🚀 Introduction

Listen up—because if you think crypto is just about price charts and diamond hands, you’re missing the real action. There’s a brawl going down in the Bitcoin trenches. Early adopters—those legendary “OGs” who made Bitcoin what it is—are rumoured to be losing faith as the market goes mainstream.

But is the king of digital assets truly losing its rebel spirit? Or is this just another shakeout before the next major run? This isn’t just news. It’s the frontlines of the future of money. Strap in.

👑 Who Are the Bitcoin OGs?

Let’s set the record straight: “OGs” aren’t your average crypto bros. They’re the pioneers—the original gangsters of the blockchain, who bought Bitcoin when everyone else was laughing. We’re talking whales, early miners, ideologues who saw freedom, not just financial upside. These guys have been holding, building, and fighting FUD since before you could buy Bitcoin on an app. Their influence? Monumental. When they move, the market listens.

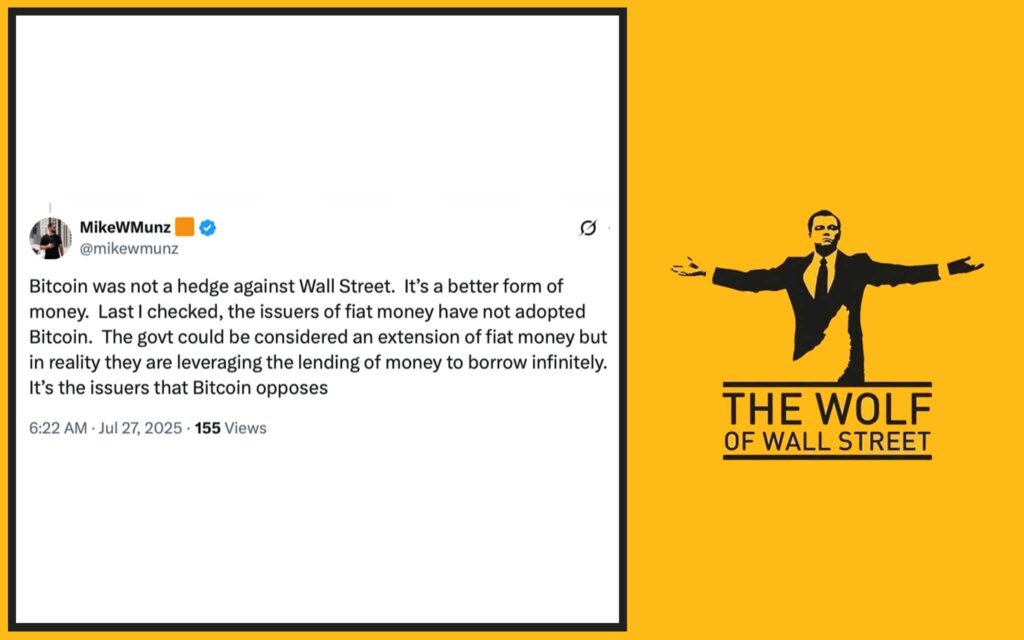

🔥 The Flashpoint: Melker’s Viral Comment

Enter Scott Melker, aka “The Wolf of All Streets.” When he talks, the crypto world pays attention. So when he posts on X (Twitter) that “many OGs have had their faith shaken” by Bitcoin’s institutional takeover, the reaction is nuclear. Suddenly, everyone’s got an opinion. Are the old guard selling out? Is the dream dead? Or is this just another case of “the sky is falling” from people allergic to change?

🧐 Unpacking the “Faith Shaken” Narrative

Let’s get real—what does “faith” even mean in crypto? It’s not about blind loyalty or cult vibes. It’s about conviction. Melker’s comment sparked the debate: Are OGs truly disillusioned, or are they just taking profits after years of HODLing? Are we witnessing a crisis of confidence, or a tactical repositioning by the smartest guys in the room?

Explore our full service hub for the most advanced crypto strategies.

For the latest in breaking crypto news, hit our news section.

Deepen your knowledge in the cryptocurrencies hub.

📉 OGs on the Move: Are They Really Selling?

Let’s talk numbers. An early Bitcoin investor just dropped 80,000 BTC through Galaxy Digital. That’s not pocket change—that’s a seismic market event. You feel that? That’s the ripple effect when whales make a move. But don’t get it twisted: just because coins are moving doesn’t mean faith is lost. On-chain analytics show that while OGs are reducing some exposure, many are just reallocating, not exiting. Panic? Not so fast.

🕵️♂️ Reasons for Selling: More Than Meets the Eye

Here’s the truth—people sell for all kinds of reasons, and it’s rarely just about losing hope. Mike Alfred nails it: “Selling ≠ loss of faith.” Maybe it’s risk management, maybe it’s lifestyle. Willy Woo? He’s selling to double down on Bitcoin infrastructure, not because he’s done with Bitcoin. PlanB’s moving to spot ETFs for easier logistics, not because he’s suddenly a doubter. The game changes. Smart players adapt.

🏦 Institutions Enter the Arena

Wall Street’s here, and the purists are sweating. What was once a decentralised, anti-bank movement is now rubbing shoulders with the suits. Why? Because institutions crave what Bitcoin has: transparency, predictability, and, frankly, the chance for massive upside. The irony? The asset designed to disrupt the old guard is being snapped up by the very institutions it was meant to bypass. If that’s not poetic, I don’t know what is.

⚡️ Institutional Adoption: Threat or Evolution?

Let’s talk cold, hard facts. Dave Weisberger says it straight: If Bitcoin’s going to conquer the world, it must get into the hands of big players. That redistribution from OGs to institutions isn’t just inevitable—it’s essential for mainstream adoption. Hate it or love it, Bitcoin can’t change the game unless it’s part of the game. If you want mass adoption, you need big money, regulation, and—yes—some suits at the table.

😤 The Emotional Undercurrent: OGs React

This isn’t just a market debate. It’s personal. There’s nostalgia here, tribalism, even a sense of betrayal. The OGs built Bitcoin as a weapon against centralisation and control. Now, watching Wall Street dive in, some feel like their creation is slipping away. But here’s the kicker: Values evolve. Some will adapt. Some will rage. But that’s what makes the space alive.

🌍 Bitcoin’s Open, Permissionless Ethos

Let’s not sugarcoat it: Bitcoin is a permissionless beast. Anyone can buy it, even the so-called “enemy.” Crypto Mags puts it best—this isn’t a gated club. Governments, bankers, rebels, and even memecoin degenerates can all join. It’s the price of success. And it’s exactly what Satoshi intended. Want to keep Bitcoin pure? You can’t. That’s the whole point.

💰 Spotlight: The 80,000 BTC Mega-Transaction

You want real drama? An early whale just unloaded 80,000 BTC via Galaxy Digital. That’s one of the biggest sales in Bitcoin history. The market didn’t crash. Why? Because liquidity’s deeper now. Institutions, trading desks, and high-net-worth players absorbed it. That’s evolution. The game’s bigger, the players bolder, and volatility is just the cost of entry.

📊 Volatility, Whales & Market Sentiment

Let’s not pretend: when whales move, markets shake. But volatility isn’t a bug—it’s a feature. The price of Bitcoin is up, down, sideways—all in a week. Market cap in the hundreds of billions, 24-hour volume hitting the stratosphere. Old hands see opportunity in chaos. Newcomers get spooked. But those with the right signals, tools, and community win big. That’s why you need the right network (see below for the inside edge).

🏛️ The Mainstreaming of Bitcoin: Pros and Cons

Here’s where the rubber meets the road. Mainstream adoption means more capital, better tools, and regulatory clarity. But it also means old ideals get diluted. Remember the early days? Anonymous forums, cypherpunks, and pizza transactions? Today’s landscape: ETFs, custodians, Wall Street narratives. History shows—every revolution risks becoming the new establishment. The question: Is Bitcoin’s soul for sale, or is it evolving for survival?

🤝💔 Community Cohesion vs. Fracture

Bitcoin’s greatest strength has always been its community. But as adoption grows, so do the fault lines. OGs vs. newcomers. Purists vs. pragmatists. Matt Hougan of Bitwise says it best: “Keep building.” The mission is bigger than short-term drama. The network is anti-fragile. When the dust settles, it’s the builders—old and new—who write the next chapter.

🦾 The New Face of Bitcoin: Adapt or Die?

This is Darwinism, crypto-style. You adapt, or you get left behind. Bitcoin isn’t static. Its killer feature is resilience. Think about every tech revolution—radio, internet, even social media. The originators set the rules, but it’s the adaptors who go global. Bitcoin OGs, take note: Evolution isn’t betrayal. It’s the price of victory.

🚦 Empowering Your Crypto Journey with The Wolf Of Wall Street

Here’s the unlock—while whales, institutions, and OGs clash, The Wolf Of Wall Street crypto trading community is quietly arming smart traders with everything they need to thrive, no matter which way the winds blow:

- Exclusive VIP Signals: Proprietary trading signals to maximise your edge in volatile markets.

- Expert Market Analysis: Real-time insights from veteran crypto traders—so you never trade blind.

- Private Community: Over 100,000 members sharing strategies, insights, and support. No lone wolves here.

- Essential Trading Tools: From volume calculators to 24/7 support, you’re never left guessing.

- Continuous Support: The market never sleeps, and neither does our support team.

Ready to turn this debate into opportunity?

👉 Join our service for full access.

👉 Plug into the action on our Telegram community.

The market rewards those who move fast, think smart, and stay connected. Don’t just watch the battle—profit from it.

❓ FAQs

Q1: Why are some Bitcoin OGs selling now?

A: OGs are cashing out for a mix of reasons: diversification, life events, tactical moves, and, for some, unease with growing institutional presence. But selling doesn’t always mean giving up on Bitcoin’s future.

Q2: Does institutional adoption threaten Bitcoin’s original values?

A: It changes the game, but doesn’t end it. Institutions bring legitimacy and capital, but the core technology remains open and permissionless.

Q3: How can newcomers make sense of Bitcoin’s market shifts?

A: Stick with communities like The Wolf Of Wall Street, use trusted signals and tools, and never trade on emotion alone.

Q4: What impact did the 80,000 BTC sale have?

A: Short-term volatility, but the market’s depth absorbed the shock. It’s a sign of Bitcoin’s growing maturity.

Q5: Is it too late to join the Bitcoin revolution?

A: Absolutely not. As Bitcoin evolves, opportunities increase. The key is staying informed and plugged in.

🏁 Conclusion: From OGs to Everyone – The Bitcoin Story Continues

Here’s the bottom line—Bitcoin isn’t dead, and neither is its ethos. The debate about OGs losing faith is noise masking a bigger truth: Bitcoin is growing up. The dream is alive, just wearing a new suit. Whether you’re an OG, a newcomer, or somewhere in between, there’s still massive opportunity. The only question: Will you adapt and thrive, or stand on the sidelines complaining about the “good old days”?

If you want to play to win, surround yourself with the right people, tools, and information. That’s how fortunes are made—regardless of who’s holding the coins.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.