🔥 Introduction: The Wolf Smells Blood in the Euro Waters

This isn’t your average corporate treasury play. This is Adam Back—Bitcoin OG, cryptographic genius, Blockstream CEO—throwing down a $2.2 million gauntlet on a Swedish health tech firm that just told Europe’s fiat lovers to shove it.

H100 Group AB didn’t just dip a toe in. They cannonballed into the Bitcoin pool with a treasury play that’s sending ripples across the EU. Why? Because this isn’t just a financial move—it’s a philosophical war cry.

Let’s break down what happened, why it matters, and how this move could mark the start of a European corporate Bitcoin revolution.

💰 Adam Back’s $2.2M Power Move — Breaking It Down

Let’s talk numbers.

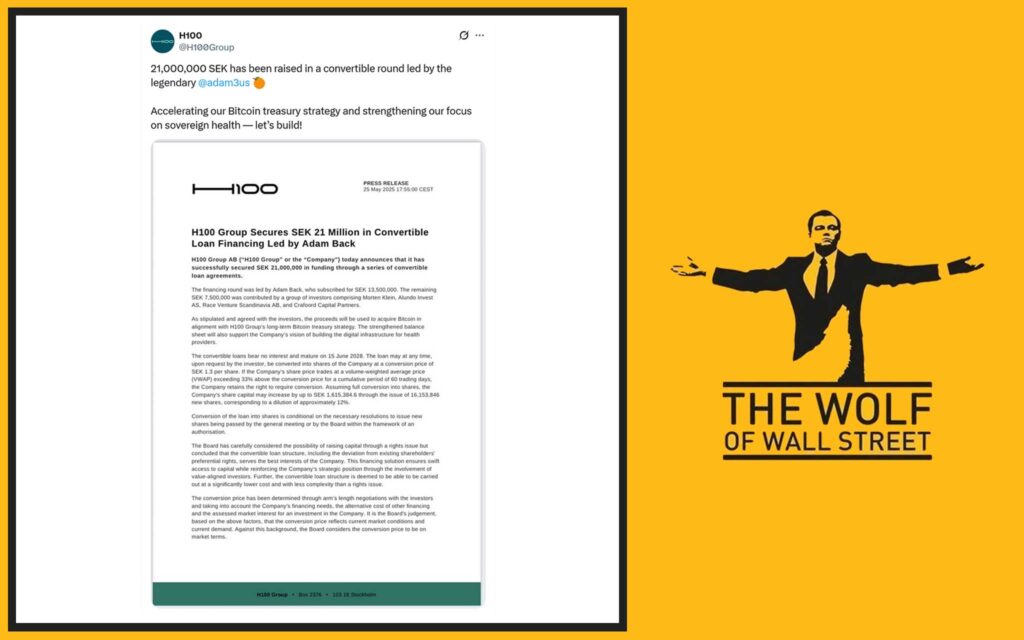

Adam Back led a 21 million SEK ($2.2 million USD) funding round for H100 Group AB. That’s not Monopoly money. That’s a statement from a man whose signature practically sits next to Satoshi’s.

The structure? 0% interest convertible loans. That’s right—no vig, no juice, just skin in the game. These loans mature on June 15, 2028, and investors can convert at a dirt-cheap 1.3 SEK per share (around $0.11 USD). If H100 stock pops 33% above that price for 60 trading days? Forced conversion. Boom—equity on the books, 12% dilution.

But no one’s flinching. Because the upside is massive. And the belief is bulletproof.

📈 H100’s Bold Bitcoin Bet — Not Just Hype, It’s Strategy

What does H100 do? They’re not a crypto company. They’re not a bank.

They’re a health tech disruptor—delivering AI-driven digital health solutions to people sick of the status quo. But their Bitcoin buy isn’t a gimmick. It’s a long-term play.

They’re using that $2.2M to buy approximately 20.18 BTC, adding to the 4.39 BTC they already scooped up on May 22. That puts them at 24.57 BTC—and counting.

This isn’t about volatility. It’s about vision. They’re betting on the long-term trajectory of a scarce, decentralised, censorship-resistant asset that aligns with their own brand values of sovereignty, resilience, and digital-first innovation.

📊 The Deal Mechanics — Where the Real Money Is

Let’s break this down like a boss:

- Convertible Loan Terms: 0% interest, maturing June 2028

- Conversion Price: 1.3 SEK/share (~$0.11 USD)

- Dilution Potential: 12% if fully converted

- Upside Potential: Massive, if Bitcoin climbs and equity follows

This setup gives investors asymmetric upside with limited downside. Classic Wolf of Wall Street playbook. You get equity exposure in a disruptive tech company plus indirect BTC exposure. It’s like owning Tesla stock in 2015 and buying Bitcoin at $300.

🇸🇪 Sweden Enters the Bitcoin Arena — First Mover Advantage

Here’s the kicker: H100 is the first public company in Sweden to adopt a Bitcoin treasury policy. That’s not just big—that’s historic.

In Europe, only ~10 companies hold Bitcoin on their balance sheets. H100’s now one of them, and the first from the Nordics.

The market reacted FAST:

- +37% share price jump the day they announced

- +5.33% the day after

This isn’t some memecoin pump. It’s investor confidence flooding in like a tidal wave.

Meanwhile, Swedish policymakers are starting to ask the right questions: Should Sweden build a national Bitcoin reserve? You bet your ass they should.

[Related link: Explore more in our Bitcoin category.]

🏥 Who Is H100? The Silent Giant in Health Tech

H100 Group AB isn’t chasing headlines. They’re building real solutions in a broken healthcare system. Their mission?

“Proactive, personalised, digital-first health—without waiting rooms and reactive medicine.”

They use AI and automation to give people control over their own health. And now they’re giving themselves control over their balance sheet—with Bitcoin.

For them, this isn’t just a financial hedge. It’s a cultural alignment. Bitcoin = self-ownership. Just like their health model.

🌍 European Corporate Bitcoin Adoption — A Sleeping Giant?

H100 isn’t alone forever.

Right now, Europe lags behind the US in corporate Bitcoin adoption. Over 100 public companies globally hold BTC. Europe? Fewer than 10.

But H100 just blew the doors open.

Expect fintech firms, SaaS platforms, and health innovators to follow the path. Why? Because it works. Because fiat is fading. Because Bitcoin is inevitable.

[Related read: Corporate strategy insights in Trading Insights.]

🚀 Share Price Surges — But This Isn’t a Pump-and-Dump

The results?

- +37% on announcement

- +5.33% next day

- Market validation that screams, “More of this, please!”

Unlike memecoin madness, this rally is backed by conviction, clarity, and cash flow strategy.

Insiders are in. Long-term holders are in. And the smart money is circling.

🔥 Why This Isn’t Just a Treasury Play — It’s a Cultural Pivot

Forget treasury strategy for a second. This is about brand identity.

H100’s customers want control. They want sovereignty. And Bitcoin isn’t just a ledger—it’s a flag. A signal. A philosophy.

This move says: “We stand for financial freedom just like we stand for personal health sovereignty.” That’s how you win hearts and wallets in 2025.

👑 Adam Back’s Legacy — Still Leading the Bitcoin Frontlines

Let’s not forget who we’re talking about here.

Adam Back isn’t some VC bro. He’s one of the few people referenced in Satoshi Nakamoto’s whitepaper. He created Hashcash, the foundation of Bitcoin’s proof-of-work.

He co-founded Blockstream, and now he’s pushing Bitcoin deeper into the fabric of traditional business.

This isn’t retirement. This is legacy building.

🔐 Risk, Reward, and the BTC Corporate Gold Rush

Is there risk? Of course. Bitcoin’s volatile. But here’s what matters:

- Fiat is guaranteed to lose purchasing power

- Bitcoin is guaranteed to have limited supply

That’s not speculation. That’s math.

And when BTC hits $150K—or $200K—companies like H100 will be light-years ahead.

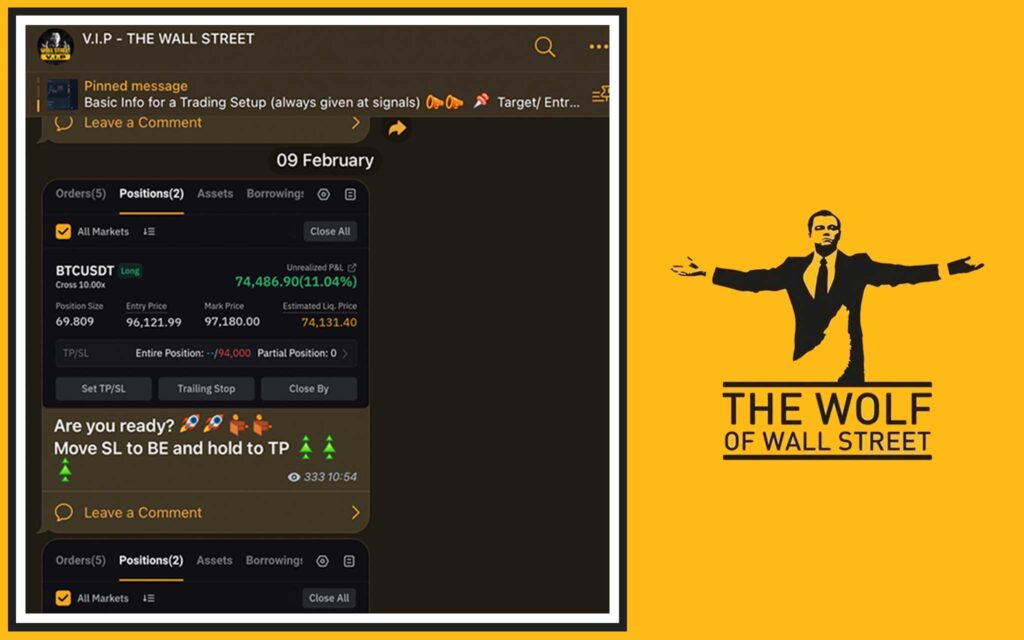

🛠 How to Capitalise Like the Pros – Tools for Traders

Want to move like Adam Back?

Start by using serious tools:

- Volume calculators

- Market analysis dashboards

- Custom indicators

Then layer on what the pros use: signals from a high-conviction community.

That’s where the The Wolf Of Wall Street crypto trading community comes in.

💎 The The Wolf Of Wall Street Edge — Where Smart Crypto Traders Get Ruthless

Inside the The Wolf Of Wall Street community, you get:

- Exclusive VIP signals (real edge, not hype)

- In-depth market analysis from real traders

- A network of 100,000+ sharp minds

- Volume calculators, trading tools, and 24/7 support

Want to stop guessing and start winning?

Join the Telegram group here

Or dive in at tthewolfofwallstreet.com

🧭 What This Means for You — Retail, Investor or Builder

This isn’t just H100’s play. It’s a blueprint for YOU:

- Retail trader? Stack sats. Build conviction. Mirror institutional behaviour.

- Builder? Think beyond VC cash—think BTC.

- Investor? Watch who’s adding Bitcoin to their treasury and ride the wave early.

This is where retail meets corporate conviction—and The Wolf Of Wall Street bridges the gap.

📚 TL;DR: The Summary That Packs a Punch

- Adam Back led a $2.2M raise for H100 Group AB

- Funds will buy ~20 BTC, adding to their 24.57 BTC stack

- H100 is the first Swedish public company to adopt a Bitcoin treasury

- Their stock surged 37% — because the market gets it

- This isn’t just finance. It’s a statement: sovereignty over everything

- And the The Wolf Of Wall Street community is where smart traders join the mission

❓ FAQ – The 5 Burning Questions Everyone’s Asking

1. Why Bitcoin for a health tech firm?

Because H100 stands for independence, sovereignty, and innovation—just like Bitcoin.

2. Is this model repeatable?

Absolutely. It’s already being copied. H100’s just the loudest voice right now.

3. What if the BTC market tanks?

Then they hold. Their BTC isn’t for short-term speculation—it’s strategic savings.

4. Who are the other European companies doing this?

A few: Seetee (Norway), Deutsche E-Bank (Germany). But none as bold as H100.

5. What’s next for H100?

Expansion, product innovation, and—if we had to bet—more Bitcoin.

🔗 The Engine Behind the Curtain

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: In-depth analysis from seasoned crypto traders.

- Private Community: Join 100,000+ like-minded individuals for insights and support.

- Essential Trading Tools: Volume calculators, dashboards, and more.

- 24/7 Support: Dedicated assistance round the clock.

Empower your crypto trading journey:

Visit tthewolfofwallstreet.com

Join the Telegram community for real-time updates and discussions.