If you’re leaving crypto off your donate page, you’re leaving money on the table. 2024 was the inflection point: more than $1 billion in cryptocurrency flowed to nonprofits, average gift sizes exploded, and 70% of the biggest US charities now accept crypto. The donors are global, young, and generous-and they move fast. Your job is simple: capture the upside and keep the IRS smiling. This playbook shows you exactly how-plain English, step-by-step, zero fluff.

We’ll decode receipts, Forms 8283/8282, appraisals, internal controls, and a 7-day launch plan, plus show you how to manage volatility like a pro so your finance team sleeps at night. (Data points and IRS guidance sourced throughout for your board’s peace of mind.)

Quick win: want sharper timing on when to convert donated crypto into fiat? Plug into VIP-grade signals, pro analysis, and a 150,000-strong network with The Wolf Of Wall Street-no-nonsense trades, disciplined entries/exits, and 24/7 support. See the service and jump into the Telegram community.

⚡ Why Crypto Donations Are Surging (and Why It Matters Now)

Let’s talk results. The Giving Block’s latest annual report puts 2024 crypto donations north of $1B, with the average gift ≈ $10,978 and adoption among the largest charities passing 70%. That’s not speculative hype; that’s a fundraising channel you can’t ignore. Millennials, Gen Z, whales, and DAOs drove the wave-bigger gifts, faster settlement, fewer borders, and an innovation signal your brand can’t replicate with traditional rails.

What nonprofits love:

- Borderless reach: receive from anywhere within minutes.

- Transparency: on-chain trails lift donor trust.

- Higher average gifts: crypto donors often give appreciated assets at scale.

What donors love:

- Tax leverage: the IRS treats crypto as property. Donors who held >12 months can generally deduct fair market value and avoid capital gains-a two-for-one tax advantage that makes gifts larger at the same after-tax cost. IRS FAQ.

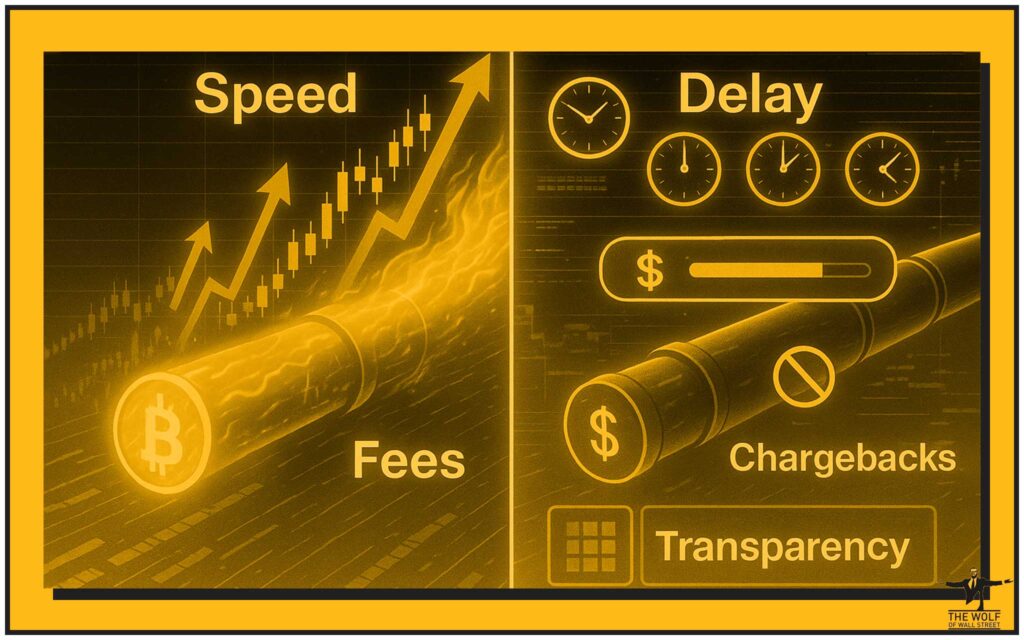

Compare at a glance (operational reality):

| Dimension | Crypto | Card/Wire |

|---|---|---|

| Settlement | Minutes to hours | Hours to days |

| Chargebacks | None (final) | Possible |

| Donor data | On-chain + optional KYC | PSP profile |

| Fees | Gateway/exchange bps | 2–3% card + FX |

| Volatility | Yes-manage via policy | No FX unless intl. |

Internal links for further reading: prime your team with crypto macro indicators and researching crypto opportunities to understand market context that can affect donation timing.

🧭 IRS Rules in Plain English (What the IRS Actually Cares About)

First principles. The IRS classifies crypto (virtual currency/digital assets) as property, not cash. That triggers the non-cash charitable contribution rules. IRS Digital Assets.

Valuation & timing

- Your receipt shows USD fair market value (FMV) on the date you receive the asset in your wallet or processor account. Keep the rate source on file. IRS Pub 526.

- Donor deduction depends on holding period:

- >12 months: donor generally deducts FMV.

- ≤12 months: donor deducts lesser of basis or FMV. IRS FAQ.

Substantiation tiers (what donors must keep)

- < $250: bank/processor record may suffice for cash; crypto is non-cash, so issue a receipt.

- ≥ $250: “contemporaneous written acknowledgement” (your receipt letter).

- > $500: Form 8283 (donor files).

- > $5,000 (crypto): qualified appraisal + Form 8283 (Section B). Instructions for Form 8283; Journal of Accountancy.

Your nonprofit’s must-dos

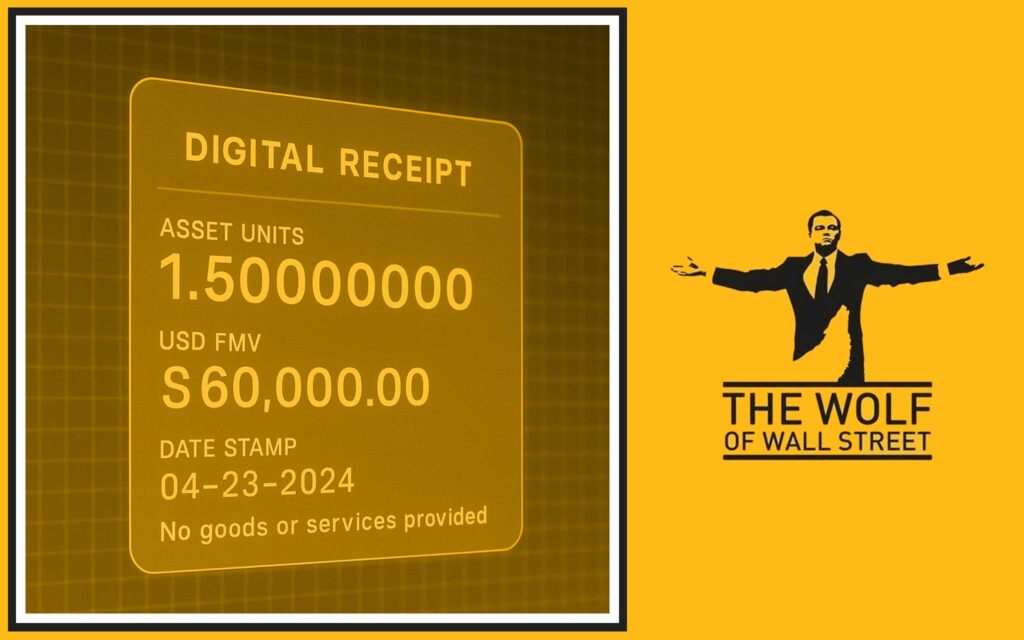

- Issue a USD receipt that states the asset, amount/units, date received, and the statement that no goods or services were provided.

- Keep a clean audit trail (wallet address, tx hash, rate provider, time-stamp).

- If you dispose of the donated crypto within 3 years, you may need to file Form 8282. About Form 8282.

Receipt template (drop-in):

[Charity Name, EIN] acknowledges receipt of [X.XXX ETH] on [DD Month YYYY]. The USD value at receipt was $[Amount] based on [Rate Provider] at [Timestamp]. No goods or services were provided in exchange for this contribution. Contact: [Name, Title, Email].

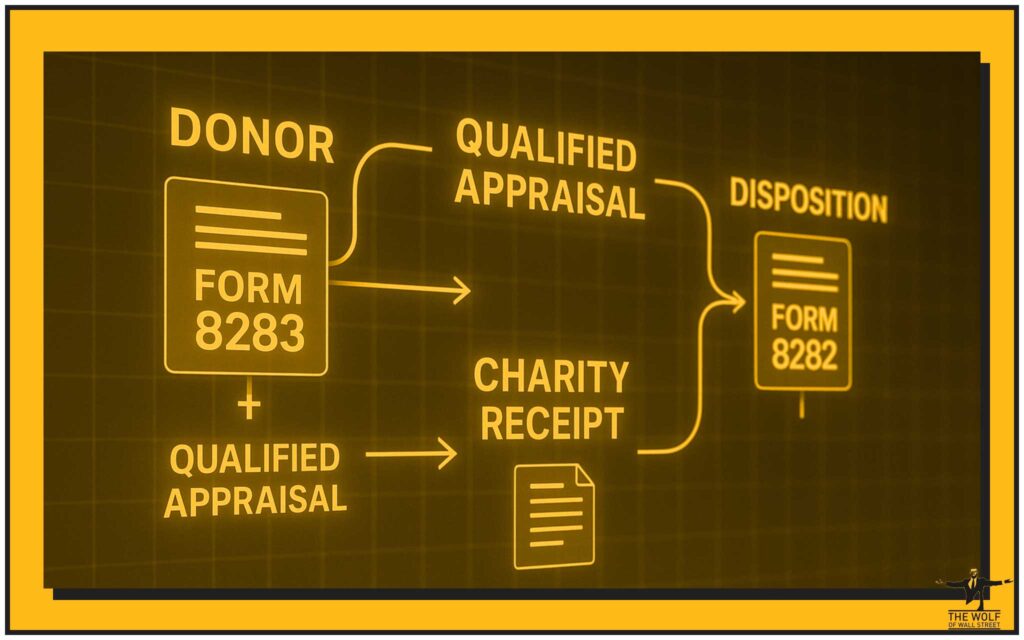

📜 Forms 8283 & 8282-Zero-Fluff Guide with Real Scenarios

Form 8283 (donor) – when and why

Donors who claim a deduction for non-cash contributions over $500 must file Form 8283; over $5,000 requires a qualified appraisal (crypto included) and Section B of the form. For very large gifts (≥ $500,000), the appraisal must be attached to the return. Your charity may need to sign the donee acknowledgement in Section B, Part IV-which simply confirms receipt, not value. IRS Instructions for Form 8283; Gordon Law.

Scenario A (donor side): A supporter gifts 1 BTC held 18 months. They secure a qualified appraisal, complete Form 8283 Section B, and ask you to sign the donee acknowledgement. They deduct FMV per IRS rules. IRS FAQ.

Form 8282 (nonprofit) – when and why

If your nonprofit sells, exchanges, or disposes of the donated crypto within 3 years of receipt, file Form 8282 within 125 days of the disposition. Send Copy B to the donor. Exceptions exist (e.g., items ≤ $500, or property consumed/distributed for charitable use). IRS: About Form 8282; The Giving Block explainer.

Scenario B (charity side): You convert 15 ETH to GBP/USD 10 days after receipt to cut volatility. That’s a disposition-you’ll generally file 8282 within 125 days and furnish a copy to the donor. ORBA.

Penalty reality check: late or missing forms can trigger penalties and scrutiny. Bake the 8282 clock into your treasury SOPs.

🧾 The Compliance Checklist (Receipts, Records, Policies)

Receipts (every time)

- Nonprofit legal name, address, EIN.

- Date received, asset + units (e.g., 2.345 ETH).

- USD FMV at receipt and how you determined it (exchange spot at timestamp, recorded internally).

- The magic sentence: “No goods or services were provided in exchange for this contribution.”

- Optional but smart: transaction hash, wallet address.

Records you keep

- Wallet(s) and derivation of control (who can sign).

- Rate source, timestamp, screenshots or API logs.

- Gift acceptance policy references for crypto.

- If disposed: trade confirmations, bank receipts, 8282 copy and proof of mailing.

Board-approved policies

- Which assets you accept (e.g., BTC, ETH, stablecoins; exclude privacy coins if risk policy requires).

- Volatility controls (e.g., auto-convert 80%, hold 20% with stop-loss rules).

- KYC/AML thresholds, enhanced due diligence triggers, provenance checks.

- Incident response (key loss, compromised wallet, processor outage).

🛠️ Operational Setup: From “We Accept Crypto” to “We Run It Like Pros”

1) Wallet architecture

Choose the right mix of custodial (ease, automation) and non-custodial (control) solutions. For treasury and larger balances, use multisig-document signers and quorum. If you self-custody, lock down private key management and disaster recovery. Explore multisignature wallets and public vs private keys.

2) Donation gateway / processor

Processors can automate: address generation, FMV capture, receipts, optional donor info, and auto-conversion to fiat. They reduce admin and evidence-gathering pain-and create a defensible audit trail your auditor will love. (Use a provider that records the exact timestamp for valuation and provides exportable logs.)

3) Volatility policy (the discipline edge)

Set rules before the first gift:

- Auto-convert X% instantly; hold Y% for treasury.

- Trading windows (e.g., “convert within 60 minutes of receipt” unless flagged).

- Execution method (market vs. TWAP/VWAP).

- Escalation for whale gifts.

Need timing help? The Wolf Of Wall Street VIP Signals + pro analysis provide the market context your finance lead wants when deciding if/when to convert. Pair with your order-types primer and TWAP vs VWAP to cut slippage.

4) Accounting & audit trail

Map donated crypto to a digital assets GL account. Capture FMV at receipt, then any gain/loss on disposition. Ensure your system stores tx hash, rate source, and supporting files. Tie your processor exports to accounting entries so your auditor can trace from gift → conversion → bank.

5) Web UX that converts

- Put “Donate Crypto” above the fold with a short explainer.

- Show accepted assets and an FAQ.

- Offer QR code + copyable address.

- Link to how-to guides for new donors (e.g., how to buy crypto, Bitcoin wallets).

🧱 Risk Management: Volatility, Donor Anonymity, Reputational & Regulatory

Market risk (price swings)

Adopt pre-set conversion rules and automate where possible. For any treasury you hold, monitor with alerts; document your rationale for exceptions. (The $1B surge didn’t remove volatility; it just made process discipline non-negotiable.)

Donor anonymity vs compliance

Balance privacy expectations with AML/KYC. Set thresholds for enhanced due diligence (EDD), note red flags, and state whether you accept assets like Monero. If you do not, say so on the policy page.

Reputational risk

Proactive comms: explain why you accept crypto (donor choice, tax efficiency, transparency), your controls (KYC, sanctions screening), and your auto-convert posture to avoid speculation.

Custody & insurance

If you self-custody, document key ceremonies, signers, and disaster recovery. If you use a custodian, request SOC reports and evidence of crime/tech E&O coverage.

Internal links to help you harden the edges: privacy stance with Web3 privacy and digital sovereignty; learn how blacklisting vs fiat freezing works.

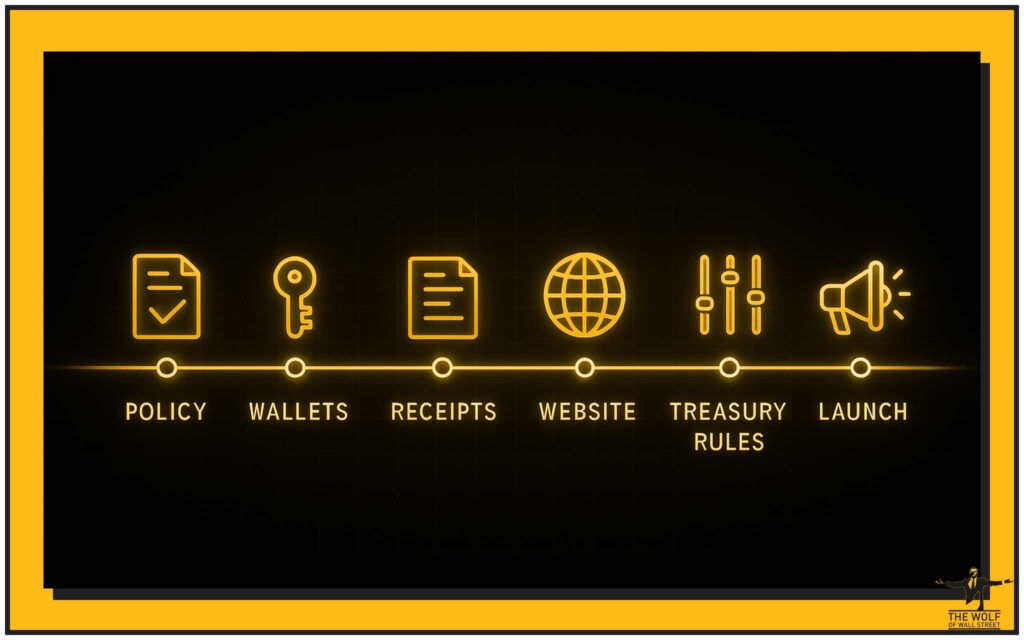

🚀 7-Day Go-Live Plan (Ship It Fast, Ship It Clean)

Day 1 – Policy & scope

Board approves a Crypto Gift Acceptance Addendum: accepted assets, conversion rules, appraisal guidance for >$5,000 donor deductions, KYC/AML thresholds, and Form 8282 triggers.

Day 2 – Wallets & custody

Stand up a processor account and a multisig treasury wallet. Document signers, quorum, and key storage. See multisig setup.

Day 3 – Receipts & forms

Load your receipt template. Document SOPs for Form 8283 sign-offs (donee acknowledgement) and Form 8282 filings within 125 days of disposition. IRS 8282; IRS 8283.

Day 4 – Website & UX

Add a top-level Donate Crypto entry in navigation. Above the fold, place the button, accepted assets, QR, and short FAQ. Link to how to buy crypto and seed phrase safety.

Day 5 – Training & test gift

Run a dry-run with a £50 equivalent gift. Validate FMV capture, receipt, export logs, and accounting entries.

Day 6 – Treasury execution rules

Implement auto-convert rules (e.g., 80/20) and escalation thresholds for gifts > $100k. Set alerts and a trade log format. Cross-train finance + fundraising.

Day 7 – Launch & comms

Announce on email and social. Share a brief explainer on why you accept crypto (donor choice + tax leverage) with your controls. Offer a downloadable checklist for donors.

📈 Case Studies (Fast-Hitting, Real-World Moves)

Humanitarian NGO (Crisis Response)

A surge of crypto gifts during a regional crisis demanded instant conversion. Their policy mandated 100% auto-convert inside 30 minutes. Outcome: protected programme budgets from a double-digit drawdown during a volatile week. Team cited improved donor trust due to clear comms and on-chain transparency.

Arts Foundation (Whale Gift via DAF)

A DAF-routed gift of high-beta tokens required a calm 8283 workflow and a clear appraisal process. The charity signed Section B, Part IV promptly, converted 90% within the day, and disclosed the policy publicly. The donor later repeated the gift-relationship win secured. IRS 8283.

STEM Education Charity (DAO-native Campaign)

A DAO community raised funds across time zones. The org’s donation page supported multiple assets and produced clean receipts. With an 80/20 auto-convert/hold split, they captured upside on the 20% treasury during a rally, then reported the 8282 disposition when trimming holdings at month-end. IRS 8282.

🔮 Future Outlook (2025+): Stablecoins, Better Rails, Smoother Compliance

Stablecoins are set to dominate donation flows-lower volatility at the point of gift, familiar “cash-like” behaviour, and easier accounting. Exchanges and processors are building automated compliance hooks (think: appraisal prompts for donors at >$5k, 8282 alerts for charities), while custody keeps moving toward MPC with policy-based approvals. Expect rising use of DAFs and DAO-organised campaigns-and a continued tilt toward US and European growth as clarity improves. (Macro data from industry annual reports signal continued expansion.)

❓ FAQs (Schema-Ready Snippets)

1) Is crypto a qualified charitable contribution for IRS purposes?

Yes-crypto is treated as property. Donors can claim deductions subject to standard substantiation rules; your charity issues a non-cash receipt with USD FMV at the time you receive the asset. IRS Digital Assets.

2) Do donors need an appraisal for crypto gifts over $5,000?

Generally yes. Donors typically need a qualified appraisal and must file Form 8283 (Section B). IRS 8283 Instructions; Journal of Accountancy.

3) Do we need to file Form 8282 if we convert immediately?

If you dispose of (sell/convert) within 3 years, yes-file Form 8282 within 125 days and furnish a copy to the donor. IRS: About 8282.

4) How do we value a crypto donation for the receipt?

Use FMV in USD at the timestamp of receipt into your wallet/processor. Record your rate source and keep the export/screenshot for audit. IRS Pub 526.

5) Can we accept privacy coins like Monero?

That’s a policy decision. Some charities exclude them due to AML/KYC and reputational concerns. If you accept them, define higher due-diligence thresholds and conversion rules.

6) How do we handle anonymous donors?

Set contribution thresholds that trigger additional checks. Your processor may offer optional donor info capture; document what you collect and why.

7) What if the gift drops 20% before we convert?

That’s precisely why you need auto-convert rules and escalation protocols. Many orgs convert most gifts immediately and reserve a small treasury allocation with stop-losses.

8) Are stablecoin donations “easier” for compliance?

They simplify valuation at receipt and may reduce volatility risk, but they’re still digital assets-so the same receipt, substantiation, and 8282 rules apply. IRS Digital Assets.

9) What should our crypto gift acceptance policy include?

Accepted assets, conversion rules, KYC/AML thresholds, privacy coin stance, appraisal guidance for donors, incident response, and 8282 timing.

10) What should the board see each quarter?

Gifts by asset, conversion time, fees, realised gains/losses, receipt accuracy, 8282 timeliness, and exceptions. Build a one-page dashboard.

✅ The Close: Capture the Upside, Master the Rules

This is your edge. Crypto donors are generous, fast, and global. The IRS wants clean receipts, correct valuations, and timely forms-you can deliver that with a clear policy, a solid processor, and airtight records. Deploy this playbook, ship your Donate Crypto page, and lock in your SOPs. Then sharpen your treasury timing with The Wolf Of Wall Street-VIP signals, expert market analysis, essential tools, and a private community built for decisive execution. Head to our service page and join the The Wolf Of Wall Street Telegram for real-time updates and support.

🧾 Source Citations & Further Reading (selected)

- The Giving Block – Annual Report on Crypto Philanthropy (2025) (>$1B in 2024; adoption, averages).

- The Giving Block – 2025 PDF (data visualisations, methodology).

- NonprofitPro: Crypto giving exceeds $1B in 2024.

- BusinessWire press release.

- IRS – Digital Assets hub.

- IRS – Instructions for Form 8283.

- IRS – About Form 8282.

- Journal of Accountancy – Qualified appraisal for crypto donations.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 150,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.