💥 Introduction: The Shot Heard Across Wall Street

History isn’t written by the cautious. It’s written by those who take risks, make moves, and set the stage for the next financial revolution. BTCS Inc. just lit up the trading floor with a bold play — announcing it will pay shareholders not in cash, not in stock, but in Ethereum (ETH).

This is no gimmick. It’s the first time in history a publicly traded company has issued a dividend in Ethereum. We’re not just watching a payout — we’re watching the convergence of Wall Street and blockchain in real-time.

🚀 The Big Announcement: Ethereum in Your Wallet

BTCS has announced a $0.40 per share dividend, and here’s the kicker: it’s split into two rounds of ETH payments.

- The “Bividend” — $0.05/share in Ethereum, hitting wallets on September 26, 2025.

- The “Loyalty Payment” — $0.35/share in Ethereum, dropping January 26, 2026, but only for those who stay locked in.

That’s right — if you want the full cut, you’ve got to play the long game.

This isn’t just a dividend. This is a signal to the market: BTCS is here to disrupt, and it’s going to reward those with the conviction to hold.

💰 Loyalty Over Hype — BTCS Rewards the Wolves

BTCS made it crystal clear: this payout is for real investors, not insiders. Officers, directors, and employees are excluded.

Translation? This isn’t a boardroom cash grab. It’s a weapon designed to give outside shareholders the edge.

In Wall Street terms, BTCS is rewarding the wolves — the traders with grit and loyalty — while leaving the sheep out to pasture.

📉 Taking Down the Predators — Anti Short-Seller Tactics

Short-sellers are the vultures of the market — they thrive when companies stumble. But BTCS just handed them a curveball.

Here’s how it works:

- A dividend payable in Ethereum creates a holding incentive.

- Shorting the stock becomes riskier, because you’re missing out on ETH payouts.

- Result? Predatory shorts lose leverage, while long-term holders strengthen their grip.

In plain English: BTCS built a moat around its investors.

📈 Market Reaction: BTCS Stock Pops 10.4%

Wall Street didn’t ignore this. Shares of BTCS shot up 10.4% to $4.87 immediately after the news broke.

Keep in mind, the stock had been trading below its July peak of $6.57. This bounce is a signal: the market believes in the move.

Momentum traders smell opportunity. Value investors see asymmetric upside. Both are circling in.

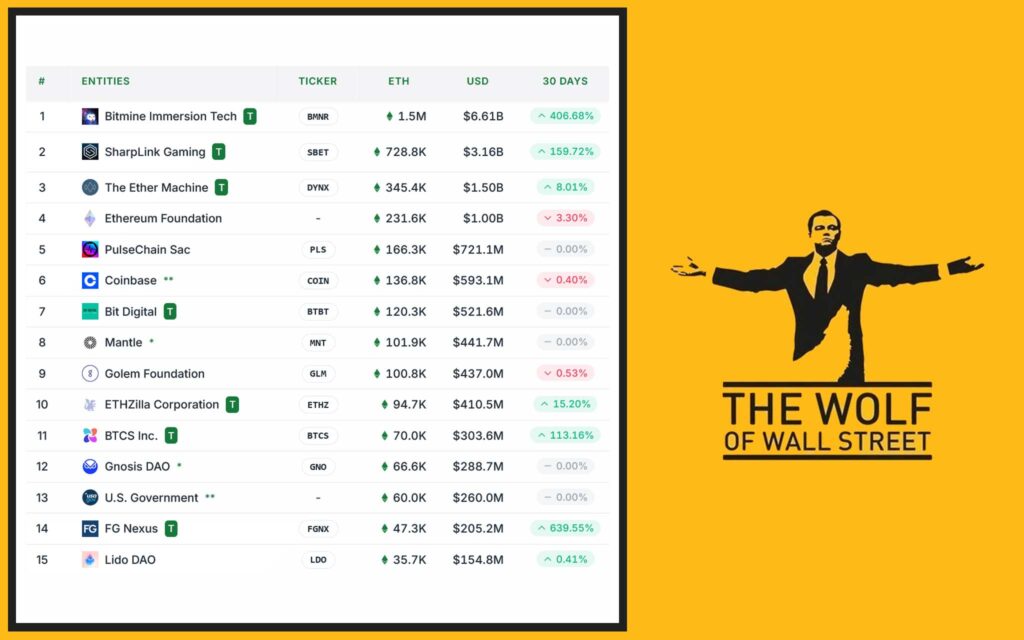

🏦 The Ethereum War Chest — $303 Million Strong

This isn’t some small-cap gimmick. BTCS is sitting on a treasure chest of 70,000 ETH, valued at roughly $303 million.

That makes them the 11th largest Ethereum treasury in the world. To put it bluntly: they’re not just playing in crypto — they’re hoarding ETH like a king stockpiles gold.

Every ETH dividend payout BTCS issues comes straight from its war chest. That’s firepower few companies can match.

⚔️ The ETH Treasury Arms Race — Competing with Giants

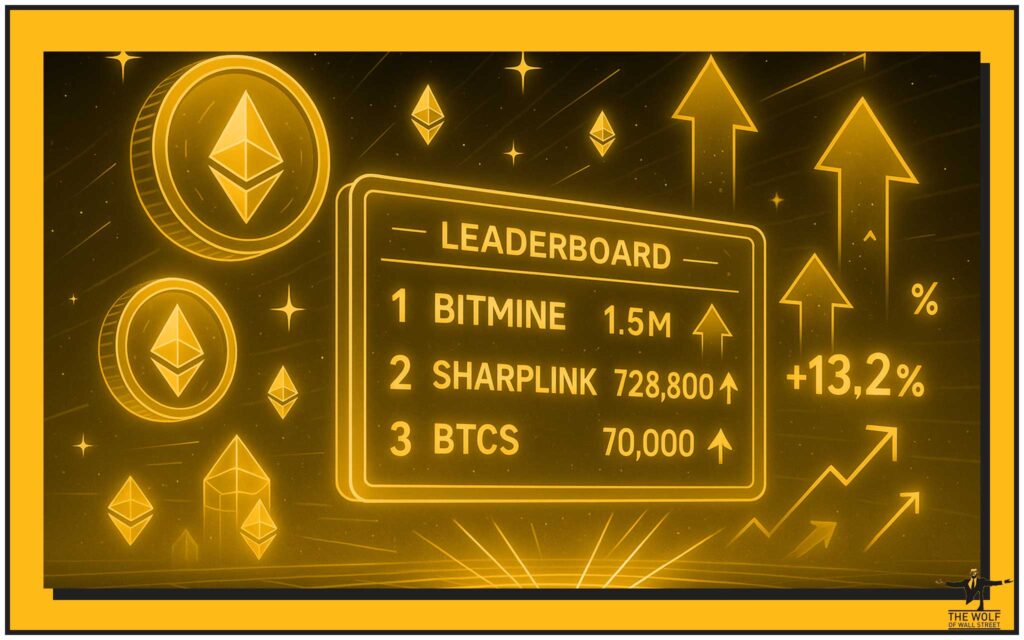

The Ethereum game isn’t just about holding. It’s about ranking. And here’s where BTCS stands in the global treasury race:

- Bitmine Immersion Tech: 1.5 million ETH.

- SharpLink Gaming: 728,800 ETH.

- BTCS: 70,000 ETH (11th place, but climbing).

This is an arms race, and BTCS wants into the Top 10 Ethereum treasuries. Their loyalty dividend isn’t just a payout — it’s a strategy to build investor trust while scaling their reserves.

And guess what? ETH treasuries have been a driving force in Ethereum’s price surge — from $1,465 to $4,775 in just four months.

🔗 BTCS Uses DeFi to Multiply Its ETH

Unlike the traditional hoarders, BTCS isn’t just sitting on ETH. They’re putting it to work.

- Staking ETH to earn yields.

- Borrowing on Aave, leveraging assets for growth.

- Liquidity plays in DeFi protocols.

This is aggressive, high-octane asset management. They’re not hoarding ETH under the mattress — they’re squeezing every ounce of value from it.

💡 Funding Growth — The Equity & Debt Playbook

How does BTCS bankroll this expansion?

Simple:

- At-the-market equity offerings.

- Convertible notes.

This gives them constant fuel without draining cash. Some call it dilution — BTCS calls it scaling. And in the growth game, scale is everything.

For investors, this means one thing: BTCS isn’t afraid to sacrifice short-term comfort for long-term dominance.

⚠️ The Risks — What Wolves Must Watch

Let’s keep it real — no play is risk-free. Here’s what investors need to keep on their radar:

- ETH Volatility — Ethereum isn’t a fixed-income bond. Dividends in ETH can swing wildly in value.

- Regulation — The SEC hasn’t exactly been rolling out the red carpet for crypto dividends. Eyes are on this one.

- Execution Risk — BTCS has ambition, but climbing the treasury ranks requires flawless execution.

High risk. High reward. That’s the name of the game.

🌍 The Bigger Picture — A Dividend Revolution?

This isn’t just about BTCS. This could be the blueprint for future dividends.

- Imagine Fortune 500s paying shareholders in ETH.

- Imagine loyalty programs tied to crypto wallets.

- Imagine a Wall Street where digital assets replace cash payouts.

BTCS may be the first mover, but they won’t be the last.

📊 Key Numbers Snapshot

- Dividend Payout: $0.40/share in ETH

- “Bividend”: $0.05/share (Sept 2025)

- “Loyalty Payment”: $0.35/share (Jan 2026)

- ETH Holdings: 70,000 ETH (~$303M)

- Global Ranking: 11th largest ETH treasury

- Market Cap: $233M

- Stock Reaction: +10.4% to $4.87

📰 Analyst & Investor Reactions

- Bullish Take: “BTCS just created the playbook for crypto dividends. Expect imitators.”

- Bearish Take: “Ethereum payouts are volatile and regulatory grey zones spell trouble.”

- Middle Ground: “Innovative, but the real test will be shareholder retention through January 2026.”

📚 Lessons for Retail Investors

Retail traders, listen up:

- Hold for the loyalty dividend. Quick flips leave money on the table.

- Watch ETH price action. Dividend value rides the ETH wave.

- Study treasury accumulation. ETH treasuries are quietly becoming market movers.

The wolves who understand this play will eat. The sheep who ignore it will be left behind.

🔥 Final Verdict — The Wolf’s Perspective

BTCS isn’t playing checkers. They’re playing chess with Ethereum on the board.

They’re fighting short-sellers, rewarding loyal investors, and building one of the largest ETH treasuries in the world.

This is more than a dividend. It’s a statement to Wall Street: the future of finance isn’t in dollars and cents — it’s in digital assets.

For investors, the choice is clear: adapt, or be left behind.

🙋 FAQs

1. What exactly is the BTCS “Bividend”?

It’s a $0.05/share dividend payable in Ethereum on September 26, 2025.

2. How do I qualify for the $0.35 loyalty payment?

You must hold your BTCS shares until January 26, 2026.

3. Why exclude officers and directors?

To ensure outside investors reap the benefits, avoiding conflicts of interest.

4. Could other companies copy this move?

Yes — BTCS is setting a precedent. Expect copycats if this works.

5. What risks should I consider?

ETH volatility, SEC scrutiny, and execution challenges.

🔗 Internal Links for Deeper Reading

- Explore Crypto Trading Services for advanced strategies.

- Stay updated with the latest News.

- Learn more about Layer 1 & Layer 2 Solutions.

- Get sharper with Trading Insights.

📌 The Wolf Of Wall Street Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Proprietary insights to maximise profits.

- Expert Market Analysis: Guidance from seasoned crypto traders.

- Private Community: 100,000+ members sharing strategies.

- Essential Trading Tools: Calculators, market resources.

- 24/7 Support: Round-the-clock assistance.

👉 Empower your crypto journey: