⚡ Welcome to the New Era of Bitcoin Power

Bitcoin just smashed through $109,700, and if you think this is the top — think again. This isn’t a fluke, and it sure as hell isn’t luck. It’s the product of macro moves, smart money flow, and a maturing narrative that’s transforming Bitcoin from an outsider to a legitimate power asset in every serious investor’s portfolio.

Bitcoin isn’t here to play games — it’s here to dominate.

💥 The Perfect Storm Behind Bitcoin’s Surge

What happens when three major global risks start cooling down simultaneously? You get a damn explosion in the markets. Here’s what triggered this rocket ride:

- US–China Trade Agreement: A 90-day tariff pause slashed market fears. Global investors stopped playing defence and started chasing growth.

- Russia–Ukraine Ceasefire Talks: This stabilised geopolitical sentiment and flipped the global fear index.

- Reduced Macroeconomic Uncertainty: Capital needed a new home. And Bitcoin? It rolled out the red carpet.

When fear subsides, risk appetite spikes. And Bitcoin — now seen as both a hedge and a high-yield play — becomes the ultimate magnet for global capital.

💰 Capital Rotation: From Fear to Fire

There’s a massive rotation of money happening right now. Funds are pulling out of stagnant, low-yield assets like gold and US treasuries, and piling into high-beta assets like BTC and tech.

This is called “risk-on” mode, and it’s the fuel behind Bitcoin’s breakout.

- Equities and crypto are soaring.

- Dollar is weakening.

- Commodities are cooling.

Smart investors are reallocating to maximise upside — and Bitcoin is now at the top of that allocation list.

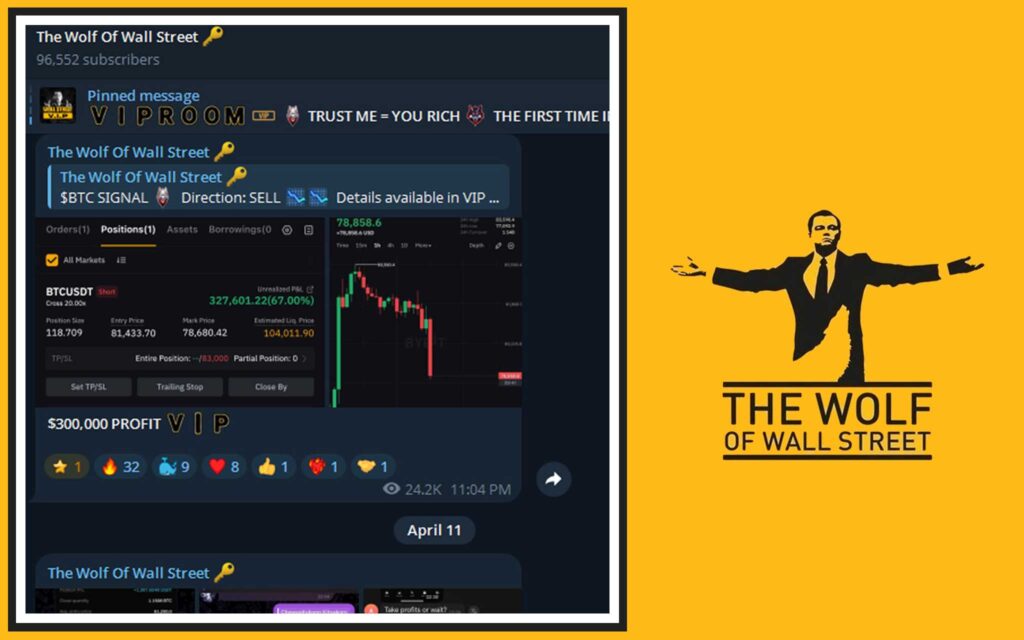

Want proof? Just look at what’s happening on platforms like The Wolf Of Wall Street, where over 100,000 traders are riding these macro tailwinds with real-time VIP signals and expert trading intelligence.

🧠 Bitcoin: The Mature Risk Asset

Let’s kill the outdated narrative: Bitcoin is no longer just “digital gold” or a hedge against chaos. That’s yesterday’s story.

Today, Bitcoin is:

- A maturing risk asset.

- A liquidity sink when global capital flows are looking for high returns.

- The poster child of institutional risk appetite.

The smartest minds in finance — from hedge funds to sovereign wealth — aren’t dismissing Bitcoin. They’re studying it, buying it, and strategising around it.

This isn’t just bullish. It’s historic.

📈 From Panic to Profit: Bitcoin’s Bounce From $74K to $109K

In early April, Bitcoin tanked to $74,434 after US tariffs rattled markets. But then came the rebound — fast, violent, and unrelenting.

Here’s the play-by-play:

- Massive liquidation flush cleared weak hands.

- Funding rates reset.

- Open interest surged.

Translation: the market purged fear, and institutional whales reloaded.

If you were in the The Wolf Of Wall Street trading community, you saw this coming in real-time through proprietary indicators and 24/7 signal drops.

Don’t trade blind. Trade smart — trade with an edge.

🧩 Macro Moves: What Analysts Are Really Saying

Here’s what the sharpest minds are saying:

- Nansen: Bitcoin is benefitting from capital rotation out of stable markets into high-beta plays.

- Bitfinex Alpha: This is the “fear-hedge-to-risk-on” pivot in action.

- Real Vision: Bitcoin is being used as a macro indicator — not just a crypto asset.

They’re not guessing. They’re calculating. And they see Bitcoin pushing past $114K — even $132K — as institutional money keeps flowing.

🚀 Targets on the Table: $114K? $132K?

These aren’t moonboy numbers. These are data-backed targets based on real capital flow, monetary policy expectations, and market structure.

- $114K: First resistance cluster, likely to hit within weeks if macro peace holds.

- $132K: Bull cycle high if volume + momentum stay aligned.

Smart traders don’t trade emotion. They trade probabilities — and they use tools like those offered inside The Wolf Of Wall Street, including volume calculators, funding rate monitors, and market heatmaps.

🔍 Why Altcoins Could Ride This Wave Too

Altcoin rallies don’t start in a vacuum — they follow BTC dominance contractions.

Here’s what happens next:

- BTC leads.

- ETH, SOL, and major alts follow.

- Memecoins and low-caps go parabolic.

But only if you’re early — and only if you’re plugged in. Follow the leaders, track dominance metrics, and front-run rotation. That’s how you compound gains, not chase them.

See what’s trending now: /category/cryptocurrencies/altcoins/

⚙️ What Most Traders Don’t See (Yet)

The average trader? Still staring at charts, chasing green candles. Pros are watching:

- Stablecoin supply flows

- Liquidity indexes

- Exchange reserve data

If you’re trading without this intel, you’re gambling. That’s why tools and education from platforms like The Wolf Of Wall Street are the secret weapon for every serious trader.

🔒 Regulatory Shifts Fueling the Fire

We’re entering a new phase — crypto regulation clarity. Finally.

- US bills focusing on stablecoin clarity and ETF regulation.

- EU’s MiCA rollout boosting institutional security.

- Asia opening floodgates for crypto asset licensing.

This removes the number one psychological barrier for institutions: regulatory risk.

Explore more here: /category/policies/

🛠️ How to Ride This Rally Without Getting Wrecked

Let’s talk survival and scale:

- Use volume-based entries, not emotion.

- Watch funding rates and open interest — they’re smoke signals.

- Always scale out — no one goes broke taking profits.

The top traders don’t YOLO. They use tools. They lean on support. They execute with precision.

And if you don’t have those tools? Well, now you do.

👑 Enter The Wolf Of Wall Street: Your Crypto Advantage

Let’s not sugarcoat it — the market’s ruthless. That’s why The Wolf Of Wall Street exists.

Here’s what you get:

- 🔥 Exclusive VIP Signals that beat the market

- 📊 Expert Market Analysis to understand why, not just what

- 🧠 Private Trading Community with over 100,000 active traders

- 🧮 Pro-Level Tools like volume calculators and entry/exit guides

- 📞 24/7 Support that actually responds

Ready to trade like a pro? Join The Wolf Of Wall Street now and level up.

🎯 Key Takeaways: Where We Go From Here

- Bitcoin breaking $109K is just the start of a macro-fueled bull run.

- Global peace = capital flow = BTC surge.

- Institutions are no longer ignoring Bitcoin — they’re driving it.

- Altcoins will follow — but only the savvy will catch the wave.

- The Wolf Of Wall Street offers the infrastructure and intel to trade this market like a beast.

❓ FAQs: No-BS Crypto Clarity

1. What triggered Bitcoin’s recent surge?

A mix of geopolitical calm, macro de-escalation, and capital rotation into risk assets.

2. How do geopolitical events affect crypto?

They shift global risk appetite. Less fear = more investment in volatile assets like Bitcoin.

3. Is Bitcoin now considered a risk asset or a hedge?

Both — it’s evolved into a hybrid macro play that thrives in both fear and greed cycles.

4. Will altcoins follow BTC’s path?

Historically, yes — especially ETH, SOL, and Layer-1s after BTC dominance peaks.

5. What makes The Wolf Of Wall Street different from other trading groups?

Real VIP signals, deep market intel, institutional-grade tools, and 100,000+ active members — all backed by 24/7 live support.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals designed to maximise trading profits

- Expert Market Analysis from seasoned crypto traders

- Private Community of over 100,000 like-minded individuals

- Essential Trading Tools like volume calculators and trend indicators

- 24/7 Support from a dedicated team

👉 Empower your trading journey:

🌐 Visit: https://tthewolfofwallstreet.com

💬 Join Telegram: https://t.me/tthewolfofwallstreet