🚀 Introduction: Welcome to the New Age of Crypto Law

You’re not here for a bedtime story. You’re here for an edge. And if you want to make serious moves in crypto, you can’t afford to ignore the seismic shift that’s hitting the industry right now: the CLARITY Act, unleashed during Crypto Week 2025 in Washington.

For years, the crypto world has been one giant legal grey zone. Ambiguity was the game. Uncertainty was the house edge. But what if I told you that edge just swung in favour of the smart, the hungry, the relentless? That’s what the CLARITY Act promises—real rules, real opportunity, and real profit for those who move fast.

🏛️ The CLARITY Act – No More Guesswork for Crypto Regulation

Here’s the reality: Crypto has been the Wild West—no sheriff, too many outlaws, and every regulator with a different badge. The CLARITY Act (officially, the Digital Asset Market Structure Clarity Act) is the law the market has been begging for. Forget vague threats and arbitrary enforcement. This is regulatory certainty—served hot.

It’s the first US law to draw a hard line: who’s in charge, what’s regulated, and how the game gets played. You want to build? You want to trade? Now you know the rules, and the winners are those who master them first.

🔍 Why the CLARITY Act Exists – What Was Broken?

Simple: Confusion kills innovation. The battle between the SEC and CFTC was costing everyone—startups hesitated, institutions sat on the fence, and everyday traders bled money trying to read between the lines.

The SEC claimed everything was a security. The CFTC said, “Not so fast.” Exchanges and projects were caught in the crossfire. This wasn’t just bad for business—it was a chokehold on the entire US digital asset market.

📈 Crypto Week 2025: A Turning Point for Digital Assets

Crypto Week in DC wasn’t some backroom conference. It was the Super Bowl for digital finance. Lawmakers, billionaires, and the biggest brains in blockchain—everyone had skin in the game.

The CLARITY Act dominated every panel, every headline, every late-night negotiation. Why? Because the US finally decided it wanted to win the global crypto race—and this bill is its opening gambit.

👥 Who’s Behind the Bill? The Power Players You Need to Know

Don’t kid yourself: Legislation this big doesn’t happen without heavy hitters. Representative French Hill spearheaded the Act, but this was a bipartisan push with power from both sides.

You’ve got SEC and CFTC chiefs, Wall Street lobbyists, and crypto-native visionaries all at the table. This isn’t politics as usual. This is business—on a scale that changes industries overnight.

Dive deeper into crypto regulations in Latin America and the Genius Act: Stablecoin Regulation 2025 for global context.

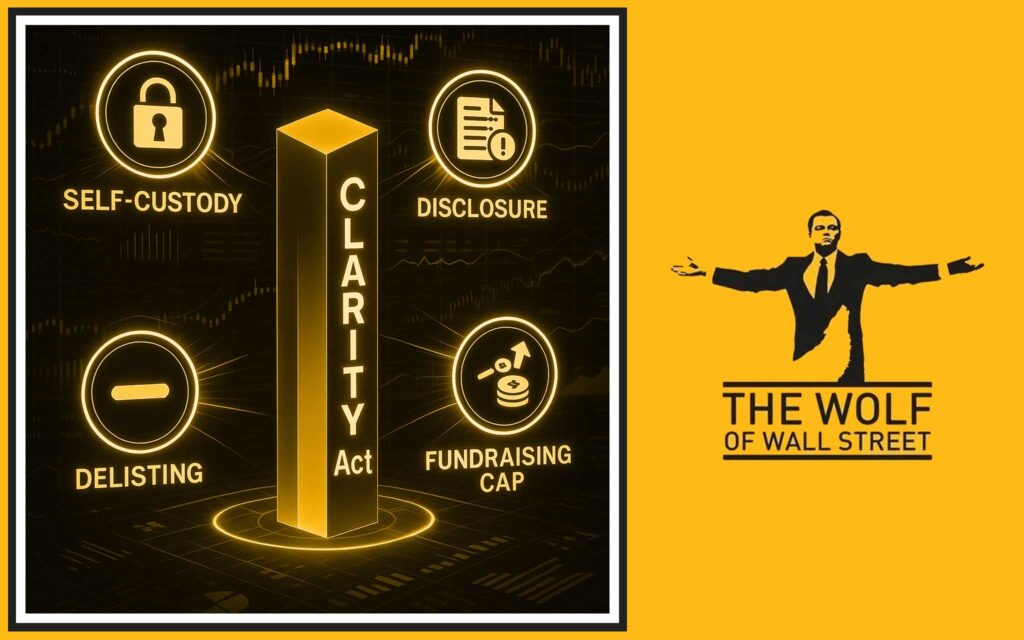

📜 CLARITY Act at a Glance – The Key Provisions

Let’s cut to the facts. The CLARITY Act isn’t just legal jargon; it’s the rulebook for the next decade:

- Clear Definitions: What’s a digital asset? What’s a commodity? What’s a blockchain? Now, there’s one answer—and the IRS, SEC, CFTC all have to play by it.

- Investment Contract Assets: The wildest innovation—tokens that start as securities can become commodities as they decentralise. This is the bridge every serious project has been begging for.

⚖️ The Regulatory Divide – SEC vs CFTC: Finally Decided?

Here’s the punchline:

- SEC regulates initial investment offerings (think token launches, ICOs).

- CFTC controls the market for decentralised tokens, commodities, and derivatives.

If a project proves it’s “sufficiently decentralised,” it can level up—move out from SEC jail and into the world of CFTC-regulated commodities. That’s game-changing for anyone building the next Ethereum, Solana, or whatever comes next.

Want a full breakdown on the CFTC’s role? Check the CFTC whistleblower programme and its seven-figure payouts.

🚀 How the Act Impacts Crypto Startups and Projects

Listen: If you’re launching, building, or listing tokens, this is your green light—if you’re ready to play by the rules.

- Fundraising Caps: Launch your project and raise up to \$75 million with an exemption from SEC registration—if you follow transparency rules.

- Registration: No more flying under the radar. Platforms need to register, disclose, and play fair.

- Exemptions: Hit the right milestones? You get streamlined paths to compliance.

If you’re a builder, check out how to create a crypto token and crypto token listing process to move fast and smart.

🛡️ Compliance and Investor Protections: Not Just Lip Service

Real talk: This Act isn’t just about big players—it’s built for everyone in the trenches.

- Self-Custody Protections: You control your keys, you control your crypto. The law protects your right to hold assets yourself.

- Disclosure Mandates: Projects must disclose what’s happening on-chain, off-chain, and in between.

- Delisting Processes: Regulators can now cooperate to delist risky or scam tokens.

For traders, this means less “rug pull” risk and more trust. For platforms, it means transparency isn’t optional; it’s survival.

Need more on compliance? Dig into crypto AML compliance strategies for the new world order.

🏃♂️ Practical Scenarios: How the Act Hits the Ground

Let’s get concrete.

- Scenario 1: A token launches as a security. Over two years, it decentralises its governance, hits the criteria, and becomes a commodity—opening up new trading opportunities on CFTC-regulated exchanges.

- Scenario 2: An exchange listing 200 tokens now knows exactly which need SEC oversight and which are “safe” as commodities—reducing legal risk overnight.

- Scenario 3: A DeFi project operating in the grey now gets a shot at mainstream adoption—if it proves decentralisation.

Want to get ahead? Start with crypto market insights and stay on top of trending regulations.

🌍 The US vs The World – International Standards and AML

The CLARITY Act isn’t just playing catch-up.

It’s the US staking its claim as a global leader in digital finance. The bill pushes for international coordination on anti-money laundering, matching the standards set by powerhouses like the EU and Singapore.

It’s about raising the bar—and forcing global rivals to keep pace or fall behind.

Get the full picture on cryptocurrency regulations worldwide and the evolving ecosystems shaping the game.

💸 The Wolf Of Wall Street: Profiting in the Post-CLARITY Act Era

You want to win? You need an edge.

That’s why the savviest traders join the The Wolf Of Wall Street crypto trading community—where regulation meets ruthless opportunity.

Here’s what The Wolf Of Wall Street members get that most traders only dream of:

- Exclusive VIP Signals to maximise profits in volatile markets

- Expert Analysis from seasoned crypto veterans

- Private Network of 100,000+ members sharing real, actionable insight

- Trading Tools like volume calculators for sharper decisions

- 24/7 Support because money never sleeps

If you’re serious, don’t just read about the market—own it.

Plug into our Telegram community for real-time updates and discussions. Take your seat at the big table.

💥 Critics in the Spotlight – Who’s Throwing Shade?

No big move is without its haters. Critics argue the Act weakens the SEC, could let big tech skirt protections, and risks creating new confusion instead of clarity.

Senator Elizabeth Warren, consumer groups, and a few former regulators are making noise. Their concerns? Investor safety, loopholes, and whether “decentralisation” can be gamed.

🗣️ Counterarguments: Why the Critics Might Be Dead Wrong

Let’s be blunt. Most criticism boils down to fear—fear of change, fear of disruption, fear of new money entering old systems.

The truth? This Act unlocks innovation, creates real safeguards, and brings institutions off the sidelines. The alternative is US irrelevance while other nations eat our lunch.

Want the bull and the bear take? The crypto profit-taking wolf’s guide lays out how to see through the noise.

🏛️ What’s Next? Senate Showdown and the Road Ahead

Don’t think the show’s over. The bill now heads to the Senate for a high-stakes battle—amendments, negotiations, and White House pressure all on the table.

Expect tweaks to investor protections, possible carve-outs for DeFi, and a lot of lobbying from every major industry player.

Timeline? Aggressive. The US wants first-mover advantage—expect fireworks before the year is out. Stay sharp with latest crypto news and policies.

🥇 Who Wins, Who Loses? Real Impact on the Market

Let’s count the chips.

Winners:

- Startups – Clear compliance paths, no more regulatory limbo

- Retail investors – Stronger protections, transparency, real rights to self-custody

- Institutions – Predictable rules, bigger bets, deeper liquidity

- US economy – Staying ahead in the blockchain arms race

Losers:

- Regulatory arbitrageurs – No more hiding in the gaps

- Bad actors – Disclosure and delisting will squeeze scams out fast

- Complacent platforms – Those who don’t adapt, die

🤔 FAQs: The CLARITY Act and Your Crypto Future

How does the CLARITY Act affect my trading?

It creates more predictable, safer markets—no more overnight delistings or surprise lawsuits. That means smarter, more confident trading.

Will DeFi finally get legit?

If you decentralise and play by the new rules, DeFi is on the path to mainstream adoption. The Act lays the foundation.

Is self-custody protected?

Absolutely. The law enshrines your right to hold your own assets. For the full breakdown, check our self-custody vs centralised crypto cards guide.

What about existing tokens?

Tokens already on the market can qualify for new status if they meet decentralisation standards—potentially unlocking major upside.

Where can I get the edge?

Join The Wolf Of Wall Street for VIP signals, pro analysis, and a network of traders who don’t just talk—they win.

🏆 Key Takeaways & Action Plan – Don’t Just Watch, Win

- The CLARITY Act is the biggest regulatory overhaul in crypto history—play it right, and the edge is yours.

- Understand the rules, use the tools, and plug into communities like The Wolf Of Wall Street for real-time advantage.

- Keep learning: crypto compliance strategies, DeFi regulation, and how to buy crypto are just the start.

💡 Conclusion: The CLARITY Act Isn’t Just Law – It’s a Mindset Shift

This isn’t just paperwork—it’s a paradigm shift.

Winners see opportunity where others see risk. The CLARITY Act clears the fog and opens the throttle for innovation, investment, and bold new plays.

Whether you’re a builder, trader, or investor—this is your green light. Grab it. Don’t look back.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.