🚀 Introduction

Listen up — the financial system is undergoing a seismic shift, and most people are asleep at the wheel. Boerse Stuttgart Group, one of Europe’s financial heavyweights, has just launched Seturion, a pan-European blockchain-based settlement platform that slashes costs, speeds up post-trade processes, and connects the fragmented European market into one streamlined network.

This isn’t some “nice to have” innovation. This is a wake-up call. For banks, brokers, fintechs, traders — hell, for anyone who touches assets — Seturion is about to change how money moves. And if you’re not positioning yourself now, you’ll be left choking on the dust of the early movers.

💥 The Big Bang: What is Seturion?

Seturion is the rocket ship. Built by Boerse Stuttgart Group, the sixth-largest exchange operator in Europe, it’s designed to unify the settlement of tokenized assets across the continent. We’re talking about a platform that bridges banks, brokers, trading venues, and tokenization platforms into one ecosystem.

Forget the mess of siloed national systems. Seturion is the first real pan-European settlement layer built for the age of digital assets.

⏰ Why It Matters Now

Timing is everything in business and trading. Settlement inefficiency is one of the biggest cost centres in finance. We’re talking about processes that bleed up to 90% more cost than they should.

Seturion bulldozes that inefficiency. It cuts post-trade settlement costs dramatically, speeds up the cycle, and reduces counterparty risk. That’s not just incremental improvement — that’s a revolution in operational efficiency.

⚙️ The Tech Powerhouse Behind Seturion

Here’s the real kicker: Seturion isn’t tied to one blockchain. It’s multi-chain by design.

- Supports public & private blockchains → maximum flexibility for institutions.

- Settlement in central bank money or on-chain cash → real trust plus crypto-native agility.

- Scalable architecture → open design lets anyone plug in without reinventing the wheel.

It’s the flexibility that wins here. This isn’t just infrastructure; it’s the rails of the next financial system.

🌍 Breaking Barriers: Cross-Border Settlement

Europe has always had a fragmentation problem. Different countries, different systems, different rules. That inefficiency has kept costs high and innovation sluggish.

Seturion solves it. By creating a unified settlement layer, it smashes those barriers and integrates the fractured European landscape. This is the first real attempt to make Europe function like a single financial market at the post-trade level.

👉 Related reading: explore cryptocurrencies, learn about layer-1-and-layer-2-solutions, or dive into trading insights.

🇨🇭 First Movers: BX Digital in Switzerland

You don’t want theory; you want proof. Switzerland’s BX Digital is already live on Seturion. Regulated by FINMA, this isn’t some backroom testnet. It’s operational.

This matters for one simple reason: execution eats strategy for breakfast. BX Digital proves Seturion works, and now the playbook is written for other exchanges, brokers, and banks to follow.

🏦 The ECB Connection

Let’s add credibility to the fire. Seturion was tested in partnership with the European Central Bank and major European banks. That’s institutional backing you can’t ignore.

Think about it — the ECB doesn’t waste its time on gimmicks. By getting them on board, Boerse Stuttgart is signalling one thing loud and clear: this platform is built to last, and built to comply.

♟️ The Regulatory Chess Game

Seturion isn’t dodging the law; it’s embracing it. Boerse Stuttgart has filed a license application with BaFin under the EU’s DLT Pilot Regime.

This regime is Europe’s sandbox for blockchain innovation. It gives exchanges and financial institutions a controlled environment to pilot DLT-based trading and settlement systems. Once the license is granted, expect the floodgates to open across Europe.

🔑 Open Architecture = Open Doors

Here’s where Seturion crushes excuses: you don’t even need a dedicated DLT license to connect. The open architecture allows institutions to onboard using their existing infrastructure.

That’s plug-and-play for the big guys. The barrier to entry is practically gone.

👩💼 Meet the Leadership: Lidia Kurt at the Helm

Every rocket ship needs a captain. Seturion is led by Lidia Kurt, a seasoned operator with the mandate to onboard new participants and expand the network.

Backed by Boerse Stuttgart’s digital-first strategy, this leadership move proves one thing: this isn’t a side project; it’s the core of their future growth plan.

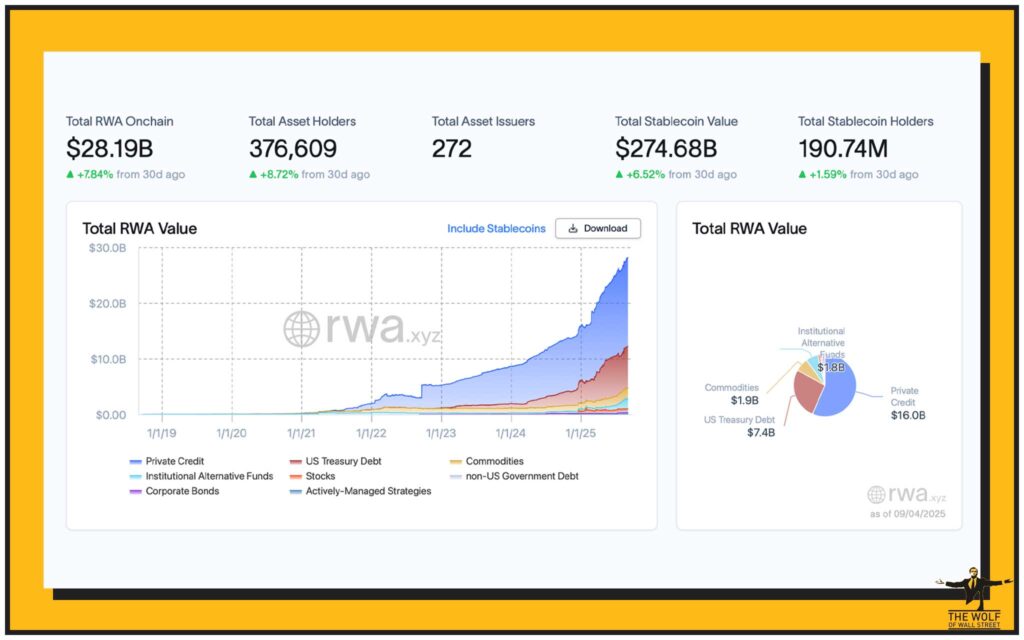

🔥 Industry Trends: Tokenization on Fire

Seturion isn’t alone in this race. The entire industry is pivoting toward tokenization:

- Taurus (backed by Deutsche Bank) → Solana custody services.

- Robinhood → expanding into tokenized assets via layer-2 tech.

- Backed Finance → Ethereum-based xStocks, tokenizing US equities.

Tokenization is the fire. Seturion is the gasoline.

🎯 Boerse Stuttgart’s Masterplan

The bigger vision? To become the digital post-trade backbone of Europe.

- Bridge traditional finance with blockchain.

- Modernize infrastructure stuck in the 20th century.

- Set the standard for pan-European settlement.

Make no mistake: they’re not just building a platform. They’re positioning themselves as Europe’s Goldman Sachs of tokenization.

💰 How Institutions Profit

For the institutions that plug into Seturion, the rewards are massive:

- Faster settlement → capital efficiency skyrockets.

- Cost reduction → up to 90% savings in post-trade.

- Liquidity unlock → access to tokenized markets that didn’t exist before.

In short: they make more, spend less, and move faster.

⚡ Retail Traders: Don’t Sleep on This

Here’s where most retail traders get it wrong. They think tokenization is just “institutional plumbing.” Wrong.

This shift means:

- New access to previously untouchable assets.

- Faster and cheaper transactions on exchanges.

- More transparency and market depth.

Tokenization is the door. If you’re smart, you’ll already be standing on the threshold.

🦾 The Wolf Of Wall Street Advantage: The Retail Edge

Institutions have Seturion. Retail traders? You need your own edge — and that’s The Wolf Of Wall Street.

- VIP Signals → designed to maximise trading profits.

- Expert Market Analysis → insights from battle-tested crypto traders.

- Private Community → over 100,000 traders sharing strategies daily.

- Essential Tools → calculators, resources, and decision-making aids.

- 24/7 Support → because markets never sleep.

👉 Check out the service, dive into our DeFi insights, or start your journey in our newbie guide.

⚖️ Challenges & Criticism

No revolution is without friction. The reality is:

- Seturion hasn’t released deep technical details yet.

- Rollout depends on regulatory green lights.

- Right now, it’s Europe-first, so global adoption is still a future play.

But let’s be real — that’s opportunity disguised as challenge. Early movers win.

🌐 The Global Ripple Effect

Seturion may be Europe-first, but the shockwaves are global.

- US: BlackRock’s BUIDL fund, SkyBridge tokenizing $300M on Avalanche.

- Asia: Regulatory sandboxes are fast-tracking tokenization pilots.

- Global: Every region is testing blockchain settlement.

This isn’t just Europe’s story. This is the global tokenization movement.

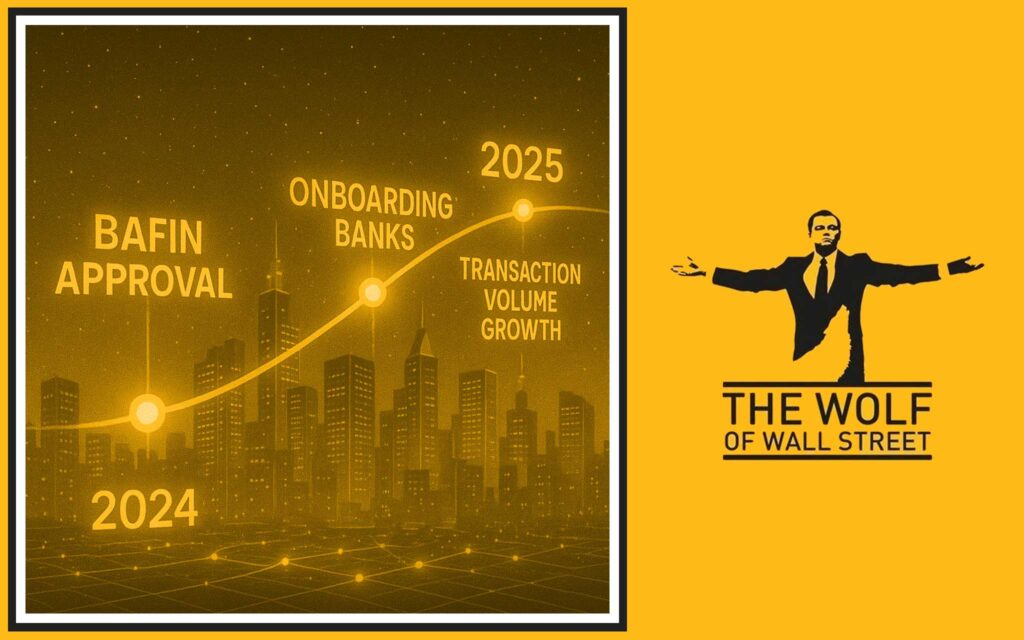

📊 The Future: 12-Month Outlook

What to watch over the next year:

- BaFin approval → green light for full-scale rollout.

- Onboarding numbers → which banks and venues plug in first?

- Transaction volume → proof of adoption and scale.

Seturion is at the start of its curve. In 12 months, it could be the standard everyone else is forced to copy.

⚡ Conclusion: Don’t Just Watch, Act Now

Let’s cut the fluff. Seturion is the biggest European financial infrastructure play in decades. It’s fast, it’s cheap, it’s compliant, and it’s coming whether you like it or not.

Institutions are already positioning. Retail traders? Your move. Learn tokenization, leverage platforms like The Wolf Of Wall Street, and ride this wave before it leaves you behind.

The question is simple: are you going to be the guy who watched it happen, or the one who cashed in?

❓ FAQs

1. What is Seturion and how does it work?

Seturion is a blockchain-based platform by Boerse Stuttgart for pan-European settlement of tokenized assets, connecting banks, brokers, and trading venues.

2. How will Seturion reduce settlement costs?

By cutting inefficiencies in post-trade systems, reducing settlement costs by up to 90%, and speeding up processing.

3. What role does the ECB play in its development?

The European Central Bank participated in trials, ensuring compliance and institutional credibility.

4. How can retail traders benefit from tokenization?

Retail gets faster access to tokenized assets, cheaper settlement, and new liquidity opportunities.

5. What makes The Wolf Of Wall Street the best place to navigate these changes?

The Wolf Of Wall Street gives retail traders the tools, analysis, and signals needed to stay competitive in a rapidly evolving tokenized market.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.