🌟 Introduction: Shaking Up the US Crypto Landscape

Crypto.com and Canary Capital are on a mission to revolutionise crypto investment in the US with their latest venture — the Canary CRO Trust. This strategic move is more than just another fund; it’s a calculated play to bring the Cronos blockchain’s CRO token to a broader audience of accredited investors, aiming to bridge the gap between traditional finance and decentralised finance.

In a market still reeling from regulatory uncertainty and a surge in crypto ETF filings, the launch of the Canary CRO Trust could serve as a significant milestone. But what does it mean for investors? And how does it position Crypto.com for further dominance in the US crypto market?

Let’s break it down.

🌐 What is the Canary CRO Trust?

The Canary CRO Trust is a US-based investment fund that offers accredited investors regulated exposure to the Cronos (CRO) token, the native asset of the Cronos blockchain. Unlike ETFs or ETPs, the CRO Trust isn’t publicly traded on exchanges but is instead structured to comply with SEC regulations, specifically targeting high-net-worth individuals and institutions.

How It Differs from ETFs and ETPs:

- Structure: The CRO Trust is a regulated investment vehicle but not an exchange-traded fund.

- Regulation: Operates under SEC exemptions, offering a legally compliant way to gain exposure to Cronos without direct token purchases.

- Target Audience: Accredited investors only, restricting access but reducing regulatory hurdles.

For more insights into investment strategies in volatile markets, visit our Trading Insights.

📉 Why Now? The Strategic Timing Behind the Launch

Timing is everything in crypto. The US regulatory landscape is currently in flux, with multiple crypto ETF applications under review by the SEC. This includes heavyweights like BlackRock and Fidelity, aiming to legitimise crypto assets under regulated investment products.

Why the Canary CRO Trust Now?

- ETF Uncertainty: The SEC has yet to approve any CRO ETFs, creating a strategic gap for the CRO Trust to attract accredited investors.

- Investor Demand: Institutional interest in crypto is at an all-time high, particularly among those seeking exposure to blockchain networks with real-world utility, like Cronos.

- Regulatory Play: By structuring the trust as a private fund, Crypto.com and Canary Capital sidestep some of the stringent regulatory scrutiny faced by ETFs.

Explore more about how regulatory changes impact cryptocurrency ecosystems here.

🚀 Crypto.com’s Expansion Strategy in the US

Crypto.com’s latest move isn’t just a standalone initiative. It’s part of a broader strategy to mainstream crypto investment through regulated financial products. From high-profile partnerships to the launch of the CRO Trust, the company is positioning itself as a dominant player in the US market.

Key Strategic Initiatives:

- Trump-Branded ETFs: Crypto.com has partnered with Trump Media & Technology Group for Trump-themed ETFs, awaiting SEC approval.

- Cronos Blockchain Expansion: The launch of the CRO Trust leverages the expanding Cronos ecosystem, a Layer-1 network focused on DeFi and NFTs.

- Market Education: Through platforms like The Wolf Of Wall Street, Crypto.com is educating investors on the potential of blockchain-based assets.

For beginners looking to understand the basics of crypto investment, check out our Newbie Section.

💼 Investor Eligibility: Who Can Participate?

Not everyone can jump into the CRO Trust. The fund is exclusively available to accredited investors, a critical distinction that affects both accessibility and regulatory compliance.

Who Qualifies as an Accredited Investor?

- Income Thresholds: Individuals earning \$200,000 annually or \$300,000 jointly for at least two years.

- Net Worth: A minimum net worth of \$1 million, excluding primary residence.

- Professional Investors: Licensed financial professionals or institutional investors.

For more on accredited investor requirements, visit our comprehensive guide in the Trading Insights section.

📊 Comparing CRO Trust with ETFs and ETPs

| Feature | CRO Trust | ETFs | ETPs |

|---|---|---|---|

| Structure | Private Trust | Publicly Traded Fund | Exchange Product |

| Regulation | SEC Exempt | SEC-Registered | SEC-Registered |

| Target Audience | Accredited Investors | Public Investors | Public Investors |

| Liquidity | Limited | High | Moderate |

| Fees | Higher | Lower | Medium |

For more insights on how ETFs and ETPs impact the crypto investment landscape, check out our DeFi Coverage.

🛠️ The Cronos Blockchain: Backbone of the CRO Trust

The Cronos blockchain is a Layer-1 network optimised for DeFi, NFTs, and Web3 applications. With a total value locked (TVL) of approximately \$440 million, it’s a robust platform for investors seeking exposure to blockchain assets.

Why Cronos?

- Scalability: Fast and cost-effective transactions.

- Interoperability: Compatible with Ethereum and Cosmos, attracting cross-chain projects.

- Utility: CRO token powers the ecosystem, facilitating transactions and staking.

Want to learn more about Layer-1 and Layer-2 solutions? Visit our Crypto Ecosystems page.

💡 Risks and Rewards: What Investors Should Know

Risks:

- Market Volatility: Crypto assets are inherently volatile.

- Regulatory Uncertainty: Future SEC rulings could impact fund operations.

- Liquidity Risks: Private funds have less liquidity than publicly traded ETFs.

Rewards:

- Regulated Exposure: Legal investment in Cronos without direct crypto purchase.

- Early Adoption: Potential for higher returns if CRO gains mainstream adoption.

- Diversification: Exposure to a promising blockchain ecosystem.

For a deeper dive into crypto risk management, check our Risk Analysis section.

🔥 Community and Ecosystem Reactions

The Cronos community is buzzing with anticipation. DeFi developers and NFT creators are eyeing the potential influx of institutional capital, while analysts speculate on the impact on CRO token prices.

For the latest updates and community discussions, join the The Wolf Of Wall Street Telegram channel here.

🏆 Expert Insights: What Analysts Are Saying

Analysts are cautiously optimistic. Some predict the CRO Trust could serve as a gateway to broader institutional adoption of Cronos, while others warn of potential regulatory roadblocks.

📅 Upcoming Developments and Potential Impact

- SEC Decisions on Crypto ETFs: Pending rulings could affect CRO Trust’s market positioning.

- Cronos Ecosystem Expansion: Increased DeFi and NFT activity could drive CRO demand.

- Crypto.com’s Next Move: Potential for more regulated products targeting US investors.

✅ Conclusion: The Canary CRO Trust – A New Era of Crypto Investment

Crypto.com and Canary Capital’s launch of the Canary CRO Trust isn’t just another fund — it’s a strategic move to mainstream regulated crypto investment in the US. With the SEC tightening its grip on ETFs, the CRO Trust offers a unique pathway for accredited investors to gain exposure to Cronos, a blockchain ecosystem with significant growth potential.

Whether you’re a seasoned investor or exploring crypto for the first time, understanding the nuances of regulated investment products like the CRO Trust can position you for potential gains in a volatile market.

🔥 FAQs: Frequently Asked Questions

- What is the Canary CRO Trust and how does it differ from ETFs?

The Canary CRO Trust is a regulated investment fund that offers exposure to the Cronos (CRO) token but is only available to accredited investors. Unlike ETFs, it is not publicly traded and operates under SEC exemptions, focusing on high-net-worth individuals and institutions. - Why is the fund only available to accredited investors?

The fund is structured to comply with specific regulatory frameworks, limiting access to accredited investors to mitigate risk and comply with SEC regulations. - How does the Cronos blockchain support the CRO Trust?

The Cronos blockchain underpins the CRO Trust, providing a scalable, interoperable platform for DeFi and NFT applications. The trust leverages CRO as its primary asset, aligning with the network’s broader ecosystem strategy. - What are the risks and rewards of investing in the CRO Trust?

Risks include market volatility, regulatory uncertainty, and liquidity limitations. However, the rewards include regulated exposure to Cronos, potential capital appreciation of CRO, and diversification into blockchain assets. - How could this development impact CRO token adoption and price?

Increased institutional participation through the CRO Trust could boost demand for CRO tokens, potentially impacting its market price positively. However, regulatory developments and market sentiment will play pivotal roles.

🚀 Empower Your Crypto Journey with The Wolf Of Wall Street

The The Wolf Of Wall Street crypto trading community offers a robust platform designed to navigate the volatile cryptocurrency market effectively. Here’s what you gain by joining:

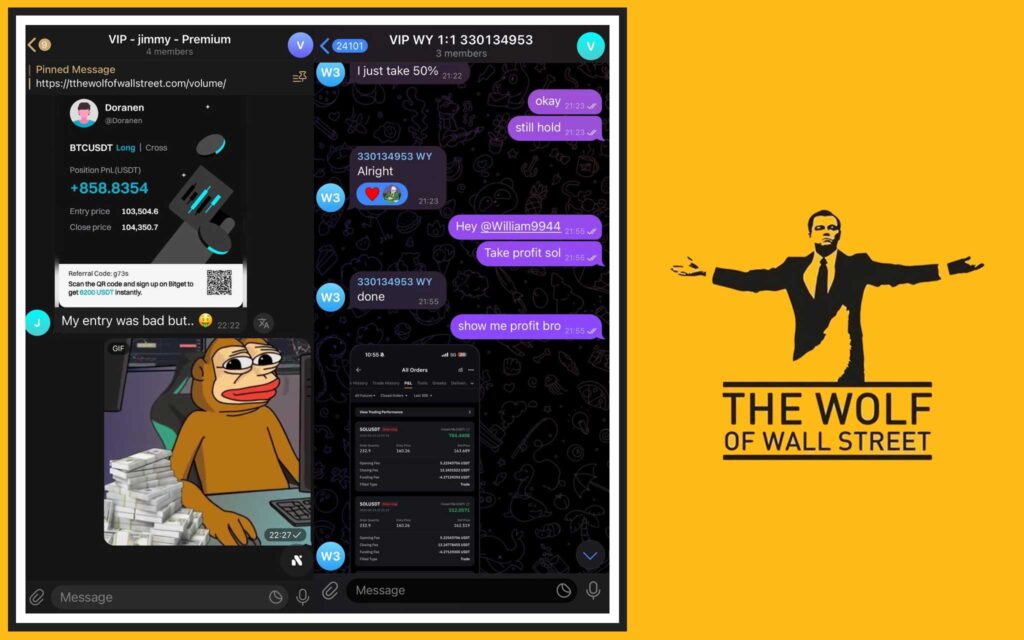

- Exclusive VIP Signals: Access proprietary signals aimed at maximising trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from experienced crypto traders.

- Private Community: Join a network of over 100,000 like-minded traders for shared insights and support.

- Essential Trading Tools: Utilise advanced volume calculators and other critical trading resources.

- 24/7 Support: Receive continuous assistance from a dedicated support team.

Empower Your Crypto Trading Journey:

- Visit our website for more information: The Wolf Of Wall Street

- Join our active Telegram community for real-time updates and discussions: The Wolf Of Wall Street Telegram

Unlock your potential to profit in the crypto market with The Wolf Of Wall Street — where trading meets opportunity.