🔑 Introduction: Welcome to the New Crypto Wild West

Forget what you think you know about markets. July 2025 isn’t just another chapter—it’s a new book. Bitcoin is breaking records, shattering ceilings, and rewriting the rules. The price has soared above $112,000, the kind of number that used to sound like a typo. But this isn’t hype—this is hard numbers, real capital, and institutional firepower.

Ask yourself: Are you just watching from the cheap seats, or are you in the arena playing to win?

🚀 Bitcoin Smashes Past $112,000

Here’s the headline: Bitcoin blasted through $111,000 and briefly topped $112,000, clocking a 93% gain over the last year, and a red-hot 17% in just six months.

What does that mean?

- This isn’t some penny stock pump.

- The world’s top digital asset is rewriting financial history.

- Millions of dollars are on the table, and the crowd’s going wild.

But the real story isn’t just the price—it’s why this is happening. Let’s break it down.

💥 What’s Driving the Rocket? Market Forces Unleashed

Let’s talk power moves.

- Institutional Demand: ETFs are soaking up supply like there’s no tomorrow. Corporate treasuries are stacking sats as a strategic hedge.

- $200M Short Liquidation: The bears got slaughtered—over $200 million in shorts wiped out at key resistance. If you were betting against the bull, you’re licking your wounds.

- Safe-Haven Status: Global uncertainty is making Bitcoin look like digital gold—except it’s more portable, transparent, and liquid.

Bottom line: The big players aren’t just dipping their toes in—they’re diving in head first.

🌍 The Macro Wildcards: Why This Isn’t 2021’s Bull Run

This is not a rerun of the last cycle.

- Tariffs, Trade Wars, and Inflation: Governments are tossing out new tariffs, rattling the global chessboard, and fiat is melting down.

- Fiat Debasement: When money printers go brrrr, capital flees to hard assets. Bitcoin is becoming the escape hatch for institutional and retail investors alike.

- Macro Headlines Matter: Every tariff, every geopolitical twist, is another push toward decentralised assets.

Want more macro context and news? Check out our dedicated news section, the latest cryptocurrency policy analysis, and the hottest market-moving stories.

🐂🐻 The Technical Battlefield: Bulls vs. Bears in the Trenches

Technical traders—listen up. After the breakout, Bitcoin is consolidating between $108,000 and $109,200. The next level to watch?

- Key Resistance: Just above $109,000

- Critical Support: $107,200

Indicators like RSI and MACD are signalling an equilibrium phase. Translation: the market’s taking a breather. But unless we break below $107,200, the bulls are still running the show.

For in-depth technical analysis and real-time signals, tap into our trading insights hub.

📊 On-Chain Data & Exchange Flows: Follow the Smart Money

Here’s where the sharks are circling:

- Declining Exchange Reserves: Since late April, coins have been leaving exchanges—fast. Long-term holders are locking in, reducing supply and fuelling the rally.

- Spot Buyer Dominance: It’s not just leveraged gamblers—it’s genuine demand.

- Whales Are Accumulating: The big money is NOT waiting on the sidelines.

Curious about the behind-the-scenes moves? Explore altcoins and defi opportunities driven by Bitcoin flows.

🔮 The Forecast: Where Does Bitcoin Go From Here?

Let’s cut to the chase.

- Analysts are bullish: Most see $115,000–$130,000 as the next stop. Some are talking $200,000 by year-end if institutions keep buying.

- But volatility is real: Choppy waters ahead if resistance holds, or macro storms hit.

- Reality check: Long-term trend? Still up. Short-term? Be ready for anything.

For the latest analyst calls and macro predictions, bookmark our cryptocurrencies news section.

🦈 Institutional Invasion: The New Bitcoin Titans

This isn’t just retail FOMO anymore.

- ETF Flows: Billions pouring in.

- Corporate Treasuries: Household names adding Bitcoin to balance sheets.

- Banks and Funds: S&P 500 companies, asset managers, and even pension funds are now buyers.

Bitcoin isn’t the fringe—it’s mainstream, boardroom-approved, and here to stay.

Want the inside scoop on institutional moves? Dive into our ecosystems section for the big-picture view.

📆 Lessons From History: How This Run Stacks Up

2025 isn’t 2021, and it’s definitely not 2017.

- Regulations are evolving: Bitcoin is now legal tender in some regions, regulated in others, and the playbook keeps shifting.

- Media coverage: From scepticism to front-page headlines.

- Investor psychology: The old patterns still matter, but new rules are being written.

See how winners and losers played it in past cycles at our Bitcoin archive.

⚠️ Risks, Pitfalls, and Market Minefields

Let’s talk straight—there are landmines.

- Regulatory surprises: One headline can move the market 10%.

- Over-leverage: If you’re chasing pumps with borrowed money, you’re playing with fire.

- Volatility: Bitcoin’s greatest strength and biggest risk.

Stay smart, stay informed. Our policies and newbie guides can keep you out of trouble.

🛠️ Tools of the Titans: Trade Like a Pro With The Wolf Of Wall Street

You want an edge? Here’s how you get it:

- Exclusive VIP Signals: Proprietary buy/sell calls, not recycled Twitter noise.

- Expert Market Analysis: Decades of combined crypto trading wisdom.

- Essential Trading Tools: Volume calculators, risk management frameworks, and more.

- 24/7 Support: Never trade alone—get help anytime, anywhere.

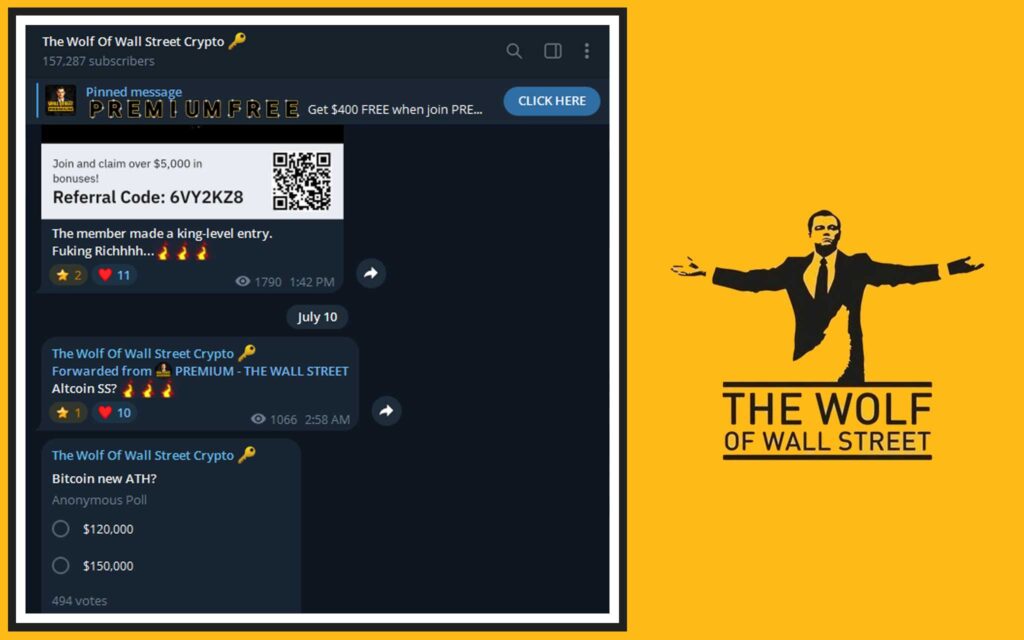

Thousands of smart traders use the The Wolf Of Wall Street service and active Telegram community to unlock real profits. Ready to join the elite? Click, join, and see for yourself.

👥 The Community Factor: Power in the Pack

Nobody wins alone. The era of the lone wolf is over—the The Wolf Of Wall Street community connects you with 100,000+ like-minded traders, all sharing real-time intel, tips, and strategies.

- Daily market analysis

- Live chat, Q&A, and accountability

- Beginner and pro resources

Curious? Jump into our newbie resources and trading insights. The pack is stronger together.

🌐 Broader Impact: What This Means for the Whole Crypto Ecosystem

This is bigger than Bitcoin.

- Layer-1 and Layer-2 Solutions: As the king rises, the whole market feels the lift. Explore now

- NFTs & Gaming: Fresh capital and new use cases exploding. Check out the action

- Memecoins: Riskier, wilder, but still moving with the tide. See what’s hot

For a full ecosystem overview, our cryptocurrencies category is your starting line.

📈 Investor Playbook: How to Ride This Bull Without Getting Gored

Here’s your actionable plan:

- Risk Management: Use stop losses, size your positions, and never bet the farm.

- Research First: The best traders are obsessed with learning—use our trading insights and The Wolf Of Wall Street signals.

- Join a Community: Don’t trade blind. The The Wolf Of Wall Street Telegram has live updates, AMAs, and constant support.

- Stay Ahead: News moves markets. Plug into our news and hot topics.

❓ Frequently Asked Questions (FAQs)

Q1: What causes Bitcoin rallies?

A: Powerful market demand, institutional flows, and big liquidations at key price levels.

Q2: Is now a good time to invest?

A: Markets are bullish long-term, but manage your risk. Corrections happen—be ready.

Q3: How do ETF flows impact the market?

A: ETFs soak up circulating supply, driving up price and legitimacy.

Q4: Where to get real-time analysis and support?

A: Join The Wolf Of Wall Street Telegram and visit our The Wolf Of Wall Street service for expert tools and signals.

🚧 Conclusion: Don’t Watch From the Sidelines – Dominate the Game

Here’s the bottom line:

Bitcoin’s run to $112,000 isn’t luck—it’s strategy, timing, and bold action. The next phase belongs to those who show up, plug in, and play to win.

Don’t let the market leave you behind.

- Catch the latest trending stories

- Stay in the loop with hot insights

- Dive deep on Bitcoin’s future

Unlock your crypto potential. Join The Wolf Of Wall Street, join the winners, and make 2025 your breakout year.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

You’ve got the blueprint. Now it’s your move. Dominate the market.