🔥 Introduction

The clock is ticking. Quantum computing isn’t some far-off sci-fi fantasy—it’s a freight train hurtling toward us, and Anatoly Yakovenko, the co-founder of Solana, just dropped a bomb: there’s a 50% chance quantum computing breaks Bitcoin within the next five years. That’s not alarmist hype—that’s a wake-up call.

Bitcoin has built its reputation on unbreakable cryptography. But what happens when quantum computers start tearing through today’s algorithms like tissue paper? This isn’t just a technical issue—it’s survival. And if Bitcoin doesn’t act fast, it risks getting blindsided.

Let’s break down the threat, the expert opinions, the hard fork drama, and most importantly—what traders and investors should be doing right now.

🚀 Quantum Threat Forecast

Yakovenko’s words were crystal clear: there’s a coin-flip chance that within five years, quantum computers will be powerful enough to smash Bitcoin’s defences. Imagine a hacker with a quantum computer—suddenly private keys aren’t private anymore, and the fortress wall of Bitcoin crumbles.

Fifty-fifty odds. Heads, Bitcoin survives. Tails, it gets shredded. You don’t bet your life savings on a coin toss.

🛡 Bitcoin’s Current Cryptography

Bitcoin security is built on the Elliptic Curve Digital Signature Algorithm (ECDSA). For decades, it’s been rock-solid. It ensures that when you sign a transaction, nobody else can forge your signature. It’s the magic trick that makes decentralised money possible.

But here’s the rub: quantum computers running Shor’s algorithm can, in theory, factorise the maths behind ECDSA in no time. What takes today’s supercomputers thousands of years could take a quantum beast just hours—or minutes. That’s the nuclear button moment for Bitcoin.

🧠 Expert Opinions: The Spectrum

Not everyone’s on the same page, and that’s the problem.

- David Carvalho: the alarm bell ringer. He says Bitcoin could be toast in less than five years. For him, quantum isn’t coming—it’s already knocking.

- Adam Back: the sceptic. He’s more relaxed, claiming we’ve got 20 years before quantum becomes a real threat.

- Samson Mow: the middle ground guy. He sees the danger, but thinks we’ve got roughly a decade to prepare.

- Anatoly Yakovenko: pushing urgency. His “50/50 odds” prediction is a call to arms for the crypto community.

So who’s right? Doesn’t matter. If you’re playing defence in the markets, you don’t wait for consensus—you prepare for the worst.

⚔ The Hard Fork Debate

Here’s where it gets messy. Switching Bitcoin to quantum-resistant cryptography isn’t a quick patch. It’s a hard fork, meaning the network has to agree on major rule changes. And if history tells us anything—just remember the battles over SegWit and Taproot—Bitcoiners don’t exactly agree easily.

Some say: “Why fork? Bitcoin is perfect as is.” Others counter: “No upgrade = dead Bitcoin.” This ideological tug-of-war could delay action until it’s too late. In decentralisation, strength comes with stubbornness.

🌍 Industry & Government Context

It’s not just crypto nerds paying attention. Governments are throwing billions into quantum research. China, the U.S., and Europe are in a tech arms race to dominate AI and quantum. If a government cracks quantum first, they won’t tweet about it. They’ll use it.

And if state actors get there before Bitcoin upgrades? Say goodbye to blockchain security as we know it.

🔐 Quantum-Resistant Solutions (Post-Quantum Cryptography)

So, what’s the fix? Enter Post-Quantum Cryptography (PQC)—the new generation of algorithms designed to withstand quantum attacks. The frontrunners:

- Lattice-based cryptography → Strong against Shor’s algorithm, candidate for future blockchains.

- Hash-based signatures → Secure but heavy in size; tricky to scale on-chain.

- Multivariate cryptography → Faster, but less battle-tested.

The U.S. National Institute of Standards and Technology (NIST) is running a global competition to standardise PQC. Winners will become the backbone of future-proof digital security. The question: will Bitcoin adopt in time?

📉 Market Risks & Impact

Let’s get real: markets don’t wait for academic papers. They move on fear. Imagine news breaking that a quantum computer cracked a smaller blockchain. Traders would instantly assume Bitcoin’s next. Panic selling, billions wiped off the market, institutional players retreating.

This isn’t just about technology—it’s about trust. Once trust wobbles, markets crash. Fast.

⚡ The Urgency of Action

Bitcoin’s greatest enemy isn’t Ethereum, regulators, or the next memecoin. It’s physics. Yakovenko’s warning is brutal but honest: stop arguing, start upgrading. Because the one thing you can’t negotiate with is mathematics.

Sitting on our hands, waiting for “proof” that quantum is ready, is financial suicide. The community must accelerate research, roadmap the fork, and prepare contingency strategies. Period.

🏦 What This Means for Traders & Investors

Alright, let’s talk money. What should you do if you’re holding Bitcoin or trading crypto?

- Diversify: Don’t park everything in BTC. Hedge with assets and coins exploring quantum-resistant security.

- Stay informed: Knowledge is leverage. Follow updates from NIST, Solana, Ethereum, and other ecosystems.

- Protect liquidity: Be ready to pivot if panic hits the markets.

- Engage communities: Join active trader groups like The Wolf Of Wall Street Service to stay ahead of market-moving signals.

Winners aren’t the ones who panic last—they’re the ones who prepare first.

🤝 The Role of Crypto Communities

Bitcoin’s strength lies in its decentralisation, but that also makes change painfully slow. Communities like Ethereum and Solana adapt faster. If Bitcoin drags its feet, it risks looking like a dinosaur while others evolve.

This is why private networks, Telegram groups, and trading hubs are so critical. Shared knowledge = survival. Communities that adapt together, profit together.

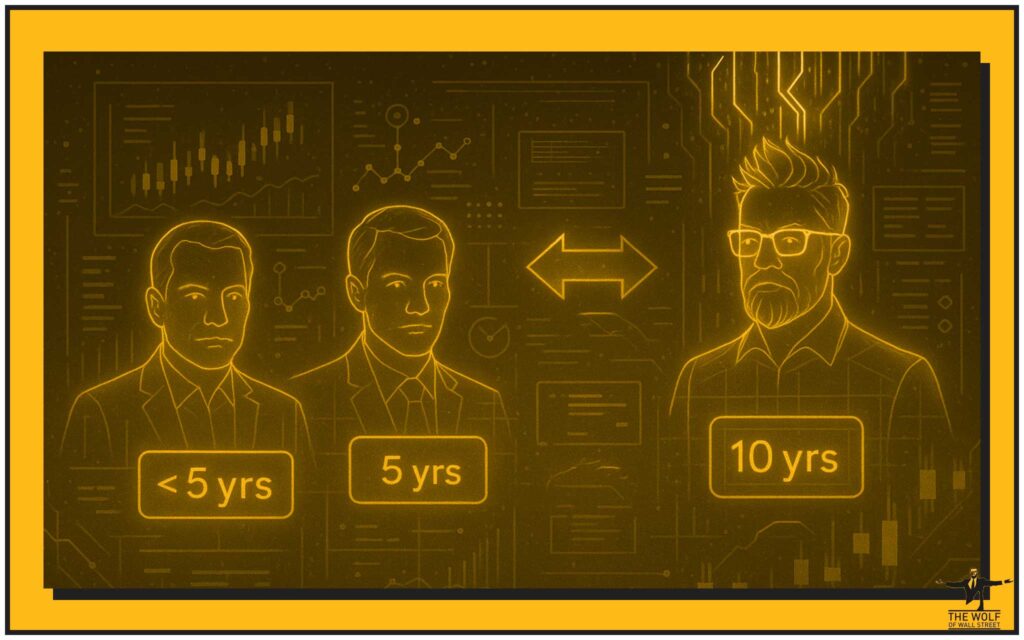

📊 Data & Timeline Explained

- Yakovenko: 5 years.

- Carvalho: <5 years.

- Mow: ~10 years.

- Back: 20 years.

Translation? The earliest credible warning is just around the corner. Even the most conservative voice says the threat lands within our lifetimes. Betting against quantum is betting against exponential tech growth. History shows: bad bet.

🔮 Future Outlook

Three possible roads ahead:

- Best Case: Bitcoin upgrades, survives, and becomes the first quantum-proof digital gold.

- Worst Case: Quantum cracks ECDSA before Bitcoin adapts. BTC collapses. Trust evaporates.

- Middle Ground: Bitcoin stumbles, forks late, but altcoins like Solana and Ethereum lead the way.

The winners? Those who planned early.

🧩 FAQs

Q1: What exactly makes Bitcoin vulnerable to quantum computing?

A: Its reliance on ECDSA, which quantum computers can theoretically break using Shor’s algorithm.

Q2: How soon could quantum computers realistically crack Bitcoin?

A: Estimates range from under 5 years to 20 years. But uncertainty itself is the risk.

Q3: What are quantum-resistant signature schemes?

A: Cryptographic methods like lattice-based or hash-based algorithms that can withstand quantum attacks.

Q4: Could Bitcoin survive a hard fork to adopt PQC?

A: Yes, but it requires massive community consensus—a tough battle.

Q5: Are other blockchains better prepared for quantum threats?

A: Many altcoins, including Solana, are already exploring quantum resistance faster than Bitcoin.

🎯 Conclusion

Here’s the brutal truth: Bitcoin’s biggest battle isn’t against regulators, or even Ethereum—it’s against physics itself. Quantum is coming, and Anatoly Yakovenko just rang the alarm bell. Whether it’s five years, ten, or twenty, the community can’t afford to procrastinate.

Adapt, upgrade, and prepare—or watch the crown slip.

For traders and investors, the play is simple: stay diversified, stay educated, and plug into communities that give you the edge. Because in the quantum era, the unprepared will get wiped out.

📌 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community: The Wolf Of Wall Street Telegram for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.