🔥 Introduction

Listen up. The SEC just lit the match that could set the financial world on fire: they approved spot Bitcoin ETFs. We’re talking about Bitcoin finally making its way into the clean-cut, pinstripe suit world of Wall Street.

No wallets, no private keys, no “oops, I lost my seed phrase.” Now, everyone—from the Wall Street hedge fund guy to your neighbour’s retirement account—can take a bite out of Bitcoin.

Here’s the deal: I’m going to break down every type of Bitcoin ETF, show you which ones can make you filthy rich, and which ones could blow up your account faster than a margin call.

🏛️ The SEC’s Big Move: Spot Bitcoin ETFs Go Live

On January 10th, 2025, the SEC finally dropped the hammer. They approved 10 spot Bitcoin ETFs.

This isn’t just some footnote in the financial news. This is BlackRock, Fidelity, and Ark Invest throwing their weight behind Bitcoin. It’s like Wall Street finally admitting: “Yeah, Bitcoin is real, and we want in.”

What does this mean for you? Simple. It means Bitcoin just went mainstream. ETFs are listed on the NYSE, Nasdaq, and CBOE—the same playing field as Apple and Tesla. Institutional money is now flooding in.

💡 What the Hell is a Bitcoin ETF Anyway?

A Bitcoin ETF (Exchange-Traded Fund) is the golden ticket for investors who want exposure to Bitcoin without actually holding Bitcoin. You’re not dealing with wallets, hacks, or shady exchanges. Instead, you’re buying a stock that mirrors Bitcoin’s performance.

Why do investors love them?

- Easy to trade through your brokerage account

- Regulated by the SEC

- Liquid as hell

Think of it as Bitcoin without the baggage.

👉 Want to understand how Bitcoin operates at its core? Check out this Beginner’s Guide to Bitcoin Nodes.

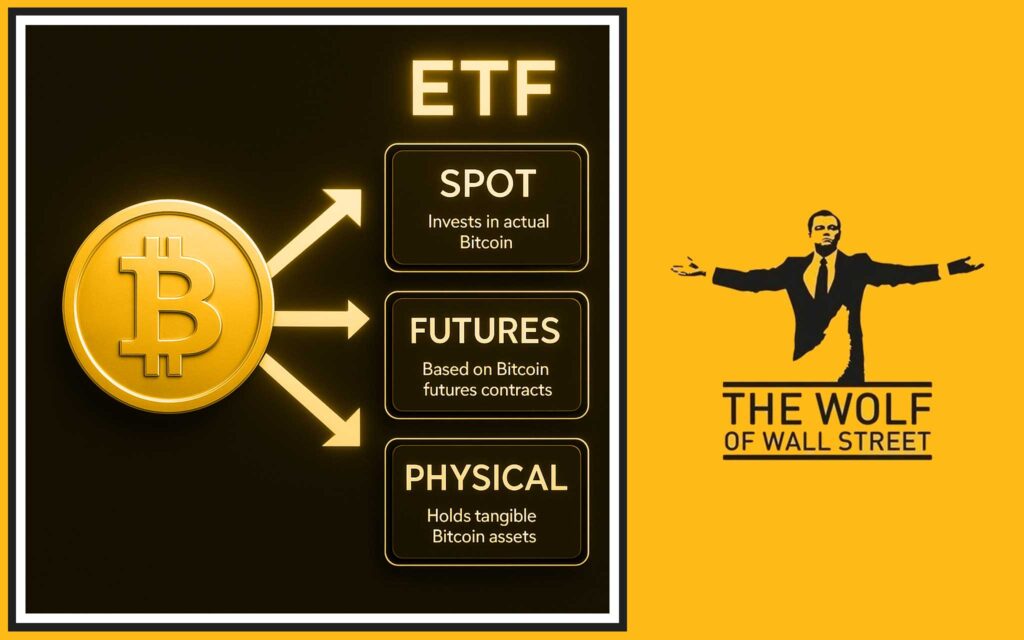

📊 The Different Types of Bitcoin ETFs You Need to Know

There are five types of Bitcoin ETFs on the table, and each plays a different game:

- Physical ETFs – Actual Bitcoin in custody.

- Spot ETFs – Tracks real-time market prices.

- Futures-based ETFs – Built on futures contracts.

- Leveraged ETFs – Amplify daily returns.

- Inverse ETFs – Profit when Bitcoin tanks.

Miss this section, and you’re basically gambling blind.

🪙 Physical Bitcoin ETFs – The “Hard Asset” Play

These funds hold real Bitcoin in custody. Think vaults, custodians, cold storage. You don’t own the Bitcoin yourself, but the issuer does, and they back every share with actual BTC.

Pros:

- Transparent and simple.

- Long-term exposure without storage drama.

Cons:

- Custody costs eat into returns.

- Less anonymity than buying Bitcoin directly.

This is for HODLers who see Bitcoin as digital gold. You want to lock it away and let it ride.

👉 If you’re interested in how to store Bitcoin outside ETFs, dive into our Bitcoin Wallets Guide.

⚡ Spot Bitcoin ETFs – Pure Market Action

Spot ETFs are the rockstars of the group. They track Bitcoin’s real-time price, giving you raw exposure without the hassle.

Pros:

- Simple to understand.

- Tracks the market tick-for-tick.

- Great liquidity.

Cons:

- Volatility will crush you if you’re unprepared.

This is the product the SEC just greenlit. If you want Bitcoin’s action without private keys, this is your playground.

📉 Futures-Based Bitcoin ETFs – Wall Street’s Old Game in New Wrapping

Instead of holding Bitcoin, these ETFs track futures contracts on exchanges like CME. That means you’re betting on what Bitcoin will be worth in the future—not its actual spot price.

Risks:

- Contango: Futures trade higher than spot—costly to roll over.

- Backwardation: Opposite problem—contracts expire below spot.

- Complexity: Not for beginners.

This is for seasoned traders who live and breathe derivatives.

👉 Want the inside scoop? Read our Bitcoin Spot vs Derivatives Trading Guide.

🚀 Leveraged Bitcoin ETFs – Double or Nothing

Want to crank the volume up to 11? Leveraged ETFs multiply Bitcoin’s daily returns—2x, sometimes 3x.

Pros:

- Insane short-term gains if you nail the timing.

Cons:

- Losses are magnified.

- Value decay kills long-term holding.

These are weapons of mass profit—or destruction. If you don’t know what you’re doing, stay away. If you’re a wolf, welcome to the jungle.

🛡️ Inverse Bitcoin ETFs – Profit When Bitcoin Tanks

Inverse ETFs are built for bears. They go up when Bitcoin goes down.

Use cases:

- Hedge your portfolio.

- Bet against Bitcoin in bear markets.

It’s not about hating Bitcoin—it’s about making money no matter which way the market runs.

🎯 Investor Considerations: Don’t Gamble Blind

Before you jump in, ask yourself:

- What’s your risk tolerance?

- Are you chasing long-term growth or short-term flips?

- Do you understand futures mechanics, or are you better off with spot?

- Do you want active trading or set-and-forget investing?

Match your style to the right ETF, or you’ll end up broke.

👉 For a broader view, read The Wolf’s Guide to Asset Classes & Crypto Wealth.

🧩 Crafting a Winning Bitcoin ETF Strategy

Here’s the playbook:

- Diversify – Mix spot with futures, hedge with inverse.

- Stay disciplined – Don’t get shaken by volatility.

- Long-term vision – Don’t try to scalp your way to millions overnight.

- Review often – Markets evolve. Your strategy should too.

This is how pros stay rich while amateurs get wrecked.

🔮 The Future of Bitcoin ETFs – What’s Next?

The SEC opened the gates. Now the flood is coming:

- More issuers, lower fees.

- Global adoption—Europe and Asia aren’t far behind.

- Tech upgrades will make custody bulletproof.

- Institutional adoption will only grow.

This is the beginning of Bitcoin’s Wall Street era.

🧠 Common Misconceptions About Bitcoin ETFs

Let’s kill the myths:

- Myth 1: ETFs are risk-free. Wrong. Bitcoin volatility still hits you.

- Myth 2: Spot ETFs guarantee profit. Nope—markets move both ways.

- Myth 3: Futures ETFs = Spot ETFs. False—they’re totally different beasts.

- Myth 4: Only whales can profit. ETFs open the game to everyone.

📚 FAQs on Bitcoin ETFs

1. Are Bitcoin ETFs safer than buying Bitcoin directly?

Yes and no. They eliminate custody risks but still face market volatility.

2. What’s the difference between spot and futures ETFs?

Spot tracks current prices; futures track contracts that bet on future prices.

3. Can I lose everything with leveraged ETFs?

Yes, faster than you think. Leverage is a double-edged sword.

4. How do ETF fees impact returns?

Fees eat into long-term performance. Always check the fine print.

5. Is it better to buy Bitcoin directly or through ETFs?

Depends. If you want control and anonymity, buy Bitcoin. If you want regulated access, go ETF.

🐺 Final Words – The Wolf’s Call to Action

Bitcoin ETFs aren’t just financial products—they’re your ticket into the next great wealth transfer. The SEC has handed Wall Street—and you—the keys. But here’s the kicker: only those who understand the game will win it.

Don’t sit on the sidelines. Pick your ETF, match it to your appetite for risk, and execute like a wolf, not a sheep.

And if you want to sharpen your trading edge? Join the The Wolf Of Wall Street crypto trading community. We’re talking:

- VIP trading signals

- Expert market analysis

- A private network of 100,000+ traders

- Essential trading tools

- 24/7 support

👉 Visit our service: The Wolf Of Wall Street Service

👉 Join the action on Telegram

Stay hungry. Stay sharp. Stay in the game.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street