Welcome to the lion’s den. In crypto, downtime isn’t just a technical glitch—it’s a $4.1 billion reality check. If you’re playing to win, you’d better understand exactly what happened when Coinbase’s Base chain went dark for 33 minutes.

Here’s the unfiltered breakdown—and what you need to do next if you want to survive and thrive in the world of decentralised finance.

💥 Introduction: Welcome to the Real World of Crypto Outages

Let’s skip the pleasantries. The Base outage on 6 June 2024 was a jolt that sent shockwaves through every corner of the DeFi universe. This isn’t a story for the faint-hearted—it’s about real money, real traders, and real risk. When a network managing over $4.1 billion in TVL goes offline, every minute is a landmine. This article will hand you the hard truths, not corporate PR spin.

🚦 Setting the Stage: Why Layer-2 Uptime Matters

You want to know why this stuff matters? Here’s the deal—DeFi isn’t a hobby anymore. Billions ride on these chains. If you’re staking, trading, or deploying liquidity on platforms like Base, every second counts. Even a five-minute hiccup can trigger liquidations, lost trades, and the kind of chaos that keeps institutional money up at night.

Uptime is king. And in a world where everyone’s promising 99.99%, the difference between winning and losing is who keeps their promises when the market hits the fan.

🕒 What Went Down: The Timeline of Base’s Outage

Here’s what the history books will say—and what traders saw in real time:

- 6:07 am UTC: The main sequencer on Base starts lagging.

- Conductor, Base’s manager, steps in: It tries to switch to the backup sequencer.

- The backup’s not ready. It’s misconfigured. Suddenly, block production stops. No new transactions. The chain is frozen.

- Community goes wild: Social media, Telegram, The Wolf Of Wall Street’s active traders—everyone’s scrambling for answers.

- 6:40 am UTC: The core Base team intervenes. Blocks start rolling again. The chain is back, but trust is rattled.

This isn’t theoretical. It’s the harsh, chaotic reality of live blockchains.

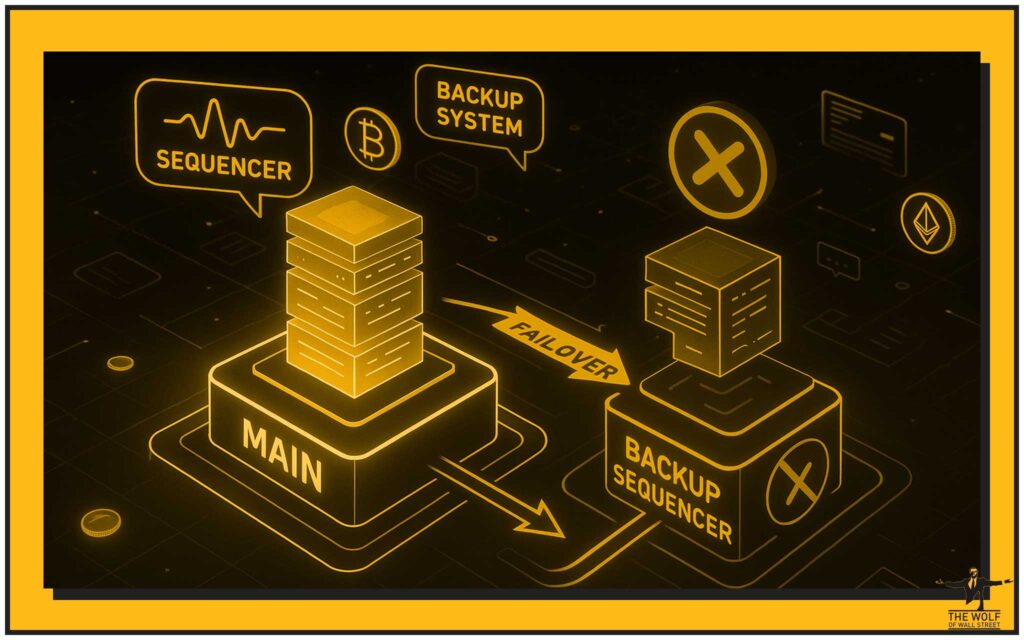

🔧 Diagnosing the Root Cause: The Sequencer Slip-Up

What tanked Base for half an hour? The answer is brutally simple: centralisation and bad configuration.

A sequencer is the gatekeeper—it decides which transactions make it into the next block. Base uses a system called Conductor to manage these sequencers. When the main sequencer choked, Conductor was supposed to hand off to a backup.

But here’s the kicker: the backup sequencer was misconfigured. Instead of stepping in like a pro, it stalled, leaving the whole chain dead in the water.

For the deep-divers, check our trading insights for a full technical autopsy.

⚡ Centralisation Risks: How a Single Point of Failure Can Crush Confidence

Don’t let anyone sell you the “decentralisation” dream without proof. If your whole network hinges on one sequencer (or one Conductor), you’re a sitting duck.

Compare that to Solana’s infamous outages, or the way Arbitrum and Optimism structure their failovers. This isn’t just an engineering debate—centralisation hits your wallet.

If you think centralisation can’t shake up prices, check the charts after any major outage. Liquidity dries up, spreads widen, and DeFi whales start hunting stop losses.

For more on the architecture wars, see our layer-1 and layer-2 solutions guide.

🚑 The Quick Fix: How Base’s Engineers Responded

Let’s give credit where it’s due—Base’s engineering team didn’t hide. Within minutes, they jumped into public comms, with the head of engineering owning the problem and promising change.

Quotes were flying on X (formerly Twitter), post-mortems were published, and accountability was front and centre. That’s how you build (or rebuild) trust in this space.

But let’s be real: patching the leak after the ship’s taken on water is not a long-term solution. The market wants proactive resilience, not just damage control.

🗣️ The Aftermath: Community Reactions, FUD, and Bullish Spin

When the dust settled, the crypto world did what it always does:

- FUD (fear, uncertainty, doubt) flew around like confetti.

- Some traders panicked. Some called for heads to roll.

- Others—especially the sharpest whales in communities like The Wolf Of Wall Street—spotted an opportunity.

The hot take? “If people care enough to panic, your chain matters.”

Bullish memes appeared almost as fast as complaints. It’s a badge of honour: you’re only relevant if your downtime makes headlines.

💸 The $4.1 Billion Question: What’s at Stake for DeFi Power Users?

When Base froze, it wasn’t just devs sweating.

- Protocols locked up.

- Traders couldn’t move or liquidate.

- Lenders and borrowers got stuck.

Luckily, there was no chain reorganisation and most funds remained safe. But this was a close call.

If your assets were locked, you learned a hard lesson:

Always have a backup plan. Always know where your liquidity sits.

Want a deeper breakdown of risk? Visit our DeFi insights, altcoin plays, and the ever-wild world of memecoins.

⚔️ Solana vs. Base: The Industry’s Outage Champions

Let’s not pretend Base is alone here. Solana’s had its share of headline-grabbing downtime. Arbitrum and Optimism? They’ve been battle-tested too.

So why do users keep coming back?

Because in crypto, utility and upside trump everything.

Solana and Base both boast huge active user bases and DeFi TVL. It’s the same reason Bitcoin survives every media panic: real usage, real value, real risk-takers.

🧩 What’s a Sequencer Anyway? (No-BS Explainer)

Here’s the simple truth:

A sequencer is like the bouncer at the hottest club in town. It decides who gets in and when.

- On Ethereum L2s, the sequencer orders your transactions.

- If the main sequencer gets tired, the backup jumps in.

- If the backup’s a no-show—like with Base—everyone waits outside in the rain.

Conductor is Base’s system for managing these sequencers. When it fumbled, the party stopped cold.

Brand new to crypto? Check out our newbie guide for more basics—minus the hype.

🏗️ Infrastructure Upgrade Plans: Can They Really Fix It?

Here’s the promise: Base will upgrade its infrastructure so that any sequencer can take over at a moment’s notice.

Sounds simple? It isn’t. Distributed failover at scale is an engineering nightmare, but it’s non-negotiable if you want to keep institutional money and serious traders in the game.

The team has pledged full transparency and regular updates. But as every Wolf knows:

“You don’t get a second chance in this market. Build it right—or get left behind.”

🔄 Centralisation vs. Decentralisation: The Million-Dollar Debate

Let’s kill the buzzwords.

- Total decentralisation is a fantasy for most chains—there’s always a trade-off.

- Centralised sequencers mean faster upgrades, but more risk.

- Full decentralisation slows everything but makes attacks and misconfigurations harder to pull off.

Want to see how this plays out? Bitcoin is the decentralisation king; Solana and Base are finding their own balance.

Smart traders know: decentralisation is insurance, not just ideology.

🧠 Lessons for Traders: How to Survive the Next Outage

Here’s the actionable stuff—Wolf style:

- Diversify across chains: Don’t get caught with all your assets on one L2.

- Stay connected to real-time alerts: Communities like The Wolf Of Wall Street and their Telegram are priceless during chaos.

- Leverage VIP signals: The edge goes to those who know first—The Wolf Of Wall Street members get proprietary signals, analysis, and support 24/7.

- Use essential trading tools: Volume calculators, risk dashboards, and expert guidance aren’t just nice to have—they’re survival tools.

- Keep a cool head: Panic never pays. The winners are always the most prepared.

❓ FAQs: What Crypto Investors Are Asking Right Now

Q1: Is my money safe on Base after this outage?

Yes, there was no chain reorg or lost funds this time. But always review your risk, and don’t stake more than you can afford to lose.

Q2: Will Base become more decentralised?

That’s the goal. Upgrades are coming, but true decentralisation takes time. Watch the engineering roadmap closely.

Q3: Can I hedge against L2 outages?

Diversification is your best hedge. Keep assets on multiple chains, and use communities like The Wolf Of Wall Street for early warnings and support.

For more answers and the latest updates, check our news section and trending topics.

🚀 Conclusion: The Brutal Truth About Blockchain Reliability

Here’s the bottom line:

No chain is invincible.

Downtime is inevitable. But the projects that own their mistakes, fix them fast, and keep their community informed are the ones you want to bet on.

If you’re serious about making it in this market, you need more than hype. You need tools, signals, analysis—and a team in your corner.

That’s where The Wolf Of Wall Street comes in:

- Exclusive VIP signals

- A private, 100,000+ member community

- Non-stop support and analysis, 24/7

- All the essential trading tools to keep you ahead

Don’t just react to the market—dominate it. Join The Wolf Of Wall Street, get in the Telegram, and play the game like a Wolf.

🔗 Further Reading & Internal Links

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

This is the Wolf’s playbook for the next big outage. Print it, share it, live it.