👑 Introduction: The New King of Market Caps

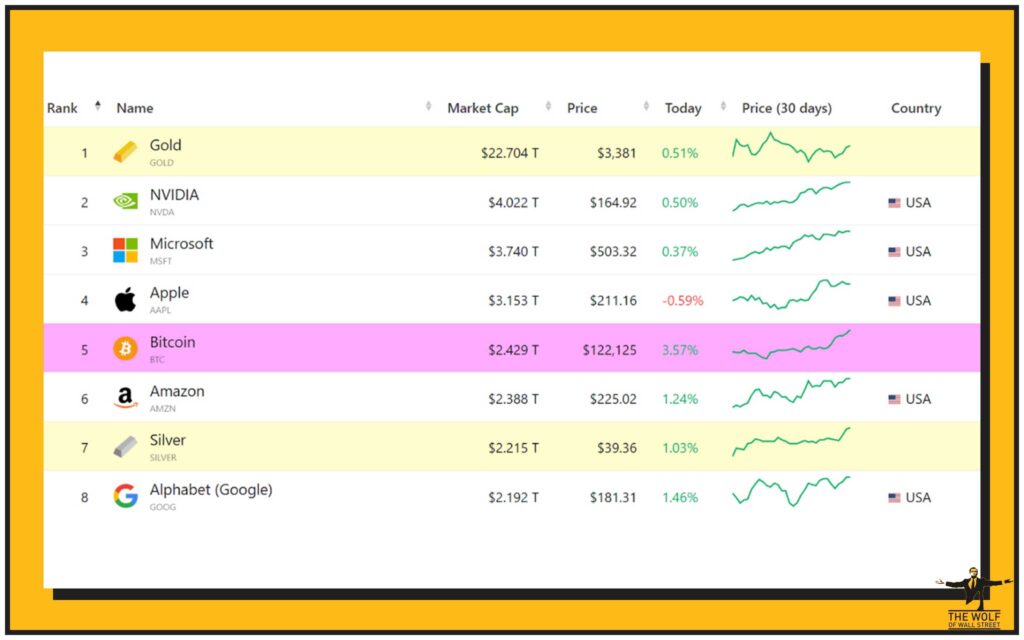

July 2025. History is made. Bitcoin doesn’t just climb—it obliterates expectations, smashing through the $122,600 barrier and taking its market cap north of $2.4 trillion. Let that number sink in. Amazon—the e-commerce titan, the company that changed shopping forever—has just been dethroned. Bitcoin now stands in the top five most valuable global assets. And if you’re still watching from the sidelines, you’re not just missing out, you’re risking irrelevance.

Here’s the raw truth: This is the moment where fortunes are made, legacies built, and the old guard gets left in the dust. Let’s break down exactly why Bitcoin’s rise matters for you, your investments, and the future of finance.

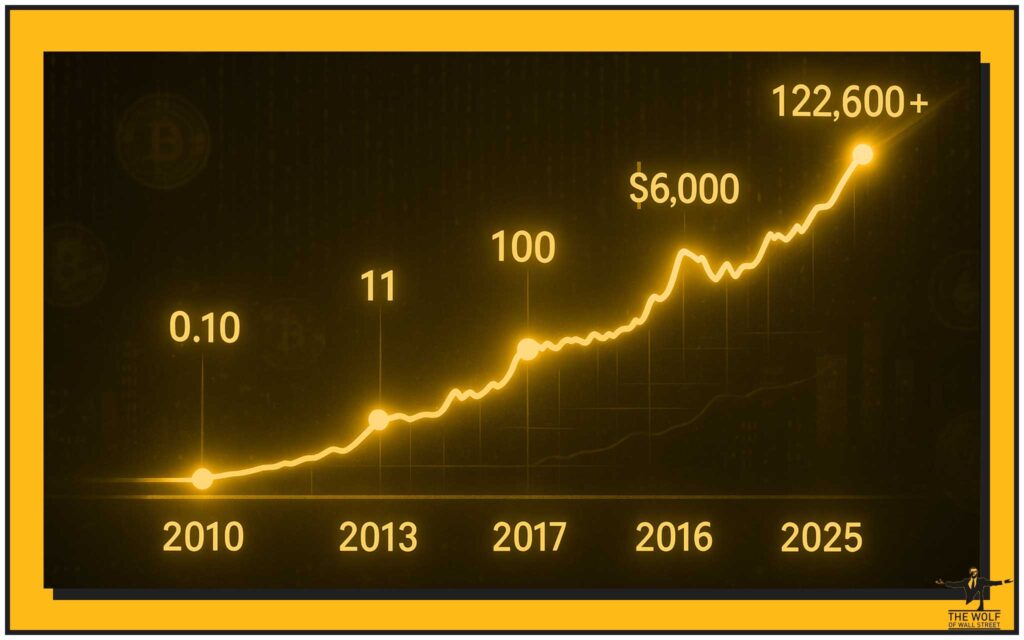

📈 Bitcoin’s Meteoric Rise: From $0.10 to $122,600+

If you’d bought Bitcoin for pennies back in 2010, you’d be sipping cocktails on your private island by now. But it’s not too late. The meteoric rise from $0.10 to over $122,600 is proof that this asset isn’t just volatile—it’s powerful. Every traditional investor, every Wall Street sceptic, is being forced to admit: Bitcoin’s here, and it’s taking over.

This isn’t luck. It’s the result of a global shift in how we see money, value, and power. Ignore it, and you get left behind.

🏆 The Market Cap Milestone: Amazon, Out—Bitcoin, In

Let’s cut the jargon. Market capitalisation is the total value of an asset. For a decade, Amazon’s $2.3 trillion seemed untouchable. Now? Bitcoin eats Amazon’s lunch, eclipsing silver, Google, and squeezing into the world’s top five assets.

This isn’t just a line on a chart. It’s a wake-up call. The new economy is here, and Bitcoin is its flagship.

💸 The Fuel: Spot Bitcoin ETF Inflows & Institutional FOMO

Here’s what set the rocket alight: ETFs—Exchange-Traded Funds. When spot Bitcoin ETFs hit the US market, the floodgates opened. Billions in institutional money surged in, shattering previous inflow records. Why? Because the big players can’t afford to miss out any longer.

Institutions want security, regulation, and liquidity. Spot ETFs delivered exactly that. Suddenly, Wall Street hedge funds, pension giants, and insurance companies are clamouring for a piece of the pie. This is no longer a playground for retail dreamers—it’s a full-blown asset class, with serious money at stake.

⚖️ Regulatory Lightning: Crypto Week’s Laws Reshape the Arena

Legislation made this bull run bulletproof. The US Congress didn’t just talk; they delivered with “Crypto Week”—a legislative blitz that included the CLARITY Act, GENIUS Act, and the Anti-CBDC Surveillance Act. These laws gave crypto the regulatory clarity and legitimacy institutions were begging for.

Why is this crucial? Because regulation reduces risk for big players. Suddenly, Bitcoin isn’t a Wild West gamble—it’s a credible, compliant investment vehicle.

Want the deep dive? Check out our detailed crypto regulations and compliance strategies, or see how the Genius Act is shaking up stablecoin regulation and what the Clarity Act means for crypto regulation.

⏳ Digital Scarcity: Bitcoin’s 21 Million Supply

Let’s talk supply and demand—the only economics that matter. Bitcoin’s supply is capped at 21 million coins, forever. No central bank can “print” more, no government can dilute your holdings. This scarcity makes Bitcoin the hardest money ever created.

Gold is valuable because it’s scarce. Bitcoin is even scarcer—programmable, transparent, and global. That’s why, in 2025, the world’s smartest investors are treating Bitcoin as the ultimate store of value.

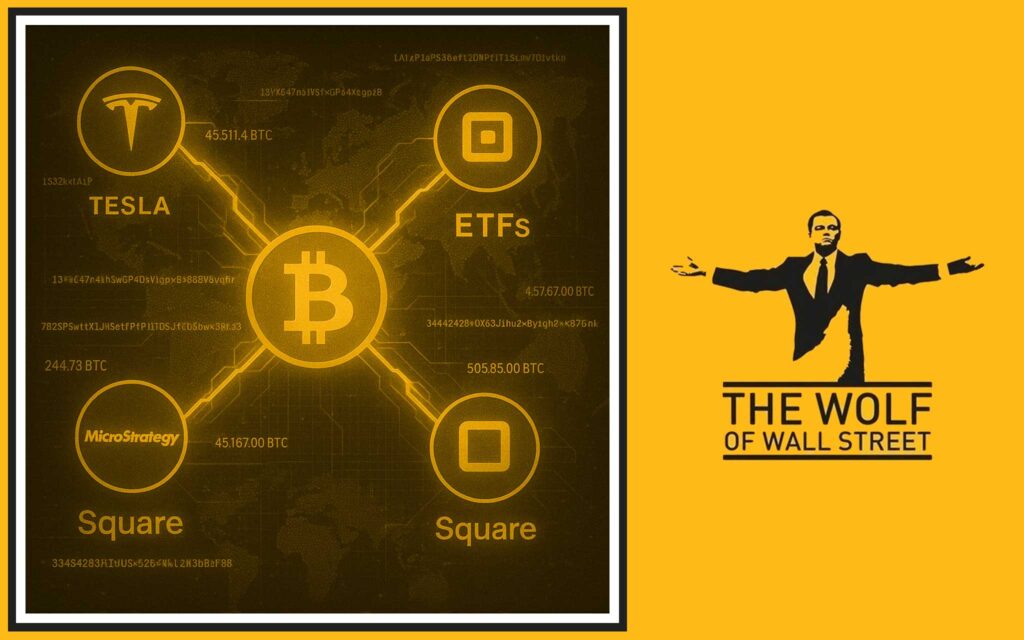

🏢 Institutional Power Players: Companies & ETFs Stack Sats

Think it’s just a few retail speculators? Think again. Over 265 publicly traded companies—including Tesla, MicroStrategy, and Square—are stacking Bitcoin on their balance sheets. ETFs alone now control around 1.4 million BTC, a jaw-dropping 6.6% of the total supply.

This isn’t a passing trend. When the titans of industry start buying in bulk, you know a paradigm shift is underway. For retail traders, this is the moment to follow the smart money—not fight it.

🥇 Store of Value: Bitcoin’s Gold 2.0 Status

For centuries, gold was the hedge against chaos. But gold is heavy, slow, and hard to move across borders. Bitcoin? It’s digital, instantaneous, and borderless. That’s why investors from Wall Street to Shanghai are dumping gold for Bitcoin.

In a world of endless money printing, Bitcoin’s scarcity is your best weapon against inflation. It’s not just a speculative asset. It’s a shield.

📊 Price Predictions: Can Bitcoin Hit $200,000 This Year?

Let’s talk numbers. JP Morgan, Standard Chartered, and a raft of top analysts are all singing the same tune: Bitcoin’s next stop could be anywhere from $135,000 to $200,000 by year-end. At that level, it will challenge Apple and Microsoft for the title of most valuable company in history.

Ambitious? Maybe. But with institutional money flooding in and supply locked tight, don’t be surprised when headlines read “Bitcoin passes Apple.”

⚠️ Risks and Reality Checks: The Roadblocks Ahead

Nothing goes up in a straight line. Bitcoin’s continued growth relies on a few big things:

- Ongoing ETF inflows: If the tide turns, so could the price.

- Regulatory clarity: One bad law could spook institutions.

- Macro policy: Global interest rates and economic stability matter.

Ignore the risks at your peril. Smart traders hedge, diversify, and stay informed. For advanced market insights, our trading insights for crypto success can keep you ahead of the game.

📉 Bitcoin’s Growing Correlation with Equities

The old narrative: Bitcoin is a hedge against traditional markets. The new reality? Bitcoin is moving in step with equities. As it gets adopted by more institutional players, its price action is increasingly tied to the broader stock market.

Is this bad news? Not necessarily. It means Bitcoin is no longer a fringe bet—it’s now a core portfolio asset. But it also means volatility in stocks could ripple through Bitcoin. Be ready. For diversification strategies, check The Wolf’s Guide to Asset Classes in Crypto Wealth.

🌐 How Bitcoin’s Triumph Reshapes Global Finance

Bitcoin overtaking Amazon isn’t just a milestone—it’s a paradigm shift. The asset class once mocked by mainstream media is now central to portfolio diversification, risk management, and future wealth building.

Banks, hedge funds, and even governments are now forced to build strategies around Bitcoin exposure. The old guard has two choices: adapt, or get left behind.

🤝 The Role of Communities: Power in Numbers

No one wins in crypto alone. Communities like the The Wolf Of Wall Street crypto trading community are giving traders an edge that no Wall Street suit can touch:

- Exclusive VIP signals to catch the biggest moves before the crowd.

- Expert market analysis to decode volatility.

- A private network of over 100,000 traders swapping real-time intel.

- Trading tools like volume calculators to keep your decisions sharp.

- 24/7 support—because opportunity never sleeps.

Ready to stop trading blind? Plug into the action:

- Visit The Wolf Of Wall Street service

- Join the Telegram for real-time signals: The Wolf Of Wall Street Telegram

- Unlock your trading potential.

Want a head start? Our how to buy crypto guide will get you set up in minutes.

🌍 The Global View: Bitcoin Beyond US Borders

This is a global revolution. From Europe to Asia and beyond, regulators are scrambling to keep up. Countries like Germany and Singapore are pushing friendly frameworks, while others tighten restrictions.

What’s next? Expect global adoption to skyrocket as regulatory certainty improves and capital controls drive demand for hard, borderless money. Bitcoin isn’t just the US story—it’s a world story.

🐻 The Bearish Perspective: What Could Go Wrong?

Let’s be honest—nothing is bulletproof. Here’s what the bears are watching:

- Competing cryptocurrencies: Will an “Ethereum killer” take Bitcoin’s crown?

- Tech risks: Quantum computing, protocol bugs.

- Regulatory backlash: Governments could still swing the hammer.

The bottom line: Stay sharp, stay educated, and don’t bet the farm on one horse.

📢 Interactive: What’s Your Move? Poll & Community Engagement

Let’s put it on the line. Would you buy, hold, or sell Bitcoin right now?

Drop your answer in the comments—don’t be shy. Are you riding this wave or waiting for a dip? Join the conversation with other hungry traders. Your move could be your next big win.

🏁 Conclusion: The Bitcoin Blueprint for the Next Decade

The verdict is in: Bitcoin is no longer a fringe experiment. It’s the real deal, and its triumph over Amazon is just the beginning. Institutional adoption, bulletproof regulation, digital scarcity—these are the forces rewriting the playbook for wealth and financial power.

If you’re serious about the future—your future—take action now. Diversify. Educate yourself. Join elite communities like The Wolf Of Wall Street and leverage every edge. The next decade will belong to those bold enough to adapt.

❓ Frequently Asked Questions (FAQs) About Bitcoin Surpassing Amazon

Q1: Why did Bitcoin’s market cap surpass Amazon’s in 2025?

Because massive institutional inflows, regulatory clarity, and Bitcoin’s digital scarcity aligned to unleash unprecedented demand and value.

Q2: Is Bitcoin a safer investment now that it’s surpassed Amazon?

Safer than before, but it still carries risks. Regulation and ETF access help, but volatility and market shocks remain possible.

Q3: Will Bitcoin keep rising or is this the top?

Analysts see room for growth, with $200,000 not out of the question—but always hedge your bets and stay alert.

Q4: How can I get started with Bitcoin trading or investing?

Begin by joining trusted communities like The Wolf Of Wall Street, learning from trading guides, and starting with small, manageable positions.

Q5: What risks should I watch for in 2025?

Keep an eye on ETF inflows, new regulations, macroeconomic swings, and technological changes.

💼 The The Wolf Of Wall Street Advantage

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

Internal Links Used: