🔥 Introduction: The Wolf’s Take on Altcoin Season

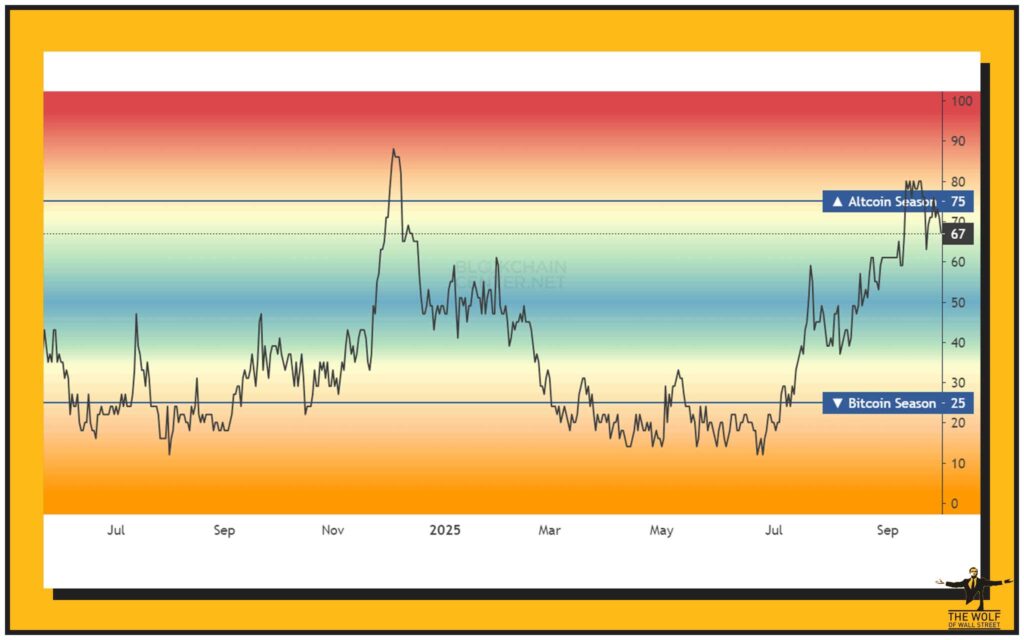

Altcoin season isn’t just a buzzword—it’s a money-printing machine if you know how to play it. When 75% of the top 100 altcoins outperform Bitcoin over 90 days, we’re officially in altseason. And here’s the kicker: most traders miss the signs until it’s too late.

I’m going to break it down—no fluff, no filler—just the raw truth about what drives altcoin season, how you can spot it, and how to profit without becoming someone else’s exit liquidity.

💰 What Is Altcoin Season?

Altcoin season, or altseason, is when altcoins take the spotlight and leave Bitcoin lagging behind. The official gauge? The Altcoin Season Index. A score above 75 means we’re in full swing. Think of Bitcoin as the bouncer at the nightclub—he lets the altcoins in once he’s made his money at the door. Without Bitcoin heating up first, altseason doesn’t even get started.

Altseason isn’t random; it’s cyclical. Every few years, Bitcoin grabs the headlines with a big rally, but then investors look for bigger returns. They rotate their profits into altcoins, igniting a firestorm of gains across the market. Understanding that dynamic is your first step toward cashing in.

📈 Bitcoin Price Cycles – The Domino That Starts It All

Every altseason starts with Bitcoin. Here’s how it works: Bitcoin runs first, dominance spikes, then stabilises, and profit-takers rotate into altcoins. That’s the domino effect. Historically, this happened in 2017 and 2021—and the same setup is flashing for 2025. Watch Bitcoin dominance (BTC.D) like a hawk: when it drops below 55–60%, the altcoin party begins.

Case Study: 2017 Altseason

Bitcoin went from $1,000 to $20,000. Then capital rotated into Ethereum, which surged from under $10 to nearly $1,400. Ripple (XRP) climbed from $0.006 to $3.50. The domino chain was undeniable: Bitcoin lit the fire, but altcoins delivered the fireworks.

Case Study: 2021 Altseason

Bitcoin hit $69,000. Once profits were taken, altcoins like Solana went from $1.50 to $260. Meme coins like Dogecoin skyrocketed 7,000%. Lesson? Bitcoin sets the stage, but altcoins steal the show.

Check our deep-dive on Bitcoin dominance trading strategies and Bitcoin spot & derivatives trading for sharper insights.

🚀 Market Sentiment & FOMO – Fuel on the Fire

The rocket fuel of altseason isn’t fundamentals—it’s FOMO. Retail traders pile in, driven by viral tweets on X, Reddit threads, and Telegram hype. We saw Dogecoin and Pepe coins skyrocket because retail frenzy amplified every move. Once FOMO kicks in, rationality exits the chat.

But don’t underestimate this. Psychology moves markets. When your neighbour is bragging about a 5x on a meme coin, that’s when liquidity floods into altcoins. And it doesn’t stop until everyone feels they’ll miss out.

Check our crypto trading insights and the madness of memecoins to see how retail hype powers these cycles.

🌍 Macroeconomic Drivers – Liquidity is King

Here’s the truth: liquidity drives everything. When the Federal Reserve cuts rates, risk assets pump. Global liquidity cycles directly affect how much money flows into crypto. Altcoins, being higher risk, benefit the most. 2025 is shaping up with favourable conditions—liquidity is coming back, and that means altcoins are primed for explosive upside.

Example: Fed Policy Shifts

- 2019–2020: Loose monetary policy fuelled Bitcoin’s rally and altseason in 2021.

- 2022–2023: Aggressive rate hikes drained liquidity, crushing altcoins.

- 2025 outlook: Rate cuts expected, meaning capital is once again ready to flow into higher-risk assets like altcoins.

📜 Regulation: From Enemy to Ally

Once upon a time, regulation was the boogeyman. Not anymore. With Ethereum ETFs pulling in billions, institutional investors now have legitimate on-ramps into altcoins. The SEC is loosening its chokehold, and inflows are skyrocketing. Regulation is no longer the enemy—it’s validation.

For more, see Ethereum ETF inflows and crypto regulations across Latin America.

🤖 Tech Innovation: The Narrative Engine

Narratives move markets. Right now, we’re seeing explosive innovation:

- AI tokens riding the AI boom

- Layer-2 scaling solutions bringing speed and cost efficiency

- Tokenisation of real-world assets attracting serious institutional interest

Narratives are sticky. Traders pile in, media amplifies, and money follows. The 2025 cycle has the strongest narrative engine we’ve ever seen. To dive deeper, explore Layer-1 & Layer-2 solutions and DeFi innovation.

🏦 Institutional Money Joins the Party

This isn’t just retail anymore. Hedge funds, pension funds, and Wall Street giants are now pushing billions into Solana, XRP, and Ether-linked products. ETFs have bridged the gap between traditional finance and Web3. Institutional money doesn’t just add volume—it adds stability and longevity to altseason rallies.

Numbers Don’t Lie

- Solana funds: Billions in inflows during 2025.

- Ethereum ETFs: Over $4 billion raised in weeks.

- XRP products: Gaining traction as regulatory clarity improves.

👥 Retail vs. Institutions – Who Holds the Wheel?

Retail creates the hype, institutions provide the firepower. When both align, you get parabolic moves. Retail can drive coins 10x, but institutions can keep them there. This synergy is what makes 2025’s altseason so dangerous—and so profitable.

Retail wants quick gains, institutions want structured exposure. Together, they create liquidity that fuels longer, stronger rallies.

📊 Key Metrics That Predict Altseason

Want to know when altseason is coming? Watch these indicators:

- Bitcoin dominance under 55–60%

- Altcoin Season Index above 75

- Spikes in altcoin trading volume

- Technical signals like RSI, MACD, Bollinger Bands

Learn more with RSI crypto trading strategies, Bollinger Bands strategy, and MACD momentum signals.

⚠️ The Dark Side: Risks of Altcoin Season

Let’s cut the hype for a second. Altcoins are volatile. Scams, rug pulls, and speculative mania wipe traders out every cycle. Regulation can swing back hard at any moment. If you don’t have risk management in place, you’re roadkill.

Real-World Example

In 2021, Squid Game token ran 40,000% before collapsing to zero—leaving latecomers with nothing. In every altseason, similar traps exist.

Arm yourself with crypto AML compliance guides and learn when to sell crypto before the market makes that decision for you.

🛡️ Survival Strategies for Wolf Traders

Here’s how to survive—and thrive:

- Diversify: Spread exposure across sectors (AI, DeFi, NFTs).

- Use stop-losses: Protect your downside.

- Ride narratives: But don’t overstay.

- Take profits in stages: Don’t wait for the top—cash out incrementally.

- Lean on a strong community: Don’t trade in isolation.

That’s where groups like The Wolf Of Wall Street give you the edge—signals, tools, and support keep you from being shark bait.

📚 Lessons From Past Altseasons

2017 ICO Boom

Wild profits, wild crashes. Lesson: regulation matters. ICO mania ended in disaster for many, but early movers saw life-changing gains.

2021 DeFi & Meme Coin Run

Retail frenzy pushed coins 100x. Lesson: narrative is everything. Uniswap, Aave, and Dogecoin defined the era.

2025 Setup

Institutions, tech narratives, and macro tailwinds—this cycle is bigger than both 2017 and 2021. The difference? Institutional depth adds staying power.

🔮 The 2025 Altseason Outlook

This cycle is different—it’s faster, deeper, and driven by both Wall Street and Main Street. With AI, tokenisation, and regulatory green lights, the conditions are perfect.

Bullish Scenario

- Bitcoin stabilises above $100k

- Altcoin Season Index > 90

- Institutions pour billions into alt ETFs

Neutral Scenario

- Bitcoin chops sideways

- Altcoins rally selectively (AI, gaming, layer-2s)

Bearish Scenario

- Liquidity dries up, regulation tightens

- Altseason cut short by external shocks

🙌 Conclusion: How to Ride the Altseason Like a Wolf

Altcoin season isn’t random. It’s when 75% of top altcoins outperform Bitcoin over 90 days, fuelled by Bitcoin cycles, retail FOMO, institutional money, and explosive narratives. The signs are there if you know where to look—BTC dominance, altcoin volume, and regulatory shifts.

The Wolf’s advice? Don’t just watch. Play the game—but play it smart. Plan your entries, lock in your exits, and remember: the market rewards the bold, but punishes the reckless.

❓ FAQs

1. How long does an altcoin season usually last?

Typically 2–3 months, though mini-altseasons can last weeks.

2. Which altcoins typically outperform Bitcoin?

Historically, Ethereum, Solana, XRP, and trending narrative coins.

3. Can altseason happen without a Bitcoin bull run?

Rarely. Bitcoin rallies almost always precede altseason.

4. What’s the safest way to trade altcoins in 2025?

Diversify, use stop-losses, and stick to strong projects with real liquidity.

5. How can beginners avoid scams during altseason?

Join trusted communities, avoid anonymous projects, and always do due diligence.

📌 The Wolf Of Wall Street Crypto Trading Community

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: In-depth analysis from seasoned crypto traders.

- Private Community: Join 100,000+ traders sharing insights and support.

- Essential Trading Tools: Volume calculators and decision-making resources.

- 24/7 Support: Continuous assistance whenever you need it.

👉 Empower your crypto trading journey:

- Visit The Wolf Of Wall Street service for detailed information.

- Join the Telegram community for real-time updates.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.