🚀 Introduction: Strap In – Bitcoin’s Next Wild Ride

Bitcoin is dancing around $110,000—just 11% below its all-time high of $123,000. Traders are split: some see it shooting past $140,000 in Q4 2025, others scream doom and gloom, calling for a crash to $60,000. Here’s the truth: the road to new highs won’t be a straight line.

It’s going to be brutal, filled with 20%+ gut-wrenching pullbacks. But here’s the kicker—those corrections? They’re the secret weapon of the wolves who know how to play this game.

⚔️ Bitcoin’s Current Battlefield

The crypto market is a battlefield, and Bitcoin sits at the frontline. Sitting at $110k, it’s within striking distance of glory, but the air is thick with fear. Retail traders panic at every red candle. Institutions quietly accumulate.

And the analysts? They’re at war with each other. One camp forecasts a glorious bull run toward $140k. The other warns of a crushing bear market collapse back to $60k. But make no mistake—this volatility is exactly why Bitcoin is the greatest wealth transfer mechanism of our time.

🧨 Why Corrections Are the Secret Weapon

Let’s get one thing straight: corrections are not crashes. They are the blood-in-the-streets moments that separate weak hands from wolves.

Market analyst Jordi Visser calls it loud and clear: Bitcoin will face multiple 20%+ pullbacks before new highs. And he’s right. Corrections aren’t obstacles—they’re opportunities.

This is Bitcoin’s DNA: sharp dips, violent recoveries, and exponential upside. If you panic-sell every time the market dips, you’re roadkill. But if you buy when fear is highest, you’re sitting on the other side of generational wealth.

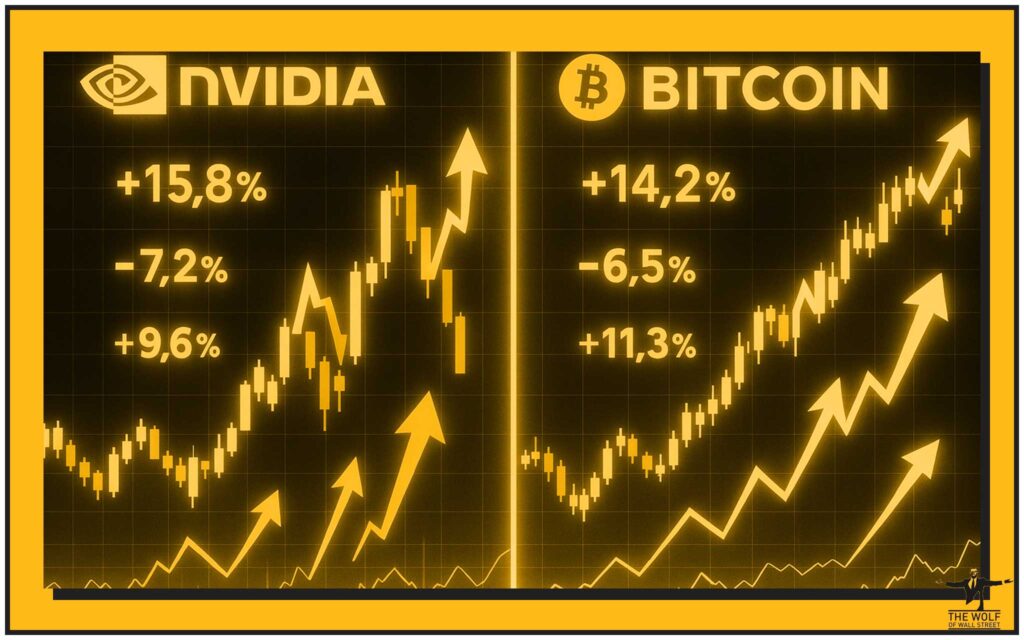

📈 The Nvidia Blueprint

Look at Nvidia. Since ChatGPT exploded in 2022, Nvidia has skyrocketed over 1,000%. But here’s the part most people forget—it didn’t move in a straight line. It took five bone-crushing corrections of 20% or more along the way.

Bitcoin is about to replay that exact script. The AI boom fueled Nvidia’s rise, and Bitcoin is riding the same wave. If you think a 20% dip means the party’s over, you’re missing the bigger picture. Wolves don’t cry over dips—they feast on them.

🤖💰 Bitcoin + AI = The New Money Paradigm

Bitcoin isn’t just crypto anymore—it’s part of the AI trade. Investors are shifting capital into technologies reshaping the global economy. AI is disrupting industries, displacing outdated companies, and creating a new money paradigm.

And where does Bitcoin fit in? As the digital store of value powering this shift. While AI eats traditional companies alive, Bitcoin becomes the anchor asset in a digitised economy. The smartest investors are already connecting the dots.

🌍 Macro Forces You Can’t Ignore

Behind the headlines, massive macro forces are driving Bitcoin’s future:

- Fiat debasement – Governments keep printing money. Inflation eats savings alive. Bitcoin stands untouched.

- Global adoption – Nations, funds, and corporations are all eyeing Bitcoin as a reserve asset.

- Safe-haven demand – Gold may be at highs, but Bitcoin is stealing the spotlight as digital gold.

This isn’t just another cycle. This is Bitcoin maturing into its final form.

🏛️ The Regulatory Jungle

Here’s the landmine: regulation. The U.S. is still dragging its feet on a Bitcoin strategic reserve, while throwing mixed signals about ETFs and institutional adoption.

But let’s not forget: in history’s biggest power plays, governments eventually buy what they can’t ban. If the U.S. decides to accumulate Bitcoin in 2025, that will be the ultimate price catalyst.

Until then, regulatory uncertainty keeps traders on edge. Wolves? They thrive in uncertainty.

💥 The Battle of Market Sentiment

Every market cycle, the battlefield looks the same:

- Bulls call for six-figure glory.

- Bears scream “bubble!” and predict catastrophic collapse.

- Wolves prepare for both and profit regardless.

This isn’t about predicting exact numbers. It’s about preparing your playbook. Whether Bitcoin hits $60k or $140k first, those corrections are the moments you load the boat.

🐺 Corrections Are Your Buying Window

History doesn’t lie. Every major Bitcoin millionaire was minted during corrections.

2017: brutal 30%+ dips on the way to $20k.

2020–21: gut-punching 25% pullbacks before blasting to $69k.

Now? The exact same movie is about to play again.

When weak hands dump in panic, wolves scoop up cheap Bitcoin. That’s how fortunes are made.

⚖️ Bitcoin vs Traditional Assets

Gold is moving. Stocks are inflating on AI hype. But Bitcoin? It’s the silent killer of traditional wealth strategies.

Unlike equities, it doesn’t depend on quarterly reports or CEOs fumbling in interviews. Unlike gold, it isn’t static. Bitcoin is living, breathing, and expanding as a financial revolution.

This is why smart traders split exposure across traditional safe havens and Bitcoin as a high-conviction asymmetric bet.

🛠️ Tools of the Trade: How to Navigate the Chaos

To play this game right, you need the tools:

- Risk management – never over-leverage, never chase green candles.

- Technical analysis – strategies like Bollinger Bands and RSI crypto trading sharpen your edge.

- Position sizing – only risk what you can survive losing.

The difference between amateurs and wolves? Amateurs guess. Wolves use data.

🤝 The Power of Community in Trading

Here’s the truth: lone wolves get slaughtered. Packs thrive.

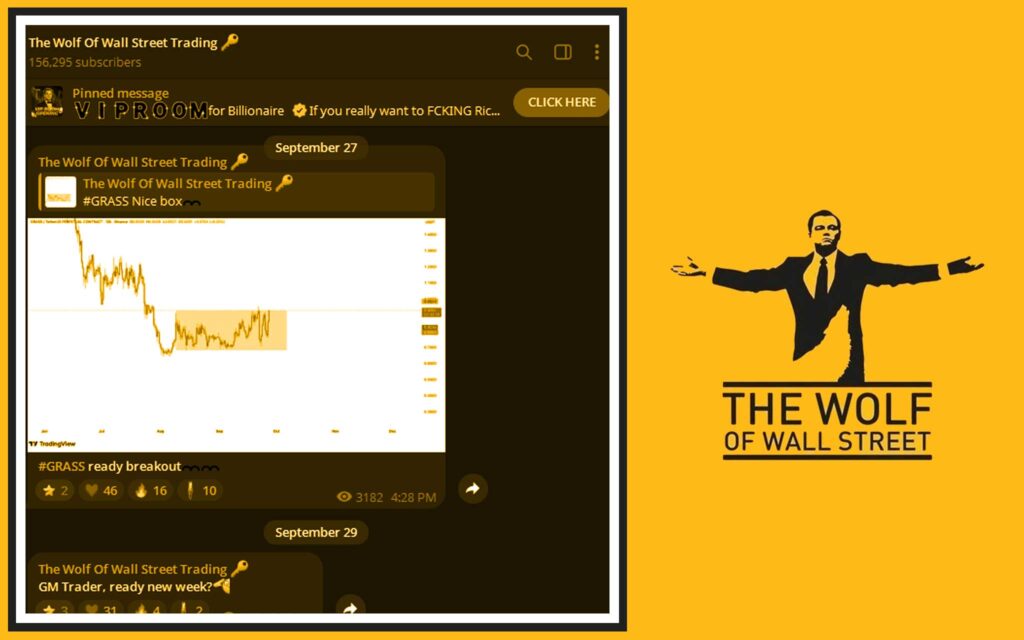

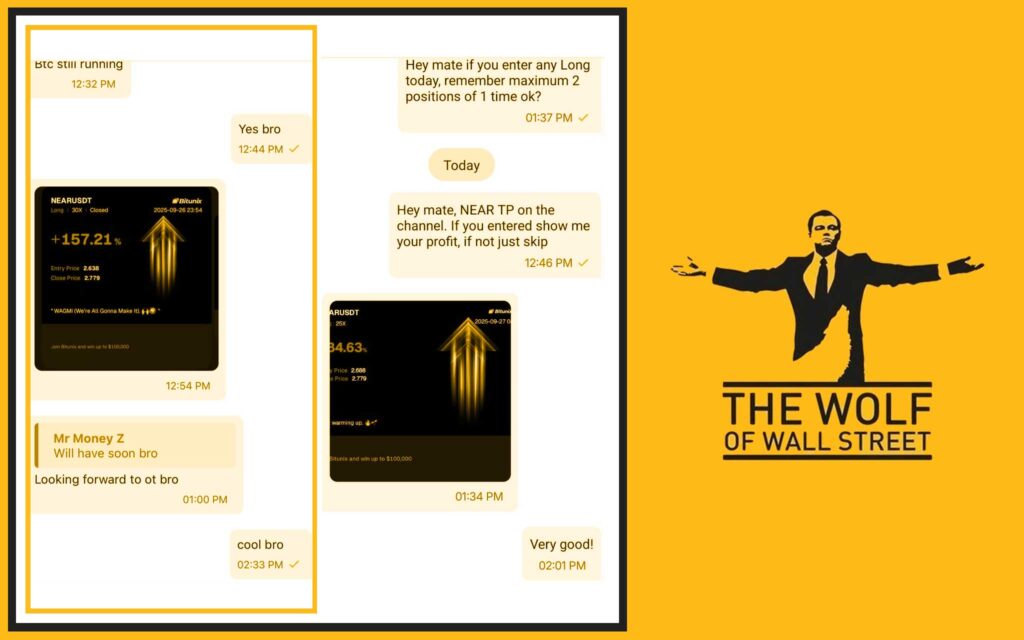

That’s why the The Wolf Of Wall Street crypto trading community is a weapon. It’s not just about signals—it’s a full-blown system:

- Exclusive VIP signals designed to maximise profits.

- Expert market analysis from seasoned traders.

- Private community of 100,000+ wolves exchanging insights.

- Essential trading tools like calculators and risk models.

- 24/7 support so you’re never flying blind.

In volatile times, that support network is your edge.

📊 Real-World Success Stories

Think Nvidia’s dips didn’t mint fortunes? Think again. Traders who accumulated in blood made life-changing returns when the stock ripped higher.

The same pattern has played out in Bitcoin time and time again. From $1,000 to $20k. From $3,000 to $69k. Every cycle leaves behind a graveyard of panic sellers and a handful of wolves who seized the moment.

This next cycle will be no different.

🐺📖 The Wolf’s Playbook for 2025

Here’s how a true wolf plays the coming year:

- Build cash reserves – so you can strike when dips come.

- Follow narratives – AI and Bitcoin are the twin engines of wealth.

- Detach from targets – don’t marry $140k or $60k. Marry your strategy.

Wolves don’t need predictions. They need preparation.

🚦 Action Plan: How to Profit from the Coming Corrections

Here’s your three-step action plan:

- Embrace volatility – it’s your income stream, not your enemy.

- Use strategies like stochastic indicators and Elliott Wave theory to identify setups.

- Leverage community insights – align with packs like The Wolf Of Wall Street for signals and support.

Simple. Ruthless. Effective.

🔥🐺 Conclusion: The Wolf’s Final Word

Bitcoin will hit new highs—but it’s going to beat the hell out of traders before it gets there. Every 20% correction will wipe out weak hands. Every panic dump will create millionaires.

This isn’t a straight line to the moon. It’s war. And in war, only wolves thrive.

If you prepare, if you stay disciplined, and if you hunt corrections instead of fearing them, you’ll come out the other side wealthier than you ever imagined.

❓ FAQs

1. Why are corrections important in Bitcoin’s growth cycle?

Because they flush out weak hands and create discounted entry points for disciplined traders.

2. How is Nvidia’s rise relevant to Bitcoin’s future?

Both are tied to AI-driven growth and follow the same volatile correction pattern before blasting higher.

3. Will AI really boost Bitcoin adoption long term?

Yes—AI disruption pushes investors toward non-traditional stores of value like Bitcoin.

4. Could government Bitcoin reserves change the market forever?

Absolutely. If the U.S. or major nations start buying Bitcoin, it will set a floor under price and trigger a supply shock.

5. What’s the best strategy for trading during corrections?

Stay calm, buy in fear, and use technical frameworks like MACD momentum signals to time entries.

The Wolf Of Wall Street Crypto Trading Community

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Proprietary alerts designed to maximise profits.

- Expert Market Analysis: Insights from seasoned crypto traders.

- Private Community: A network of 100,000+ like-minded traders.

- Essential Trading Tools: Volume calculators and other pro resources.

- 24/7 Support: Always-on guidance to support your journey.

👉 Empower your trading with The Wolf Of Wall Street or join their Telegram community for real-time updates.