If you want certainty, buy a calendar. In crypto, you buy edge-and South Korea’s new play says banks issue the stablecoins, yields are out, and anyone without a banking licence gets to carry the bags. That’s not doom-it’s a map. Read it right, you get paid.

⚡ What’s changing-fast

South Korea is lining up a bank-monopoly on stablecoin issuance, a ban on stablecoin yields, and tight rules that sideline exchanges from launching their own coins. Fintechs can build rails, not mint money. The pitch? Lower depeg risk, cleaner AML, calmer monetary policy. The catch? Less competition, slower product velocity, fewer on-chain yield paths for everyday users (policy snapshot).

Want the edge while policymakers argue? Check our VIP Signals and plug into real-time reads in our Telegram community.

🧭 Why the Bank of Korea likes this

The Bank of Korea (BOK) isn’t being coy. Privately issued money has a colourful history, and depegs blow up confidence. The logic: keep issuance inside heavily supervised banks, bake in strong KYC/AML, and trim systemic risk. With a CBDC pilot conversation in the background, regulators want payments and remittances stable, boring, and banked (BOK rationale). For policymakers, that reads like safety. For builders, it sounds like a speed limit.

If you’re playing this market, focus on price action over passive yield. Pair rule-driven momentum with tools like our primers on the MACD indicator and moving averages to keep your signals clean when carry is capped.

🚀 The pushback: innovation doesn’t wear a tie

Industry leaders (notably Kaia DLT’s Dr Sangmin Seo) argue a bank-only regime doesn’t magically fix technical and operational risk. What works is eligibility-based rules-clear, transparent standards that banks and qualified non-banks can meet. Ban direct yield if you must, but choke off secondary utility (DeFi integrations, programme incentives) and you kneecap adoption before the party starts (critique).

If you’re a builder, that means: keep shipping compliance-first rails; don’t waste the cycle trying to win a permission that won’t come. For traders, expect liquidity to consolidate in a few bank coins-less fragmentation, tighter spreads, fewer depeg tails.

💼 Market map: banks in the driving seat

At least eight major banks are preparing won-pegged stablecoins, with late-2025 to early-2026 pencilled for first issuances. Big tech groups aren’t standing still; strategic moves around leading exchanges position them for payments at scale-utility first, not savings products (summary).

Translation: Korea is building a payments stack, not an on-chain savings account. If you’re trading the headlines, watch for pilot go-lives and bank consortium announcements-those are your volatility catalysts.

🌍 Global cross-check: Korea vs EU MiCA vs US GENIUS

- Issuer eligibility: Korea = banks only; EU MiCA = banks + e-money institutions under strict rules; US GENIUS-style proposals tilt bank-first with supervised non-banks in the mix (MiCA overview).

- Yield: Korea = ban; EU = restricted (not outright banned); US proposals = tightly limited (policy explainer).

- Exchange-issued coins: Korea = prohibited; EU/US = possible with licensing/oversight.

The net: Korea optimises for stability. Europe and the US allow controlled diversity that often breeds faster product iteration.

📈 Winners, losers, and where the alpha hides

Traders: You’ll likely see lower tail risk but a thinner yield landscape. That tilts strategy to momentum, breakout, and mean-reversion backed by disciplined risk. Revisit Bollinger Bands and sharpen exit logic with When to sell crypto.

Banks: You inherit distribution and trust. Play is payments and remittances, not deposit displacement. Expect aggressive compliance UX.

Fintechs/DeFi: Build wallets, analytics, fiat ramps, invoicing, and cross-border rails. Monetise services, not yields. The smart money doubles down on enterprise-grade KYC/AML-start with our Crypto AML guide.

Exchanges: Without proprietary stables, focus shifts to market quality (depth, spreads), listings, and derivatives liquidity-hedging becomes the hook. We cover this in Bitcoin spot & derivatives trading.

🗓️ Timeline to watch

- Q4 2025: Legislation finalisation and supervisory guidance; public comms on bank issuer criteria.

- Q4 2025–Q1 2026: First won-pegged bank pilots; wallet integrations; merchant pilots.

- H1 2026: Remittance corridors, POS pilots, and first DeFi-adjacent (non-yield) utilities.

Bookmark our Policies hub for updates and our trading insights for trade setups when those milestones drop.

💣 The yield ban: what it really means

No interest for holding a stablecoin. And if “yield by another name” shows up-staking wrappers, DeFi pass-throughs-expect scrutiny. That shrinks the carry trade but doesn’t kill utility: payments, settlements, and fast conversions survive. For a deeper legal read, compare Korea’s stance with our explainer on the GENIUS Act and the EU’s MiCA materials above (ban reports).

🧩 FAQs

Are stablecoin yields banned in Korea? Yes-direct interest/yield payments are set to be prohibited; secondary workarounds will face tight limits (outline).

Can exchanges issue their own stablecoins? Current direction: No-issuer role is restricted to banks (exchanges can integrate, not mint).

When do bank stablecoins launch? Market watchers point to late-2025/early-2026 for initial go-lives (roadmap signals).

Does this kill DeFi in Korea? No-but it re-prices it. Expect payments-first use cases and compliance-heavy integrations rather than yield farms.

🏁 Your move

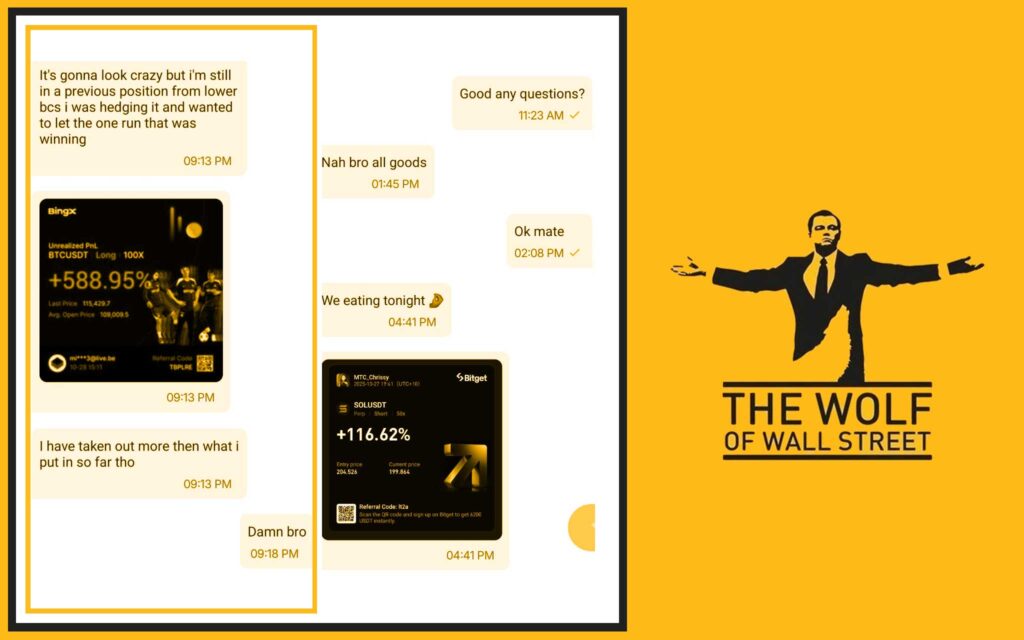

If regulators are building guard rails, you use them like lanes to accelerate-not excuses to park. Plug into The Wolf Of Wall Street VIP Signals, stack our expert analysis, and trade with people who move before headlines, not after. Join 150,000+ operators in our Telegram. No fluff, just execution.

The Wolf Of Wall Street

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. You get Exclusive VIP Signals, Expert Market Analysis, a Private Community of 150,000+, Essential Trading Tools, and 24/7 Support.

Empower your trading: visit our service and join our Telegram to unlock your potential in the crypto market.