🚀 The Bull Run Is Real — But It’s on a Knife’s Edge

You want to make real money in crypto? I’m not talking about a few extra bucks — I mean the kind of money that flips your entire financial reality. That future you’ve been fantasising about? The mansion, the Lambo, the freedom? It’s still on the table — but Bitcoin’s bull run just hit a major speed bump.

The price has pulled back from a record-breaking $111K to a tension-filled $104K zone. And now? The $104,500 weekly close is the ultimate test. Nail it, and we’re moon-bound. Miss it, and we might be in for a rough ride. This isn’t FUD — this is facts.

📉 The Drop from Glory: What Just Happened?

Bitcoin went full throttle to $111,000 — a level that had the crypto crowd celebrating like it was New Year’s Eve in Ibiza. But now? We’ve seen an 8% dip, sliding back to the $104K–$105K range. That’s not a rug-pull — it’s a classic shakeout.

This $104,500 zone? It’s not just a price. It’s a fortress. What used to be resistance is now the battleground for bulls and bears. And this week’s candle close is everything. Fail to hold it? We could tumble fast.

📍 Related: Bitcoin Market Updates

🧠 Profit-Taking or Panic Selling? Here’s the Truth

Let’s not sugar-coat it: the market got a little too greedy. On-chain data shows average unrealised profits surged past 30% when we were brushing $111K. That’s when the paper hands start selling.

Profit-taking kicked in like clockwork, and boom — momentum stalled. But here’s where you stay ahead of the herd: don’t confuse a healthy correction with a crash. Smart money locks gains and reloads at support. This could be your re-entry point.

🐋 Whale Moves Don’t Lie

Let’s talk whales — the sharks of this ocean. Over the last month, whale-held balances increased 2.8%. That’s a red flag, folks. Historically, when accumulation slows, it signals consolidation or a stall in the uptrend.

Whales aren’t emotional. They move with data, not dreams. So if they’re pausing, you better believe it’s strategic.

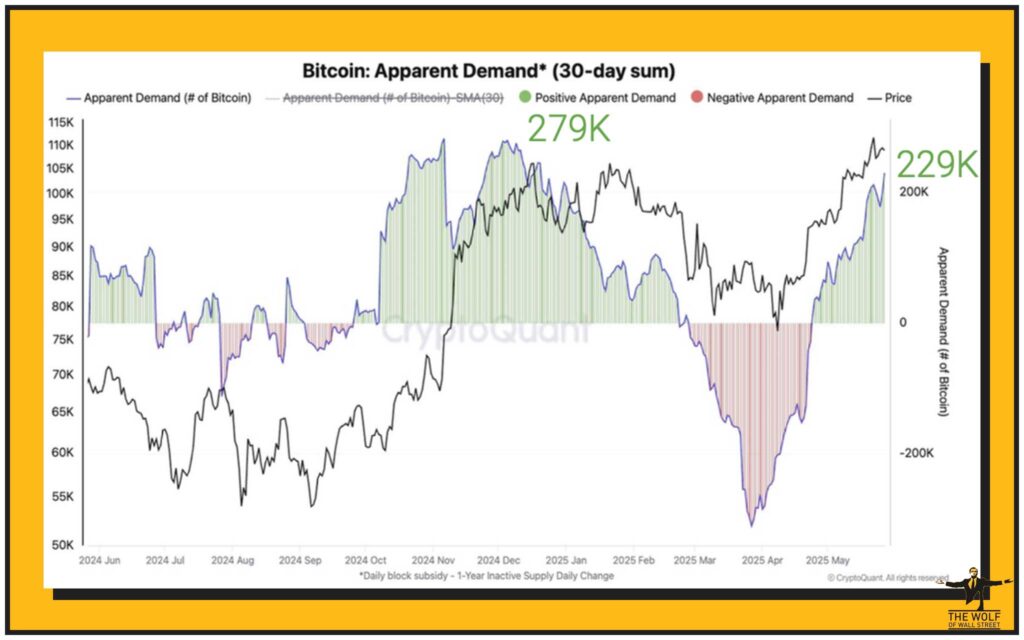

📊 Onchain Metrics Flash Warning Lights

According to CryptoQuant, Bitcoin demand growth over the past 30 days sits at 229,000 BTC. That’s just shy of the 279,000 BTC from the last major top in December 2024.

Translation? We’re nearing a temporary ceiling. No, it’s not doom — it’s data. And if you ignore it, you’re just guessing.

🚦 The Make-or-Break Levels You Need to Know

| 💰 Level | 🔍 What It Means |

|---|---|

| $104,500 | Key weekly close level. Break this and the run might stall |

| $100,000 | Psychological + technical support — market pivot point |

| $112K–$115K | Short-term resistance zones; watch if bulls return |

| $97K–$93K | Correction territory if $104K fails |

| $73,700 | Macro-level support; still bullish long-term |

📍 Dive deeper: Trading Insights

🧠 What the Smart Analysts Are Saying

📉 Short-Term: It’s Shaky

If Bitcoin can’t close this week above $104,500, you can expect more downside. We’re talking a potential drop under $100K. Sound scary? Maybe. But if you know your entry points — it’s an opportunity.

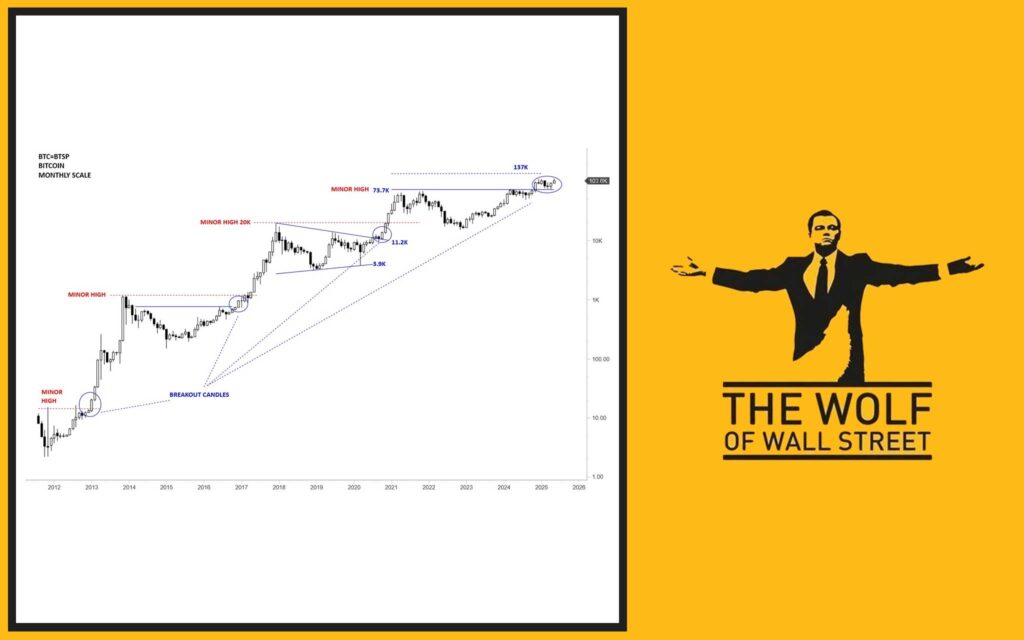

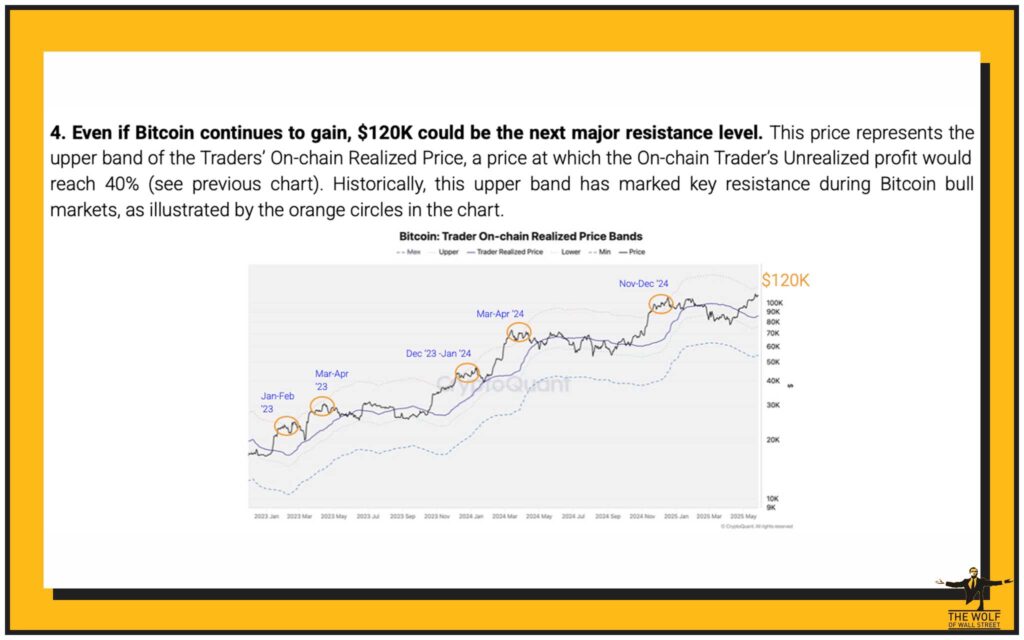

📈 Medium-Term: $120K–$137K Still in the Cards

Plenty of analysts still expect BTC to hit $120K–$137K by the end of 2025. That’s assuming the current correction holds above key levels and doesn’t spiral. This is just a speed bump.

🔁 The Cycle Isn’t Over

The bull market isn’t dead. Far from it. Most cycle models are eyeing a peak around July–August 2025. What we’re seeing now? Just a breather before the sprint.

🏗️ The Bullish Case Is Still Bulletproof

💼 Institutional Money Is Flooding In

- Spot Bitcoin ETFs are pulling in billions

- Corporate treasuries are quietly stacking

- Supply on exchanges is dropping like a stone

This is the biggest institutional shift in crypto history. And it’s not going anywhere.

⚖️ Regulatory Winds Are Finally Shifting

The SEC dropped its lawsuit against Binance, and the new Digital Asset Market Clarity Act just passed. That means less uncertainty, more confidence — and a green light for real capital to come in.

Check out the Latest News for more on regulatory moves.

📐 Market Structure Is Still Bullish

Yes, price action looks messy. But zoom out, and you’ll see it:

- Higher lows

- Sustained volume

- Support zones holding

We’re still in a macro uptrend. Don’t get lost in the noise.

⚠️ Short-Term Risks You Must Respect

📉 Volatility Is Back — And It’s Savage

Price swings of 5–10% a day? That’s par for the course right now. And it’s mostly profit-taking and overleveraged longs getting wiped out. It’s messy — but necessary.

🔧 Liquidations Cleared the Deck

Thousands of overleveraged positions just got flushed. That’s a reset for the next rally, not the end. Volatility now = stability later.

🎯 What Smart Traders Are Doing Right Now

📊 Watching the $104.5K Close Like a Sniper

The weekly candle close at or above $104.5K? That’s your green light. Anything less, and we’re playing defence.

🛠️ Using Tools, Not Hype

If you’re trading on emotion, you’re already losing. Use tools like:

- Volume calculators

- Risk-to-reward ratios

- Real-time onchain metrics

You’re not just investing — you’re playing chess with people who know the game.

💬 Joining the Right Inner Circle

Let me drop some truth: the people who win in crypto aren’t on Reddit. They’re in private communities, getting real signals, and sharing real strategies.

Which brings us to…

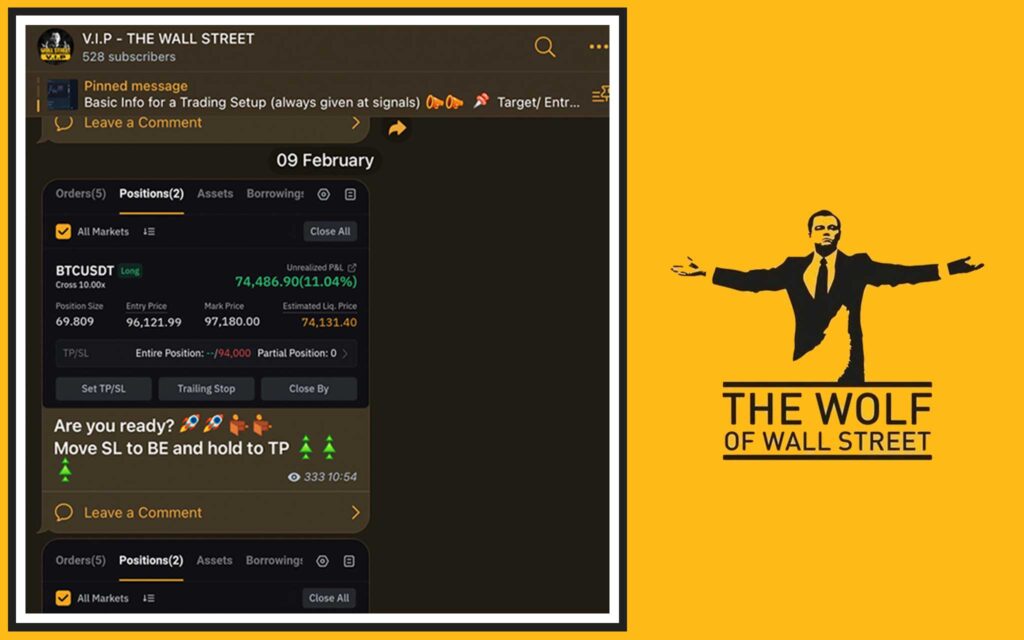

💸 The Wolf Of Wall Street: The Ultimate Crypto Edge

If you’re serious about making money in this market, you need more than hope. You need a system, a strategy, and a squad behind you.

That’s The Wolf Of Wall Street.

🔥 The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

Here’s what you get:

- Exclusive VIP Signals – Trade like an insider, not a bystander

- Expert Market Analysis – Real breakdowns, not TikTok fluff

- Private Community – Over 100,000 traders worldwide

- Pro Tools – Volume calculators, real-time metrics, custom dashboards

- 24/7 Support – Anytime, anywhere, someone’s got your back

👉 Join now: https://tthewolfofwallstreet.com/

👉 Chat with 100K+ real traders: https://t.me/tthewolfofwallstreet

Don’t trade blind. Trade with power.

📌 Final Thoughts: Make a Move or Miss the Boat

Here’s the reality: Bitcoin’s bull run is still on — but it’s testing your discipline.

- $104,500 close is everything

- Fall below $100K? Don’t panic — recalibrate

- Hold above support? Get ready for liftoff

The winners are already positioning. The dreamers are hesitating.

So what’s it going to be?

👉 Read more Bitcoin insights here

👉 Learn to trade like a boss with The Wolf Of Wall Street

👉 Check out the Hot trending markets

🙋 5 Must-Know Bitcoin FAQs

1. What happens if Bitcoin closes below $104,500?

A close below that level opens the door for a pullback to $100K or lower. It’s a test of short-term momentum.

2. Is the bull market over?

No. Macro indicators are still bullish. This is a correction, not a collapse.

3. What’s the upside if support holds?

Analysts are targeting $120K–$137K by late 2025 if momentum resumes.

4. Should I buy now or wait?

Depends on your risk tolerance. Buying support levels like $100K can be smart — but only with risk controls.

5. How can I stay ahead of these moves?

Use tools, follow signals, and join communities like The Wolf Of Wall Street that give real-time insights.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street