⚡ Introduction: The Wolf Sniffs Blood in the Market

Listen up — Australia just dropped a bombshell in the crypto jungle. We’re not talking about another toothless government memo or vague “consultation paper.” No. This is hard-hitting draft legislation that will change the way exchanges operate in the land down under.

It’s called the “cornerstone” of Australia’s digital asset roadmap, and trust me, that’s no throwaway line. This is about power, legitimacy, and the government finally flexing on a sector that’s been dancing in the grey zone for way too long.

If you’re a trader, an exchange operator, or even just hodling on the sidelines, here’s the truth: adapt or get crushed. This isn’t optional. This is the new era of Australia crypto regulation, and the Wolf’s going to walk you through it, step by step.

🔑 Draft Law Overview: The Foundation of Australia’s Digital Asset Roadmap

The Australian government’s draft law is designed to drag crypto exchanges into the same league as traditional finance players. No more Wild West. No more shady operators hiding behind vague AUSTRAC registrations.

The law demands that digital asset platforms and tokenised custody platforms secure an Australian Financial Services Licence (AFSL) and formally register with ASIC. It’s about accountability. It’s about giving consumers confidence that the platforms holding their hard-earned capital aren’t fly-by-night operations.

This isn’t just regulation. This is strategy.

🏦 From Loose Ends to Tight Leash: The Shift from AUSTRAC to ASIC

Right now, the only box most Australian exchanges have to tick is AUSTRAC registration — basically an anti-money laundering checkbox. But here’s the kicker: many of those registered exchanges aren’t even active.

The new model consolidates oversight into the hands of ASIC, Australia’s financial watchdog. That means exchanges will need to prove they’re up to scratch — not just at onboarding users, but in how they manage custody, transparency, and risk.

This is the government closing the loopholes. And when loopholes close, only the strong survive.

👉 Want to understand why compliance is about to become the difference between profit and extinction? Read our guide on crypto AML compliance and crypto travel rule strategies.

📜 Licensing & Registration: No Free Passes Anymore

If you’re running a digital asset platform or a tokenised custody service, the message is clear: get licensed or get out.

This AFSL requirement isn’t just a rubber stamp. It means proving operational competence, financial safeguards, and compliance protocols. Custody providers, staking services, wrapped token issuers — they’re all in the crosshairs.

This is about separating the real businesses from the backyard hustlers.

🪙 Key Activities Under the Microscope

This legislation doesn’t just regulate “exchanges” as a vague category. It zooms in on specific activities that carry unique risks:

- Wrapped Tokens: New rules ensure custody transparency so users don’t get rugged.

- Staking: Platforms offering staking must prove fairness, liquidity, and proper custodianship.

- Custody & Settlement: Custody providers need to meet standards that mirror traditional finance custodians.

By targeting activities instead of just broad categories, Australia is acknowledging the nuanced beast that crypto really is.

🚨 Compliance Rules: What Exchanges Must Do or Die Trying

The compliance obligations are heavy. Think of it like Wall Street’s compliance desk on steroids:

- Safeguarding Assets: Clear custody standards.

- Settlement Standards: Rules for how digital assets are exchanged and cleared.

- Audit & Transparency: Mandatory reporting.

- Consumer Protection: Frameworks to protect investors from insolvency events.

Ignore these obligations and you’re not just in trouble — you’re roadkill.

🥊 Penalties with Teeth: Why Non-Compliance Isn’t an Option

Let’s talk about the stick, because this law isn’t all carrot.

Non-compliance could mean fines of AUD 16.5 million or 10% of annual turnover — whichever stings more. In some cases, three times the financial benefit gained through misconduct.

In other words: the government is setting traps for the wolves who think they can game the system. And these traps have teeth.

🐣 Exemptions for Small Players: The “Low-Risk” Clause

Here’s the bone thrown to the little guys: “low-risk” platforms don’t face the same heat.

Criteria:

- Less than AUD 5,000 per customer

- Annual turnover under AUD 10 million

If you’re operating in that sandbox, congratulations — you get a pass. But remember, a pass doesn’t mean immunity. Smaller players might dodge AFSL requirements, but they still need credibility to attract customers.

👉 If you’re new to trading and wondering how to navigate this safely, start with our crypto newbie guide and step-by-step how to buy crypto.

🧩 What the Law Doesn’t Cover

This draft isn’t universal. It deliberately avoids:

- Crypto Issuers: No rules yet for token creators.

- Non-Financial Tokens: Think gaming NFTs and social tokens.

The government is focused on platforms, not creators. That’s a choice — and a smart one, at least for now.

🏛️ The Government’s Rationale: Cleaning Up the Street

This law didn’t appear in a vacuum. It’s a reaction to:

- FTX-style collapses

- High-profile scams

- Consumers losing faith in exchanges

The Albanese government wants to weed out the scammers, clean the blood off the street, and create a market that institutional investors can trust.

Because when institutions trust, big money flows.

🌍 How Australia Stacks Up Globally

Is Australia blazing a trail or just catching up? Let’s compare:

- EU (MiCA): Broad licensing across all member states.

- U.S. SEC: Aggressive lawsuits, unclear framework.

- Singapore: Licensing model with strong consumer protections.

Australia’s approach is pragmatic: focused on platforms, not choking innovation at the source.

👉 For more regional insights, see our analysis of Latin American crypto regulation and the Clarity Act in the U.S..

💥 Industry Reactions: Cheers, Tears, and Fears

- Exchanges: Larger players will cheer — they can afford compliance. Smaller ones? Panic stations.

- Investors: Likely to welcome stronger safeguards.

- Critics: Warning about stifled innovation and higher barriers to entry.

But make no mistake: this is happening. And the smart operators are already adapting.

🦾 Implications for Traders: What This Means for YOU

For everyday traders, this legislation could be a blessing:

- Safer custody of assets.

- More trustworthy platforms.

- Staking with transparency.

- Lower risk of rug pulls.

The game is levelling up. Your strategy should too.

👉 For deeper strategies, check out our trading insights hub.

🛠️ Tools to Survive the New Era

How do you stay ahead in this regulated battlefield?

- Use Compliant Platforms: Stick to exchanges that meet AFSL requirements.

- Leverage Tools: Volume calculators, risk trackers, compliance checkers.

- Join Communities: You don’t have to trade alone.

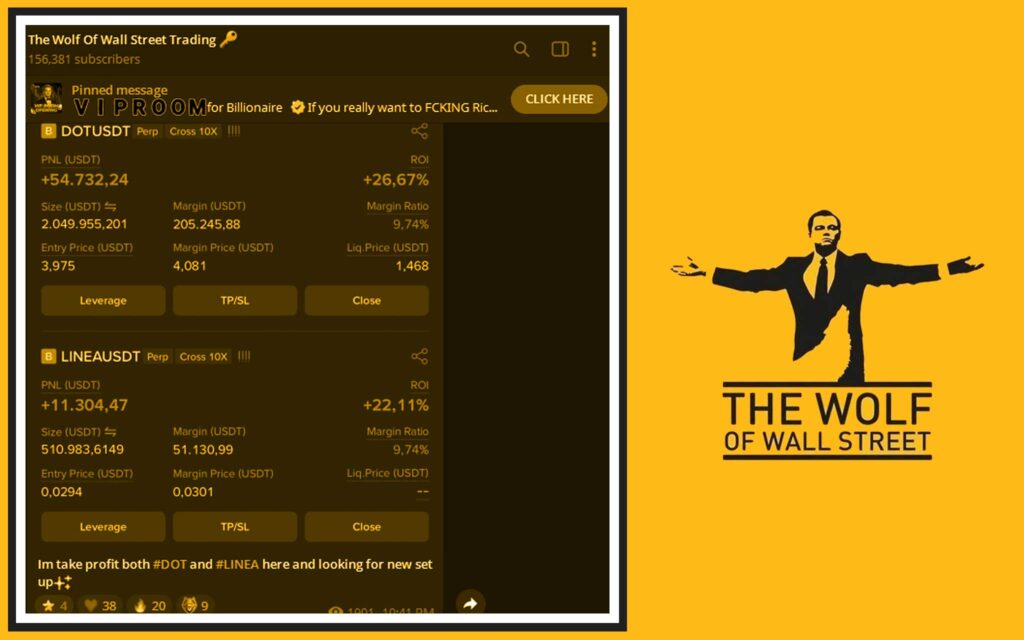

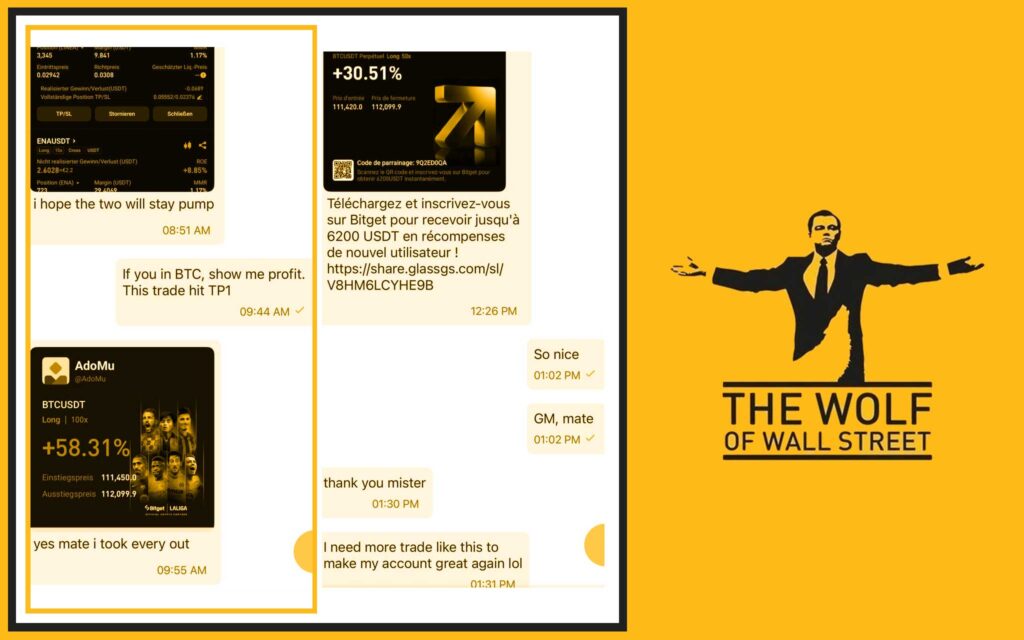

This is where the The Wolf Of Wall Street crypto trading community shines:

- VIP trading signals

- Expert analysis

- Private network of 100K+ traders

- 24/7 support

👉 Learn more at The Wolf Of Wall Street Service or join their Telegram army at The Wolf Of Wall Street Community.

🔮 Future Outlook: The Wolf’s Prediction for Australia’s Crypto Jungle

Here’s the forecast:

- Short-Term: Some platforms exit. Compliance costs rise. Traders panic.

- Medium-Term: Market stabilises, institutions enter, retail confidence grows.

- Long-Term: Australia positions itself as a global crypto hub with clean, secure infrastructure.

The Wolf’s call? This law is the beginning of something big.

❓ FAQs: Cutting Through the Noise

1. Who needs an AFSL under the new law?

All digital asset and tokenised custody platforms above the “low-risk” exemption threshold.

2. Will small exchanges survive?

Yes, if they stay under AUD 10M annual turnover and AUD 5K per customer.

3. How do penalties compare internationally?

They’re among the toughest — aligning with Europe’s MiCA and surpassing some U.S. frameworks.

4. Does this affect retail crypto users?

Indirectly — it means safer platforms, but potentially fewer choices.

5. What about DeFi and staking protocols?

Staking is included. Pure decentralised DeFi (not run as a platform) is harder to regulate — for now.

🏁 Conclusion: Australia Just Put Crypto on Notice

Here’s the bottom line: the party’s over for the bad actors. Australia’s draft law is about taking crypto from chaos to credibility, from wild west to Wall Street discipline.

For traders, it’s a chance to operate in a safer, more transparent market. For exchanges, it’s adapt or die.

This is Australia crypto regulation with teeth — and the Wolf approves.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Maximise trading profits.

- Expert Market Analysis: Insights from seasoned traders.

- Private Community: 100K+ members strong.

- Essential Trading Tools: Volume calculators and more.

- 24/7 Support: Dedicated help anytime.

Empower your crypto trading journey:

- Visit: The Wolf Of Wall Street Service

- Join Telegram: The Wolf Of Wall Street Community