🔥 Introduction: The New Era of Trading

Listen up—Coinbase just dropped a bomb on both Wall Street and Crypto Valley. This isn’t your average new product announcement. We’re talking about the Mag7 + Crypto Equity Index Futures, launching September 22.

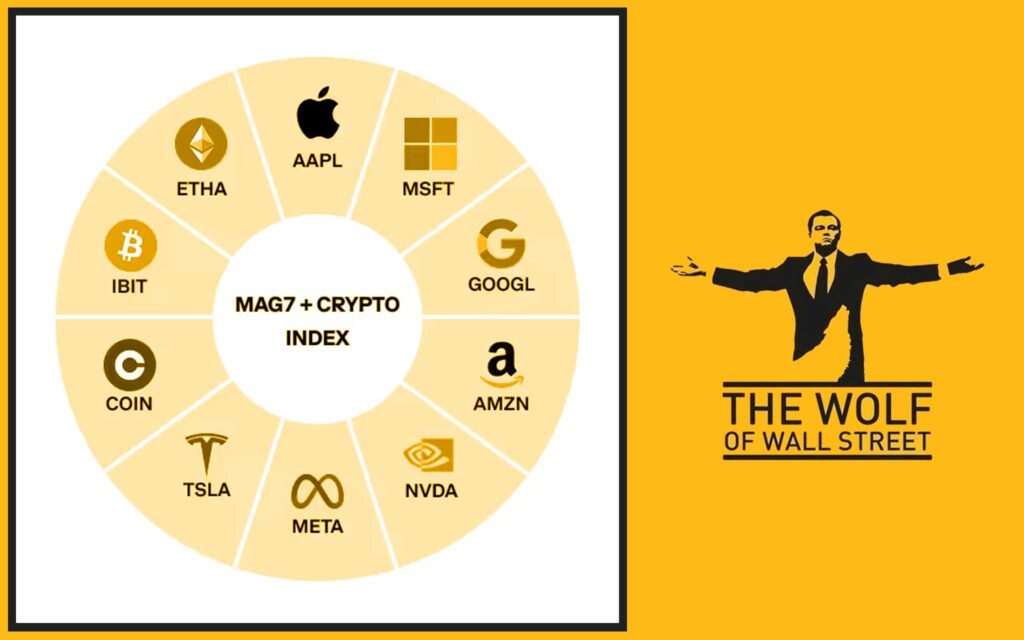

Imagine one futures contract that gives you exposure to Apple, Tesla, Microsoft, Amazon, Meta, Alphabet, Nvidia, plus BlackRock’s Bitcoin ETF, Ether ETF, and Coinbase stock. Ten juggernauts, each locked at a 10% weighting, packaged neatly into one explosive derivative.

This is more than a product—it’s a market-shifting event. Coinbase isn’t just playing the game anymore. They’re rewriting the damn rules.

🤔 What Exactly Is the Mag7 + Crypto Equity Index Futures?

Let’s break this beast down:

- The Magnificent 7 tech stocks: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla.

- BlackRock ETFs: Bitcoin Trust + Ethereum Trust.

- Coinbase stock: because why not add their own play?

Every component carries a 10% equal weight. No single stock or ETF dominates—balanced exposure, all in one contract.

Instead of buying 10 separate positions, you ride them all through one streamlined product.

💥 Why This Product Is a Game-Changer

This is the first U.S.-listed futures product that blends tech equities with crypto ETFs.

Think about the implications:

- Hedge funds get diversification without complexity.

- Retail traders get a way to bet on tech and crypto in one shot.

- Coinbase plants its flag as the first mover.

This isn’t just efficient. It’s innovative leverage. The Wall Street suits and the hoodie-wearing crypto degens are about to trade on the same battlefield.

⚙️ The Mechanics of the Index

Here’s how the machine works:

- Contract size: $1 × index value.

- Settlement: Cash-settled, monthly expiration.

- Rebalancing: Quarterly, managed by MarketVector, a reputable index provider.

Translation: you don’t mess around with actual shares or coins. You’re trading pure exposure, with liquidity and transparency baked in.

🎯 Who Gets First Dibs?

Institutions. The big boys. Hedge funds, asset managers, pension funds—they get the first taste.

Retail traders? Hang tight. Coinbase has made it clear: access for individual traders is coming in the months ahead. This two-phase rollout isn’t random. It’s smart. Institutions bring liquidity, and retail brings volume. Both win.

🌍 Coinbase’s Bigger Game Plan: Becoming the “Everything App”

Brian Armstrong isn’t shy about the vision. Coinbase wants to be the crypto super app. Trading, wallets, payments, even social features.

And the $2.9 billion acquisition of Deribit, the world’s leading crypto options exchange, was the launchpad. With this futures index, Coinbase is building infrastructure for the next decade of trading.

This isn’t just a product launch—it’s a step toward an empire.

📈 Record Volumes: Proof of Momentum

Coinbase isn’t rolling this out in a vacuum. Derivatives trading on their platform is already exploding:

- Daily volumes hit $5B+ consistently.

- Peak days? $9.9B in volume.

The appetite for futures is red-hot. And with this index, Coinbase is pouring gasoline on the fire.

🔗 Why Tech + Crypto Is the Perfect Fusion

Let’s call it like it is: tech and crypto are cousins in volatility and growth.

- Tech stocks = established innovators with earnings power.

- Crypto = the frontier with unlimited upside.

When you fuse them? You get diversification plus torque. Traders crave that mix of stability and speculation.

🥊 Competitors Are Watching: Kraken’s Countermove

Coinbase isn’t the only shark in the water. Kraken just bought NinjaTrader to beef up its derivatives business.

But here’s the difference: Kraken offers crypto derivatives. Coinbase? They’re blending Wall Street’s crown jewels with crypto’s rocket fuel. That hybrid angle is the differentiator.

💼 Institutional Angle: Hedge Funds, Asset Managers, Big Money

Institutions are salivating for this. Why?

- Capital efficiency: one contract, ten assets.

- Risk management: hedge tech and crypto exposure in one move.

- Regulatory credibility: first U.S.-listed product of its kind.

This isn’t exotic anymore. This is Wall Street-grade diversification, wrapped up in a futures bow.

🧑💻 Retail Angle: What’s In It for You?

When retail access opens, traders get:

- One-click exposure to the most hyped assets on Earth.

- Simplified diversification without buying 10 separate tickers.

- Leverage opportunities—with the right risk controls.

But let’s be clear: this isn’t “get rich quick.” Futures cut both ways. Know your tools before you swing.

⚠️ The Risk Factor: Don’t Ignore the Downside

Trading futures is like driving a Ferrari. You look slick, you move fast—but crash once, and it’s ugly.

Risks here include:

- Leverage blow-ups.

- Correlation risk: when tech and crypto crash together.

- Regulatory changes shifting contract availability.

Bottom line? Education and discipline matter. Or you’ll end up funding someone else’s win.

🔍 The Regulatory Spotlight

You better believe the regulators are circling.

- SEC and CFTC will scrutinize this hybrid beast.

- Questions around how crypto ETFs integrate with equities in one product.

- If Coinbase clears the compliance hurdles, it cements credibility.

If not? Expect legal tussles.

🧠 Market Psychology: Why Traders Will Flock

Let’s not kid ourselves. Traders aren’t just rational. They’re emotional animals.

- FOMO: first-of-its-kind product.

- Prestige: trading the shiny new toy.

- Narrative power: “I’m in on both tech + crypto at once.”

This is why liquidity will flood in. Narrative + novelty = volume.

🚀 Strategic Impact on Coinbase

This launch positions Coinbase as more than a crypto exchange. It’s a global derivatives powerhouse.

- Expands beyond spot markets.

- Locks in institutional credibility.

- Builds infrastructure for retail dominance.

This is how Coinbase transitions from exchange to financial empire.

🌐 Strategic Impact on the Market

Make no mistake—this is the first domino.

- Expect CME, Nasdaq, and others to follow with hybrid futures.

- Blurred lines between TradFi and DeFi are inevitable.

- The future is convergence. Coinbase just lit the fuse.

📚 Practical Guide: How to Prepare as a Trader

Here’s how you gear up for this launch:

- Study futures mechanics. Know the rules before you play.

- Understand index components. Tech + crypto have different drivers.

- Risk management: use stop losses, volume calculators, and position sizing.

- Plug into communities (hint: see The Wolf Of Wall Street below).

Smart preparation = survival and profit.

🔑 The Wolf Of Wall Street Advantage

If you’re serious about playing in these markets, don’t do it blind. The The Wolf Of Wall Street crypto trading community is your insider edge:

- Exclusive VIP signals to spot trades before the herd.

- Expert analysis from seasoned crypto traders.

- Private network of 100,000+ members sharing strategies.

- Trading tools like volume calculators to sharpen execution.

- 24/7 support when the markets get wild.

👉 Join the Telegram community for real-time updates and strategies.

Also check:

❓ FAQs: Straight Answers, No Fluff

Q1: What makes this different from regular futures?

It fuses tech equities and crypto ETFs in one contract—first in the U.S.

Q2: When will retail access open?

Institutions first, retail coming in the months ahead.

Q3: Is this safe for beginners?

Not without education. Futures are high-risk, high-reward.

Q4: How often does the index rebalance?

Quarterly, handled by MarketVector.

Q5: Can this be used for hedging?

Absolutely. Hedge crypto with tech exposure, or vice versa.

🏁 Conclusion: The Takeaway

Coinbase just detonated the old barriers between equities and crypto. With the Mag7 + Crypto Equity Index Futures, they’re giving institutions—and soon, retail traders—one contract that does it all.

This isn’t just another derivative. It’s the blueprint for the future of trading.

For traders: opportunity on steroids.

For institutions: efficient, diversified exposure.

For the market: the start of a fusion era.

Bottom line? Get informed. Get ready. Or get left behind.