🔥 Introduction – The SEC Drops the Ball

The SEC just missed its deadline on Canary Capital’s spot Litecoin ETF, and the timing couldn’t be worse. Why? Because it happened in the middle of a government shutdown. That’s not just bureaucracy—it’s a handbrake on the future of crypto markets.

If you’re an investor, here’s the brutal truth: uncertainty equals opportunity. While the masses panic, the sharp operators prepare to profit. The SEC’s silence isn’t the end of the story. It’s the prelude to a bigger play.

⚖️ Regulatory Deadlock: What Just Happened?

Let’s cut through the noise.

- Deadline missed: The SEC had until Thursday to rule on Canary’s Litecoin ETF. They stayed silent.

- Canary’s move: Canary Capital pulled its 19b-4 filing—right at the SEC’s request.

- The result: Regulatory limbo. Nobody knows what happens next.

This isn’t just paperwork—it’s a signal. When the SEC ducks a decision, it’s not random. It’s strategic.

🚨 The Shutdown Effect: SEC at Half Power

During a government shutdown, the SEC goes into hibernation. Their “Operation Plan” makes it clear:

- No new applications reviewed.

- No ETF approvals.

- Staff cut down to survival levels.

The only thing still running? The EDGAR database—essentially their filing cabinet. That’s it.

Translation? The watchdog is asleep, and the market is free to run.

🏦 The ETF Battlefield: Where We Stand

The ETF arena is already red hot:

- Bitcoin ETFs? $61.3 billion inflows since launch.

- Ethereum ETFs? $13.4 billion and growing.

- Altcoin ETFs waiting: Solana, XRP, Avalanche, Cardano, Chainlink, Dogecoin.

The market for spot crypto ETFs is $75 billion strong and expanding like wildfire. Canary Litecoin ETF is just one piece of this puzzle—but it could be the trigger for an altcoin ETF wave.

For context on crypto ETFs already making moves, check out the Bitcoin & Ethereum ETFs guide.

🐦 Canary Capital’s Withdrawal: Strategy or Surrender?

Why would Canary pull its filing instead of fighting? Because sometimes retreat is the smarter move than rejection.

- At SEC’s request: They were asked to step back, not shut down.

- Tactical delay: Avoids a public rejection stamp.

- Message to market: The ETF isn’t dead. It’s just on ice.

That’s Wall Street chess—not checkers.

📜 The Rule Change Nobody Saw Coming

Here’s the kicker. The game has changed.

- Old world: 19b-4 filings, hard deadlines.

- New world: Rule 6c-11, focusing on S-1 statements.

What does that mean? Approvals that once took months could take days. Canary’s “delay” might actually put them in a better position once the SEC is back at full speed.

💰 Investor Impact: Opportunity in Uncertainty

This is where winners and losers are made.

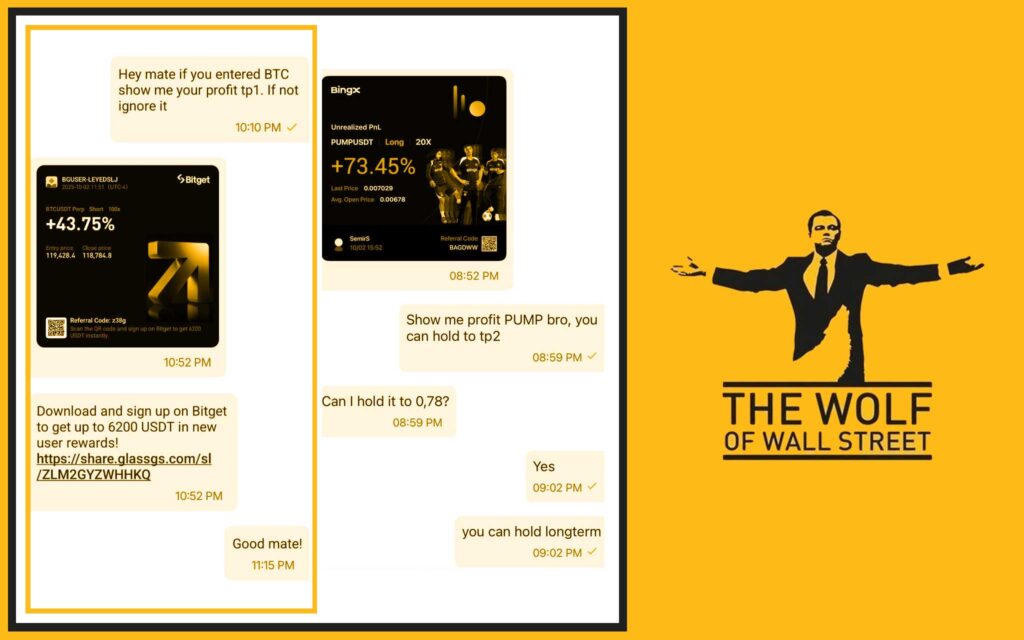

- Retail investors: They panic, dump holdings, and wait for clarity.

- Smart investors: They accumulate, hedge, and position for the breakout.

Delays fuel volatility, and volatility is profit fuel. If you know how to play technical setups like RSI swings and moving averages, you’re already ahead. See our RSI crypto trading strategies or dig into moving averages and market trends for tactical insights.

🏢 Institutional Money: Hungry but Waiting

Don’t think for a second that hedge funds, pension funds, and big asset managers aren’t watching this. They’re waiting at the door, ready to pour money into altcoin ETFs the second the SEC lifts its boot.

Canary’s delay isn’t a “no.” It’s a “not yet.” For the big players, that’s enough to keep the champagne on ice.

🌍 Global Spotlight: Who’s Watching the SEC

This isn’t just an American game.

- Europe is already pushing forward with regulated digital asset products.

- Asia is experimenting with ETFs faster than the US.

- Capital goes where opportunity flows.

If the SEC drags its feet, the US risks falling behind in the global race for crypto dominance.

🧠 The Psychology of Delay: Fear vs FOMO

The average investor hates limbo. The pros thrive in it.

- Fear: Retail traders see no decision and panic.

- FOMO: Smart traders see discounted entry points and load up.

The difference? Perspective. Remember, the market doesn’t reward hesitation—it rewards conviction.

🚀 The Road Ahead: Once the SEC Wakes Up

When the SEC is back in full swing, things could move fast:

- Approvals may take days, not months.

- Investor access will widen.

- Altcoin legitimacy will surge.

The Canary Litecoin ETF might not just be another product—it could be the starting gun for altcoin ETF season.

🗣️ Industry Voices: Analysts and Insiders

Analysts are already calling it:

- Rule 6c-11 could unlock the bottleneck.

- ETF floodgates could open.

- Investor access could expand dramatically.

Even SEC officials admit the new framework is designed to accelerate approvals.

🎯 Action Plan for Investors: Play This Right

So what do you do now?

- Stay informed – follow regulatory updates closely.

- Use technical tools – volatility is profit if you know how to time entries.

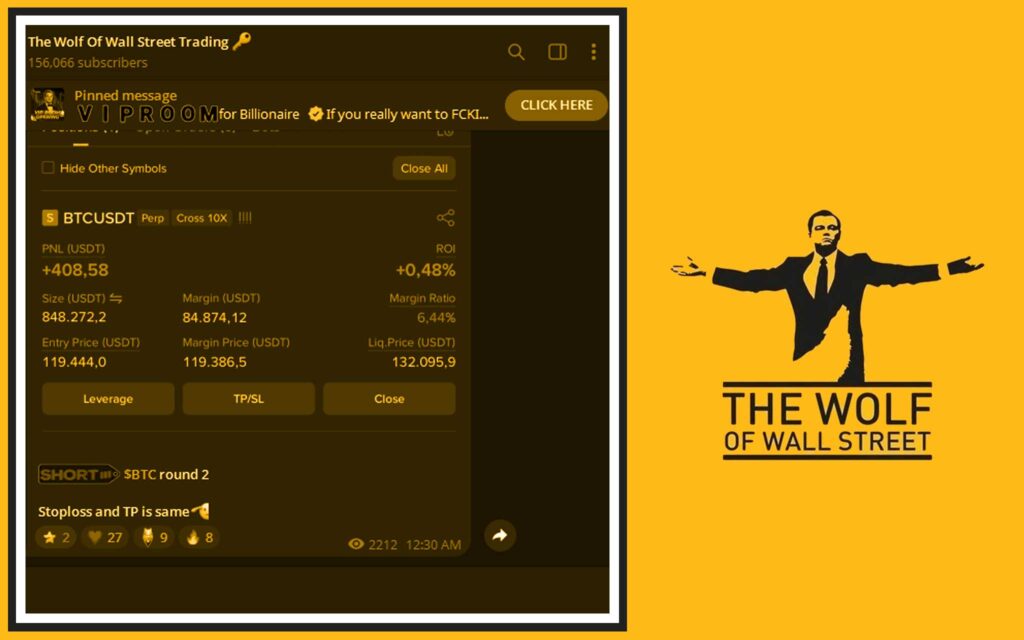

- Don’t go solo – communities like The Wolf Of Wall Street give you insider-level analysis and signals.

If you want to sharpen your edge, dive into advanced strategy guides like crypto-token listing process guide or our crypto profit-taking wolf’s guide.

🐺 The Wolf’s Take: This Isn’t Delay – It’s a Setup

Listen closely: the SEC didn’t kill the Canary Litecoin ETF. They staged it. This is Wall Street theatre.

- The delay creates uncertainty.

- Uncertainty creates volatility.

- Volatility creates profit.

Smart traders don’t complain about delays—they exploit them.

🏆 Conclusion: Chaos Creates Champions

The SEC’s silence on Canary’s Litecoin ETF isn’t the end of the story—it’s the setup for the next chapter.

The ETF market is expanding. The rules are evolving. The money is waiting.

When the green light flashes, you’ll either be the one holding the right cards—or watching others cash in while you sit on the sidelines. Don’t wait. Don’t hesitate. Dominate.

❓ FAQs

1. Why did the SEC miss the Canary Litecoin ETF deadline?

Because of the government shutdown and Canary’s withdrawn 19b-4 filing.

2. How does the government shutdown affect crypto ETF approvals?

The SEC can’t review or approve applications during a shutdown.

3. What altcoin ETFs are next in line?

Solana, XRP, Avalanche, Cardano, Chainlink, and Dogecoin.

4. What does Rule 6c-11 mean for crypto ETFs?

It replaces old processes with faster approvals based on S-1 filings.

5. How should investors react during SEC delays?

Stay calm, position smartly, and use volatility as a profit engine.

🔑 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market:

- Exclusive VIP Signals: Proprietary signals to maximise profits

- Expert Market Analysis: Insights from seasoned traders

- Private Community: Over 100,000 members sharing strategies

- Essential Trading Tools: Calculators and resources

- 24/7 Support: Dedicated assistance, round the clock

👉 Empower your trading journey:

- Visit The Wolf Of Wall Street Service

- Join the Telegram Community