Right. Buckle up. You think making money is about picking the right stock or crypto coin? That’s for amateurs. The real money, the life-changing, generational wealth, is made by having information that nobody else has. It’s about seeing the rot behind the curtain and having the guts to monetise it.

Listen to me, and listen good, because I’m about to show you how to turn Wall Street’s and the crypto world’s dirty little secrets into a seven-figure payday with the CFTC Whistleblower Program.

🕵️♂️ So, What the Hell is This CFTC Program Anyway?

Let’s cut the crap. You’re here because you want to know how to get paid. The Commodity Futures Trading Commission (CFTC) isn’t just some government agency in a stuffy suit; it’s a cash machine for people with the right information.

It’s Not Just a Programme; It’s Your Golden Ticket

This isn’t some chump-change reward for being a good citizen. This is a golden ticket. It’s a direct invitation from the US government to expose the financial predators, the market manipulators, and the straight-up thieves operating in the commodity, futures, and, yes, the crypto markets. In return for your intel, they give you a piece of the action. A big piece.

Born from the Ashes: How the Dodd-Frank Act Created an Army of Millionaires

Remember the 2008 financial crash? The whole system came crumbling down because a bunch of greedy, overleveraged fat cats got caught with their trousers down. Out of that dumpster fire, the government created the Dodd-Frank Act in 2010. Buried inside that mountain of regulation was Section 748—the kill shot. It created this whistleblower programme to deputise people like you—the insiders, the analysts, the accountants who see things. They realised they couldn’t police the hen-house alone, so they decided to start paying the foxes.

The Mission, Should You Choose to Accept It: Exposing the Rats

Your mission is simple: find the rats and report them. The CFTC is hunting for anyone violating the Commodity Exchange Act. This isn’t just about corn futures anymore; we’re talking about precious metals, oil, and the wild west of digital assets. Your job is to be the eyes and ears on the ground, and for that, you get rewarded handsomely.

💰 Let’s Talk Money: How You Get Filthy Rich

Forget your salary. Forget your annual bonus. This is the big score. This is what separates the wannabes from the titans.

The Magic Numbers: Your 10% to 30% Cut of the Kill

Mark these numbers down: 10% and 30%. If your information leads to a successful enforcement action where the CFTC collects more than $1 million in sanctions, you are legally entitled to a reward of between 10% and 30% of that money. Not “up to,” not “maybe.” You are entitled to it.

Unpacking “Monetary Sanctions”: What That Means for Your Bank Balance

“Monetary sanctions” is just fancy talk for the fines, penalties, and disgorgement the CFTC rips from the crooked company or individual you exposed. If they slap a firm with a $50 million fine because of your tip-off, you’re looking at a cheque for somewhere between $5 million and $15 million. Let that sink in.

The Million-Dollar Entry Fee: Why the CFTC Only Hunts Big Game

The CFTC isn’t interested in small-time crooks; they’re hunting whales. The $1 million threshold is there for a reason. It ensures they focus their firepower on the biggest and most damaging schemes. This is good for you. It means if your case gets picked up, it’s already a major-league play, and the potential payday reflects that.

Hypothetical Payday: Let’s Run the Numbers on a Big Score

Imagine you know about a crypto exchange that’s manipulating market prices through wash trading—a classic scam. You report it. The CFTC investigates and hits them with a $100 million penalty. Based on the quality of your intel and your cooperation, the commission decides to award you 20%. That’s a $20 million wire transfer hitting your account. Your life doesn’t just change; it enters a new dimension.

✅ The Line-Up: Are You a Player in This Game?

Not just anyone can walk in and claim a prize. You have to meet the criteria. But if you have the goods, getting in the game is simple.

The “Original Information” Rule: You Can’t Bring Me Old News

Your information has to be original. This means the CFTC doesn’t already have it. It can’t be something you read in the newspaper or heard on TV. It must come from your independent knowledge or analysis. You have to be the source, the one with the real dirt that nobody else has found.

Stepping into the Ring: Why Your Tip Must Be Voluntary

You have to come to the CFTC on your own terms. You can’t provide the information as part of a pre-existing legal duty or in response to a government request. You must be the one who proactively decides to blow the whistle. You make the first move. You control the play.

The Ghost Strategy: Using a Lawyer to Stay Anonymous and Protected

Listen to me carefully on this. You can submit your tip anonymously, but you must do it through a lawyer. This is a non-negotiable power move. A good whistleblower attorney doesn’t just file the paperwork; they act as your shield. They handle all communication, protecting your identity from ever being revealed to the public, your company, or anyone else. You become a ghost with a multi-million-dollar bank account.

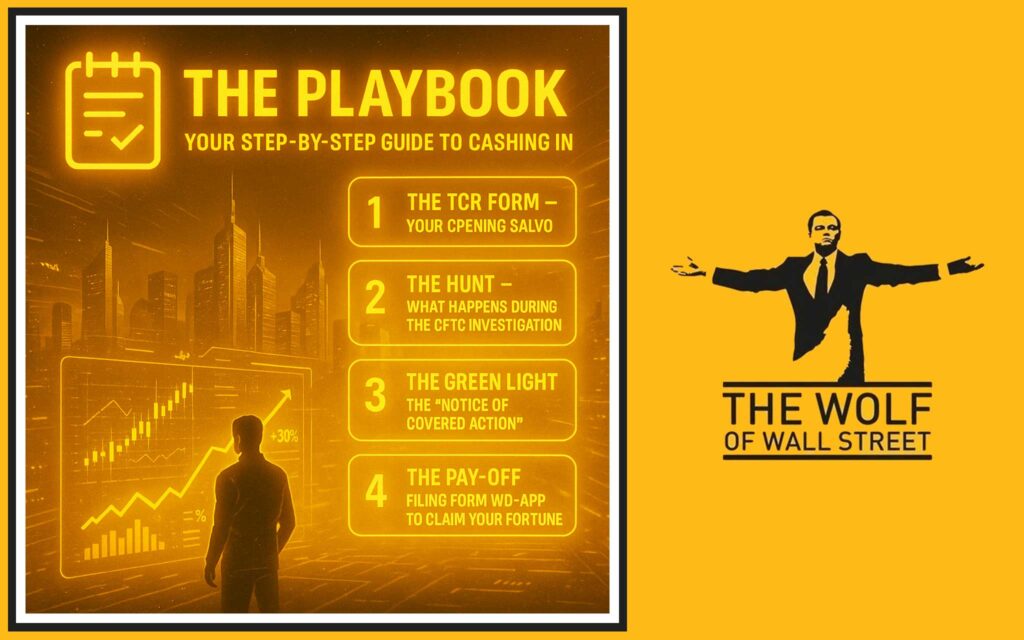

📝 The Playbook: Your Step-by-Step Guide to Cashing In

Success is a system. It’s a process. Follow the playbook, and you win.

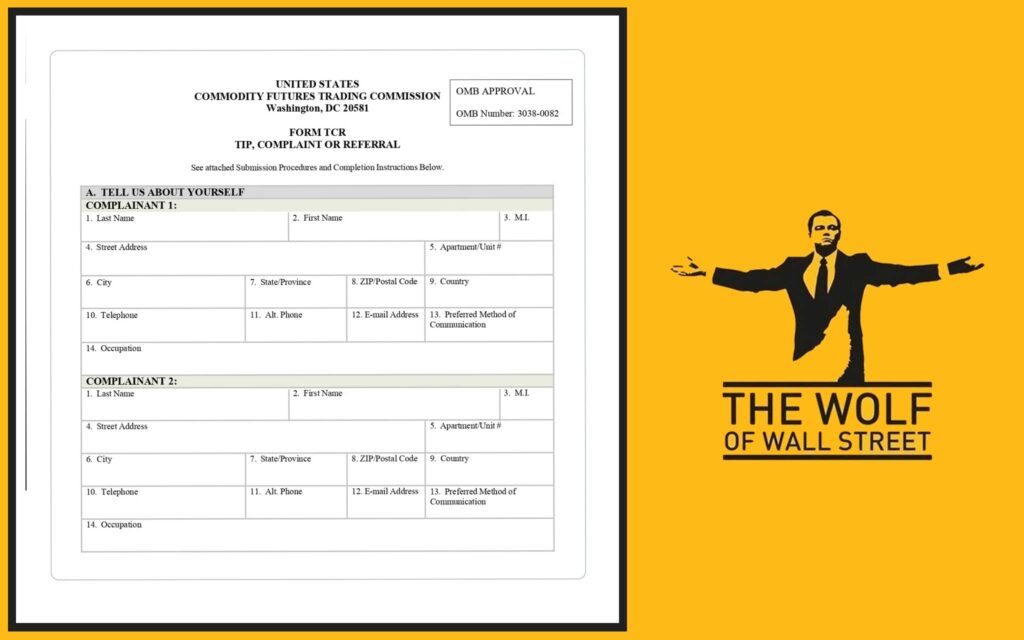

Step 1: The TCR Form – Your Opening Salvo

Everything starts with the Form TCR (Tip, Complaint, or Referral). This is where you (or your lawyer) lay out the details of the misconduct. Be specific. Provide documents, emails, transaction records—whatever proof you have. This is your opening shot; make it count.

Step 2: The Hunt – What Happens During the CFTC Investigation

Once you’ve fired your shot, you wait. The CFTC’s enforcement division will pick up your lead and launch its own covert investigation. This can take months, sometimes years. They’ll subpoena documents, interview witnesses, and build an iron-clad case. Your job is to stay quiet and let the hunters do their work.

Step 3: The Green Light – The “Notice of Covered Action”

If the investigation leads to a successful enforcement action of over $1 million, the CFTC will post a “Notice of Covered Action” on its website. This is your signal. It’s the green light telling you that the money is on the table and it’s time to claim your share.

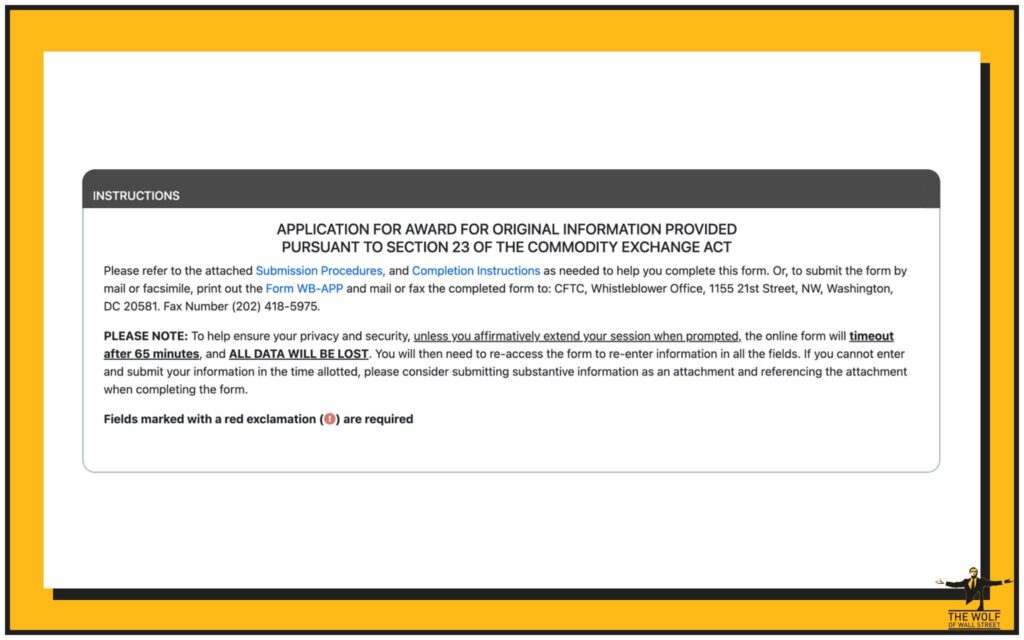

Step 4: The Pay-Off – Filing Form WD-APP to Claim Your Fortune

Once the notice is posted, you have 90 days to file Form WD-APP (Whistleblower Award Application). This form officially connects you to the original tip and makes your case for a reward. Your lawyer will argue why your information was critical and why you deserve the maximum 30% payout.

📈 The New Frontier: Whistleblowing in the Crypto Gold Rush

If you think this is just a Wall Street game, you’re living in the past. The biggest opportunities right now are in the digital asset space, and the CFTC is planting its flag.

Wall Street’s Filthy Secrets Move to Web3

Pump-and-dumps, insider trading, fraudulent ICOs, manipulative exchange bots—all the classic scams that plagued Wall Street for decades have found a new home in crypto. But here’s the kicker: the market is new, unregulated in many ways, and full of unsophisticated investors. It’s a feeding frenzy for sharks, making it a paradise for whistleblowers. Knowing the difference between legitimate market moves and scams is crucial, which is why understanding the tools of the trade, like how to master crypto order types for trading, gives you a massive advantage.

The Tip Tsunami: Why Thousands Are Lining Up to Snitch

The numbers don’t lie. In 2016, the CFTC received about 1,000 tips. By 2023, that number exploded to over 7,000. Why? Because people are waking up and realising the incredible financial power of this programme, especially with the explosion of crypto-related fraud.

By the Numbers: The Explosive Growth from 1,000 to 7,000 Tips

This isn’t a slow trickle; it’s a tidal wave. This growth tells you two things: first, there’s more fraud than ever, and second, the programme is working. The paydays are real, and the word is out. The question is, will you be one of the ones cashing in, or will you be on the sidelines watching?

🛡️ Untouchable: How the Programme Protects Its Most Valuable Assets

Worried about getting caught? Worried about retaliation? Stop thinking like a sheep. The programme was designed by killers, for killers. They protect their assets.

Fort Knox Confidentiality: Your Name is Never Spoken

By law, the CFTC cannot disclose any information that could reasonably identify you. It is one of the strongest confidentiality protections in the world. They will protect your identity from the public, your employer, and even other government agencies, unless in very specific criminal proceeding contexts.

The Anti-Retaliation Shield: They Can’t Touch You

The Dodd-Frank Act also gives you iron-clad anti-retaliation protections. If your employer fires, demotes, harasses, or discriminates against you for reporting to the CFTC, you can sue them for double back pay, legal fees, and reinstatement. They are legally forbidden from touching a hair on your head.

🎯 The Hit List: What Kind of Dirt Is Worth Millions?

The CFTC has a hit list. If you have information on any of these, you’re sitting on a potential goldmine.

The Usual Suspects: Spoofing, Insider Trading, and Corruption

This is the bread and butter. “Spoofing” is placing large orders to create a false appearance of market interest and then cancelling them. Insider trading is using non-public information to make a profit. Any form of bribery or corrupt practices is also high on their list.

The Crypto Crime Wave: Digital Currency Fraud and Manipulation

This is the hot zone. The CFTC is aggressively pursuing fraud in the digital asset markets. This includes everything from unregistered crypto futures products to platforms that misuse customer funds (sound familiar?). If you know which exchange is a house of cards, your information is invaluable. Staying clean in this environment is paramount, which is why a solid grasp of compliance, detailed in our crypto AML guide for 2025, is non-negotiable.

Unmasking the Big Players: Bank Secrecy Act Violations

This involves anti-money laundering (AML) failures. If a financial institution or crypto exchange isn’t properly monitoring and reporting suspicious activity, they’re breaking the law. Exposing this kind of systemic failure can lead to massive sanctions.

🐺 The Wolf’s Counsel: How to Play and Win

Now for the real talk. Information is one thing; knowing how to use it is everything.

Don’t Be a Lone Wolf: Why You Need a Winning Team

Trying to navigate this process alone is financial suicide. You need a top-tier whistleblower lawyer. You also need to be part of a network that understands the market inside and out. You can’t spot anomalies if you don’t know what “normal” looks like.

Information is Power. Money is Just the Scorecard.

The ultimate asset is information. The money is just how we prove who’s winning. In the crypto markets, information moves at the speed of light. You either have the right intel at the right time, or you’re the one left holding the bag.

The The Wolf Of Wall Street Edge: Where the Real Players Get Their Intel

So how do you get that edge? You join a pack of wolves. You immerse yourself in a community that lives and breathes this stuff. The The Wolf Of Wall Street crypto trading community is exactly that—a platform for winners. You get:

- Exclusive VIP Signals: Proprietary intel designed to maximise trading profits.

- Expert Market Analysis: Insights from traders who have been in the trenches for years.

- A Private Community: Over 100,000 members sharing real-time insights. You’re never alone.

- Essential Trading Tools: Resources like volume calculators to make stone-cold, informed decisions.

This is how you get the context to spot the scams. This is how you sharpen your instincts. Empower your journey by visiting our service page or joining the real-time discussion on our Telegram channel. Stop guessing and start knowing.

🤔 Your Burning Questions Answered (FAQ)

Let’s clear up the last few things holding you back.

What are the most common scams people report?

The most common violations include market manipulation (like spoofing), digital asset fraud, pump-and-dump schemes, and violations of the Bank Secrecy Act, which usually relates to poor anti-money laundering controls at exchanges and financial firms.

How solid is the confidentiality promise, really?

It’s as solid as it gets. The CFTC is legally bound to protect your identity. It’s one of the cornerstones of the programme’s success. Without it, nobody would come forward. They have a vested interest in keeping you anonymous.

What if my claim gets denied? Do I have another shot?

If your award claim is denied, you have the right to appeal. Your lawyer can request the records the CFTC used to make its decision and file an appeal with the Commission. If that fails, you can even take your case to the Federal Court of Appeals. The fight isn’t over until you say it is.

There you have it. The choice is yours. You can sit on what you know and watch someone else get rich, or you can step up, take control, and claim the fortune you’re entitled to with the CFTC Whistleblower Program.