As governments race to roll out Central Bank Digital Currencies (CBDCs), a new financial battleground is forming – not just over technology or policy, but over something far more personal: your privacy. The digital pound, the digital euro, the e-CNY – each promises innovation, inclusion, and speed. But underneath the glossy press releases lies a critical question: will CBDCs protect your financial autonomy, or quietly erode it?

Let’s strip out the fluff and break this down – the opportunities, the surveillance risks, and how you can protect yourself while governments rewrite the rules of money.

⚡ What “Privacy” Really Means in a CBDC

Privacy isn’t just about hiding what you buy – it’s about who holds your data, how it’s used, and what they can infer. A CBDC transaction generates three critical data layers:

- Identity data – who you are (linked to KYC or digital ID).

- Transaction data – what, when, where, and how much.

- Behavioural data – patterns revealing lifestyle, preferences, even political leanings.

Unlike cash, which is peer-to-peer and leaves no trace, CBDCs run through digital infrastructures that always leave footprints. The big question: who can see those prints?

Who Can See What?

| Actor | What They See | Why |

|---|---|---|

| User | Transaction details | Personal records |

| Merchant | Buyer info, transaction ID | Sales, tax reporting |

| Intermediary | KYC identity, payment logs | Compliance, AML |

| Central Bank | Aggregated or anonymised data (in theory) | Monetary policy |

| Government / Regulators | Audit trails under warrant | Enforcement |

According to the European Central Bank (ECB), the digital euro’s offline mode aims to offer “cash-like privacy” – meaning small offline transactions wouldn’t reveal personal data. But for online payments, privacy is only as strong as data minimisation and encryption policies allow.

⚡ Design Choices That Decide Your Privacy

When it comes to CBDCs, architecture is destiny. The way a system is built defines how private (or public) your financial life becomes.

Intermediated vs. Direct Models

The Bank of England (BoE) and HM Treasury propose an intermediated model for the digital pound – commercial banks or fintechs manage user wallets, while the BoE operates the core ledger. (BoE Consultation Response 2024) This creates a buffer layer, meaning the central bank shouldn’t directly see user-level data.

Contrast that with China’s e-CNY, where the People’s Bank of China retains more centralised control, limiting anonymity. It’s functional – but hardly private.

Online vs. Offline Transactions

Offline CBDCs mimic cash: stored locally, exchanged via NFC or Bluetooth, then synced later. The ECB’s 2024 progress report confirmed plans for an offline mode providing users a “cash-like level of privacy.” But offline comes with risk – if your device is lost or hacked, that ‘digital cash’ might be gone forever.

Tiered Privacy by Transaction Size

Small transactions could be anonymous; larger ones trigger identity verification – a compromise between AML/CFT obligations and personal freedom.

Policy Safeguards

Beyond tech, privacy depends on regulation: data minimisation, purpose limitation, and strict retention rules. Under GDPR, any CBDC must undergo a Data Protection Impact Assessment (DPIA) and define clear boundaries for data access. (EDPB Joint Opinion 2024)

⚡ Europe vs. UK vs. China: Who’s Doing Privacy Right?

| Region | Model | Privacy Level | Offline Option | Regulator Access |

|---|---|---|---|---|

| EU (Digital Euro) | Intermediated | Moderate | Yes | Limited via intermediaries |

| UK (Digital Pound) | Intermediated | Moderate–High | Evaluating | Through regulated PSPs |

| China (e-CNY) | Centralised | Low | Limited | Direct to central bank |

Both the ECB and BoE claim users’ data will not be visible to them directly. The IMF’s 2024 report notes that “privacy and trust are decisive for CBDC adoption” and warns that overreach could undermine legitimacy (IMF Fintech Note 2024/004).

In short – the West is talking privacy; China’s already enforcing control.

⚡ Surveillance & Abuse: The Real Privacy Risks

CBDCs don’t have to become surveillance tools – but they could, if designed without safeguards.

Centralised Data Gravity

CBDCs create a honeypot of transactional data. When combined with tax, social welfare, or health databases, they can expose patterns of life – who you donate to, where you travel, what you consume. Once such datasets exist, mission creep follows.

Function Creep

Authorities may start by using CBDCs for AML enforcement – then extend to tax compliance, sanctions, or even consumption incentives. That’s the slippery slope privacy advocates fear.

Social Scoring: Speculative but Not Impossible

No Western central bank proposes “social scoring,” but critics warn the infrastructure could enable it. The key is governance – transparency, oversight, and technical separation of powers.

As the Deutsche Bundesbank stated, “Privacy is a core design feature of the digital euro.” (Bundesbank Speech 2024). Let’s hope they mean it.

⚡ Cybersecurity: Protecting the System and the User

Privacy means nothing if your wallet or the system itself can be compromised.

System-Level Threats

The IMF’s 2024 Cyber Resilience Report warns of new risks: key management failures, distributed denial-of-service attacks, and vulnerabilities in validation nodes. (IMF Fintech Note 2024/003)

User-Level Threats

Fake wallet apps, malware, phishing – the same old villains, but now targeting your CBDC wallet. The convenience of digital cash could become a hacker’s playground.

Offline Trade-Offs

Offline transactions protect privacy but heighten theft risk. Lose your device, lose your funds. This mirrors cash – but with higher tech stakes.

For real-world protection, use secure devices, multi-factor authentication, and stay current with wallet security practices.

⚡ Privacy-Enhancing Technologies (PETs): The Secret Weapons

Tech alone won’t save you – but it helps.

Selective Disclosure & Anonymous Credentials

BBS+ signatures let you prove you’re authorised without exposing your identity. (ResearchGate 2024)

Zero-Knowledge Proofs (ZKPs)

You can verify a transaction’s legality without revealing any personal data. It’s cryptographic magic – already explored by the IMF and ECB.

But Policy Still Rules

PETs reduce data exposure, but law defines access. True privacy demands alignment between tech, policy, and transparency.

For deeper reading, check Zero-Knowledge Proofs in Crypto Trading.

⚡ The Practical Playbook: Protecting Your Privacy

CBDCs are coming. You can’t stop them, but you can play smart.

1. Choose Trusted Wallet Providers

Look for transparent audits, strong encryption, and open-source code. Avoid unverified apps from random marketplaces.

2. Limit Data Leakage

Keep devices clean, disable unnecessary permissions, and use hardware wallets for crypto diversification.

3. Diversify Your Financial Rails

Don’t put all eggs in one CBDC basket. Balance with self-custody crypto and traditional accounts.

4. Join a Community That Moves With Intelligence

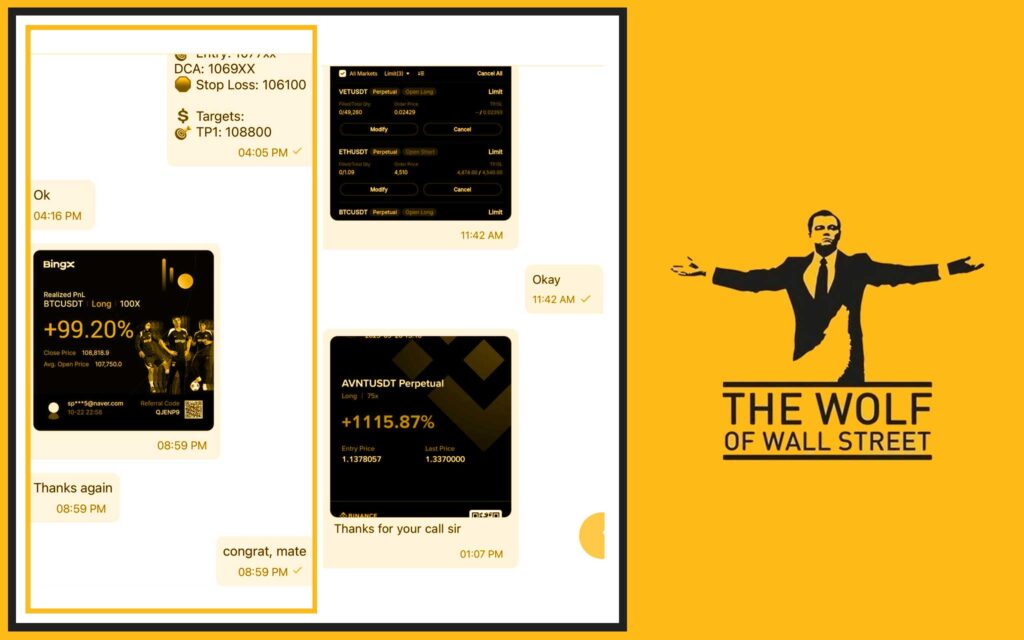

While central banks debate privacy, markets move. The The Wolf Of Wall Street crypto trading community gives you:

- VIP trading signals for top-tier insights.

- Expert market analysis from seasoned pros.

- Private Telegram network of 150,000+ traders.

- Volume calculators and real-time tools.

- 24/7 support for all your trading questions.

💼 Ready to sharpen your edge? Join The Wolf Of Wall Street and follow real-time updates on Telegram.

⚡ FAQs: Privacy and CBDCs

Q1: Are CBDCs anonymous like cash?

No. Cash is fully anonymous; CBDCs offer conditional privacy at best.

Q2: What does “cash-like privacy” mean?

Offline payments may hide personal data, but are still subject to limits and sync checks.

Q3: Can central banks see my purchases?

In intermediated systems, they shouldn’t. But regulators may gain access via intermediaries.

Q4: How is CBDC privacy different from stablecoins?

Stablecoins operate privately but lack regulatory guarantees. CBDCs reverse that equation.

Q5: How can I protect my financial privacy?

Stay informed, use secure wallets, diversify, and engage in privacy-focused discussions on platforms like The Wolf Of Wall Street.

⚡ The Bottom Line

CBDCs are inevitable – but trust is optional. Privacy-by-design isn’t a luxury; it’s a prerequisite for adoption. Offline modes, cryptographic safeguards, and transparent oversight can deliver the balance we need – but only if central banks respect the boundaries.

Your best defence? Stay ahead, stay diversified, and stay educated.

When governments test the future of money, make sure you’re already playing the next game.

👉 Join The Wolf Of Wall Street – where 150,000 traders navigate volatility with insider precision, expert signals, and a relentless focus on profit.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 150,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.