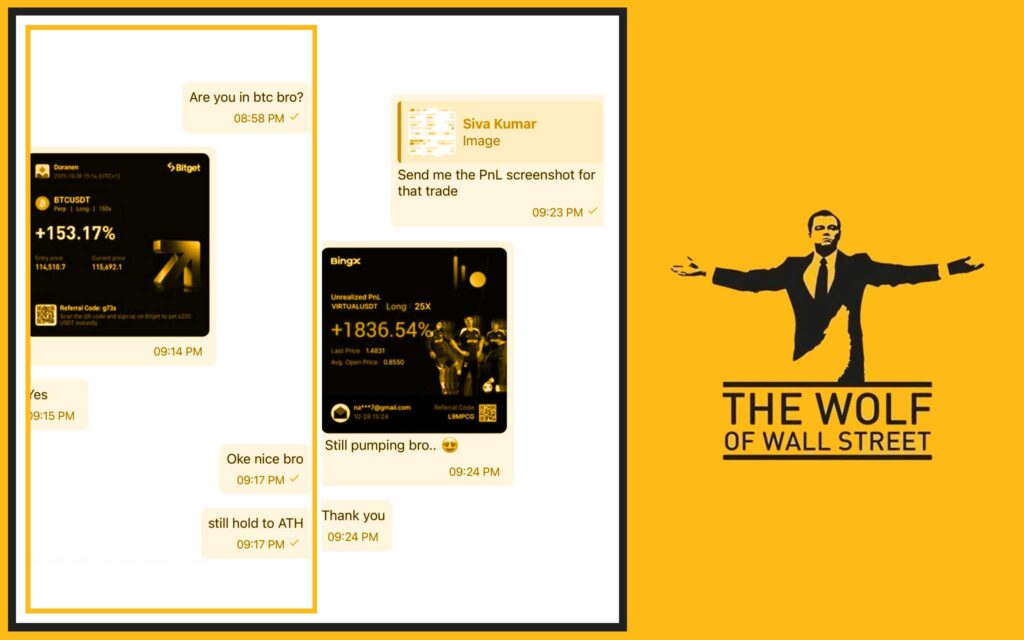

🐺 The Wolf’s Take – Bottom Line

This isn’t a memo; it’s a market signal. Western Union is arming a 200-country network with a fast, cheap settlement layer. Get positioning right and you ride the wave; get casual and you’ll be the liquidity for someone who didn’t. The launch clock is ticking – and the first corridors will write the playbook. Start with Western Union’s primary source here, then watch for partner exchange announcements and corridor pilots.

🧠 Pro Tip – Build Your Edge with The Wolf Of Wall Street

If you want to surf the move – not get dumped by it – plug into a desk that hunts edge 24/7. The Wolf Of Wall Street gives you:

- Exclusive VIP Signals for fast news-driven trades

- Expert Market Analysis from seasoned crypto traders

- Private Community of 150,000+ for live playbooks

- Essential Trading Tools like volume calculators and sizing templates

- 24/7 Support from a dedicated team

Jump in via our service page or the Telegram community. Then revisit core strategy like when to take profits and how stablecoins solve real problems – because preparation beats prediction, every time.