You want clarity, speed, and fewer nasty surprises from the taxman. Here’s the play: learn the 2025 rules, follow a clean workflow, lock your records, and squeeze every legal advantage. This is a straight-talking guide in UK English built for US crypto traders and investors who value time, certainty, and outcomes. No waffle, no hand-waving-just the moves that keep more of your money where it belongs: with you.

⚡️ Read This First – What Changed for 2025 (and Why You Can’t Ignore It)

Two big shifts define 2025. First, Form 1099-DA-the IRS’s new reporting slip for digital asset proceeds-enters the scene for transactions in the 2025 tax year. Brokers will issue 1099-DA to you and the IRS, increasing transparency and closing reporting gaps. (See the IRS overview and instructions for 1099-DA for the official framing.) Second, wallet-by-wallet accounting becomes the default expectation: rather than treating all wallets as a single bucket, you reconcile cost basis and gains per wallet to mirror how assets actually move through your ecosystem-clean, traceable, defensible.

The enforcement climate is also hotter. The IRS has been explicit about the digital asset question on Form 1040 and the need to answer it correctly every single year. Answering “No” when you had taxable activity is the fastest way to invite attention. Put bluntly: compliance apathy is expensive. Tighten up now.

Who’s impacted? If you traded, swapped on DeFi, flipped NFTs, mined, staked, got airdrops, or accepted crypto for work-you’re in scope. If all you did was buy with fiat and hold, you still need to keep records, but you won’t owe tax until disposal. And if you’re moving assets between your own wallets, that’s generally not taxable-but you must still track everything to prove it.

Here’s the mindset: control the inputs (records, method, forms) and you control the outcome (lower stress, lower risk, legally lower tax).

📐 How Crypto Is Taxed (Simple, Fast, Accurate)

Crypto is treated as property, not currency. That means two buckets: capital gains (when you dispose of a capital asset) and ordinary income (when you receive value, e.g., mining, staking, airdrops, referrals, or payment for services). Short-term gains (held < 12 months) are taxed at your ordinary income rate; long-term gains (≥ 12 months) get preferential rates. Use the holding period strategically-converting short-term to long-term can be the cleanest legal lever to reduce tax on winners. Pair that with accurate cost-basis tracking and you’ve got a simple, powerful optimisation lever.

Common taxable events:

- Selling crypto for dollars

- Swapping one coin/token for another (yes, that’s a disposal)

- Spending crypto on goods or services

- Receiving crypto as income (employment, freelancing, mining, staking, airdrops)

Common non-taxable events:

- Buying crypto with fiat (no disposal yet)

- Moving crypto between your own wallets or exchanges (but keep hashes/records to prove continuity)

If you mine or stake as a business, income typically lands on Schedule C; you may deduct ordinary and necessary expenses. Run it as a hobby and you lose a lot of flexibility-don’t play small if you’re serious.

🧭 The 2025 Filing Flow – Step-by-Step (Follow This Sequence)

This is the sequence that gets you from chaos to compliant-fast.

Step 1 – Collect documents and exports.

Pull every statement you can: 1099-DA from exchanges (for 2025 transactions), any 1099-MISC for rewards or promos, and full CSV exports from each platform. If you used multiple CEXs, DEXs, bridges, or cold storage, assume you’re missing something until you prove you’re not.

Step 2 – Aggregate wallet-by-wallet.

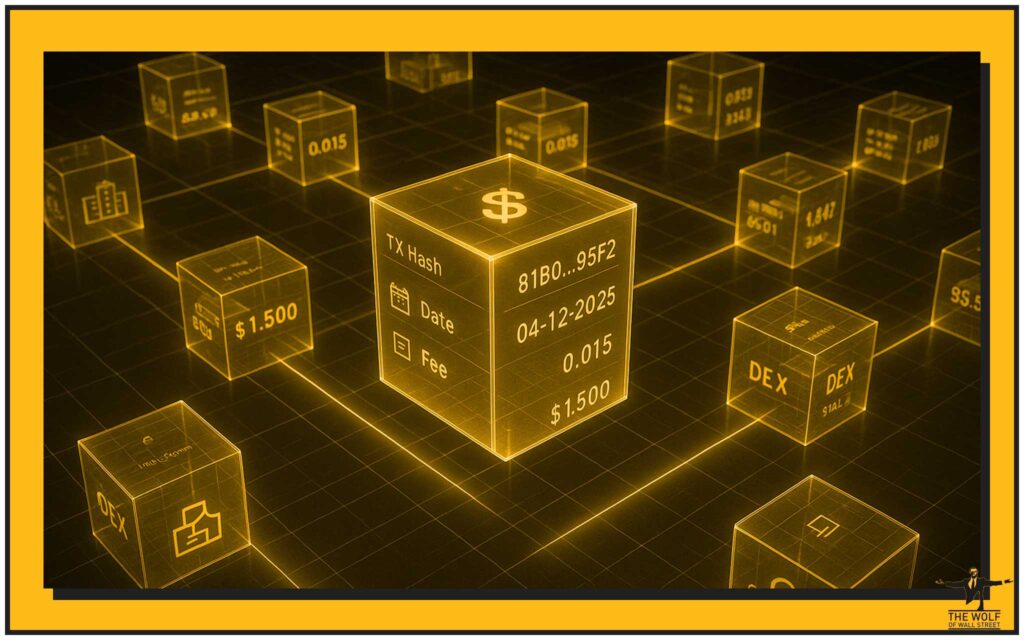

Build per-wallet ledgers: opening balance, deposits/withdrawals (with tx hashes), acquisitions, disposals, fees, and fair market values in USD at time of each event. No commingling. Treat each wallet like its own book, then reconcile transfers between them to avoid phantom gains.

Step 3 – Categorise transactions.

Split everything into capital vs income. Within capital, separate spot trades, DeFi swaps, NFT disposals, derivatives closes. Within income, separate mining, staking, airdrops, referral/affiliate, payments for services. Correct category = correct form.

Step 4 – Compute gains/losses and income.

For each disposal, compute proceeds – cost basis – fees = gain/loss. For income, record the USD value at receipt. Don’t forget that coin-to-coin swaps are disposals and spending crypto is a disposal too.

Step 5 – Complete the forms.

- Form 8949: line-by-line (or category totals) for each disposal; attach statements where allowed.

- Schedule D: totals from Form 8949 (short-term and long-term).

- Form 1040: flows from Schedule D, plus the digital asset question.

- Schedule C (if a business): mining/staking operations and deductions.

Step 6 – Document and back up.

Save PDFs/CSVs, exchange statements, screenshots, and explorer links. If the IRS asks, you answer in minutes, not weeks.

Step 7 – File on time; fix fast if needed.

Missed something? File an amended return. Honest, prompt corrections beat quiet non-compliance every day. For reference dates and a quick checklist, see reputable 2025 guides from major exchanges.

Need a second brain to sanity-check your process? The The Wolf Of Wall Street community has 150k+ traders sharing workflows, calculators, and answers 24/7. See the service hub or join the Telegram for real-time support.

🧾 Forms You’ll Actually Use (and When)

- Form 8949: Report each disposal (or summarised categories where permitted) with dates, proceeds, and basis. This is where reconciliation happens, especially if a 1099-DA doesn’t capture your full activity.

- Schedule D: Roll up your totals-short-term and long-term-after 8949.

- Schedule C: If mining/staking/trading rises to a business, record income and legitimate expenses here.

- 1099-DA vs 1099-MISC vs 1099-K: 1099-DA covers digital asset proceeds from brokered transactions; 1099-MISC may hit for promo rewards or certain income; 1099-K can apply in payment-processor contexts. Don’t rely solely on any 1099-your records rule.

- State returns: Many states piggyback on federal rules; check rates and deadlines locally.

If you want a refresher on order types or derivatives mechanics before you file, bookmark our guide on mastering crypto order types and our explainer on spot vs derivatives for context.

🧩 DeFi, NFTs, and Advanced Scenarios (Cut Through the Noise)

DeFi swaps and LPing. A token-to-token swap is a disposal; record proceeds and basis at the time of the swap. Providing liquidity can create complex mixed positions: depositing tokens into a pool and receiving LP tokens may be a disposal and an acquisition; exiting the pool is another disposal. Farming rewards are generally ordinary income at receipt. For broader orientation, scan our DeFi coverage so your tax map matches how protocols actually work.

Bridges, wraps, migrations. Wrapping or bridging can be tax-neutral in some structures and taxable in others, depending on whether the protocol treats the event as a new asset or a pass-through representation. Token migrations and chain swaps vary-check the project’s documentation and treat conservative by default unless authoritative guidance supports non-taxable treatment. Our guide on token swaps and migrations breaks down the dominance risks and record-keeping you need to protect cost basis.

NFTs. Minting is usually an acquisition (fees added to basis). Flips are disposals. Creator royalties you receive are typically ordinary income at the time they hit your wallet. If you operate an NFT business-marketplace, studio, or regular sales-expect Schedule C implications.

Derivatives. Gains from perpetuals, futures, and options are generally capital in nature, but treatment can differ by platform and instrument. Keep pristine records of entry, exit, funding, and fees. If this is your arena, our profit-taking guide will sharpen your timing and documentation.

Airdrops and staking. At receipt, recognise ordinary income at fair market value. When you later dispose of those coins, you’ll have a capital gain/loss based on that initial income basis. Time the sale thoughtfully to manage brackets.

🧮 Legally Paying Less Tax (No Tricks, Just Tactics)

1) Harvest losses-intelligently. Realise losses to offset gains; unused net capital losses can offset up to a limited amount of ordinary income annually and carry forward thereafter. Watch for economic substance: don’t create sham transactions. Document intent, timing, and pricing.

2) Hold for the right period. Flip winners into long-term territory when the economics justify it. The difference between short- and long-term rates is real money.

3) Give strategically. Gifting can move appreciated crypto to family members in lower brackets (be mindful of gift tax thresholds and Form 709 where applicable). Donating appreciated crypto to qualifying charities can eliminate capital gains and create a deduction-double win when documented correctly.

4) Use the right cost-basis method. Where available, Specific Identification lets you dispose of high-basis lots first, reducing gains. Understand when FIFO/HIFO apply, and how wallet-by-wallet accounting interacts with your method in 2025. For a deeper dive, see our explainer on FIFO, HIFO, and Specific ID.

5) Business discipline when warranted. If your mining/staking activities are substantial and profit-motivated, formalise as a business to deduct legitimate costs-hardware, electricity, hosting, software. Reality and records first; structure second.

If you’re optimising exits, pair this with our playbook on when to sell crypto and our primer on market dominance strategies to turn volatility into tax-aware decision-making.

🗂️ Record-Keeping That Survives Audits (Wallet-by-Wallet in Practice)

Bullet-proof records are a competitive advantage.

Log for every transaction: tx hash, date/time (UTC), asset, quantity, counterparty/wallet, fees, and USD value at time of event. Maintain per-wallet ledgers and a master transfer map. Reconcile CEX deposits/withdrawals to on-chain moves. If a transaction can’t be matched, investigate before filing; unexplained deltas often become audit magnets.

Pick software that actually covers your footprint: CEX + DEX + chains you use + NFTs + derivatives. Export Form 8949 summaries and full detail. Back up in three places: local encrypted drive, cloud, and offline. Our walkthrough on trendlines and moving averages isn’t just for traders-use those disciplines to annotate entries/exits so your tax trail matches your trading logic when you reconcile at year-end.

🚨 Mistakes That Cost You (Don’t Be the Case Study)

- Ignoring “small” DeFi swaps or bridge events. Pennies become pounds when multiplied.

- Double-counting fees or proceeds. Don’t let imports from multiple tools stack the same trade twice.

- Mixing personal and business wallets. Separate them; document inter-wallet transfers.

- Misclassifying staking rewards. Income at receipt, capital when sold-two distinct events.

- Relying solely on 1099-DA. Great starting point, incomplete picture. Your ledger is the master record.

🗓️ Compliance Timeline & Late Fixes

Mark your calendar early. The federal filing deadline is mid-April unless extended; quarterly estimates may apply if you book sizable gains. Late? File as soon as possible to reduce penalties and interest. If you discover errors after filing, use an amended return. If you receive a notice, respond promptly, professionally, and with documentation. For a quick date reference and prep list, see a current-year exchange checklist.

🛠️ The Toolkit: Checklists, Templates, and Help

- Crypto Tax Filing Checklist (2025): Documents, exports, per-wallet reconciliation steps, and form touchpoints.

- Gain/Loss Calculator (CSV): Wallet-by-wallet tab structure with automatic lot matching notes.

- Where to get help: A qualified crypto CPA/EA for complex cases-and a battle-tested trading community for speed and clarity.

The Wolf Of Wall Street is built for that: VIP signals, expert analysis, essential tools like volume calculators, and 24/7 support inside a 150,000+ private community. For details, hit the The Wolf Of Wall Street service page or join the Telegram and get answers in real time.

❓ FAQs (Built to Win People-Also-Ask)

Do I need to file crypto taxes if I didn’t get a 1099-DA?

Yes. You must report taxable crypto activity whether or not you received a tax form. 1099-DA improves visibility, but it doesn’t replace your duty to file.

How does wallet-by-wallet accounting work in 2025?

You maintain separate ledgers per wallet, track transfers between them, and calculate basis and gains within each. This aligns reporting with the way assets move on-chain and reduces mismatches when reconciling forms and statements.

Which forms do I need this year?

For disposals, Form 8949 and Schedule D; for business activity, Schedule C; answer the Form 1040 digital asset question accurately. If you have other income types (e.g., self-employment), additional schedules may apply.

Are DeFi swaps and NFT flips taxable?

Yes-swaps and flips are disposals. Record proceeds, basis, dates, and fees. For NFTs, treat creator royalties as ordinary income at receipt.

How are staking and airdrops taxed?

Value at receipt is ordinary income; subsequent sale triggers capital gains or losses from that basis.

What if I lost money-can I deduct it?

Yes-use capital losses to offset capital gains; limited excess losses can reduce ordinary income each year, with the remainder carried forward. Log everything properly.

Is buying crypto taxable? Are transfers between my wallets taxable?

Buying with fiat isn’t taxable until you dispose. Transfers between your own wallets are typically non-taxable, but record them to prove continuity and basis.

Which states are friendliest for crypto taxes?

Rates and rules differ by state; check your state’s guidance-don’t assume zero tax just because federal treatment is clear.

Can I still fix last year’s mistakes?

Yes. File an amended return with corrected schedules and supporting statements. Fast corrections plus strong documentation usually reduce risk.

What records do I keep to survive an audit?

Everything: tx hashes, timestamps, prices, fees, wallet tags, CSV/PDF exports, and your reconciliation notes. If you can reproduce any total in minutes, you’re prepared.

What’s the safest way to reduce my crypto tax bill?

Hold for long-term where sensible, harvest losses with substance, donate appreciated coins, use Specific ID when allowed, and run serious operations like a business-with real records.

🎯 Bottom Line (and Where The Wolf Of Wall Street Fits)

You can’t bluff the IRS. In 2025, with 1099-DA and wallet-by-wallet accounting, the winners are the traders who operate like pros: clean inputs, correct categories, right forms, fast filing. Pair that discipline with sharper entries and exits and you compound results on both sides-more after-tax profit, less noise.

If you want speed, certainty, and a community that gets it, The Wolf Of Wall Street is your unfair advantage: VIP signals, expert market analysis, private community (150k+), essential tools like volume calculators, and 24/7 support. Start at the The Wolf Of Wall Street service page or jump into the Telegram community and level up today.

References & further reading

- IRS Digital Assets hub – official guidance.

- IRS Form 1099-DA – about the form and instructions.

- Digital asset question on Form 1040 – IRS newsroom note: what you must answer.

- Forms for crypto – TurboTax overview: crypto tax forms; Schedule D primer: how Schedule D works.

- 2025 guides – Kraken, Koinly, and practitioner view on wallet-by-wallet rules: Gordon Law Group.

Disclaimer: This article is educational information, not tax or financial advice. Speak with a qualified tax professional for your specific situation.