💥 Intro – The Big Question That Could Shake Bitcoin’s Core

Picture this: you wake up, check your charts, and the crypto news explodes — Bitcoin’s sacred 21-million cap is gone. Doubled. Infinite. Whatever. The digital gold we’ve trusted for over a decade suddenly looks like the US dollar with a hangover.

That’s not just a headline. That’s a potential earthquake under the foundations of the most valuable decentralised asset on Earth. Whether you’re a day trader, a long-term HODLer, or an institution managing billions, this is the kind of scenario that forces you to rethink everything.

Before we dive into the mechanics, the history, and the explosive consequences, let’s lock in one key term: a hard cap.

🏛️ What the Heck is a Hard Cap in Crypto?

In crypto, a hard cap is the absolute maximum number of coins or tokens that can ever exist — hardcoded into the blockchain’s DNA. Once you hit it, game over. No more supply. No sneaky inflation.

Contrast that with a soft cap, which is more like a funding target in ICOs — you can go over it, but it’s just a milestone. The hard cap is a brick wall.

For Bitcoin, that number is 21 million. Not one more. Not one less. Enforced by code, agreed upon by the network, and — so far — untouchable.

🪙 Scarcity = Value: The Digital Gold Effect

Why does this matter? Because scarcity is the oxygen of value. When you’ve got a fixed number of something the world wants, its price doesn’t just rise — it explodes.

Bitcoin’s hard cap is why it’s constantly compared to gold. Except unlike gold, you know exactly how much Bitcoin exists and when the last one will be mined. That’s predictability Wall Street salivates over.

If you want to understand the true power of this, check out the psychology behind owning a full Bitcoin in 2025 — scarcity creates FOMO, and FOMO drives demand like a rocket.

📊 The Current State of Bitcoin Supply

Fast-forward to 2025: over 19.8 million BTC have been mined. That leaves fewer than 1.2 million BTC to ever exist — forever.

Bitcoin halves its block rewards roughly every four years in events called halvings. This predictable cut in new supply is a built-in price pressure cooker. By 2140, the final satoshi will be mined, and that’s it.

📆 Predictable Monetary Policy in a World of Chaos

You know why Bitcoin has won over institutions? Because while governments print money like they’re giving out candy on Halloween, Bitcoin plays by one rulebook — and it never changes.

Investors love predictability. When you know the exact supply schedule for the next 100+ years, you can build models, manage risk, and plan strategy. That’s why predictable issuance is one of Bitcoin’s most powerful value props.

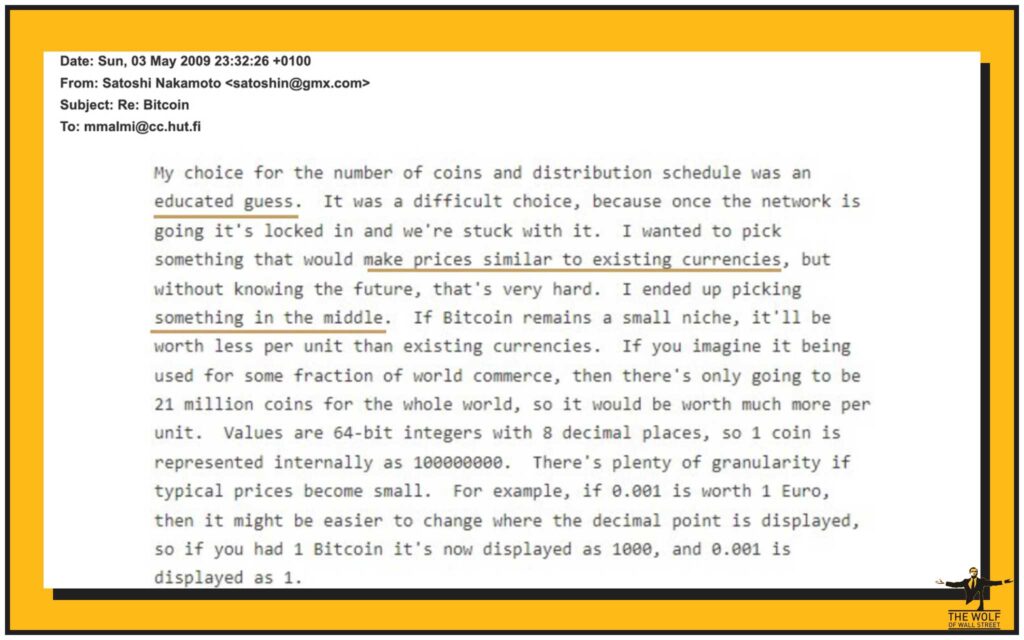

📜 Historical Inflation Debates – The Early What-Ifs

Bitcoin OG Hal Finney — one of the first to ever receive BTC from Satoshi — once floated the idea of adding a small inflation rate after the cap to keep miners incentivised.

Others chimed in over the years with similar hypotheticals. But here’s the truth: none of these were ever formal proposals. They were thought experiments. Intellectual sparring, not real change attempts.

🛠️ Changing Bitcoin’s Hard Cap – The Technical Side

Let’s be clear: technically, the code can be changed. Any programmer could tweak it in minutes.

But Bitcoin isn’t ruled by a single coder — it’s governed by consensus. Every full node in the network must agree to adopt the new rules. And that’s where the dream of changing the cap dies a fiery death.

😬 The Governance Nightmare

If you think getting developers, miners, and node operators to agree on a fundamental rule change is easy, you weren’t around in 2017.

That was the Block Size Wars, a brutal battle over how big Bitcoin blocks should be. The result? A permanent split and the birth of Bitcoin Cash.

For a deeper dive into crypto governance chaos, check out Decred’s hybrid consensus system — it’s a masterclass in balancing decentralisation with decision-making.

🚨 What Happens if the Cap Changes?

This is where the blood drains from investors’ faces.

- Loss of trust: Bitcoin’s brand is scarcity. Break that, and it’s just another altcoin.

- Market panic: Traders dump. Institutions pull out. Price nosedives.

- Hard fork risk: You’d end up with two competing chains, splitting the community and the market.

Remember: Bitcoin overtaking Amazon in market cap was fuelled by belief in its scarcity. Remove that, and you remove the magic.

🏦 Institutional Muscle: Could They Force It?

BlackRock could roll in with billions and a press release saying, “We’re forking Bitcoin to remove the cap.” Guess what? Unless the community follows, it’s just another fork destined for irrelevance.

Money can buy code changes, but it can’t buy cultural buy-in. And Bitcoin’s culture is built on the gospel of scarcity.

🔍 Comparing Bitcoin to Other Capped Cryptos

- Litecoin: 84M cap.

- BNB: Hard cap, but subject to burn mechanisms.

- Ethereum: No fixed cap, but now has a burn mechanism post-EIP-1559.

History shows that coins with changing supply rules tend to lose monetary credibility fast.

⛏️ The Miner Incentive Debate

The anti-cap-change crowd says miners will thrive on transaction fees once block rewards vanish.

The pro-change crowd says without inflation, miners will quit, and network security will suffer. This debate reappears every few years — and every time, the community slams the door.

🛡️ Why Bitcoin’s Cap is Practically Untouchable

Code can be edited. Belief cannot.

Bitcoin’s hard cap is defended by game theory, ideology, and a globally distributed army of believers who’d rather fork off than follow inflation. This is why it’s one of the most immovable rules in all of crypto.

📈 Lessons for Traders and Investors

If you’re a trader, you need to watch for any whispers of a cap change like a hawk. Rumours alone can swing the market.

Learn to use scarcity as part of your long-term forecasting. For strategies, see mastering cry pto dominance trading — scarcity is a weapon in your portfolio.

pto dominance trading — scarcity is a weapon in your portfolio.

🚀 Call to Action – Protect Your Edge

The market rewards those who see the moves before they happen. Governance debates, even if they fail, can create volatility you can profit from — if you’re prepared.

That’s where the The Wolf Of Wall Street crypto trading community comes in. You get:

- Exclusive VIP Signals for precise entries/exits.

- Expert Market Analysis to decode trends.

- 24/7 Support and a network of 100,000+ traders.

If you’re serious about winning in this market, join the The Wolf Of Wall Street community today and get in on Telegram for real-time action.

✅ Conclusion – The Immutable Truth

Technically, the 21M cap can be changed. But practically? Forget it.

Bitcoin’s value is rooted in the fact that it won’t be changed — not by coders, not by miners, not by Wall Street. Break that, and the game changes forever.

The smart money understands this — and positions accordingly.

❓ FAQs

1. Can Bitcoin’s hard cap be increased?

Yes, in theory — but consensus makes it nearly impossible in practice.

2. What’s the difference between hard cap and soft cap?

Hard cap = max supply limit. Soft cap = funding target.

3. Why 21 million specifically?

It’s how Satoshi balanced block rewards, halving schedule, and time to final supply.

4. Could a Bitcoin fork remove the cap?

Yes — but it would likely be ignored by the majority.

5. Will miners support Bitcoin without block rewards?

Most believe transaction fees will take over as the main incentive.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.