Listen up. Most people think crypto trading is just buying and selling coins. They’re only seeing half the picture! If you want to multiply your gains (and yes, your risks), you need to understand the Bitcoin Spot vs. Derivatives Trading landscape. This isn’t just about owning Bitcoin; it’s about speculating on its price, leveraging your bets, and playing a whole new ballgame. Get this right, and you open up massive opportunities. Get it wrong, and you’re liquidated.

💰 Spot Trading: Owning the Asset

Spot trading is the most direct and straightforward way to engage with Bitcoin or any cryptocurrency. It’s exactly what it sounds like: you buy the asset, and you own it. You’re exchanging one asset (like fiat currency or another cryptocurrency) for Bitcoin at the current market price, for immediate delivery.

What is Spot Trading? Direct Ownership.

When you engage in spot trading, you are buying or selling the actual underlying asset. If you buy Bitcoin on a spot exchange, those Bitcoin tokens are transferred to your wallet. You have direct ownership. This is different from trading contracts that represent the asset.

Simplicity and Transparency.

Spot trading is typically easier to understand for newcomers to the market. There are no complex contracts, no expiry dates, and no leverage (unless you explicitly use margin from the exchange, which we will discuss later). The price you see is the price you pay (plus trading fees). This simplicity makes it a popular starting point for many individuals entering the cryptocurrency space. Its transparency comes from directly reflecting real supply and demand for the asset itself.

Key Advantages:

- No expiry dates: Unlike many derivatives, you hold the asset for as long as you want. There’s no forced selling or buying due to a contract expiring.

- Full control over your Bitcoin: Once you own the Bitcoin, you can move it to your personal wallet (cold storage for long-term holding), use it for payments, or engage in other activities like staking (if it’s a Proof-of-Stake coin). This direct control is a major draw.

- Lower direct risk: While still subject to market volatility, you cannot be liquidated in spot trading merely due to price fluctuations, as you’re not using borrowed funds.

Risks of Spot Trading:

- Market volatility: Bitcoin prices can fluctuate wildly. Even without leverage, sharp downturns can significantly reduce your capital.

- Security: Holding Bitcoin on an exchange carries counterparty risk – the risk that the exchange could be hacked or face insolvency. Moving it to a personal, secure wallet mitigates this, but then places the security responsibility entirely on you.

- Liquidity: For smaller altcoins, low liquidity on spot markets can make it hard to buy or sell large amounts without affecting the price significantly.

Popular Spot Strategies:

- Hodling: This term, originating from a misspelling of “holding,” refers to buying Bitcoin and holding it for the long term, ignoring short-term price swings. It’s based on the belief that Bitcoin’s value will appreciate significantly over years.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money into Bitcoin at regular intervals (e.g., £100 every week), regardless of the price. This reduces the impact of volatility and removes the emotion of trying to time the market.

📝 Derivatives Trading: The Contract Game

Derivatives trading is a different beast entirely. It allows you to speculate on the price movements of an asset (like Bitcoin) without actually owning the asset itself. You’re trading contracts whose value is ‘derived’ from the underlying Bitcoin price. This opens up vastly more complex, but potentially more profitable, strategies.

What are Derivatives?: Contracts, not assets.

A derivative is a financial contract between two or more parties. Its value is tied to an underlying asset or group of assets. In crypto, common underlying assets are Bitcoin or Ethereum. You’re not buying or selling Bitcoin; you’re agreeing to buy or sell a contract that follows Bitcoin’s price. This distinction is fundamental.

The Power of Leverage: Magnifying Gains and Losses.

The defining characteristic of derivatives trading is the ability to use leverage. Leverage means you borrow funds from the exchange to increase your position size beyond what your own capital would allow.

- If you use 10x leverage, a £100 investment controls a £1,000 position.

- Small price moves in your favour can lead to large profits.

- However, small price moves against you can lead to disproportionately large losses, much faster than in spot trading.

Leverage amplifies everything. It’s a double-edged sword that can multiply your gains but also accelerate your losses, leading to quick liquidation.

📜 Types of Bitcoin Derivatives Contracts

The world of crypto derivatives offers several types of contracts, each with its own mechanics and risk profile.

Futures Contracts: Obligation to Buy/Sell.

A Bitcoin futures contract is an agreement to buy or sell a specific amount of Bitcoin at a predetermined price on a specified future date.

- Mechanics and Expiry Dates: When you buy a futures contract, you are obligated to buy the Bitcoin at that future price, regardless of what the market price is on the expiry date. If you sell, you are obligated to sell. These contracts have fixed expiry dates (e.g., quarterly, monthly).

- Profit and Loss Examples: If you buy a Bitcoin futures contract at £30,000 and on expiry Bitcoin is £32,000, you profit. If it’s £28,000, you incur a loss. The key is the obligation.

Options Contracts: Right, Not Obligation.

Bitcoin options contracts give the holder the right, but not the obligation, to buy or sell Bitcoin at a specific price (the strike price) on or before a certain expiry date.

- Calls and Puts Explained:

- A Call Option gives you the right to buy Bitcoin. You buy a call if you expect Bitcoin’s price to go up.

- A Put Option gives you the right to sell Bitcoin. You buy a put if you expect Bitcoin’s price to go down.

- Flexibility and Risk Limitation (Premium): You pay a non-refundable upfront fee (the premium) to buy an option. This premium is the maximum you can lose when buying an option. This defined risk is a major appeal.

- Profit and Loss Examples: If you buy a Call Option with a strike price of £30,000 for a £100 premium, and Bitcoin rises to £32,000 by expiry, you profit significantly (minus the premium). If Bitcoin stays below £30,000, you only lose the £100 premium.

Perpetual Contracts: Futures Without Expiry.

Perpetual contracts are a unique innovation in crypto derivatives. They are similar to futures contracts but they do not have an expiry date. This means you can hold a long or short position indefinitely, as long as you meet margin requirements.

- Funding Rates Explained: To keep the perpetual contract price closely tied to the spot price, a ‘funding rate’ mechanism is used. Funding rates are periodic payments made between traders holding long and short positions. If the perpetual price is above the spot price, longs pay shorts. If below, shorts pay longs. These rates can add or subtract from your profit.

- Maintaining Positions Indefinitely: As long as your account balance (margin) remains above the maintenance margin level, you can keep your position open.

Margin Trading: Borrowing for Bigger Positions.

Margin trading allows you to borrow funds from an exchange or other users to trade more than your own capital allows. While it can be applied to spot markets (leveraged spot trading), it’s a core component of derivatives.

- How Margin Works (Initial, Maintenance Margin):

- Initial Margin: The minimum amount of capital you must put up from your own funds to open a leveraged position.

- Maintenance Margin: The minimum amount of capital you must maintain in your account to keep the position open. If your equity falls below this level, you face a margin call.

- The Threat of Margin Calls and Liquidation: If your position moves against you and your equity falls below the maintenance margin, the exchange will issue a margin call, requesting you to add more funds. If you fail to do so, the exchange will automatically close (liquidate) your position to prevent further losses, often resulting in the loss of your initial margin and any remaining collateral. This is a brutal, fast way to lose capital.

⚔️ Spot vs. Derivatives: The Key Differences

Understanding these distinctions is crucial for choosing your trading style and managing risk.

Ownership: Asset vs. Contract.

- Spot: You buy or sell the actual Bitcoin. You take custody of the asset.

- Derivatives: You trade a contract that derives its value from Bitcoin’s price. You don’t own the underlying Bitcoin.

Leverage: Direct vs. Magnified.

- Spot: Typically no leverage, unless you intentionally use leveraged spot trading options. Your profit/loss is linear to price change.

- Derivatives: High leverage is standard. Even small price movements are magnified, leading to potentially massive gains or losses.

Risk Profile: Volatility vs. Liquidation.

- Spot: Your main risk is market volatility impacting the value of your asset. You won’t be liquidated unless you were using margin in a spot trade.

- Derivatives: In addition to market volatility, you face liquidation risk due to leverage. A small counter-move can wipe out your margin. There’s also funding rate risk (for perpetuals) and counterparty risk.

Profit Potential: Linear vs. Exponential.

- Spot: Profit potential is linear. If Bitcoin goes up 10%, your £100 investment makes £10.

- Derivatives: Profit potential can be exponential due to leverage. If Bitcoin goes up 10% and you used 10x leverage, your £100 investment could theoretically make £100 (minus fees).

Complexity: Straightforward vs. Advanced.

- Spot: Relatively straightforward. Buy low, sell high.

- Derivatives: Significantly more complex. Requires deep understanding of contract mechanics, funding rates, margin requirements, expiry dates, and risk management.

🚀 Derivatives Trading Strategies: High-Octane Plays

Derivatives open up strategies not possible or practical in spot markets, often due to leverage or the nature of the contracts.

Swing Trading: Capitalising on short-to-medium term price swings.

Traders hold positions for a few days or weeks to profit from expected price swings. Derivatives allow larger position sizes for these short-term moves due to leverage.

Scalping: Executing very short-term, frequent trades to capture small price movements.

Scalpers hold positions for minutes or even seconds, aiming for tiny profits on many trades. Leverage makes these small moves meaningful, but it also carries high risk if not managed with precision.

Range Trading: Profiting from sideways markets by buying at support and selling at resistance within a defined range.

In a market that isn’t trending, traders can use derivatives to take both long and short positions as price oscillates within a range, profiting from both sides of the movement.

Hedging: Using derivatives to offset (reduce) risk from spot market positions.

A sophisticated strategy where a trader uses derivatives (e.g., shorting futures) to protect gains on a long spot position. If their spot Bitcoin drops, the profit from the short futures position offsets the loss. This is a risk management tool.

⚠️ Risks of Derivatives: Where Fortunes Are Lost

This is not a game for the unprepared. The amplified gains of derivatives come hand-in-hand with amplified risks.

Liquidation Risk: The Margin Call Nightmare.

This is the single biggest risk. If your leveraged position moves against you, and your account equity falls below the maintenance margin level, the exchange will automatically close your position. This happens without your consent and typically results in a total loss of your initial margin and any collateral used for that specific position. It’s fast, it’s brutal, and it’s how fortunes disappear overnight.

Funding Rate Risk (for Perpetuals).

While perpetual contracts offer flexibility, funding rates can eat into your profits, especially if you hold a position against the prevailing market sentiment for an extended period. Constantly paying a high funding rate can make a profitable trade unprofitable.

Counterparty Risk.

This is the risk that the exchange or the other party to your contract might not fulfil their obligation. While major regulated exchanges mitigate this significantly, it’s a factor, especially with less reputable or decentralised platforms.

Complexity Risk: Misunderstanding the Contracts.

Derivatives contracts can be highly complex. Misunderstanding how expiry works, how funding rates impact your position, or the nuances of options pricing (e.g., Theta decay, Vega sensitivity) can lead to unexpected and significant losses. A common mistake is buying options when volatility is high and seeing their value disappear rapidly as volatility drops.

Security Best Practices: Protecting Funds on Exchanges and Wallets.

Even if you’re playing the derivatives game, security remains paramount. Exchanges are targets.

- Use strong, unique passwords: For every exchange account.

- Enable Two-Factor Authentication (2FA): Always.

- Keep most funds in cold storage: For any capital not actively used in trades.

- Diversify funds across exchanges: Don’t keep all your trading capital on one platform.

- Remember major hacks: The Bybit Ether theft (2022) or other high-profile incidents serve as reminders that even top platforms have vulnerabilities. Due diligence extends to the security practices of your chosen exchange.

⚖️ Regulatory and Tax Implications

This is where derivatives get even trickier. Regulations are evolving, and they vary wildly across jurisdictions.

Differing Treatment by Jurisdictions.

Many countries have different rules for spot crypto trading versus derivatives. Some jurisdictions (e.g., UK, US for retail) restrict or ban crypto derivatives for retail traders due to their high risk. Others allow them but with strict leverage limits. Understanding the legal status of both Bitcoin itself (commodity, security, property) and derivatives in your specific country is critical. You might need to look into global Policies as they affect where you can trade.

Tax Complexity for Derivatives.

Calculating taxes on derivatives can be significantly more complex than spot trading. Rules vary on how profits/losses from futures expiry, options premiums, funding rates, and liquidation are treated for tax purposes. This often requires professional tax advice. Don’t assume the same tax rules apply.

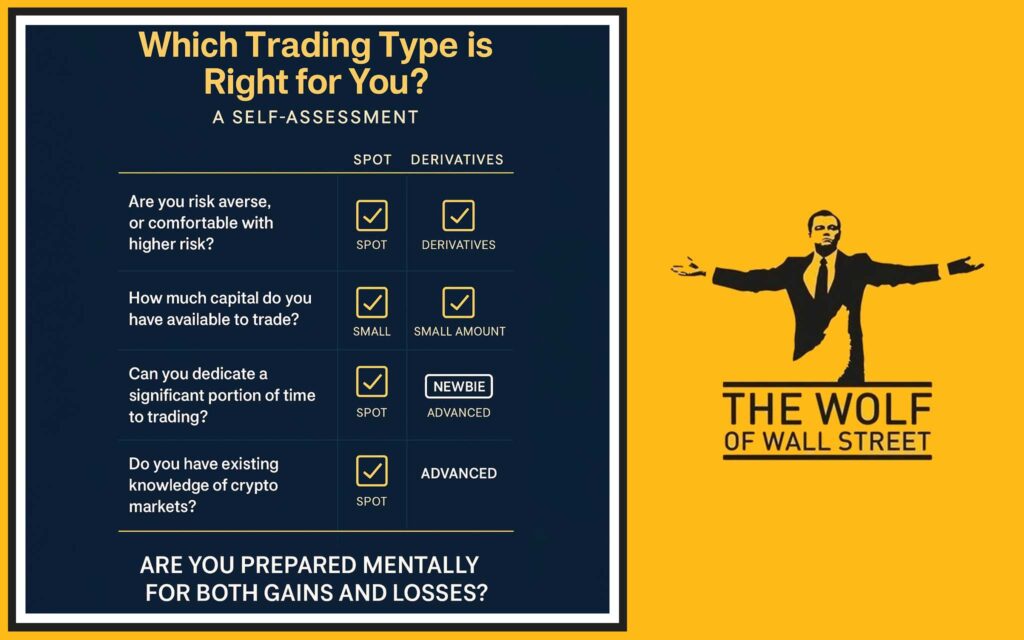

❓ Which Trading Type is Right for You? A Self-Assessment

Before you jump into the high-octane world of derivatives, ask yourself some hard questions.

Assessing Goals and Risk Tolerance.

- Are you looking for long-term asset appreciation and stability (spot), or are you comfortable with higher risk for potentially faster, amplified gains (derivatives)?

- Can you stomach the possibility of losing your entire margin quickly? If a minor price swing against you would cause panic, derivatives are not for you.

Matching Style to Instrument.

- Do you prefer simplicity, direct ownership, and a ‘set it and forget it’ approach (spot)?

- Or do you thrive on complexity, active management, and the ability to profit from both rising and falling markets (derivatives)?

- Do you have the time and discipline for constant monitoring and advanced risk management?

Glossary of Key Trading Terms:

For anyone serious about this, here’s a quick rundown of essential terms that appear in derivatives trading:

- Liquidation: The forced closing of a leveraged position by an exchange due to insufficient margin.

- Margin Call: A demand from your broker or exchange to deposit additional funds into your account to meet minimum margin requirements.

- Funding Rate: Periodic payments in perpetual contracts to keep the contract price pegged to the spot price.

- Perpetual Contract: A futures-like contract with no expiry date.

- Call Option: Gives the right to buy an asset at a strike price.

- Put Option: Gives the right to sell an asset at a strike price.

- Strike Price: The price at which an option contract can be bought or sold.

- Underlying Asset: The asset (e.g., Bitcoin) from which the derivative’s value is derived.

- Leverage: Borrowed capital used to increase the potential return of an investment.

- Spot Price: The current market price at which an asset can be bought or sold for immediate delivery.

Here are some related articles to deepen your grasp of the crypto market and its components:

- Understanding Digital Assets: Cryptocurrencies

- General Trading Skills: Trading Insights

- Basic Investor Information: Newbie

- Regulatory Considerations: Policies

- Deeper Research: Research Crypto Opportunities Guide

- Spotting Reliable Projects: Crypto Token Listing Process Guide

The bottom line on Bitcoin Spot vs. Derivatives Trading? One is about ownership, the other is about calculated speculation. Both offer opportunities, but derivatives come with a magnification of risk. Understand the game, manage your exposure, and you put yourself in a position to win.

💡 FAQs and Answers for Bitcoin Spot vs. Derivatives Trading

- What is the primary difference between Bitcoin Spot and Derivatives trading?

- Answer: Spot trading involves buying or selling actual Bitcoin, leading to direct ownership of the asset. Derivatives trading, conversely, deals with contracts whose value tracks Bitcoin’s price, allowing speculation without owning the underlying asset itself.

- What does “leverage” mean in derivatives trading?

- Answer: Leverage in derivatives trading means borrowing funds from an exchange to increase the size of a trading position beyond what your own capital would permit. This amplifies both potential profits and potential losses from price movements.

- What is “liquidation risk” in derivatives trading?

- Answer: Liquidation risk is the danger in leveraged derivatives trading where if your position moves against you and your account equity falls below a certain threshold (maintenance margin), the exchange automatically closes your position, often resulting in the loss of your collateral.

- How do Futures contracts differ from Perpetual contracts in crypto?

- Answer: Futures contracts have a specific expiry date by which the contract must be settled, obligating the holder to buy or sell. Perpetual contracts are similar to futures but do not have an expiry date, allowing positions to be held indefinitely as long as margin requirements are met and funding rates are managed.

- Is it recommended to use only derivatives for trading decisions?

- Answer: No, it is not recommended to use only derivatives. While derivatives offer high profit potential, they come with significantly greater risks, especially due to leverage. A deep understanding of contract mechanics, risk management, and often confirmation from other analysis methods is vital.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””