Coinbase just delivered a quarterly performance that makes Wall Street look like a Sunday-league team. The crypto exchange giant didn’t just nudge past expectations – it obliterated them.

In Q3 2025, Coinbase raked in nearly $1.9 billion in revenue, pumped net income up more than five-fold to $433 million, and loaded another 2,772 BTC (about $299 million) onto its balance sheet. That’s a power move – and a message: Coinbase isn’t in the business of surviving; it’s in the business of dominating.

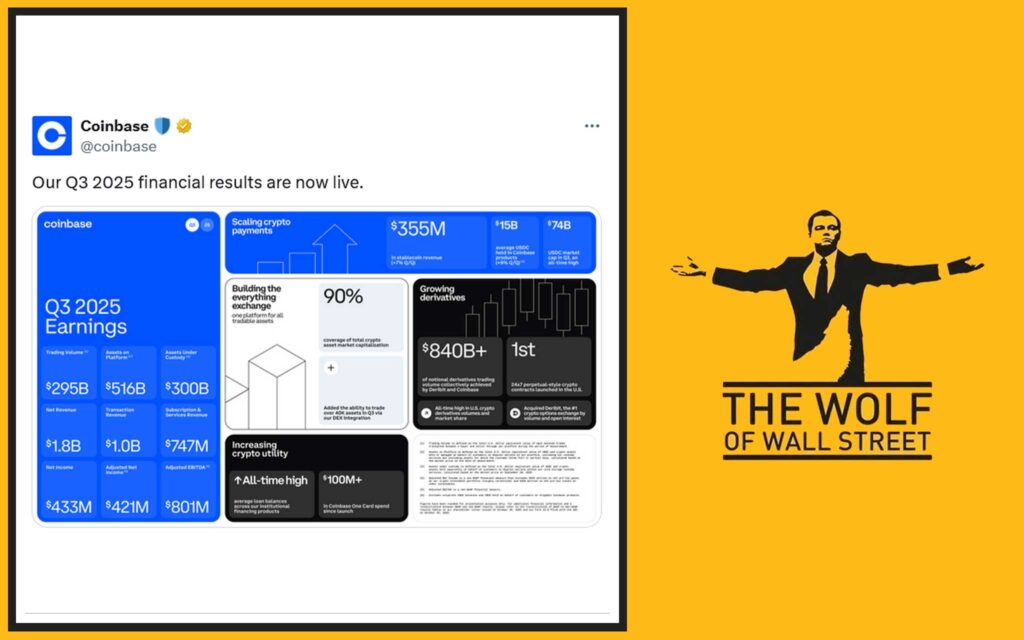

💰 Coinbase Q3 2025 – The Numbers Don’t Lie

Let’s cut the fluff and go straight for the jugular – the hard stats that define the quarter (source):

- Revenue: $1.87 – $1.9 billion (+25 – 55 % YoY)

- Net Income: ≈ $433 million (+5× YoY)

- Earnings Per Share: $1.50 (beating analyst forecasts)

- Bitcoin Holdings: 14,548 BTC (+2,772 BTC this quarter, ≈ $1.6 billion value)

- Institutional Trading: 80 % of $295 billion total volume

- Assets Under Custody: $300 billion + (record high)

- Ethereum Volume Share: 22 %, nearly equal to Bitcoin’s 24 %

In short – Coinbase isn’t “profitable.” It’s printing. This isn’t luck; it’s leverage – and execution. The company has evolved from retail exchange into what I call the Goldman Sachs of crypto, only faster, leaner, and hungrier.

Curious about how institutional traders dominate like this? Check out the trading-insights section for advanced breakdowns.

🧱 Building the ‘Everything Exchange’ – Coinbase’s Next-Level Vision

Here’s where things get exciting. Coinbase’s game plan is crystal-clear: build the Everything Exchange – a single platform for every digital asset on the planet.

They’re going beyond spot crypto. The focus now:

- Derivatives and tokenised stocks for institutional players.

- Prediction markets and early-stage token sales to capture next-gen liquidity.

- Stablecoin growth, driven by the partnership with Circle’s USDC.

- Base L2 network expansion – a growing ecosystem of payments, lending, and social apps powered by Flashblocks for lightning-fast confirmations.

Brian Armstrong isn’t dropping details on a Base token yet, but his stance is loud and bullish: accumulate Bitcoin, scale infrastructure, and lead the next crypto cycle (source).

As I said before – this isn’t diversification; it’s domination. Want to know more about Armstrong’s “wolf-of-crypto” mindset? Read the Brian Armstrong leadership profile.

🏦 Institutional Trust at Record Highs

The quiet truth: institutions don’t gamble – they position.

With more than $300 billion in assets under custody, Coinbase has become the custodian of trust in digital finance. Eighty percent of its trading volume comes from hedge funds, asset managers, and corporates who now treat Bitcoin, Ethereum, and stablecoins as strategic holdings.

Market reaction? Mixed short-term, bullish long-term. Shares jumped after hours as investors processed the scale of the beat, then corrected as traders locked in quick gains – a textbook crypto profit-taking move.

When institutions move billions, they do it quietly – and right now, they’re quietly moving into Coinbase.

⚙️ What This Means for Traders – and How You Profit Like a Pro

Let’s translate corporate headlines into street-level strategy.

Coinbase’s success is a masterclass in conviction:

- Hold strong assets when others hesitate.

- Scale into momentum, not noise.

- Use data and signals, not emotions.

If you’re trading solo without structure, you’re not playing the same game – you’re the mark, not the market-maker.

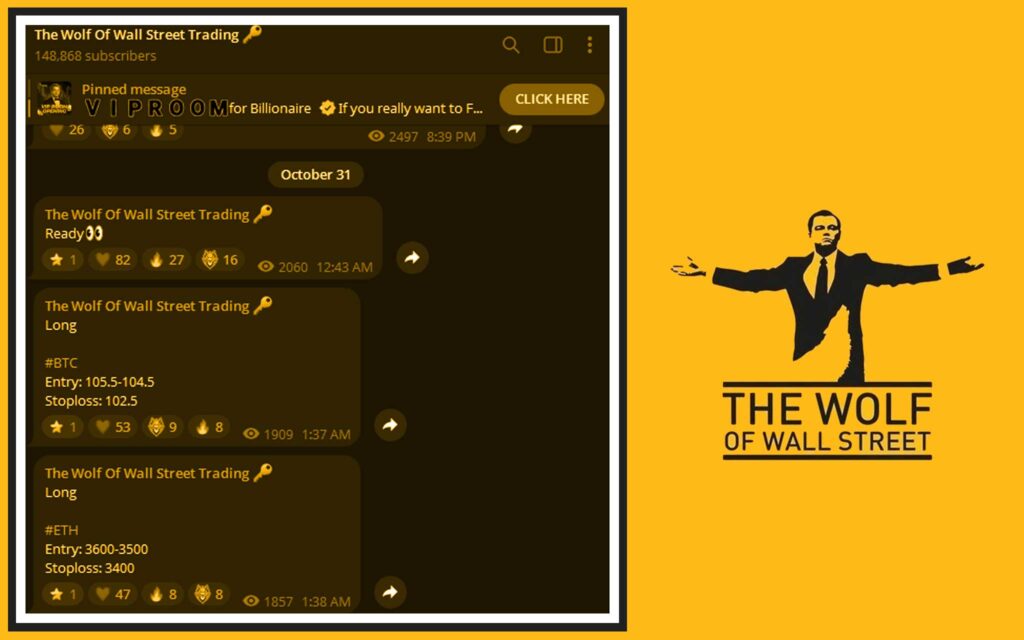

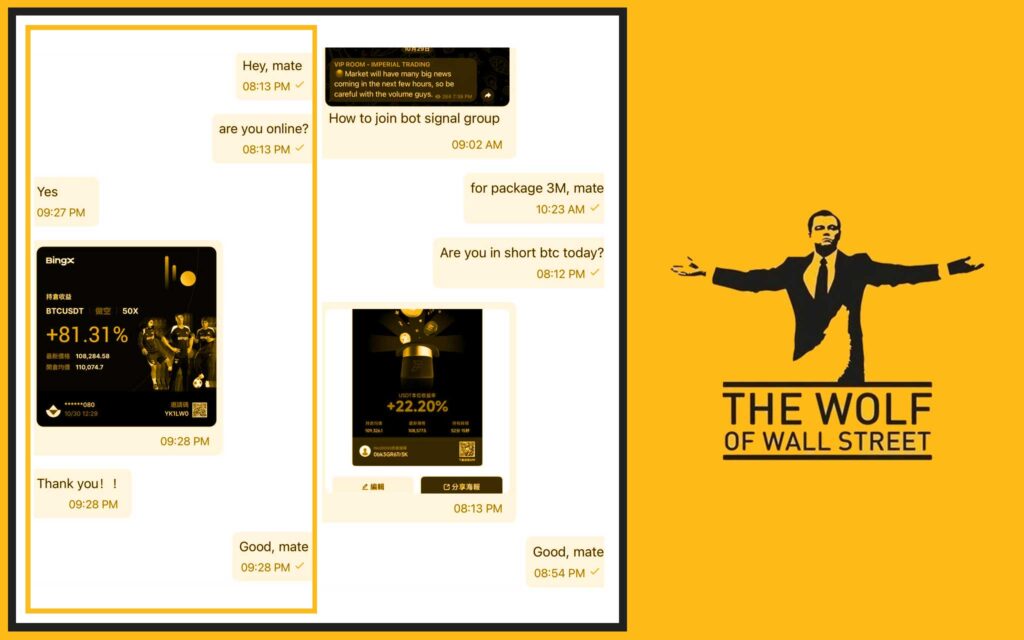

That’s where the The Wolf Of Wall Street crypto trading community flips the script. Inside The Wolf Of Wall Street, you get:

- Exclusive VIP signals that pinpoint profit zones before they hit the charts.

- Expert market analysis from seasoned crypto traders.

- Private community of 150 000 + members who share real-time intel.

- Essential trading tools (volume calculators, risk dashboards).

- 24/7 support so you’re never stuck in the dark.

As I say – you don’t wait for the market to hand you profits – you take them.

👉 Visit The Wolf Of Wall Street Service for detailed info.

👉 Join the Telegram community for live market updates.

🚀 Final Thoughts – Coinbase, Confidence and the Next Crypto Cycle

Coinbase’s Q3 2025 report isn’t a quarterly blip – it’s a statement of intent. The company has positioned itself as the institutional gateway to crypto, with record revenue, rising Ethereum adoption, and a strategy to tokenise everything that moves.

For traders, the message is clear: the next crypto cycle won’t be led by luck – it’ll be driven by discipline, information, and access to the right networks.

So arm yourself with the same edge that fuels billion-dollar moves. Join the The Wolf Of Wall Street community today – where traders move faster, think smarter, and profit harder.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 150 000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Use volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from a dedicated team.

Empower your crypto journey: Visit The Wolf Of Wall Street Service | Join Telegram