🐺 Introduction: The Wolf’s Call to the Bitcoin Jungle

Listen up, because this is the shot you don’t want to miss. Everyone’s been chasing Bitcoin for the upside, the moonshot, the Lamborghini fantasy. But here’s the truth: the real smart money is chasing yield. BlackRock — yes, the trillion-dollar king of Wall Street — just pulled another power move after their smash-hit IBIT ETF. They’re about to launch a Bitcoin Premium Income ETF, designed to turn your Bitcoin exposure into cold, hard cash flow.

If IBIT was a blockbuster, this one’s the sequel with recurring income. Let’s break it down Wolf-style: no fluff, pure profit-driven strategy.

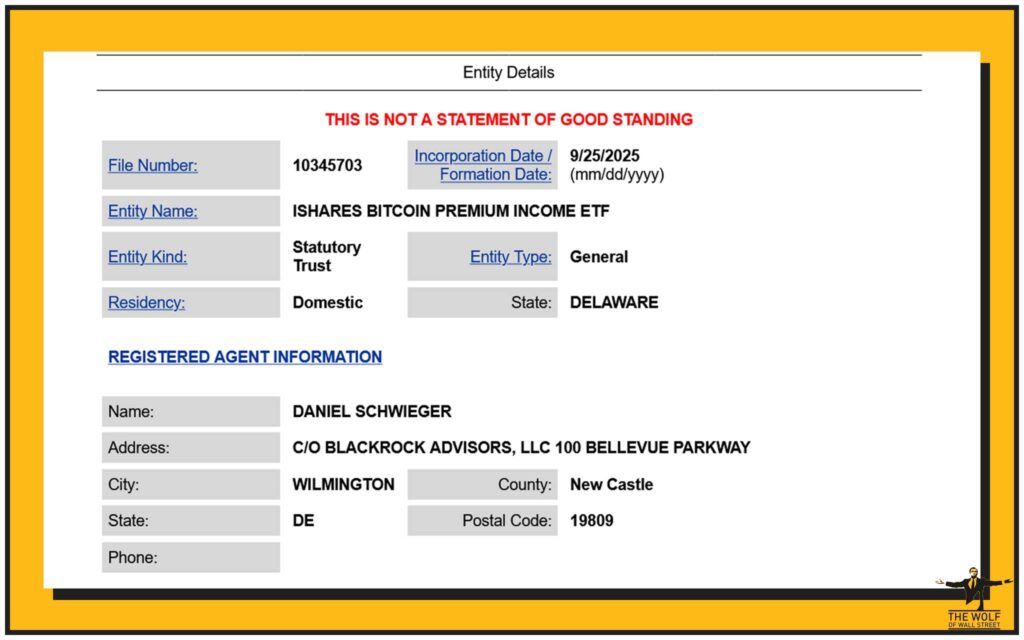

🏦 The Big Move: BlackRock Files for Delaware Trust

BlackRock has filed to register a Delaware trust company, the first step before submitting the ETF for SEC approval. Why Delaware? Because that’s where Wall Street titans set up serious vehicles to move billions. This is a pre-launch countdown — the ETF is not just an idea, it’s coming.

This filing signals intent: BlackRock is not playing games. They’re building the rails for an ETF that will flip the script on Bitcoin investing.

💰 Sequel to a Smash Hit: IBIT’s Billion-Dollar Inflows

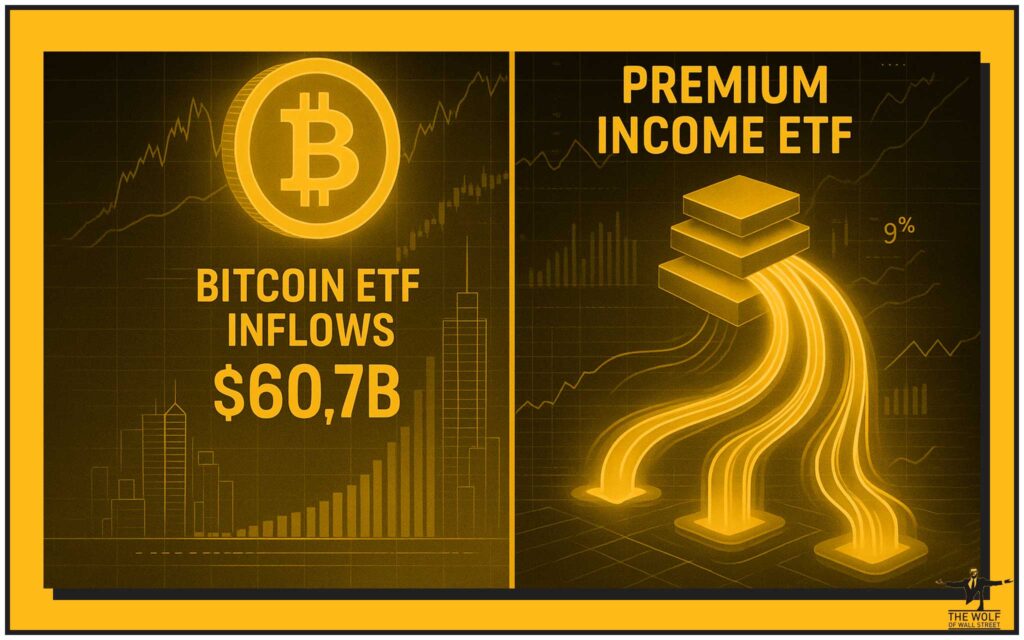

Let’s rewind. January 2024, BlackRock launches IBIT — their spot Bitcoin ETF. Result? Over $60.7 billion in inflows in less than a year. That’s record-breaking, the biggest Bitcoin fund inflows in history. Why? Because institutions, pension funds, and retail investors alike wanted a regulated, easy way to get Bitcoin exposure.

Now BlackRock is back, and the Premium Income ETF is IBIT’s sibling. IBIT gave you exposure. This one gives you income.

🎯 The Covered Call Play: Yield from Bitcoin Options

So how does this thing work? It’s called a covered call strategy. Here’s the Wolf-friendly breakdown:

- The ETF holds Bitcoin futures.

- It sells call options on those futures.

- The premium from selling those calls flows back to investors as yield.

Translation? You trade away some upside (you won’t catch every parabolic pump), but in exchange, you get steady, predictable cash flow.

It’s not about YOLO gains. It’s about a consistent stream of income from the world’s most volatile asset.

🌱 Yield in a Yield-Starved Bitcoin World

Bitcoin doesn’t pay dividends. It doesn’t spit out cash flow. Until now. That’s what makes this ETF revolutionary. Yield products are rare in the U.S. crypto market. Institutions have been begging for this — a way to lock in income from Bitcoin exposure without building complicated options strategies themselves.

Compared to equities or bonds, Bitcoin has been an all-or-nothing bet. With this ETF, it turns into a real income asset class. That’s a paradigm shift.

🚦 Trump, Regulators, and the Green Light for Crypto

Timing is everything. Under President Trump’s agenda, U.S. regulators are warming up to crypto. The SEC just approved a generic listing standard, meaning future crypto ETFs can move through faster.

This is the perfect moment for BlackRock to push yield-based Bitcoin products. They know the gatekeepers are loosening their grip.

🎪 BlackRock’s Focus: Bitcoin & Ether Only – No Altcoin Circus

Notice what BlackRock is doing here: they’re laser-focused on Bitcoin and Ether. No Solana ETF, no Dogecoin sideshow, no meme-coin gamble. Why? Because they’re aiming institutional. The pension funds and family offices don’t want to explain to their boards why they bought Dogecoin.

That said, don’t sleep on the fact that altcoin ETFs are coming. The market’s whispering about Litecoin, Solana, XRP, even Dogecoin getting ETF wrappers soon. But BlackRock? They’re staying blue-chip.

🥩 The Market’s Hungry for Yield – and BlackRock Serves the Steak

Institutions don’t care about memes. They care about consistent return profiles. They’re starving for yield in a market that doesn’t offer much beyond speculation.

This ETF delivers exactly that: Bitcoin with a paycheck attached. And that’s the kind of innovation that brings billions in inflows.

📊 Expert Voices: Balchunas and Market Analysts

Bloomberg ETF analyst Eric Balchunas called it like it is: this ETF is about attracting a whole new wave of investors who don’t want to gamble on moonshots. They want consistent inflows, predictable distributions.

This isn’t a trader’s fantasy. It’s a portfolio manager’s dream.

🧑💻 What This Means for Retail Traders Like You

Here’s the question you’re asking: why should you care? Simple.

This ETF sets a new benchmark. Covered calls cap your upside but give you yield. If you’re a retail trader who’s sick of staring at a flatline Bitcoin chart for months, this ETF pays you to wait.

That’s a game changer.

🔥 Crypto ETF Boom: The Bigger Picture

The ETF market is exploding. In just two years, we’ve seen Bitcoin and Ethereum ETFs go from fantasy to reality. And with the SEC shifting gears, the door is open for altcoin ETFs. Litecoin, Solana, XRP, Dogecoin — they’re coming.

BlackRock’s Premium Income ETF isn’t just about yield. It’s a marker of how fast this entire ETF space is evolving.

📈 Trading Lessons from BlackRock’s Strategy

There’s a bigger lesson here: risk management. BlackRock isn’t chasing moonshots. They’re monetising volatility.

Retail traders can take notes. You don’t need to reinvent the wheel — you can replicate similar strategies directly. Want a place to start? Study the mechanics in our Bitcoin spot vs derivatives trading guide.

Combine that with passive income strategies in crypto, and you’ve got the Wolf’s blueprint for cash flow.

🚀 The Wolf’s Playbook: Positioning for Profit

So how do you play this? Here’s the move:

- Use IBIT for pure exposure.

- Layer in the Premium Income ETF for yield.

- Balance risk: growth + income.

Think of it like running a dual-engine rocket. One engine (IBIT) pushes you forward, the other (Premium Income ETF) keeps the fuel flowing.

👹 Risks: The Devil in the Details

Don’t get it twisted — nothing is risk-free. By selling calls, you cap your upside. If Bitcoin goes parabolic, you’ll miss some of that explosive gain. Options also bring complexity. And let’s not forget: SEC approval isn’t guaranteed until the final signature hits.

But that’s the trade-off. Income versus unlimited upside.

⚔️ The Coming ETF War: Altcoins on the Horizon

The SEC’s new generic standard means ETFs for Litecoin, Solana, XRP, and Dogecoin aren’t a matter of if, but when. Once those gates open, it’s an ETF arms race. BlackRock’s choice to stick with Bitcoin and Ether is calculated — let the smaller players fight over scraps, while they dominate the big leagues.

Still, if you’re an altcoin trader, this is your signal to prepare. Start studying with our Bitcoin and Ethereum ETFs guide to understand the blueprint that altcoin ETFs will follow.

🧠 Crypto Wolf Mindset: Adapting to Market Evolution

The key lesson? Adaptability. The market’s not just about HODLing anymore. It’s about structuring cash flow, hedging volatility, and playing smarter than the average trader.

Yield-based Bitcoin strategies prove crypto is maturing. We’re no longer chasing dreams; we’re building income.

📢 Conclusion: Don’t Just Watch – Position Yourself

BlackRock’s Premium Income ETF is a milestone. This is how Bitcoin transforms from a speculative asset into a true investment vehicle. If you sit on the sidelines, you’ll miss the shift.

The Wolf’s advice? Don’t just HODL. Position yourself for income and growth. Adapt now, or get left behind when the institutions pour billions into yield-based Bitcoin.

❓ FAQs

1. What is a Bitcoin covered call strategy?

It’s when you hold Bitcoin futures and sell call options on them, collecting premiums as income. You cap your upside but generate cash flow.

2. How does the Premium Income ETF differ from IBIT?

IBIT gives pure Bitcoin exposure. The Premium Income ETF gives yield by selling options on Bitcoin futures.

3. Will this ETF affect Bitcoin’s price directly?

Indirectly, yes. Demand for the ETF means more demand for Bitcoin futures. But price impact will depend on flows.

4. Can retail investors buy into this ETF easily?

Yes. Like IBIT, it’ll be traded on major U.S. exchanges once approved.

5. Are altcoin ETFs coming soon?

Yes. Litecoin, Solana, XRP, and Dogecoin are expected to follow once SEC approvals expand.

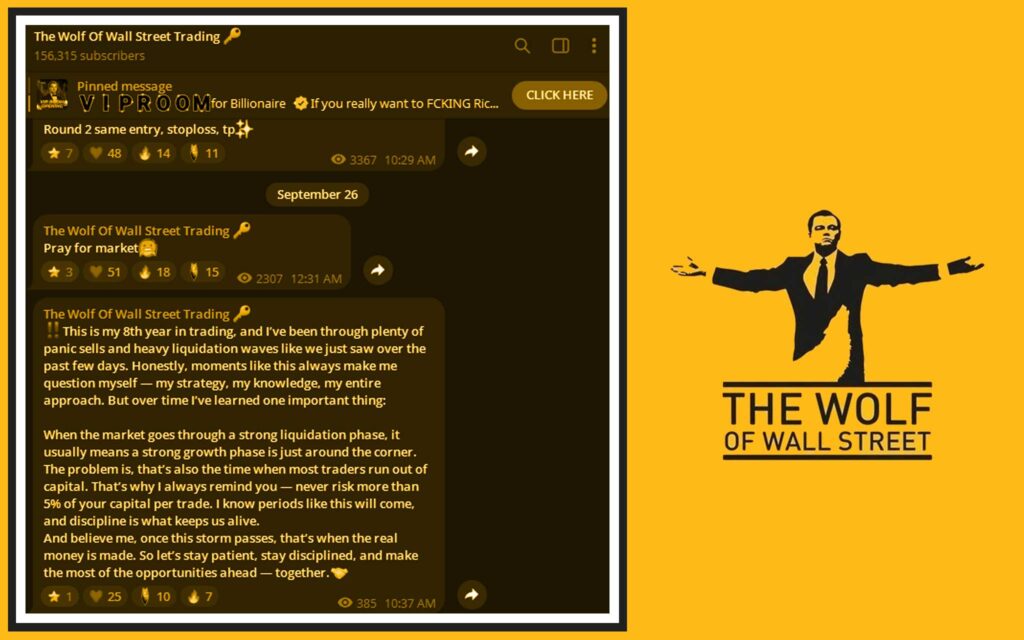

💎 The Wolf Of Wall Street Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: proprietary profit-maximising alerts.

- Expert Market Analysis: in-depth breakdowns from seasoned traders.

- Private Community: 100,000+ members sharing insights.

- Essential Tools: calculators, decision-making resources.

- 24/7 Support: always-on help.

👉 Empower your crypto trading journey:

- Visit The Wolf Of Wall Street Service

- Join The Wolf Of Wall Street Telegram

- Unlock your potential with The Wolf Of Wall Street