🔥 Introduction: The Corporate Gold Rush into Bitcoin

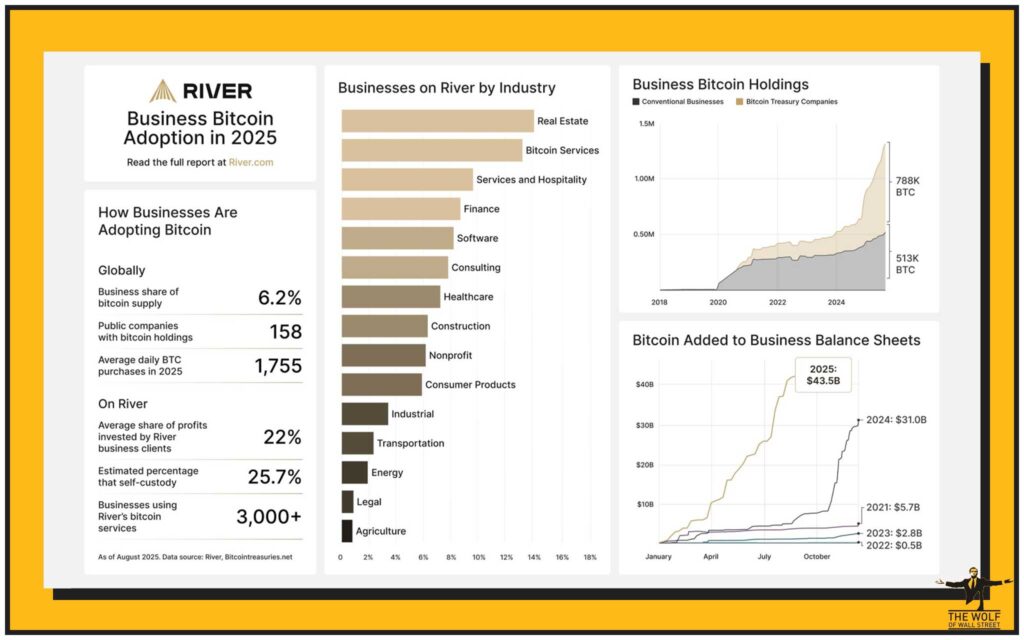

Listen up—because this isn’t your average Wall Street bedtime story. Businesses today aren’t just stacking cash in the bank. They’re flipping profits straight into Bitcoin. According to River, companies are reinvesting a shocking 22% of their net profits into the king of digital assets. This isn’t hype. It’s a movement. And if you’re not paying attention, you’re already behind.

💰 Profit Reinvestment – The 22% Shockwave

Here’s the deal: On average, businesses are reinvesting 22% of their hard-earned profits into Bitcoin. Why? Because cash is trash when inflation eats it alive. Bitcoin, with its capped supply of 21 million, is digital real estate. It’s the asset you can’t print more of.

Real estate firms are leading the charge, funnelling nearly 15% of profits into Bitcoin. And when an industry built on tangible, inflation-sensitive assets moves this aggressively? That’s your wake-up call.

🏢 Real Estate Leads the Charge

Let’s cut to it—real estate is ground zero for this shift. Landlords, developers, and property funds are turning profits into Bitcoin as a hedge against fiat erosion. Why? Because they understand scarcity. There’s only so much land. There’s only so much Bitcoin.

When real estate starts using Bitcoin to protect wealth, it sets the tone for every other sector. This is why adoption is snowballing beyond the walls of traditional finance.

👉 Dive deeper into Bitcoin adoption trends here.

🍷 Beyond Real Estate – Other Sectors Join In

It’s not just property tycoons. Hospitality chains, fintech firms, software houses, even nonprofits are now buying Bitcoin with profits. We’re talking 8–10% reinvestment rates across industries that never touched crypto before.

From boutique fitness studios to legacy financial firms, the writing’s on the wall: Bitcoin is the hedge you can’t afford to ignore.

👉 Explore broader adoption in altcoins.

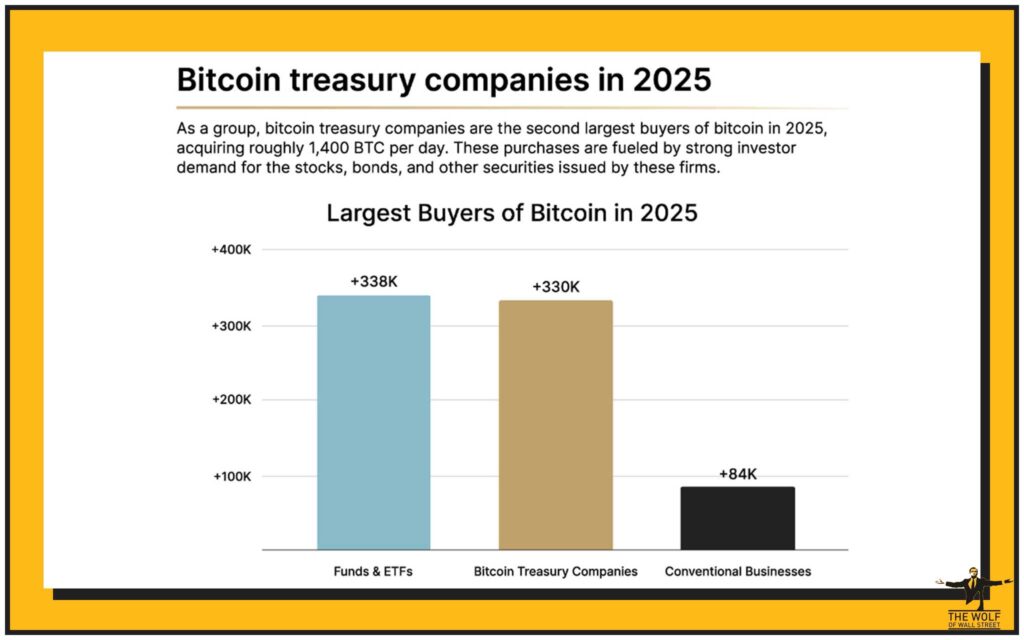

📊 84,000 BTC – The Silent Whale Accumulation

Now here’s the kicker: businesses scooped up a staggering 84,000 Bitcoin in 2025 alone. That’s about a quarter of all institutional and corporate Bitcoin holdings.

This isn’t a headline grab. It’s quiet accumulation, grassroots style. While Wall Street debates ETFs and regulations, SMEs are quietly stacking sats—and stacking them hard.

👉 For the latest buzz, check out News, Trending, and Hot.

👥 Small Businesses – The Real Mavericks

Here’s what most analysts miss: 75% of these businesses have 50 employees or fewer. That’s right—small firms are the backbone of Bitcoin adoption.

Why? Agility. They don’t need endless committee meetings. The CEO decides, they move. That’s why small businesses can front-run corporates. And when entrepreneurs smell blood in the water, they don’t wait—they pounce.

🏢 Why Big Corporates Are Missing the Boat

Big corporates? Forget it. They’re slow, they’re cautious, they’re obsessed with “norms.” Committees kill speed, and speed is profit.

While they debate risk, small firms are already cashing in. And history proves it: those who hesitated during past Bitcoin cycles ended up paying top dollar while the early movers banked generational wealth.

📈 How Much Do They Allocate?

Here’s how the spread looks:

- Over 40% of businesses allocate between 1%–10% of their profits.

- Another 10% go heavy—over 50% of net income straight into Bitcoin.

Most are testing the waters, but a fearless minority are betting big. And guess what? The bold usually win.

🔄 Comparing Market Cycles

Flashback to 2020–2021: Bitcoin pumped because of retail hype—FOMO-driven, unstable, short-term.

Fast forward to 2025: businesses are leading the charge. This isn’t Reddit speculation. This is boardroom allocation. That makes this cycle more sustainable, more stable, and infinitely more profitable long-term.

⚖️ Regulatory Clarity – The Missing Piece Falls Into Place

One of the biggest blockers for corporate adoption? Regulation and accounting. That’s shifting.

Recent improvements in Bitcoin accounting standards now let businesses treat Bitcoin more like a recognised treasury asset. Regulators worldwide are opening doors instead of slamming them shut. This clarity is fuelling adoption.

👉 Stay updated with Policies.

🧠 The Awareness Gap – Why Businesses Still Don’t Get It

But here’s the twist: Bitcoin isn’t rejected by most businesses—it’s ignored. Not because it doesn’t make sense, but because decision-makers don’t understand it.

Surveys show:

- Only 6% of people know Bitcoin’s capped supply.

- Over 60% admit they don’t understand it at all.

That’s your edge. While the masses are confused, the informed are profiting.

🏆 Analyst Insights – Bitcoin as a Complement, Not a Replacement

River’s analyst Sam Baker nails it: businesses don’t see Bitcoin as a replacement—they see it as a complement. It’s the edge, not the core.

For companies, it’s not “all in.” It’s about strategic allocation to boost resilience and hedge risk. And that’s the beauty of Bitcoin: it plays well with existing models.

👉 Gain more trading insights.

🛠️ Tools of the Trade – Making Bitcoin Adoption Easier

Adoption isn’t happening blind. Businesses are using volume calculators, treasury management tools, and real-time analysis platforms.

And this is where The Wolf Of Wall Street comes in strong:

- Exclusive VIP signals for maximising profits.

- Expert analysis from seasoned traders.

- A private community of 100,000+ members sharing strategies.

👉 Check out the full service.

💡 Risks and Rewards – Playing It Smart

Let’s be straight: Bitcoin is volatile. But volatility is opportunity.

The smart play? Balance.

- Start small (1%–5%).

- Scale when confidence grows.

- Diversify, but don’t ignore.

The biggest risk isn’t volatility—it’s ignorance.

🧩 What This Means for the Future of Bitcoin

Businesses adopting Bitcoin changes the game:

- It brings stability.

- It cements Bitcoin as a treasury standard.

- It fuels parallel adoption in ecosystems and DeFi.

Retail hype fades. Business adoption sticks. That’s the long-term difference.

🔮 The Wolf’s Take – Why You Can’t Afford to Sit Out

Here’s the Wolf talking straight: If you’re a business owner and you’re not reinvesting at least a fraction of profits into Bitcoin, you’re asleep at the wheel.

The data is screaming at you—22% on average, with small businesses leading. The train is moving. You can either jump on now or watch it disappear into the distance.

✅ Conclusion: The Next Corporate Revolution Runs on Bitcoin

Let’s wrap this: Businesses are recycling 22% of profits into Bitcoin. Real estate, hospitality, software, finance—all in. SMEs are leading, corporates are sleeping, and regulation is clearing the path.

Bitcoin adoption isn’t hype—it’s evolution. The question is: will you adapt, or will you get left behind?

❓ FAQs

1. Why are businesses reinvesting profits into Bitcoin?

To hedge against inflation, protect value, and capitalise on Bitcoin’s scarcity.

2. Is Bitcoin adoption only for small firms?

No. Small firms move faster, but larger corporates will follow once regulations and awareness catch up.

3. How does regulation affect corporate adoption?

Clearer accounting standards and evolving global rules make adoption easier and less risky.

4. What risks should businesses consider before investing?

Volatility, regulatory uncertainty in some regions, and knowledge gaps.

5. Will Bitcoin become a standard treasury asset?

Yes. Current adoption trends strongly suggest Bitcoin will sit alongside cash, gold, and bonds.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

👉 Visit our service: The Wolf Of Wall Street Service

👉 Join our Telegram: The Wolf Of Wall Street Community

Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.