Boom — $220 million, gone in seconds.

That’s not a headline. That’s a wake-up call.

On May 22, 2025, Cetus, a leading decentralised exchange (DEX) built on the Sui blockchain, suffered one of the most devastating exploits in DeFi history. In a flash, hundreds of millions vanished — and the industry saw the curtain pulled back on the illusion of decentralisation.

This isn’t just another crypto hack. This is the moment the market had to ask: who really holds the power in decentralised finance?

Let’s break it down — no fluff, just facts and fierce insight.

🔍 Breaking Down the Breach

A Hack Heard Around the World

The Cetus hack unfolded with speed that would make a Wall Street flash trader blush. In under ten minutes, attackers drained $220 million by exploiting a vulnerability in Cetus’s smart contract logic — the very code that’s supposed to run “trustlessly.”

What was the flaw? Sources suggest it involved improper verification of liquidity pool balances and manipulated transaction calls.

By the time the devs blinked, it was too late.

When the Blockchain Bites Back

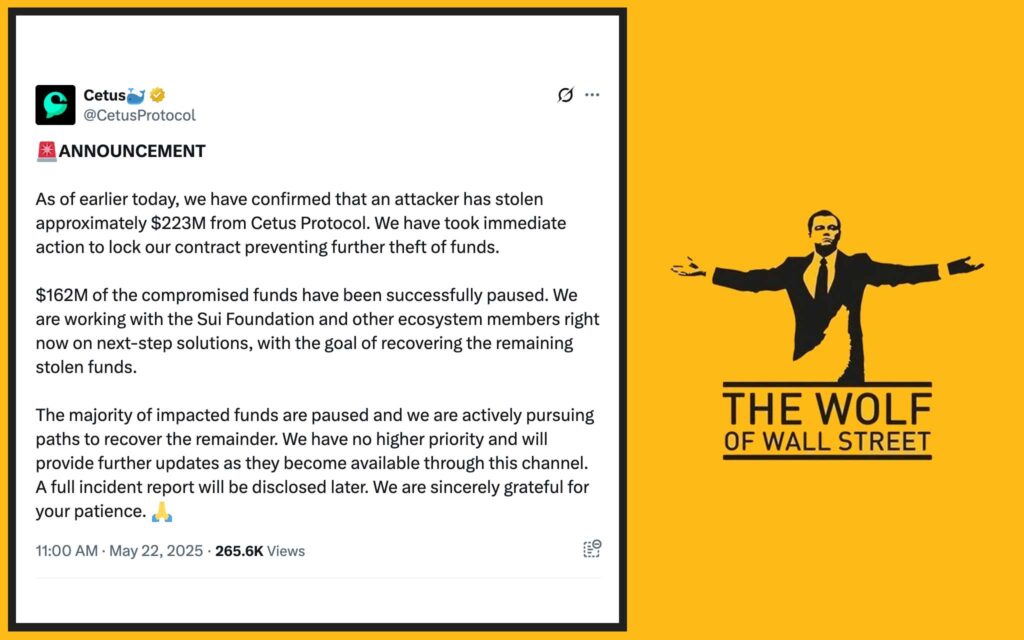

The twist? Sui validators froze $162 million of the loot. That’s right. Blockchain actors, who were supposedly neutral infrastructure, stepped in like cops at a heist — stopping the flow and freezing the funds.

What’s left? Roughly $63 million made it out. Laundered, bridged, and cleaned across networks like Ethereum, vanishing into mixers faster than the market could react.

🧠 Who’s Really in Control?

This was a black mirror moment for DeFi.

Validators on Sui took it upon themselves to ignore transactions from wallets linked to the exploit. While many in the crypto community cheered the action — saying it protected users — others shouted one word:

“Censorship.”

If a network can decide to block transactions, is it decentralised? Or is it just a central bank in disguise?

That’s the million-dollar (or $220 million) question.

🔒 The Freeze Heard ‘Round the World

Let’s talk about that $162 million freeze.

Sui validators — the big nodes that run the network — coordinated with Cetus developers and external security experts to lock down funds. That’s how the bulk of the stolen assets stayed put.

On one hand, it’s impressive. On the other? Terrifying.

“If they can stop a thief’s wallet, they can stop yours.” That’s the growing sentiment among DeFi purists.

And for some, it draws eerie parallels to what’s supposed to be the antithesis of crypto: banking-style control.

⚔️ Trustless No More?

The promise of DeFi is clear: code is law.

But this exploit showed us something else. Code is optional when validators have veto power.

This isn’t the first time, either:

- EOS froze 27 accounts in 2019.

- Solana paused the network multiple times.

- And now, Sui flexed its centralised muscle.

This isn’t decentralisation. This is discretionary finance — and that’s a whole different game.

👉 Related read: Layer-1 and Layer-2 Solutions

🧮 Follow the Money: Laundering & Bridging

The real crooks here? They weren’t amateurs.

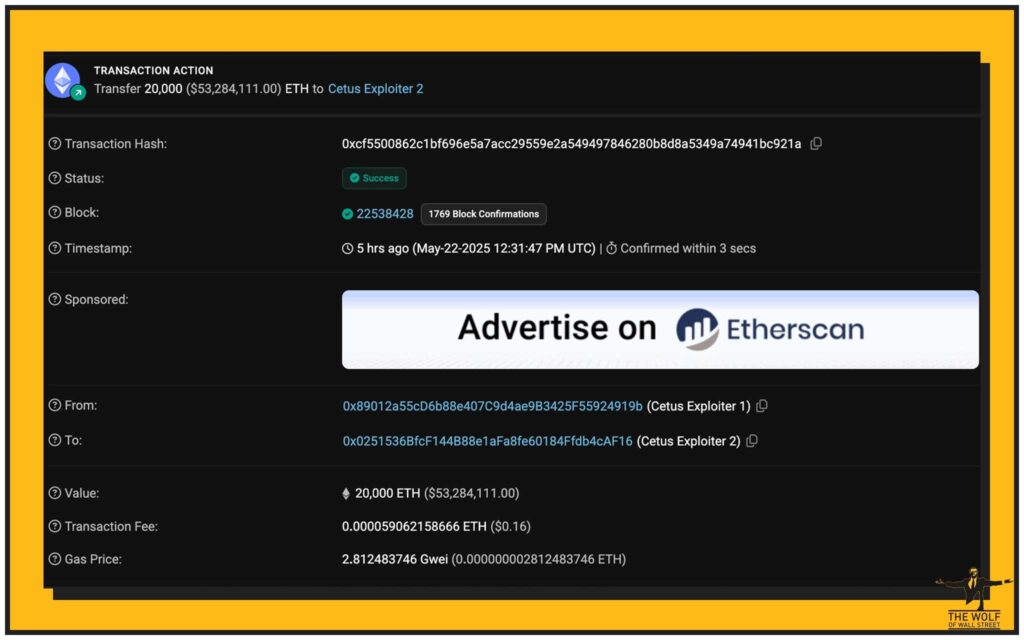

The hackers used advanced bridging techniques, jumping $63 million to Ethereum in minutes. Once across, they used laundering tactics:

- Wrapped ETH swaps

- DEX-to-DEX obfuscation

- Privacy tools like Tornado Cash forks

One wallet alone moved 20,000 ETH, roughly $53 million.

Law enforcement is watching. But let’s be real — in crypto, speed beats justice 9 times out of 10.

🛠️ Security Flaws or User Failures?

This was a contract logic flaw, plain and simple.

Cetus, like many DeFi protocols, rushed to market. Audits? Maybe. But comprehensive logic reviews? Unlikely.

The key takeaways:

- Dev teams must invest in multiple layers of audit.

- Users must vet protocols — or risk being exit liquidity.

Want to avoid the next rug pull? Start by understanding how smart contracts really work.

👉 Check out our Trading Insights for safer strategies and protocol reviews.

📣 The Crypto Crowd Reacts

After the smoke cleared, the industry weighed in:

- Some praised the freeze, saying it saved users.

- Others screamed centralisation, saying it set a dangerous precedent.

- Regulators? They smiled.

Because every time crypto self-censors, it hands them more ammunition for the inevitable: global regulation of DeFi.

And it’s coming — fast.

🔥 Is Sui Still Worth the Hype?

After this? Tough call.

Cetus’s TVL (Total Value Locked) tanked by 38%. Developer morale is shaken. And questions loom over every project building on Sui.

Still, some devs are doubling down. They see this as a feature — not a bug. “The ability to protect users is part of Sui’s strength,” one foundation dev said.

But the broader market? Skeptical.

🎯 Lessons for Every Trader

This isn’t just about Cetus. It’s about your next trade.

Here’s what you need to internalise:

- Don’t blindly trust “decentralised” protocols.

- Always check for third-party audits.

- Use platforms with proven security records.

The goal isn’t to avoid risk. It’s to manage it like a pro.

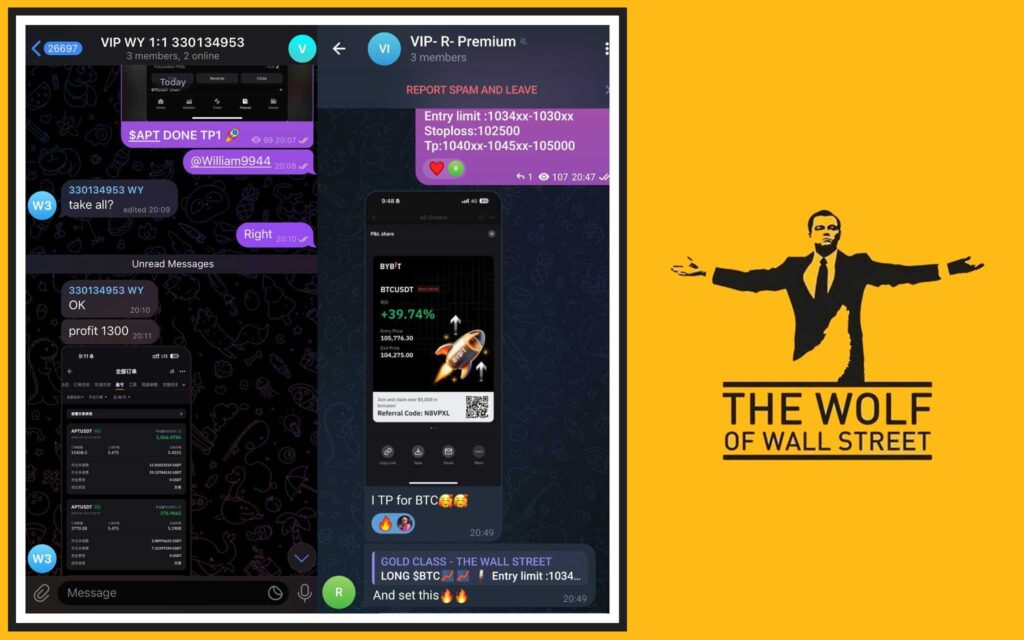

And that’s where The Wolf Of Wall Street comes in.

🧰 Bonus: Protect Yourself in a World Gone DeFi

You’re either hunting alpha or getting hunted. There’s no in-between.

The Wolf Of Wall Street is the cheat code:

- VIP Signals designed for max profit

- 24/7 expert market analysis

- Essential tools like volume calculators

- A community of 100,000+ traders sharing real-time insights

Don’t get caught sleeping. Trade smart, trade prepared.

👉 Explore The Wolf Of Wall Street or jump into our Telegram community

💼 Enter the The Wolf Of Wall Street Edge

This isn’t theory. This is execution.

The Wolf Of Wall Street is your shortcut to trading like a seasoned pro.

- You get real-time alpha

- You stay ahead of hacks, dumps, and rug pulls

- And most importantly — you stop gambling and start growing

The next Cetus moment? You’ll be ready.

🧭 What This Means for the Future of DeFi

The balance between decentralisation and safety is getting tested. Every validator decision, every exploit, and every freeze is shifting the narrative.

The industry now faces a crossroads:

- Double down on code-as-law?

- Or bake in security protocols that override it?

Either way, the days of naïve trust in code are over.

Welcome to the new DeFi: sharper, smarter, and yes — a little more centralised.

🧠 FAQs – Real Answers for Real Traders

1. How did the Cetus exploit happen?

By manipulating logic flaws in the smart contract’s liquidity pools — allowing attackers to drain funds rapidly.

2. Can Sui validators freeze any funds they choose?

Technically, yes. That’s the core of the decentralisation debate. They can ignore certain transactions.

3. How much has actually been recovered?

Roughly $162 million was frozen. The rest? Likely lost or laundered.

4. Is Sui now considered centralised?

Many argue it is, given validator intervention. Others claim it’s just “responsible governance.”

5. What should traders do after events like this?

Use vetted tools, stay informed, and join communities like The Wolf Of Wall Street to sharpen your edge.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals to maximise profits

- Expert Market Analysis from top traders

- Private Community of 100,000+ members

- Essential Trading Tools like volume calculators

- 24/7 Support

Join the movement:

- Visit: https://tthewolfofwallstreet.com/

- Telegram: https://t.me/tthewolfofwallstreet