Introduction: The Unexpected Move by CZ

Changpeng Zhao, the enigmatic former CEO of Binance, is back in the headlines, and this time, it’s not about launching a new crypto token or expanding Binance’s global footprint. Instead, Zhao, often known as CZ, has confirmed that he has applied for a presidential pardon from Donald Trump — a move that has raised eyebrows across the cryptocurrency community.

Just two years ago, CZ was convicted of money laundering, resulting in a $4.3 billion fine for Binance and a $50 million personal payout. After initially denying reports of seeking a pardon, CZ has now acknowledged that he filed the request. But why the sudden change of heart? And what does this mean for Binance, its investors, and the broader crypto market?

Let’s break it down.

🌐 1. The Rise and Fall of Changpeng Zhao

Changpeng Zhao didn’t just build Binance; he personified it. Rising from a background in tech and finance, Zhao quickly became the face of the largest cryptocurrency exchange in the world.

In 2023, however, everything came crashing down. The US Department of Justice charged Zhao with money laundering, accusing him of using Binance to funnel illicit funds in violation of the Bank Secrecy Act. Zhao struck a plea deal, agreeing to pay $50 million and serve four months in prison.

The scandal not only tarnished Zhao’s reputation but also shook Binance to its core. Binance was hit with a record $4.3 billion fine, and Zhao was barred from holding any managerial position in the company.

But Zhao isn’t the type to quietly fade into the background. Since his release, he has been working as a blockchain advisor for governments in Pakistan and Kyrgyzstan, effectively rebuilding his influence without officially holding a position at Binance.

💥 2. The Presidential Pardon Request: Why Now?

So why is Zhao seeking a pardon now, especially after initially denying it?

The answer lies in a strategic move reminiscent of Trump’s controversial 2024 pardons of the BitMEX founders. In 2024, Trump granted clemency to three BitMEX executives convicted of violating anti-money laundering laws — a case that closely mirrors Zhao’s legal troubles.

Initially, Zhao distanced himself from the pardon rumours, stating that he had no intention of filing one. But as reports of his legal team’s efforts began to surface, Zhao had to come clean. In March 2025, he publicly acknowledged that he had indeed applied for a presidential pardon.

The move is a calculated gamble. By aligning his request with the precedent set by BitMEX, Zhao is effectively banking on Trump’s willingness to pardon high-profile crypto figures. But unlike the BitMEX founders, Zhao’s case involves significantly larger sums of money and a higher degree of regulatory scrutiny.

🧐 3. Strategic Implications for Binance

The potential outcomes of Zhao’s pardon request present a double-edged sword for Binance.

If the Pardon Is Granted:

- Zhao could theoretically return to Binance in a managerial capacity, although he has stated publicly that he has no intention of reclaiming his CEO role.

- Binance.US could leverage Zhao’s expertise to regain market share, especially in the face of rising competition from Coinbase and Kraken.

- Investor sentiment may stabilise, leading to a potential recovery in Binance’s BNB token.

If the Pardon Is Denied:

- Binance may continue to face regulatory pressure, with Zhao’s legal troubles casting a long shadow over the exchange.

- Competitors will likely capitalise on Binance’s instability, positioning themselves as more regulatory-compliant alternatives.

- Investor confidence could take another hit, particularly if further legal actions are initiated against Binance or its executives.

📉 4. Market Reactions: Investor Sentiment and Public Perception

Since Zhao’s confirmation of the pardon request, Binance’s BNB token has experienced fluctuating trading volumes. Investors are divided — some view the request as a sign of desperation, while others see it as a strategic play that could potentially clear Zhao’s criminal record and stabilise Binance’s operations.

Market analysts have also noted that Binance’s competitors are ramping up their marketing efforts, using Zhao’s legal issues as a cautionary tale to attract more cautious investors. This is evident in the way exchanges like Kraken and Coinbase are emphasising regulatory compliance in their recent campaigns.

For more insights on how market sentiment affects trading decisions, check out our Trading Insights section.

📅 5. Timeline of Zhao’s Legal Troubles

- 2023, November: Zhao is convicted of money laundering under the Bank Secrecy Act. Binance is fined $4.3 billion, and Zhao personally pays $50 million.

- 2024, March: Reports surface that Zhao is seeking a presidential pardon. Zhao denies the allegations.

- 2025, March: Zhao confirms the pardon request, citing Trump’s pardons of BitMEX founders as a motivating factor.

- 2025, May: Trump’s camp remains silent on the pardon request, and the crypto community is left speculating.

🔥 6. Comparison with Similar Crypto Scandals

BitMEX Founders:

- Pardoned in 2024 after being convicted of money laundering.

- Trump’s decision set a precedent for Zhao’s request.

Ross Ulbricht (Silk Road):

- Requested a pardon for life imprisonment but was denied.

Charlie Shrem (Bitcoin Foundation):

- Served two years for unlicensed money transmission. Denied a pardon in 2018.

📈 7. What Happens Next? Potential Scenarios

- Scenario 1: Pardon granted — Zhao regains influence but opts to remain an advisor rather than a CEO.

- Scenario 2: Pardon denied — Zhao’s reputation takes another hit, and Binance distances itself further from its founder.

- Scenario 3: Pardon delayed — Uncertainty continues, causing volatility in Binance’s market position.

🎯 8. Key Takeaways and What to Watch For

- Zhao’s Presidential Pardon: Trump’s previous pardons suggest a possible path forward, but the stakes are higher this time.

- Market Implications: Binance’s BNB token may continue to experience volatility until the pardon decision is finalised.

- Regulatory Scrutiny: Regardless of the pardon, Binance remains under the regulatory microscope.

- Investor Sentiment: The outcome of Zhao’s request could either stabilise or further destabilise investor confidence in Binance.

For ongoing updates and in-depth analysis, visit our News and Policies sections.

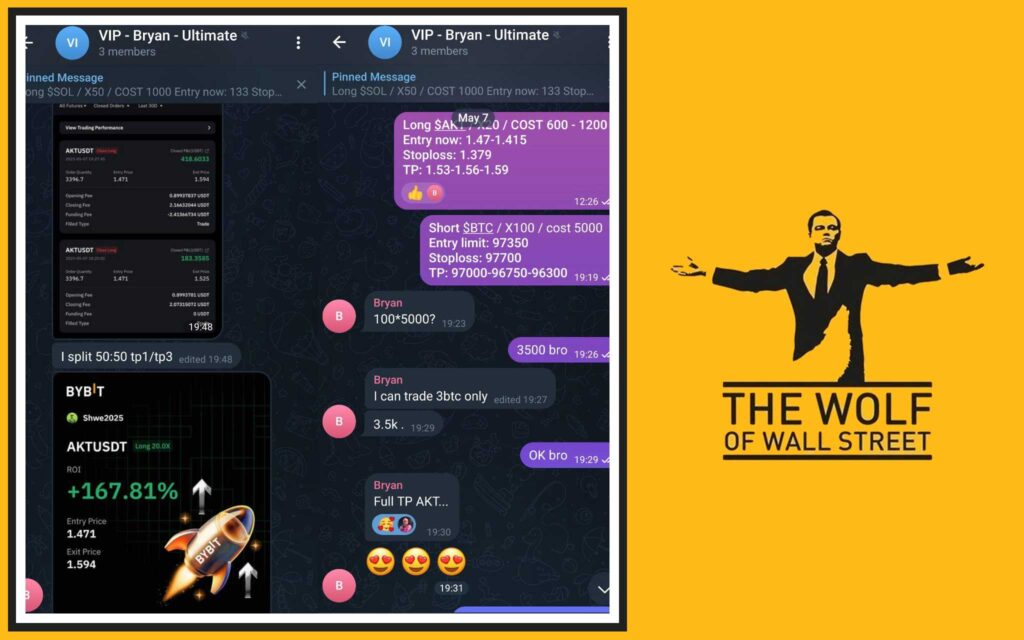

🔗 Stay Ahead of the Curve with The Wolf Of Wall Street

Want to make smarter trading decisions in these uncertain times? Join The Wolf Of Wall Street Crypto Trading Community and access:

- VIP Signals: Real-time trading alerts to maximise profits.

- Expert Analysis: In-depth market insights and forecasts.

- Private Community: Connect with over 100,000 traders worldwide.

Ready to level up your crypto trading game? Visit our Telegram Community for exclusive updates and insights.

✅ FAQs About Zhao’s Pardon Request

- Why is Changpeng Zhao seeking a presidential pardon?

To potentially clear his record and regain a strategic position in Binance. - How could a pardon impact Binance’s regulatory status?

It could stabilise investor sentiment but wouldn’t erase Binance’s regulatory challenges. - What precedent does Trump’s previous pardons set?

The BitMEX founders’ pardon suggests a potential path forward for Zhao. - What’s the current status of Zhao’s request?

As of now, Trump has not officially responded to the request. - Could Zhao return as Binance CEO if pardoned?

Unlikely, but he may continue to influence Binance as an advisor.