🔥 Introduction: The Big Money Shift in Crypto

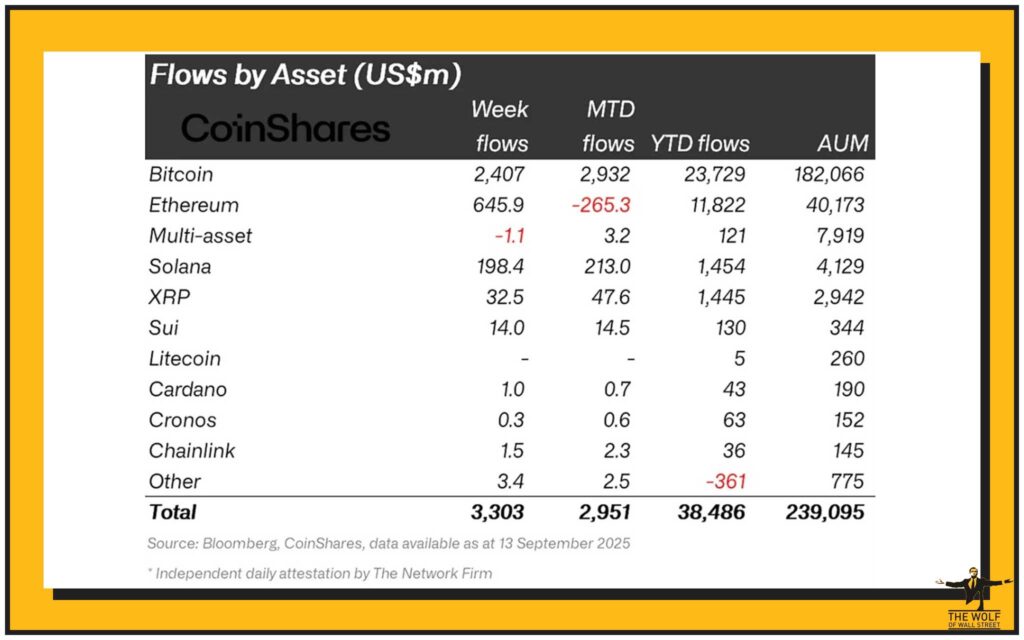

Last week, global crypto exchange-traded products (ETPs) saw $3.3 billion pour in, nearly smashing the all-time record for assets under management at $239 billion. This isn’t just numbers on a screen—it’s a tidal wave of confidence from institutions and smart money. When that kind of capital flows in, it’s a signal: the market is heating up again. If you’re sitting on the sidelines, you’re missing the show.

In this article, we’ll break down Bitcoin’s dominance, Ethereum’s comeback, and Solana’s breakout surge. Plus, we’ll cover the institutional moves that are rewriting the playbook—and how you can ride the same momentum.

💰 The $3.3 Billion Rebound Explained

After weeks of uncertainty, inflows came roaring back. $3.3 billion in just seven days pushed the market’s AUM to nearly $239 billion. That’s not retail noise; that’s institutional conviction. These numbers tell us one thing loud and clear: the bulls are back in the ring.

👑 Bitcoin Still the King

Bitcoin reminded the market why it wears the crown. It raked in $2.4 billion in inflows, the biggest since July. Prices climbed from $111,900 to $115,600—a solid 3.3% gain.

This isn’t hype—it’s calculated institutional bets. Bitcoin ETPs continue to be the gateway for big money, and when the whales are loading up, you better believe they see upside.

🔥 Ethereum’s Quiet Comeback

Ethereum has been fighting through a rough patch, but last week it flipped the script. For four straight days, inflows totalled $646 million—a reversal after weeks of bleeding. ETH prices jumped 4.6%, moving from $4,300 to $4,500.

Momentum is building again, and with the network’s roadmap evolving, institutions are dipping back in. Don’t underestimate Ethereum’s ability to grind higher once the confidence returns.

🌊 Solana Steals the Show

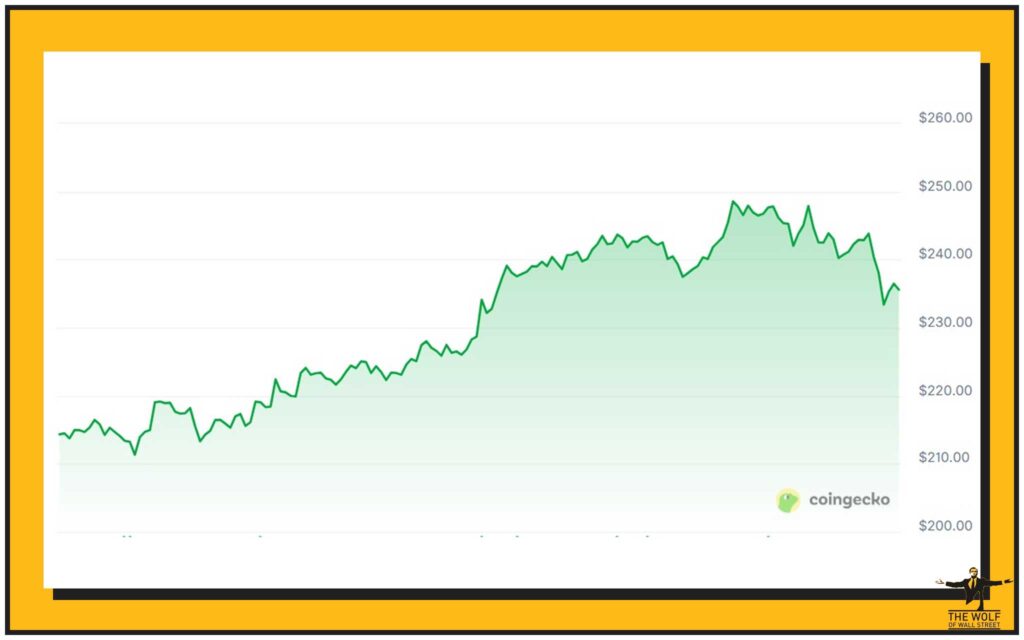

Now here’s where it gets exciting. Solana absolutely ripped the spotlight away. With a record-breaking $145 million single-day inflow, it closed the week at $198 million in total inflows. Price? Up a massive 11.6%, from $214 to $239.

That’s not retail traders causing a spike—it’s big institutional firepower. Solana outperformed Bitcoin and Ethereum, proving it’s not just a side project—it’s a serious contender in the next wave of blockchain adoption.

🏦 The Institutional Game-Changer

This wasn’t random money chasing green candles. Forward Industries dropped a bomb, announcing a $1.65 billion Solana treasury, backed by heavy hitters like Galaxy Digital. Speaking of which, Galaxy Digital went all-in, buying $1.5 billion in Solana tokens last week, including $305 million in one single day.

This is institutional conviction at scale. When multi-billion-dollar firms take positions like this, they’re not thinking days or weeks—they’re thinking long-term dominance.

📈 Why This Surge Isn’t Just Noise

We’ve seen inflows before. But this rebound feels different. Here’s why:

- It comes after a rough patch of consistent outflows.

- The volume is institutionally driven, not retail hype.

- Assets under management are near all-time highs.

That’s not noise. That’s a sentiment shift, and shifts like these reshape markets.

🔑 ETPs: The Investor’s Gateway

Quick refresher: crypto ETPs (Exchange-Traded Products) are like the stock market’s version of crypto exposure. Instead of buying tokens directly, investors—especially institutions—buy ETPs for simplicity, regulation, and security.

Why it matters:

- Institutions love them. Cleaner compliance.

- Liquidity is solid. Easy in, easy out.

- Retail investors benefit too. You get to ride the same waves without needing billions in capital.

⚔️ Winners and Losers in the ETP Race

- Bitcoin: Still the heavyweight champion in inflows.

- Solana: Fastest riser with monster gains.

- Ethereum: Stabilising and gearing up for growth.

- Other altcoins: Still lagging, waiting for their moment.

The trend is clear: big money is concentrating in proven assets, not chasing meme tokens.

🧟♂️ Investor Confidence: Back from the Dead

Two months ago, fear ruled the markets. Today? Optimism is back in full force. The psychology has shifted:

- Liquidity is flowing in.

- Institutions are betting big.

- Prices are climbing steadily.

Confidence is the most powerful fuel in markets. Once it flips, the momentum feeds itself.

⚠️ Risks on the Horizon

Don’t get it twisted—crypto’s still a high-risk game. Watch for:

- Volatility: Gains this fast mean swings can be brutal.

- Regulation: Governments could pump the brakes.

- Overreliance: Too much institutional concentration is a double-edged sword.

The play isn’t to avoid risk. The play is to manage it like a pro.

🎯 Strategic Takeaways for Traders

Here’s how you translate inflows into profits:

- Track ETP inflows weekly. They’re the early signal of where smart money is going.

- Ride the momentum, but set stops. Don’t fall in love with a coin.

- Watch Solana closely. It’s showing leadership strength.

- Balance your exposure. Don’t bet the farm on one asset.

Winners don’t guess. They act on data.

🐂 The Bigger Picture: Is This the Next Bull Run?

Here’s the billion-dollar question: are we at the start of a new bull cycle? With $3.3B inflows, Bitcoin holding steady, Ethereum regaining ground, and Solana exploding higher—the signs are there.

Institutions aren’t gambling. They’re planting flags. And when they do that, it usually signals the early innings of something much bigger.

🔒 The Wolf Of Wall Street Community Advantage

If you’re serious about capitalising on these inflows, you can’t go it alone. The The Wolf Of Wall Street crypto trading community gives you:

- Exclusive VIP Signals to catch moves before the herd.

- Expert Market Analysis from seasoned traders.

- Private Community of over 100,000 investors.

- Essential Tools like volume calculators.

- 24/7 Support so you’re never trading blind.

Stay connected with the action:

- Explore services here: The Wolf Of Wall Street

- Join the live community: The Wolf Of Wall Street Telegram

Smart traders use every edge they can get. This is yours.

🏁 Conclusion: Don’t Watch from the Sidelines

Bitcoin inflows. Ethereum reversal. Solana’s breakout. Institutions are betting billions, and the data is crystal clear: confidence is back. The question is—are you in the game, or are you watching from the cheap seats?

Opportunities like this don’t last forever. Position yourself, stay sharp, and use platforms like The Wolf Of Wall Street to maximise every single move.

❓ FAQs

1. What are crypto ETPs, and how do they differ from ETFs?

ETPs are exchange-traded products giving exposure to crypto assets, while ETFs are specific fund structures. Both allow investors to trade crypto exposure like stocks.

2. Why did Solana outperform Bitcoin and Ethereum last week?

Institutional confidence, massive inflows, and a $1.65B treasury announcement created a surge in demand, driving Solana higher.

3. How do institutional inflows affect crypto prices?

Large-scale buys increase demand, tighten supply, and push prices upward. They also boost retail confidence, creating momentum.

4. Are these inflows a guarantee of a long-term bull market?

No guarantees—but historically, inflows of this size have often signalled the start of bullish cycles.

5. What risks should retail investors consider before following institutional trends?

Volatility, regulation, and concentration risk. Always manage position sizes and use stop losses.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.