🚨 Introduction: The Crypto Market Shaking Update

Brace yourself – in October 2025, Bitcoin Core 30 is set to shatter expectations by expanding OP_RETURN data limits from a puny 80 bytes to a colossal 4 MB. This isn’t just an incremental tweak—it’s a seismic shift that’ll redefine on‑chain utility, innovation and controversy. If you’re serious about staying ahead, buckle up.

✨ What Is OP_RETURN and Why You Should Care

OP_RETURN is the Bitcoin transaction field that allows users to embed arbitrary data—think text, images, or document hashes—directly onto the blockchain. Before Core‑30, that data was limited to an 80byte payload: enough for a fingerprint of a document, not much else.

Now, that freedom? It’s about to go nuclear. Literally.

🚀 From 80Bytes to 4MB – The Technical Tsunami

In Bitcoin Core‑30, the OP_RETURN max jumps to nearly the full block size: 4MB. This empowers you to upload far more than a digital stamp—you can anchor entire documents, NFTs or identity tokens, all in one on‑chain sweep.

Yes, node operators can still dial the cap down manually, but over time, that flexibility may vanish as the network defaults to the new limit.

🌟 Bullish Case: Bigger, Bolder Bitcoin

Developers—folks like Peter Todd and Gloria Zhao—argue it’s time Bitcoin got flexible, modern, with real-world utility. This change:

- Fuels timestamping and document anchoring

- Supports decentralised identifiers (DIDs) and developer tools

- Opens doors to tokenisation, mini‑smart contracts, NFTs

If you’re in crypto innovation, this is your launchpad. It aligns Bitcoin with emerging Layer 1 and Layer 2 Solutions that demand robust, scalable on‑chain utility.

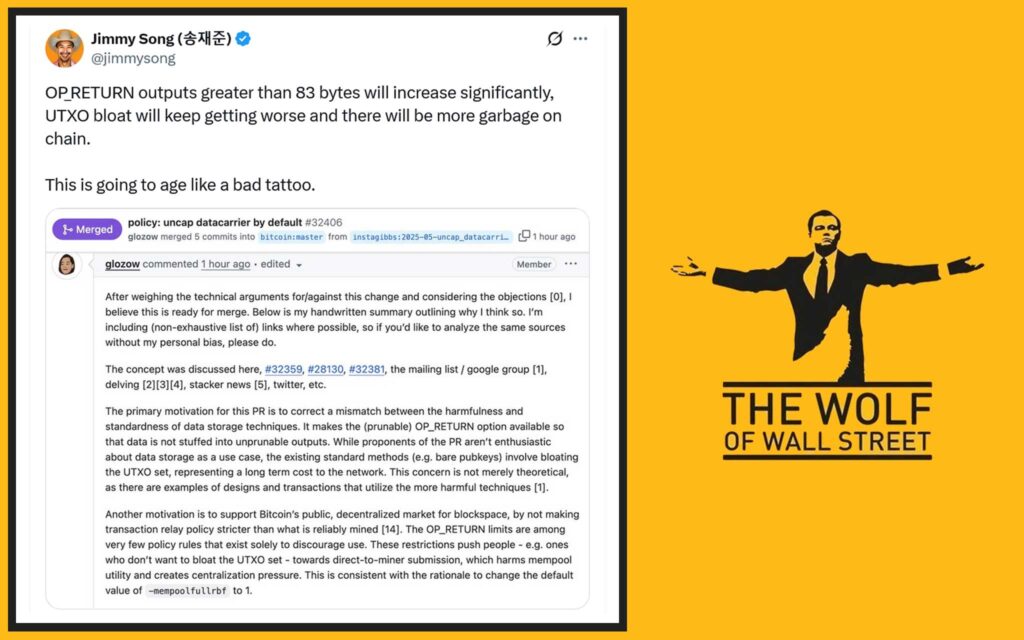

⚡ Bearish Blowback: Critics Pull No Punches

Some Bitcoin OGs aren’t sugar‑coating it. Luke‑Dashjr, Samson‑Mow and other purists say this is reckless:

“Turning Bitcoin into a data dump is a direct threat to its financial focus.”

They fear:

- The blockchain morphing into a graffiti board of irrelevant content

- Spike in fees due to congestion

- Hardware bloat making node operations harder

- Greater centralisation from the fewer who can run beefier nodes

This isn’t just technical—it’s ideological.

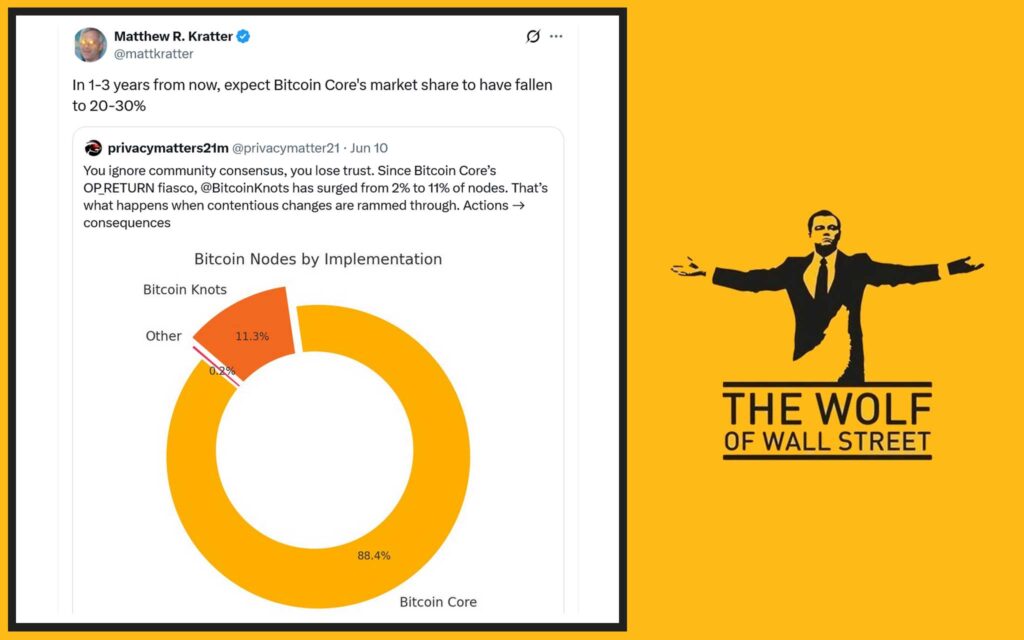

🚧 Node Wars: Community Cleavage

The numbers don’t lie: Bitcoin Core’s dominance among node software has dropped from roughly 98% to just over 88%, with Bitcoin Knots absorbing most of the shift. Node operators actively tweak OP_RETURN limits, signalling a growing rift in the ecosystem.

Where once Bitcoin Core was the standard, now forks and alternatives rally trade-offs—and trust is eroding.

🧰 Use Cases Unleashed: What You Can Actually Store

Get ready to think bigger. That 4MB capacity means:

- NFT minting directly on Bitcoin (image + metadata, on-chain)

- Legal documents and contracts timestamped immutably

- Encrypted communications or proof records anchored forever

Industries from law to entertainment to finance can leap into on-chain innovation, bypassing sidechains and off-chain tools. This is a major step toward universal blockchain integration.

💸 Fee Frenzy and Market Dynamics

Space in a block is limited real estate. Load it up with data, and what happens? Competition spikes. Transaction fees will climb, and miners will chase bigger payouts.

This could rewire fee markets and spark new prioritisation algorithms—but hey, traders thrive in volatility.

⛔ Centralisation Risk: Soul of Bitcoin at Stake

Here’s the rub: handling larger data equals heftier resource demands. Smaller node operators may drop off, leaving only enterprises and datacentres. That path leads straight to centralisation—the very opposite of Bitcoin’s peer‑to‑peer dream.

We need to weigh the newfound utility against the growing power concentration. It’s an uneasy balancing act.

🏋️ Ideology at War: Financial Purism vs. Functional Progress

Bitcoin’s DNA has long been focused on sound money and decentralisation. This update challenges that. The question: does Bitcoin stay a trusted store of value or morph into a multi-purpose blockchain like Ethereum?

This ideological schism is heating up, threatening another civil war—but also fostering innovation. History shows it fuels progress, but also friction.

🔧 Developer Philosophy: Hands-Off or Hands-On

Bitcoin Core is adopting a laissez-faire approach: let users choose how to use it. OP_RETURN expanded, node limits adjustable—your call.

But is that decentralised democracy, or a slippery slope? If future releases start removing options, it might slip into force‑fed defaults.

📈 What This Means for You – The Retail Trader

Yeah, this matters to YOU:

- Wallets and exchanges must adapt to bigger transactions

- Fee predictions will grow more complex

- On‑chain tools—like The Wolf Of Wall Street—become essential for decoding trends and risks

Your HODL strategy may need tweaking, but for those willing, this is a chance to leverage new opportunities.

🌐 The The Wolf Of Wall Street Edge: How Smart Traders Get Ahead

Here’s where the The Wolf Of Wall Street crypto trading community delivers ultimate value:

- ✨ VIP Signals tuned to pre‑ and post‑update volatility

- ⚖️ Expert analysis to navigate fee surges and sentiment swings

- 📊 Support tools like volume calculators to time entries

- ⏰ 24/7 backup so you’re never flying blind

Join the pack, stay informed, and position yourself to ride the volatility train to profit.

🔥 Community Sentiment: Bitcoin Civil War on Display

Reddit, GitHub, Telegram—all ablaze. Influencers are polarised. Some say it’s the dawn of Bitcoin’s next chapter; others preach entrenchment and purity. Traders are making bets, developers forking in response.

It’s messy. It’s loud. And it’s exactly where you want to be, weighing both sides and making moves.

✅ Final Verdict: Evolution or Heresy?

Let’s break it down:

The Upside

- Mega utility, true on‑chain data storage

- New revenue and monetisation methods

- Amplifies developer innovation

The Risk

- Fee inflation, congestion

- Centralisation creep

- Ideological fracture, network trust decay

If it succeeds, Bitcoin goes universal. If it flops, we face fragmentation. The real question: are you ready to ride—or get left behind?

📢 Call to Action: Own Your Crypto Future

This is your moment. Learn, question, pivot. Find your edge with The Wolf Of Wall Street. Stay sharp in the chaos, and convert volatility into opportunity.

If you’re serious about surfing this wave, join the community. Adapt—or be wiped out.

💬 FAQs – Straight to the Point

Will this update affect my Bitcoin wallet?

Yes—wallets will need to support larger OP_RETURN outputs, adjust fee calculation, and handle bigger transactions gracefully.

Is this a hard fork?

No. It’s a soft fork: backward-compatible change. Nodes can choose to limit OP_RETURN manually.

Can I opt-out?

Absolutely. Node operators can set a custom cap beneath 4MB. But over time, defaults may lock new behaviour in.

How will miners react?

Expect some to embrace the fee bump. Others may prefer cleaner blocks. It’ll depend on proprietary economic incentives.

🔹 TL;DR

Bitcoin Core‑30 transforms OP_RETURN from 80bytes to 4MB, unleashing a wave of on‑chain use‑cases—from NFTs to legal contracts. Supporters see modernisation; critics warn of bloat, fees and centralisation. It’s a bet on innovation vs risk—choose your side, or better yet, own both. Connect with The Wolf Of Wall Street to stay ahead and profit.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in‑depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like‑minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real‑time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street.”