Bitcoin’s derivatives market isn’t just heating up – it’s erupting. We’re talking record-breaking action, headline-grabbing numbers, and traders moving with conviction.

Open interest (OI) on Bitcoin options has hit a staggering $63 billion, according to CoinGlass. To put that in perspective – this isn’t a “maybe something’s brewing” signal. This is a blaring siren that the smart money is loading up for major moves.

At the centre of this financial storm? Deribit – commanding roughly 80% of global options volume, clocking in at around $50 billion. The rest of the field? Playing catch-up.

🔥 The Data That’s Got Traders Buzzing

When you peel back the numbers, the story gets even more explosive.

Across the board, traders are piling into bullish positions – stacking call options with strike prices soaring above $120K, $130K, and even $140K. That’s right – the market is positioning for Bitcoin’s next moonshot.

But this isn’t blind optimism. The put/call ratio sits at a balanced 1.03, meaning there’s still some defensive hedging going on – just enough to keep things interesting (Bloomberg News).

And the big event? A colossal $5.1 billion in BTC options expiry is coming up on Deribit, which means fireworks for volatility. Historically, expiry days like this are where legends – and liquidations – are made.

You can almost feel the pulse of the market. $63 billion isn’t money sitting idle – it’s capital hunting opportunity.

Traders scanning for edge should review insights like Bitcoin spot and derivatives trading and crypto trading insights to stay ahead of these waves.

📈 Why This Matters: Reading Between the Charts

Let’s cut through the noise.

High open interest isn’t just a headline – it’s a mirror of trader conviction. When money floods into options, it signals one of two things: fear or opportunity.

Right now, the structure screams the latter. Heavy call positioning well above the current spot price (~$111K) indicates traders betting that Bitcoin’s next major breakout is just around the corner (CoinDesk).

Still, not all OI is created equal. Some institutions use these instruments to hedge, not gamble – meaning they might be locking in profits or managing risk, not necessarily calling for a $140K BTC overnight.

And here’s a key term to know – the max pain point. It’s the price where most options contracts expire worthless, currently sitting near $114K. Translation? Market makers have an incentive to nudge prices toward that zone before expiry – it’s where they win and retail traders lose.

Want to master these dynamics? Start with guides like Bollinger Bands trading strategy or Money Flow Index (MFI) 2025 strategies to better read these volatility setups.

🚀 What Traders Should Watch Next

Here’s the game plan for anyone serious about catching the next move:

- Watch the expiry. Friday’s $5.1B expiry could spark a tug-of-war between bulls and bears – a short-term volatility blast.

- Track key levels. $114K is the “max pain zone.” $120K is the psychological breakout. $130K? The euphoria trigger.

- Look for volume confirmation. If open interest keeps rising and spot price breaks $120K, expect institutional FOMO to flood in.

Cointelegraph notes that Bitcoin’s consolidation phases after high OI often precede big directional moves. Translation? The fuse is already lit.

As Deribit CEO Luuk Strijers put it, traders are “actively positioning for major price moves” – and history shows they usually don’t stack billions in calls for fun.

If you’re analysing this data manually, consider reading How ChatGPT Analyses Bitcoin Trends 2025 or explore AI vs Trading Bots to boost your strategy edge.

💼 How to Stay Ahead of the Curve – The The Wolf Of Wall Street Edge

Here’s the truth: you can’t outpace the market solo. The battlefield is global, 24/7, and ruthless.

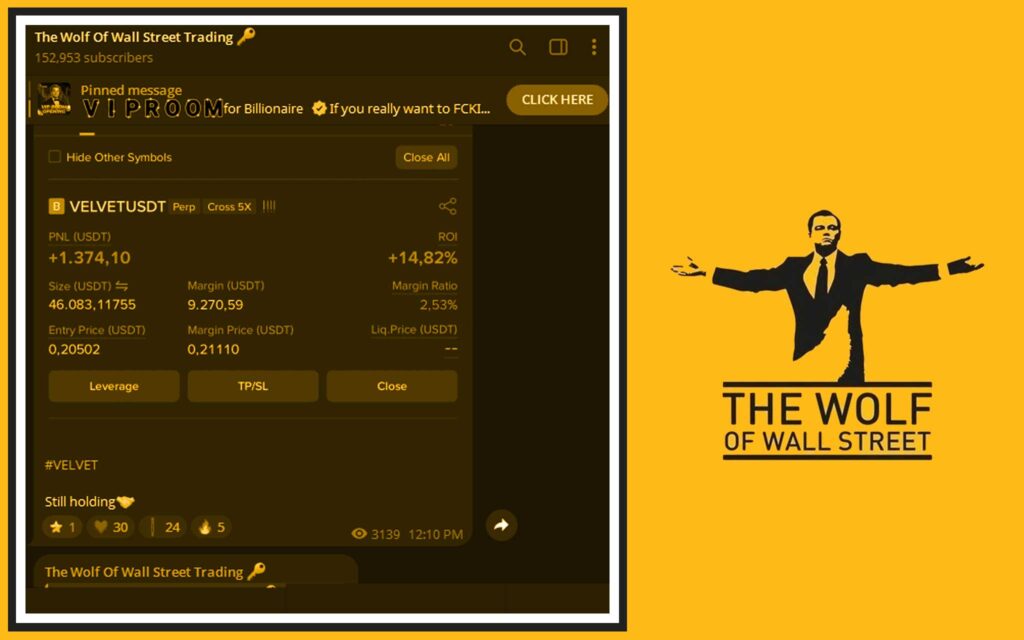

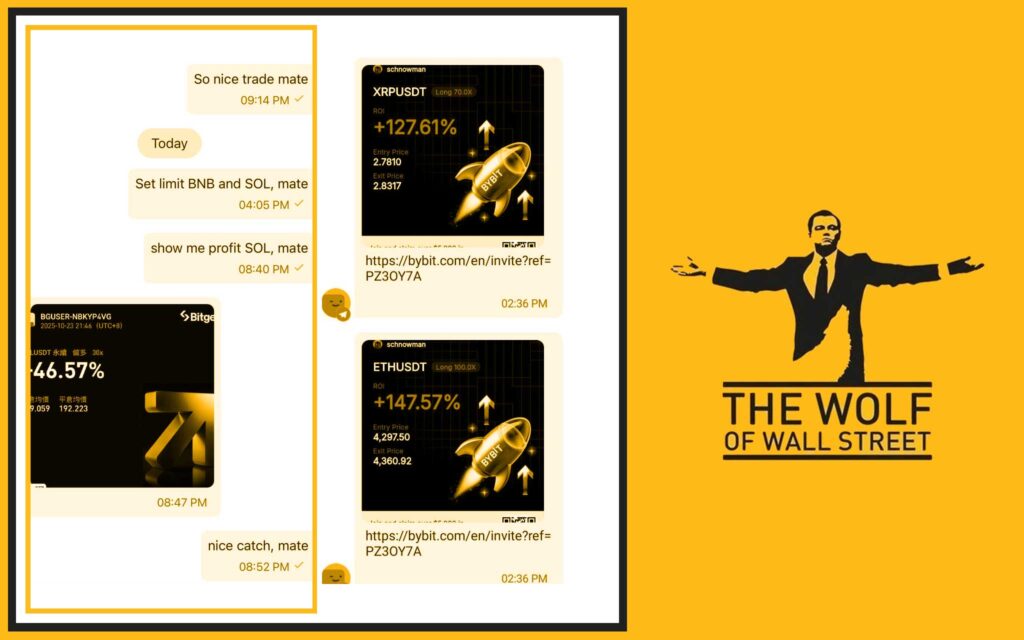

That’s where The Wolf Of Wall Street comes in – a crypto trading community built for wolves, not sheep. Inside The Wolf Of Wall Street, you get:

- Exclusive VIP Signals – proprietary setups from top-tier analysts.

- Expert Market Analysis – deep dives into trends, volatility, and entry zones.

- Private Community – over 150,000 traders exchanging real-time intelligence.

- Essential Tools – volume calculators and risk-tracking resources.

- 24/7 Support – because opportunity never sleeps.

Join the The Wolf Of Wall Street Telegram community for live updates, or check the The Wolf Of Wall Street service page for full details.

Because in crypto trading, speed and information aren’t luxuries – they’re survival tools.

💥 Conclusion

The numbers don’t lie – the bulls are charging, and Bitcoin’s derivatives market is screaming momentum.

Whether this $63B OI leads to a parabolic surge or a volatility storm, one thing’s for sure: sitting on the sidelines is no longer an option.

The next move belongs to those prepared, connected, and informed.

Be that trader.

Join The Wolf Of Wall Street – trade smarter, win bigger, and dominate the market like a wolf among sheep.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: In-depth insights from seasoned crypto traders.

- Private Community: Join 150K+ like-minded traders for shared intelligence and support.

- Essential Trading Tools: Volume calculators, data dashboards, and real-time alerts.

- 24/7 Support: Always-on assistance to keep you trading with confidence.

Empower your trading journey today:

🔗 The Wolf Of Wall Street Service Page | 💬 The Wolf Of Wall Street Telegram