🔥 Opening Hook – The High-Stakes Crypto Game

Listen up—because this is the part where most people either make life-changing money… or get crushed. Right now, the U.S. is standing at the biggest crossroads in crypto history. The Commodity Futures Trading Commission (CFTC)—the guys who call the shots on commodities and futures—is launching its second “Crypto Sprint.”

And let me tell you, this isn’t just some government paperwork shuffle. This is the real deal. It’s about who controls the rules, who wins, and who gets left holding the bag when the music stops.

In other words: if you’re in crypto—whether you’re a Bitcoin maximalist, a DeFi degenerate, or an NFT flipper—you better start paying attention. Because if you don’t? You’re already losing.

🚀 The CFTC’s Crypto Sprint – What It Really Means

So what the hell is a “crypto sprint”? Simple: it’s the CFTC’s way of saying, “We need clarity, fast.” This is round two. The first sprint was about research, mapping the problems, and testing the waters.

Now? They’re calling on the public—yes, YOU—to weigh in. Acting Chair Caroline D. Pham has opened the floor for input. She’s asking the market, traders, and innovators:

- Should leveraged and margined crypto trading be restricted?

- How do we protect retail investors without strangling innovation?

- What does regulation look like when trading goes decentralized?

That’s massive. Normally, regulators play behind closed doors. Now they’re basically saying: “Speak now, or forever shut up when we set the rules.”

Deadline? October 20. Mark it down, because that’s when the CFTC closes the feedback window—and locks in the next chapter of crypto regulation.

🏛️ White House Crypto Mandate – “Win on Crypto”

Here’s the kicker. This isn’t just about the CFTC. The Trump administration has made it loud and clear: America doesn’t just want to regulate crypto… it wants to win.

That’s right. In a 166-page White House report, the President’s Working Group on Digital Asset Markets laid out 18 policy recommendations to shape the future of digital assets.

And two of those fall directly on the CFTC’s desk:

- Clarify crypto as commodities.

- Update rules for blockchain-based derivatives.

Sounds boring? Wrong. That’s the foundation of how the U.S. decides to treat crypto—whether it’s seen as the digital gold of the future or just another Wild West casino.

And let me tell you: if the U.S. wants to stay competitive, it can’t afford to sit back while the EU pushes forward with MiCA and Asia builds regulatory sandboxes.

⚖️ CFTC + SEC: Frenemies or Power Partners?

Now here’s where it gets spicy. The CFTC isn’t operating alone. It’s partnering with the SEC—but let’s be honest, these guys are frenemies at best.

The SEC claims authority over securities. The CFTC runs commodities. And crypto? Well, it’s stuck right in the middle. Is Ethereum a commodity or a security? Is DeFi trading a futures contract in disguise?

Here’s the truth: market clarity is the holy grail. Without it, innovation slows, capital leaves, and America loses ground. With it? The U.S. could become the global hub for digital finance.

The two agencies are trying to collaborate with “existing authorities.” Translation: they’re rewriting the rulebook, but nobody’s sure who’s holding the pen.

👔 The Leadership Roadblock – A House Without a Boss

Picture this: you’re running a billion-dollar company, but only two executives show up to work. Chaos, right?

That’s the current state of the CFTC. The Trump administration nominated Brian Quintenz as chair—but guess what? The Senate hasn’t confirmed him yet. Which means, right now, the CFTC is running with just two commissioners.

Let’s be real. Regulation doesn’t happen in a vacuum. It takes leadership, direction, and political will. And until Quintenz gets that confirmation, the CFTC is operating like a ship without a captain.

Crypto advocates know this. That’s why they’re pushing hard—lobbying Congress to move faster. Because until there’s stable leadership, the CFTC’s ability to make progress is crippled.

📣 Industry Response – The Loudest Voices in the Room

Here’s where you come in. The crypto industry isn’t sitting quietly. Advocacy groups, investors, even retail traders are raising their voices. They’re urging regulators: “Stop dragging your feet. Give us clarity.”

But it’s not just about lobbying. It’s about the CFTC’s open feedback process. Right now, anyone—from a Wall Street hedge fund to a solo trader in their basement—can submit comments.

And make no mistake: those comments get read. They shape policy. This is your chance to help define how leverage, margin, and DeFi rules get written in the United States.

So the real question is: are you going to sit on the sidelines, or are you going to be one of the loudest voices in the room?

💰 Why This Matters to You – The Trader’s Edge

Let’s cut the fluff. Here’s what it means for YOU:

- Leverage Traders: If you’re swinging big positions on Binance, Bybit, or Coinbase, new CFTC rules could limit your leverage. That changes your game plan overnight.

- DeFi Platforms: If you’re deep in DeFi yield farms, the CFTC may start treating DeFi protocols like regulated exchanges. That means compliance, audits, and maybe even restrictions.

- Retail Investors: If you’re stacking altcoins, expect tighter rules around consumer protection. Think: disclosures, risk warnings, maybe even trading limits.

Bottom line: this isn’t abstract policy. It’s your money on the line.

The winners? Those who anticipate the rules and adjust early. The losers? Those who wait until the CFTC drops the hammer.

🌍 Global Context – U.S. vs. the World

Let’s zoom out. The U.S. isn’t the only player here.

- Europe: The EU just dropped MiCA (Markets in Crypto Assets), which lays out a complete regulatory framework.

- Asia: Countries like Singapore and Hong Kong are creating crypto sandboxes—safe zones where innovation can happen without fear of legal shutdowns.

- Middle East: Dubai is going all-in, positioning itself as a global crypto hub.

Now ask yourself: do you really think the U.S.—the home of Wall Street, Silicon Valley, and global finance—is going to sit back and let other countries dominate this trillion-dollar industry? Not a chance.

But the clock is ticking. Without strong leadership and clear rules, the U.S. risks falling behind.

📈 The Wolf’s Call-to-Action – Don’t Just Sit There

Here’s the deal. The rules of the game are being written right now. You’ve got two options:

- Sit back, binge Netflix, and let the future get decided without you.

- Pay attention, get informed, and position yourself ahead of regulation.

I’ll make it simple: If you’re serious about building wealth in crypto, you can’t just react to headlines. You need to anticipate them. That’s what separates the winners from the broke dreamers.

And guess what? The feedback window closes October 20. After that, the train leaves the station.

🚀 Your Edge in the Chaos – Join The Wolf Of Wall Street

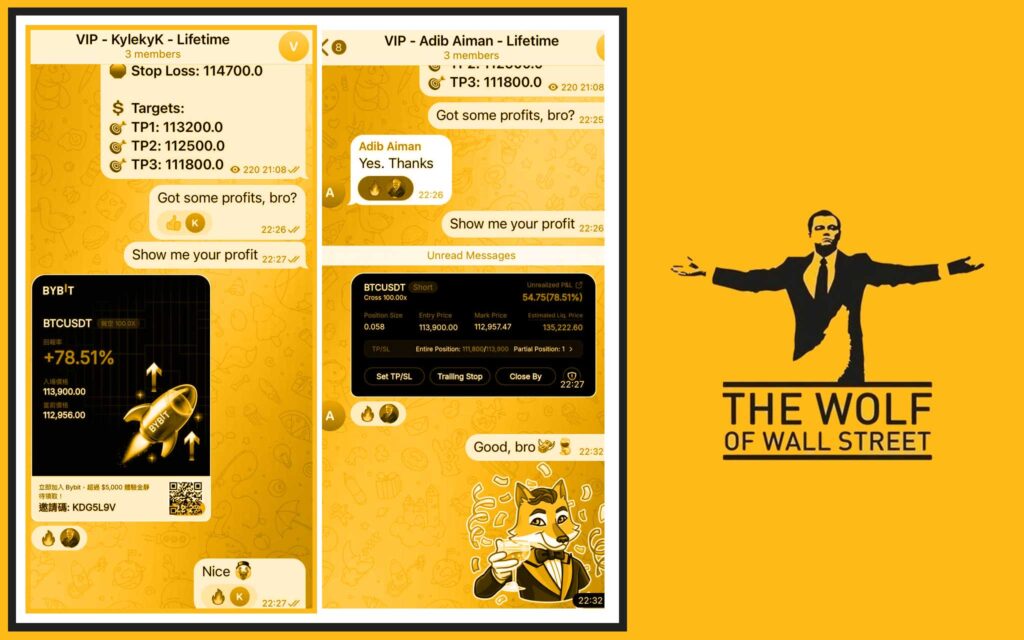

If you want to survive—and thrive—in this high-stakes game, you need more than news. You need signals, tools, and a crew. That’s where The Wolf Of Wall Street crypto trading community comes in:

- Exclusive VIP Signals: Get proprietary signals that maximize trading profits.

- Expert Market Analysis: Leverage insights from seasoned traders who’ve been through the wars.

- Private Community: Connect with over 100,000 like-minded traders who share insights and strategies.

- Essential Trading Tools: From volume calculators to advanced trackers, get the tools that give you the edge.

- 24/7 Support: Because the market never sleeps—and neither should your strategy.

👉 Empower your journey: The Wolf Of Wall Street Service

👉 Join the real-time community: The Wolf Of Wall Street Telegram

If you’re serious about making money in crypto—this is your play.

🔗 Internal Links (Stay Informed, Stay Ahead)

Want to go deeper? Explore these essential categories:

- Policies – Stay ahead of regulatory changes.

- Trading Insights – Level up your strategies.

- Cryptocurrencies – Track the latest market movers.

- Bitcoin & Altcoins – Understand where the market is headed.

- DeFi – See how decentralized finance adapts to regulation.

- Layer 1 and Layer 2 solutions – Get the lowdown on scaling solutions shaping the future.