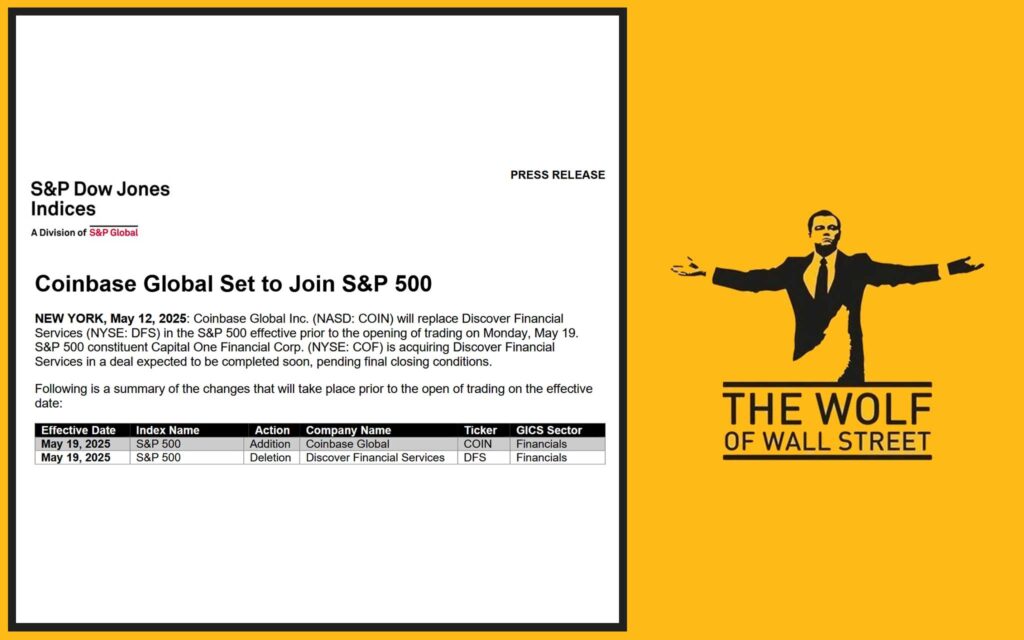

Cryptocurrency just got a seat at the big table. Coinbase Global, the crypto giant, is officially joining the S&P 500 on May 19, 2025. This is a historic milestone for both the company and the entire digital asset industry. For the first time ever, a cryptocurrency firm will be part of the elite 500 companies that make up this prestigious index. So, what does this mean for Coinbase, the broader crypto market, and traders looking to capitalise on this shift? Let’s break it down.

🚀 What Does Coinbase’s S&P 500 Inclusion Mean?

The S&P 500 isn’t just any index — it’s the gold standard of the American stock market. It tracks the performance of the top 500 publicly traded companies, representing approximately 80% of the total US stock market value.

To be included, companies must meet stringent criteria, including:

- Market cap exceeding $13.1 billion.

- Positive earnings in the most recent quarter and over the past year.

- High liquidity and significant trading volume.

Coinbase’s market cap hit $52.8 billion following the announcement, positioning it comfortably within the lower tier of the S&P 500.

📈 How Did Coinbase Perform Before the Announcement?

Before the S&P 500 announcement, Coinbase’s stock price surged by 8.8% in after-hours trading. The stock closed at $225.4 per share, a significant jump that reflects investor confidence.

In terms of market cap, Coinbase now sits at $52.8 billion, surpassing some long-standing S&P 500 members. This inclusion not only boosts Coinbase’s profile but also validates the crypto sector as a whole, signalling a shift in mainstream acceptance.

For more on how major crypto firms are impacting the market, check out Cryptocurrencies.

💥 How Will S&P 500 Inclusion Impact Coinbase’s Stock?

Let’s not mince words here — being in the S&P 500 is a massive deal. Index funds that track the S&P 500 are now required to buy Coinbase shares, which could lead to a sustained price surge.

Potential impacts include:

- Increased volatility: With more institutional investors entering the fray, expect greater price swings.

- Heightened scrutiny: Regulatory bodies will keep a closer eye on Coinbase’s operations.

- Market expectations: As a member of the S&P 500, Coinbase will now be held to higher financial standards.

This is where traders need to stay sharp. Want real-time updates and trading insights? Head over to Trading Insights.

🧐 What This Means for Crypto Firms Eyeing S&P 500 Inclusion

Coinbase isn’t just blazing a trail; it’s setting a precedent for other crypto firms. If Coinbase can make the cut, who’s next? Potential contenders include:

- MicroStrategy (MSTR): Heavy on Bitcoin but suffered a $4.2 billion loss in Q1 2025.

- Ripple Labs (XRP): Strong performance despite regulatory challenges.

- Square (SQ): Integrating crypto into mainstream finance.

📉 Risks and Challenges: The Dark Side of S&P 500 Inclusion

For every silver lining, there’s a cloud. Coinbase’s inclusion in the S&P 500 is a double-edged sword.

Potential Risks Include:

- Regulatory pressure: The SEC has been cracking down on crypto firms, and Coinbase is now firmly in the spotlight.

- Market volatility: S&P 500 inclusion attracts institutional investors, who are less forgiving of poor earnings reports.

- Operational challenges: As a listed entity, Coinbase must now meet quarterly earnings expectations or risk a sell-off.

For traders looking to navigate this volatility, The Wolf Of Wall Street Crypto Trading Community provides VIP signals and expert analysis. Learn more at The Wolf Of Wall Street.

🛠️ Coinbase vs. Discover Financial: A Strategic Swap

In a move that underscores the changing tides of finance, Coinbase is replacing Discover Financial (DFS) in the S&P 500. Why? Because Discover has underperformed, posting declining earnings and struggling with bad debt.

| Metric | Discover Financial | Coinbase |

|---|---|---|

| Market Cap | $23.5 billion | $52.8 billion |

| Share Price | $98.30 | $225.40 |

| Revenue Growth | -4% | +12% |

🔥 Industry Reactions: What Are Analysts Saying?

John Davidson, a financial strategist at Goldstone Capital, states:

“Coinbase’s inclusion is symbolic, but it doesn’t erase the inherent volatility of crypto markets. Investors need to remain cautious.”

Expect more commentary as analysts dissect the broader market implications.

💡 The Wolf Of Wall Street Crypto Trading Community: Navigating the Market Volatility

Navigating the crypto landscape can be complex, especially with seismic shifts like this one. The The Wolf Of Wall Street Crypto Trading Community offers tools to help traders stay ahead of the curve:

- Exclusive VIP Signals: Access proprietary trading signals.

- Expert Market Analysis: Get insights from seasoned crypto traders.

- 24/7 Support: Round-the-clock guidance from experts.

Ready to elevate your trading game? Join the The Wolf Of Wall Street community at The Wolf Of Wall Street.

🏆 How Coinbase’s Inclusion Validates the Crypto Sector

Coinbase’s S&P 500 inclusion is more than just a market move — it’s a cultural shift. It signals that digital assets are no longer on the fringe but are now part of the mainstream financial conversation.

For other crypto firms, this could pave the way for more widespread acceptance and integration into traditional indices.

📊 Data Snapshot: Coinbase’s Financial Performance in 2025

| Metric | Before Announcement | After Announcement |

|---|---|---|

| Share Price | $207.30 | $225.40 |

| Market Cap | $48.6 billion | $52.8 billion |

| Trading Volume | 3.8 million | 5.2 million |

📅 Timeline of Coinbase’s S&P 500 Journey

- January 2025: Coinbase announces record earnings.

- April 2025: Rumours of S&P 500 inclusion circulate.

- May 19, 2025: Official inclusion date.

🎯 Conclusion: A Defining Moment for Crypto and Traditional Finance

Coinbase’s S&P 500 inclusion is a watershed moment for both the firm and the broader crypto market. It’s a clear signal that digital assets are now part of mainstream finance.

For those looking to capitalise on these shifts, now is the time to sharpen your trading strategy and stay informed. Stay ahead of the curve with the latest updates and expert insights at The Wolf Of Wall Street.

The Wolf Of Wall Street Crypto Trading Community offers tools to navigate market volatility, including VIP signals, market analysis, and 24/7 support. Join the community at The Wolf Of Wall Street or on Telegram at https://t.me/tthewolfofwallstreet.