🏁 Introduction: The Day Wall Street Blinked

Listen up, because what you’re about to read isn’t just another corporate makeover—it’s a masterclass in financial audacity. This is how KindlyMD, a company that once hawked alternative medicine, detonated its old identity and became the first true Bitcoin-native public company—pulling in $51.5 million in a white-hot 72-hour window. Think that’s wild? Strap in. We’re just getting started.

💥 The Corporate Pivot No One Saw Coming

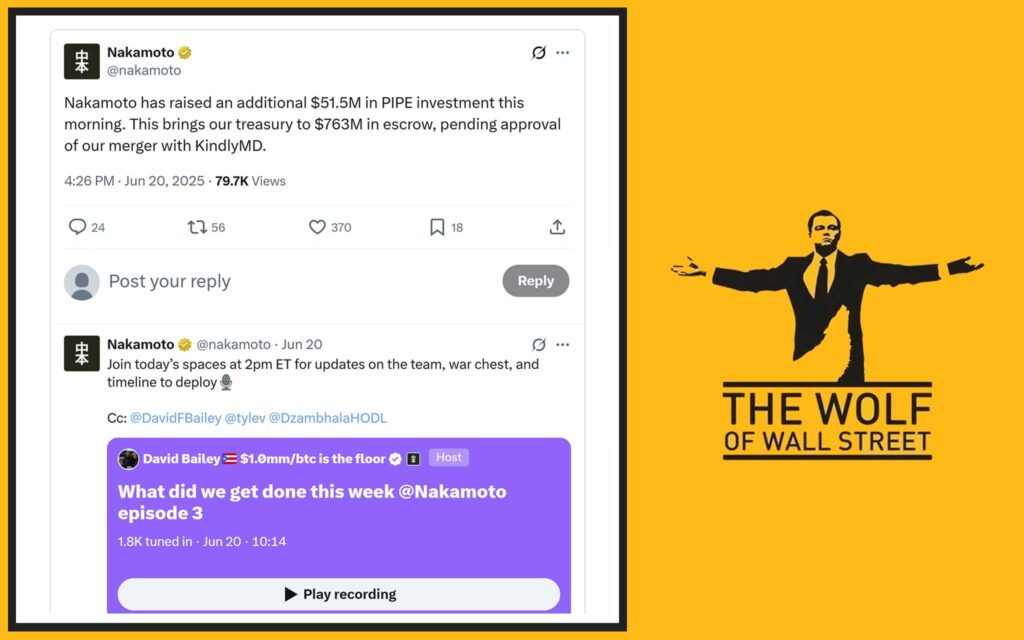

Let’s call it what it is: a pivot of biblical proportions. KindlyMD was a vanilla healthcare player, Nasdaq-listed, ticking boxes. Then, almost overnight, it went all in on Bitcoin. No timid “diversify the treasury” nonsense—this was scorched-earth, HODL-or-die conviction. They engineered a reverse merger with Nakamoto Holdings and dropped a PIPE bomb to raise $51.5 million. Result? A new corporate beast—public, Bitcoin-native, and aiming to become the next institutional lodestar.

💸 What the Hell Is a PIPE—and Why Did It Raise $51.5M Overnight?

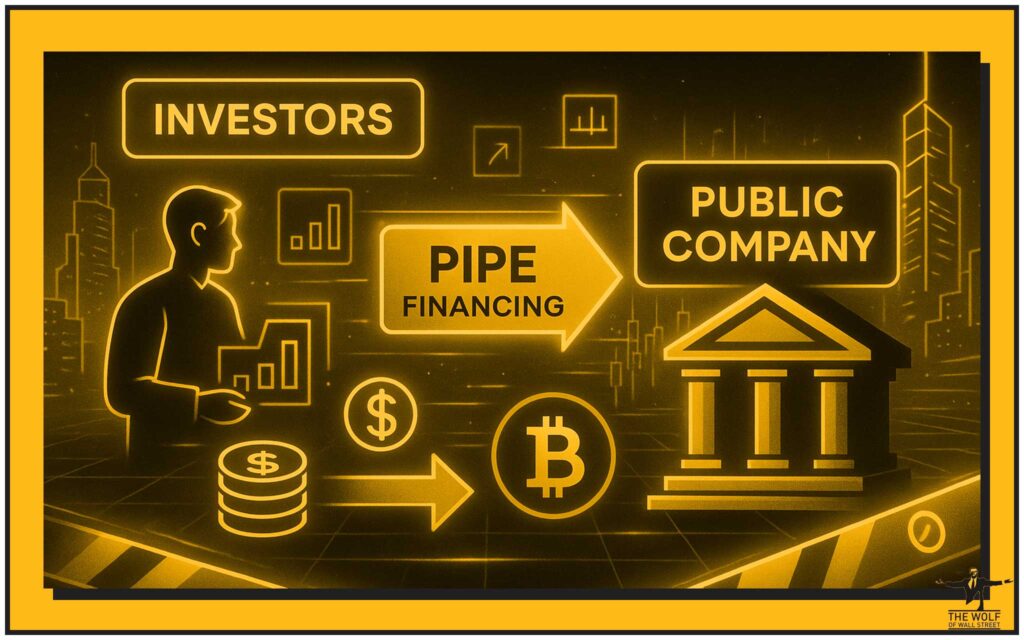

Time for a reality check. PIPE stands for Private Investment in Public Equity. It’s the smart money’s favourite move when a public company wants to raise serious capital, fast, with minimal noise. The playbook: issue new shares at a negotiated price to institutional investors. No retail drama. No slow-motion IPO process. In KindlyMD’s case, the PIPE was oversubscribed at $5 per share—because the smart money saw the upside and they wanted a piece now. For more insider trading strategies, you can deep-dive into our trading insights hub.

⚡ Why KindlyMD Went Full Bitcoin—Fast

Ask yourself: Why ditch a perfectly good business and jump head-first into the deep end of crypto? It’s simple—opportunity. Bitcoin isn’t just a currency, it’s a corporate growth engine and a global hedge. KindlyMD’s execs, with the swagger of true outliers, saw the writing on the wall: treasuries are getting smoked by inflation, cash is deadweight, and Wall Street is itching for regulated, scalable ways to get Bitcoin on the books.

They didn’t just want exposure—they wanted to architect the model. Want the inside scoop on riding these trends? Don’t miss our crypto news and insights and crypto trading service for the sharpest edge.

🦾 Meet Nakamoto Holdings – The New Face of the Revolution

After the dust settled, KindlyMD shed its old skin and rebranded as Nakamoto Holdings Inc. (NAKA). This is more than a name change—it’s a mission statement. Led by BTC Inc. CEO David Bailey, Nakamoto Holdings is positioned as the first publicly traded, fully Bitcoin-native holding company. The plan? Accumulate BTC, execute strategic Bitcoin-aligned acquisitions, and serve as the institutional gateway for capital looking to break into digital gold.

Want to understand why Bitcoin is flipping the script for corporate treasuries? Our guide on mastering crypto order types is your playbook.

📈 Institutional Appetite—Why the Sharks Are Circling Bitcoin

Forget retail FOMO. What happened here was pure, institutional-grade greed—the kind that moves markets. The PIPE round was massively oversubscribed, with big players elbowing each other out of the way for a seat at the table. Why? Because Bitcoin-aligned equity is the new frontier. It’s not just about holding coins; it’s about owning shares in companies that are structurally wedded to Bitcoin’s long-term upside. Institutions aren’t dabbling—they’re betting the farm.

🔍 Anatomy of the Deal—How the Money Moved in 72 Hours

This was no slow-motion capital raise. The PIPE deal slammed $51.5 million onto the balance sheet in record time—less than three days. Here’s how the dominoes fell:

- Announcement: KindlyMD signals intent to merge with Nakamoto Holdings.

- PIPE Launch: Share offering opens at $5 per share—terms negotiated in advance.

- Investor Scramble: Institutions pile in, pushing the round into oversubscription.

- Funds Allocated: Every penny earmarked for Bitcoin acquisition, post-merger.

In other words: Institutional demand + decisive leadership + Bitcoin narrative = rocket fuel.

🏦 Reverse Merger—The Fast Lane to Becoming a Bitcoin Public Company

Why a reverse merger? It’s the express lane to the public markets. Instead of waiting months (or years) for regulatory green lights on an IPO or ETF, you take an existing, listed shell and inject it with a new business model. That’s what KindlyMD did—flipped from healthcare to Bitcoin overnight, skipping the queue, and letting the PIPE investors ride shotgun from day one.

If you’re still catching up on how reverse mergers work in the crypto sphere, get schooled in our crypto token listing process guide.

🚀 From Healthcare to HODL – The Vision Behind the Move

This wasn’t a whim—it was a vision. The management team understood that Bitcoin is the future of sound money and corporate value preservation. They didn’t want to play small ball; they wanted to set the new industry standard for what a public company built around Bitcoin could look like. This is MicroStrategy on steroids—a full business pivot, not just a treasury tweak.

Want to know how these shifts are shaking up layer-1 and layer-2 solutions and DeFi? Check out our DeFi category.

🔄 PIPEs vs. ETFs—The Institutional Playbook (And Why This Matters NOW)

Let’s get real: ETFs are slow, regulatory headaches. PIPEs? They’re fast, flexible, and direct. That’s why PIPEs are rapidly becoming the tool of choice for bold corporate pivots into Bitcoin. Instead of tiptoeing through SEC hoops, these companies are using the capital markets to rewrite their DNA. And the market is begging for it—PIPE investors aren’t speculators; they’re forward-thinking funds hungry for asymmetric upside.

Curious how ETFs stack up in this game? Get the breakdown in our ETPs vs. ETFs investment guide.

🏗️ Rebuilding a Business on Bitcoin – Operational Shifts

Let’s not sugar-coat it—pivoting an entire company to Bitcoin is an operational earthquake. You’re talking about:

- Treasury Overhaul: Allocating new capital to buy and custody Bitcoin.

- Corporate Rebranding: Everything from mission statements to investor decks is rewritten in Bitcoinese.

- Staffing Shifts: Hiring crypto-native talent, retraining legacy staff.

- Investor Relations: Educating Wall Street on a whole new playbook.

The lesson? If you’re going to do this, do it big and do it fast—or get left behind.

👑 Bitcoin as Corporate Treasury—Lessons from MicroStrategy, Strive, and Beyond

Let’s talk precedent. MicroStrategy made headlines by pouring billions into Bitcoin, but they’re not alone. Strive and other forward-leaning firms are rewriting what it means to be a public company in the digital age. KindlyMD/Nakamoto Holdings took the blueprint, dialled it up, and brought in institutional buy-in at the ground floor.

Want the full playbook? Our crypto profit-taking wolf’s guide lays out every step.

🛡️ Regulatory Rumbles—What Could Trip Up the Next Bitcoin Pivot?

Here’s the million-pound question: will the regulators rain on this parade? Sure, reverse mergers are legal. PIPEs are time-tested. But the SEC, Nasdaq, and institutional gatekeepers will be watching—closely. Any company thinking of following KindlyMD’s path needs airtight disclosures, battle-tested compliance, and a board that understands both the risk and the reward.

Get the lowdown on compliance in our crypto AML guide and crypto travel rule strategy.

🧠 Investor Psychology—Why the Smart Money Loves This Play

Let’s make one thing clear: this isn’t retail mania. PIPE investors are the top sharks—hedge funds, family offices, and digital asset VCs. What do they see? A chance to own leveraged upside on Bitcoin through public equity, with all the regulatory protections of the traditional market. They’re not buying coins—they’re buying the future of corporate capital allocation.

Want to become the smart money? Learn from the best in our research crypto opportunities guide.

🤝 Community, Tools, and the The Wolf Of Wall Street Edge in Crypto Trading

Pause and ask yourself: how do you gain your edge in the chaos of the crypto markets? You don’t do it alone. The The Wolf Of Wall Street crypto trading community is where real traders level up, with exclusive VIP signals, institutional-grade market analysis, a private network of over 100,000 crypto strategists, and 24/7 support. Whether you’re chasing the next PIPE or learning to read the macro tea leaves, The Wolf Of Wall Street delivers actionable value, not noise. Jump into their Telegram channel and get real-time updates that actually move the needle.

🔥 What This Means for the Future—Trend or Outlier?

Is KindlyMD’s move a flash in the pan, or the start of an avalanche? Smart money says this is just the beginning. As inflation burns cash, and regulators drag their feet on ETFs, more companies will follow the PIPE-to-Bitcoin playbook. It’s the fastest, boldest route into the ecosystem—and now that the market has tasted blood, don’t expect the sharks to wait around.

Track these shifts in our trending and hot news categories.

📦 Key Takeaways—The Wolf’s Cheat Sheet for Ambitious Investors

- KindlyMD/Nakamoto Holdings pivoted from healthcare to Bitcoin-native public company in a single, high-velocity deal.

- PIPE financing enabled a $51.5 million raise in just 72 hours, drawing serious institutional demand.

- Reverse merger made the transition instant—no regulatory bottleneck, no wasted time.

- Bitcoin is now the gold standard for public company treasury strategy—expect more to follow.

- Institutional capital is hungry for Bitcoin-aligned equity—this isn’t a fad, it’s a fundamental shift.

🗺️ Action Plan—How You Can Position Yourself for the Next Bitcoin Pivot

Ready to get off the sidelines? Here’s how you capitalise:

- Follow the money—watch PIPE deals and reverse mergers in the news and cryptocurrencies sectors.

- Sharpen your trading skills—start with our crypto trading service, dive into trading insights, and track Bitcoin spot and derivatives trading.

- Study the winners—read the crypto profit-taking wolf’s guide and learn how seasoned traders ride volatility.

- Join the community—network with high-level strategists at The Wolf Of Wall Street and get real-time updates in their Telegram group.

- Stay ahead—explore our newbie and how to buy crypto guide for tactical first steps.

🙋 FAQs: Burning Questions About Bitcoin Pivots, PIPEs, and Public Market Moves

Q1: What is a PIPE, and why is it ideal for a Bitcoin pivot?

A PIPE is a fast, direct way for public companies to raise capital from institutional investors. For Bitcoin pivots, it means instant access to funds—no ETF or IPO delays.

Q2: What risks do companies face when switching to a Bitcoin-native model?

Regulatory scrutiny, operational overhaul, and the challenge of educating traditional investors. But the upside? First-mover advantage and asymmetric returns.

Q3: Are institutional investors driving this trend?

Absolutely. PIPE rounds like KindlyMD’s are dominated by funds hungry for equity-based exposure to Bitcoin.

Q4: How can retail investors benefit?

Track PIPE deals, monitor new Bitcoin-native listings, and align with communities like The Wolf Of Wall Street for actionable insights.

Q5: What’s next for corporate Bitcoin adoption?

Expect a wave of pivots as inflation persists, ETFs lag, and institutional demand for Bitcoin exposure accelerates.

🏁 Conclusion: The Only Direction Is Forward

There’s no more hiding behind corporate conservatism. The KindlyMD playbook is now public—and the only way forward is full throttle. If you want to survive and thrive in this new game, you’ve got to think big, move fast, and own your exposure to Bitcoin. The market doesn’t wait for the timid. Neither should you.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service page for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.