Listen up. If you’re serious about making real money in the crypto game, the first thing you need to master is how to protect it, which is why understanding Bitcoin wallets is lesson number one. The digital world is the new Wall Street, a 24/7 boiler room of opportunity and risk. You’re either a shark navigating the currents or you’re chum waiting to be devoured. The choice is yours.

Too many amateurs think buying Bitcoin on an exchange means they own it. Wrong. Dead wrong. Leaving your assets on an exchange is like leaving a stack of cash on a park bench and hoping nobody takes it. The exchange holds the keys, which means they hold your money. When that exchange goes down—and they do go down—your fortune vanishes with it. You’re left holding an empty bag, a nobody.

So, let me drill this into your head until it sticks. There is one golden rule in this universe, the only one that matters: Your Keys, Your Bitcoin. My Keys, My Bitcoin. If you don’t control the private keys, you own a glorified IOU. You’re a spectator. Today, you stop being a spectator and start being a player. You’re going to learn how to lock down your assets in a digital fortress so impregnable that nobody can touch them but you.

🔑 What Exactly is a Bitcoin Wallet?

It’s Not a Leather Folder; It’s Your Digital Vault

Forget everything you think you know about a “wallet.” We’re not talking about some leather bifold you stuff in your back pocket. A Bitcoin wallet is a sophisticated piece of software or hardware that serves one primary purpose: to secure the private keys you need to access and control your Bitcoin on the blockchain. It doesn’t “store” your Bitcoin in the traditional sense; your coins exist on the distributed ledger. The wallet simply holds the keys to your kingdom.

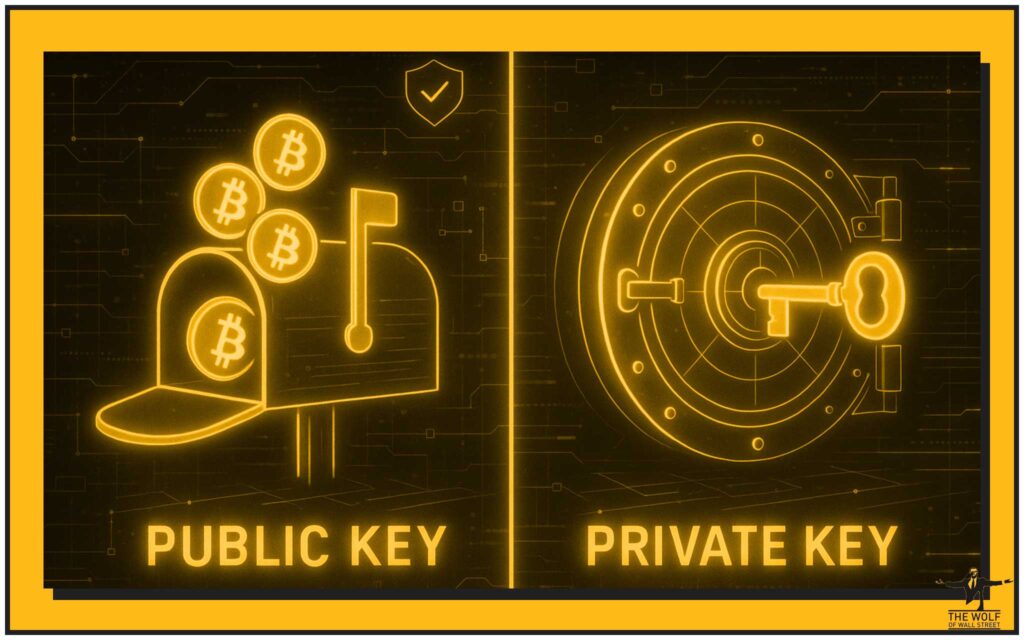

Public vs. Private Keys: The Lock and The Only Key in Existence

This is the most critical concept you will ever learn in crypto. Get this wrong, and you might as well set your money on fire. Every Bitcoin wallet operates with a pair of cryptographic keys. They are mathematically linked, but it’s a one-way street.

Your Public Key: The Address You Give to the World

Think of your public key like your bank account number. It’s an address you can safely share with anyone who needs to send you Bitcoin. People can send funds to this address, but they can’t use it to take anything out. It’s your digital drop-box, open for deposits only.

Your Private Key: The God Key – Guard it With Your Life

Now, the private key… this is the master key. This is the holy grail. It’s a secret string of alphanumeric characters that gives you, and only you, the authority to spend the Bitcoin associated with your public key. If someone gets your private key, it’s game over. They have total control. They will drain your account faster than you can blink, and there’s no bank manager to call, no fraud department to save you. You lose it, you lose everything. You expose it, you lose everything. For a more detailed breakdown, absorb our guide on Public vs Private Keys in Crypto.

The Bottom Line: Control the Keys, Control the Fortune

Let me be crystal clear. The entire game of Bitcoin ownership boils down to one thing: the zealous, paranoid, and absolute protection of your private keys. The wallet is merely the tool, the digital safe, that helps you manage this responsibility.

⚙️ How These Digital Fortresses Work

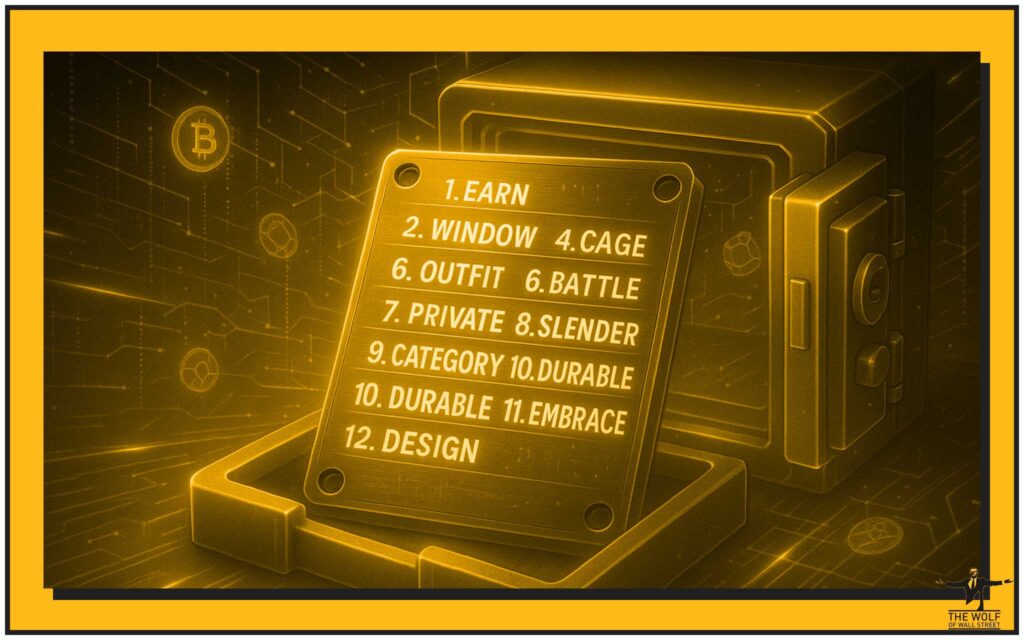

The Seed Phrase: Your 12-Word Golden Parachute

When you first set up a non-custodial wallet, it will generate something called a seed phrase, or recovery phrase. This is typically a list of 12 to 24 simple words in a specific order. This phrase is your ultimate backup. It’s the master key that can regenerate all your private keys if your wallet is ever lost, stolen, or destroyed.

Write these words down on a piece of paper—or better yet, stamp them into metal—and store them in multiple secure, offline locations. Never, ever store your seed phrase on a computer, on your phone, or in a cloud drive. That’s for amateurs. A digital copy is a target. Get the fundamentals right by reading this essential brief on the Private Key vs Seed Phrase.

The Magic of Hierarchical Deterministic (HD) Wallets

Modern wallets are geniuses of efficiency. They are Hierarchical Deterministic, or “HD.” This means that from that single master seed phrase, the wallet can generate a nearly infinite tree of public and private keys. Why is this a killer feature? Privacy. Every time you receive a transaction, the wallet can generate a new public address, making it incredibly difficult for outsiders to track your total wealth or transaction history. It’s like having a new, unlisted bank account for every payment you receive.

Understanding UTXOs: The Digital “Change” From Your Transactions

Bitcoin works on a system of Unspent Transaction Outputs (UTXOs). Think of it like paying for a £5 coffee with a £20 note. You give the cashier the £20 (your input), they take the £5 (the transaction), and they give you back £15 in change (a new UTXO sent back to your wallet). Your wallet manages all these pieces of digital change automatically, so you don’t have to think about it. All you need to know is that it’s this system of inputs and outputs that forms the backbone of every transaction.

🔥 Hot Wallets vs. Cold Wallets: The Ultimate Showdown

Not all wallets are created equal. The biggest distinction is whether they are connected to the internet or not. This is the difference between a checking account and a Swiss vault.

Hot Wallets: Fast, Furious, and Living on the Edge

A hot wallet is any wallet that’s connected to the internet. They’re convenient for everyday transactions and for traders who need to move assets quickly. But that convenience comes at a price: security risk. Anything online can be hacked.

- Desktop Wallets: Software you install on your laptop or PC. More secure than web wallets but still vulnerable to malware and viruses.

- Mobile Wallets: Apps on your smartphone. Fantastic for spending Bitcoin on the go, but you risk losing everything if your phone is compromised or stolen.

- Web Wallets: Accessed through your internet browser. The least secure type, as they are prime targets for phishing attacks and hacks. Use them only for small, disposable amounts.

Cold Wallets: The Fort Knox in Your Pocket

A cold wallet, or cold storage, is a wallet that is kept completely offline. The private keys are generated and stored in a device that never touches the internet, making them virtually immune to online hacking attempts. This is where you keep the serious money—the assets you aren’t planning to touch for a long time.

- Hardware Wallets: These are the gold standard. Small, physical devices (like a USB stick) that store your private keys offline. To authorize a transaction, you physically press a button on the device. Even if your computer is riddled with malware, your keys remain safe. This is non-negotiable for any serious investor.

- Paper Wallets: An old-school but effective method where you print your public and private keys onto a piece of paper. It’s completely offline, but it’s vulnerable to physical damage like fire, water, or simply being thrown away.

🤝 Custodial vs. Non-Custodial: Who’s the Boss?

Non-Custodial Wallets: You Are the CEO, Chairman, and Janitor

This is the way of the wolf. A non-custodial wallet means you, and only you, hold the private keys. You have absolute, sovereign control over your funds. With great power comes great responsibility. If you lose your keys or your seed phrase, your money is gone forever. There is no one to help you. This is true financial freedom.

Custodial Wallets: Letting Someone Else Hold the Keys to Your Kingdom

A custodial wallet is one where a third party, like a cryptocurrency exchange, holds the private keys for you. It’s convenient because you can recover your account with a simple password reset. But you’re trusting them completely. You’re at the mercy of their security, their solvency, and their terms of service. They can freeze your account for any reason. It’s not your crypto.

The Wolf’s Pick: Why Non-Custodial is the Only Way to Fly

Do you want to be in control of your destiny or do you want to ask for permission to access your own money? The answer should be obvious. Get a non-custodial wallet. Learn to manage your own keys. It’s the only way to be truly sovereign in the digital age.

🛠️ Setting Up Your Wallet: From Zero to Bitcoin Hero

Actionable Steps for Setting Up a Hot Wallet

- Choose a Reputable Wallet: Do your homework. Look for well-reviewed, open-source wallets.

- Download and Install: Get the software from the official website ONLY. Double-check the URL.

- Create Your Wallet: The software will guide you through the process.

- BACK UP YOUR SEED PHRASE: This is the most important step. Write it down. Store it securely offline. The wallet will ask you to confirm it. Do not skip this.

- Set a Strong Password: This password encrypts the wallet file on your device. Make it long, complex, and unique.

The Unboxing: Setting Up Your First Hardware Wallet

- Buy From the Manufacturer: Never buy a hardware wallet from a third-party seller. It could be tampered with.

- Initialise the Device: Follow the instructions. The device will generate your private keys and your seed phrase.

- Write Down the Seed Phrase: The phrase will be displayed on the device’s secure screen. Write it down and store it somewhere safe.

- Set a PIN Code: This is the PIN you’ll use to unlock the physical device.

- Transfer Funds: Send a small test amount first to make sure everything is working correctly before moving your entire stack.

🛡️ Security: How to Not Lose Your Shirt (And Your Bitcoin)

This Isn’t a Game – It’s Financial Warfare

The crypto space is filled with scammers, hackers, and thieves trying to get their hands on your money. Your security is your personal responsibility. You are the last line of defence.

The Cardinal Sins: What Gets Amateurs Rekt

- Reusing Passwords: Using the same password for your email and your crypto accounts is begging to be robbed.

- Clicking on Phishy Links: Scammers will send you emails and messages that look legitimate, trying to trick you into giving up your credentials or seed phrase. Be paranoid. Trust no one.

- Bragging About Your Holdings on Public Wi-Fi: Using public Wi-Fi for crypto transactions is like shouting your bank details in a crowded room. Don’t do it.

The Wolf’s Security Playbook: Unbreakable Defence

- Two-Factor Authentication (2FA) is Non-Negotiable: Use an app like Google Authenticator for any online account associated with your crypto. SMS-based 2FA is better than nothing, but it’s vulnerable.

- Securing Your Seed Phrase: Think fireproof, waterproof, idiot-proof. Use a steel wallet to stamp your words into metal. Store copies in different, secure locations. Never speak it aloud. Never photograph it.

- The Power of Multi-Signature Wallets: For serious funds, the big leagues use multi-signature (multisig) wallets. These require two or more private keys to authorise a transaction. It’s like a bank vault that needs multiple keyholders to open. Learn more with our Multisignature Wallet Security Guide.

❓ Frequently Asked Questions (FAQs)

Can my Bitcoin wallet be hacked?

Yes and no. A hot wallet stored on a malware-infested computer can absolutely be compromised. However, the Bitcoin network itself has never been hacked. Cold storage wallets, like hardware wallets, are virtually impossible to hack remotely as the private keys never leave the device. Security is about protecting your keys, not the network.

What happens if I lose my hardware wallet?

Nothing, provided you have your seed phrase. You simply buy a new hardware wallet (from the same or a different brand), enter your 12 or 24-word recovery phrase, and your entire portfolio will be restored. This is why the seed phrase is infinitely more important than the physical device.

How many Bitcoin wallets can I have?

As many as you want. There is no limit. In fact, it’s smart practice to have multiple wallets for different purposes: a mobile hot wallet for small, daily spending; and one or more hardware cold wallets for your long-term savings. Don’t keep all your eggs in one basket.

💸 Conclusion: Secure the Bag, Then Make it Bigger

You Have the Knowledge, Now Take Action

You now know more about securing digital assets than 99% of the population. You have the blueprint. You understand the difference between being a victim and being a victor. The theory is over. Now it’s time to execute. Go out there, get the right wallet, and lock down your Bitcoin like your life depends on it. Because in the new digital economy, it does.

The Real Game Begins After You’ve Secured Your Assets

Securing your Bitcoin is just the first step. It’s the defensive play. But the wolves of Wall Street don’t just play defence; they play offence. Once your capital is secure, the real fun begins: making it grow. You need to plug into a network of winners, people who see the market not as a casino but as a chess board. You need expert analysis, winning signals, and a community that pushes you to be sharper, faster, and more profitable.

Your Next Move: From Storing to Profiting

That’s where we come in. The The Wolf Of Wall Street crypto trading community is a comprehensive platform for navigating this volatile market. When you’re done securing your assets and are ready to multiply them, this is your next call.

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

Empower your crypto trading journey. Visit our service at https://tthewolfofwallstreet.com/service and join our active Telegram community at https://t.me/tthewolfofwallstreet for real-time updates. The knowledge you’ve gained today is your foundation; now it’s time to build your empire with the best Bitcoin wallets and the sharpest trading minds in the business.