🔥 Introduction – The Money Game in Motion

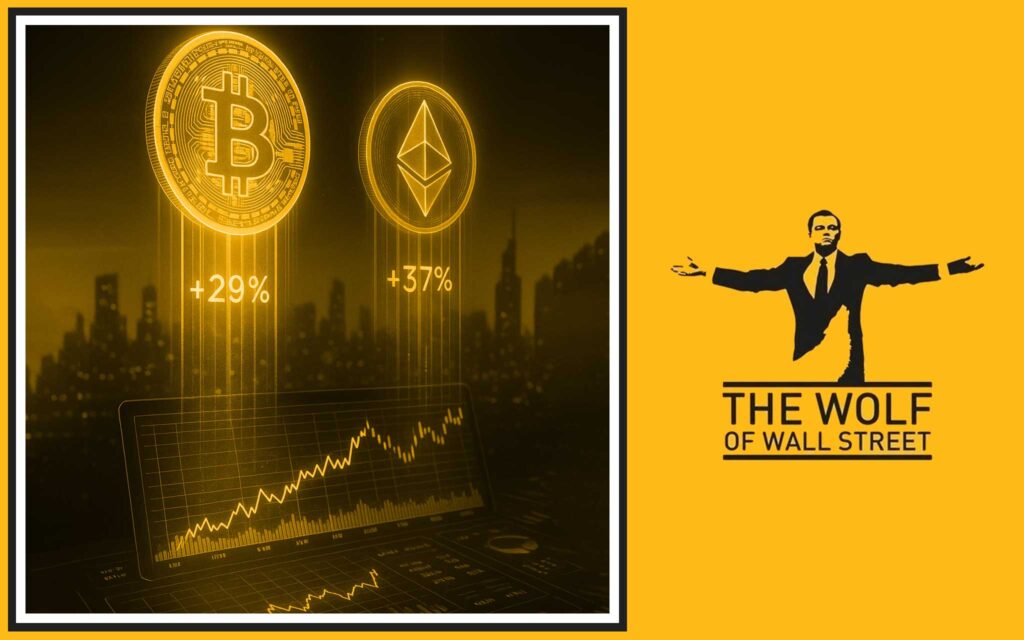

Listen up — if you’re in crypto and you’re not paying attention to CoinShares right now, you’re asleep at the wheel. In Q2 2025, CoinShares just pulled off a 26% jump in assets under management (AUM), skyrocketing to $3.46 billion. And guess what? That’s with Bitcoin exploding +29% and Ethereum ripping +37% in the same quarter. Net profits? Up to $32.4 million. This isn’t background noise — this is a wake-up call.

So buckle in, because I’m about to break this down for you like it’s a masterclass in how to surf the crypto wave.

📈 CoinShares at a Glance – The Digital Asset Titan

CoinShares isn’t some small-time trading desk. They’re Europe’s heavyweight in digital asset management, moving serious capital across multiple product lines. Their arsenal includes:

- XBT Provider ETPs — market-traded crypto exposure.

- CoinShares Physical — backed by actual assets, catering to institutional money.

- Capital markets and staking strategies — where the smart yield happens.

Bottom line: CoinShares is built to handle volatility and extract profit from chaos.

💰 Q2 2025 Financial Performance Breakdown

Here’s the money shot:

- Assets under management (AUM): $3.46 billion (+26%).

- Net profit: $32.4 million (up 2% YoY, up 26% QoQ).

- Management fees: $30 million.

- Capital markets gain: $11.3 million.

- ETH staking profits: $4.3 million.

That’s not survival — that’s thriving in a market most people claim is “too volatile.”

⚡ Bitcoin & Ethereum – The Twin Engines Behind the Growth

Let’s call it like it is: CoinShares’ Q2 was fueled by Bitcoin and Ethereum’s monster rally. Bitcoin’s +29% pump and Ethereum’s +37% rip lit a fire under the entire digital asset class. That price action directly inflated AUM, and CoinShares was positioned perfectly to catch that wave.

Lesson: when you’re exposed to the right assets at the right time, the numbers don’t just add up — they explode.

📊 Product Performance – Winners & Losers

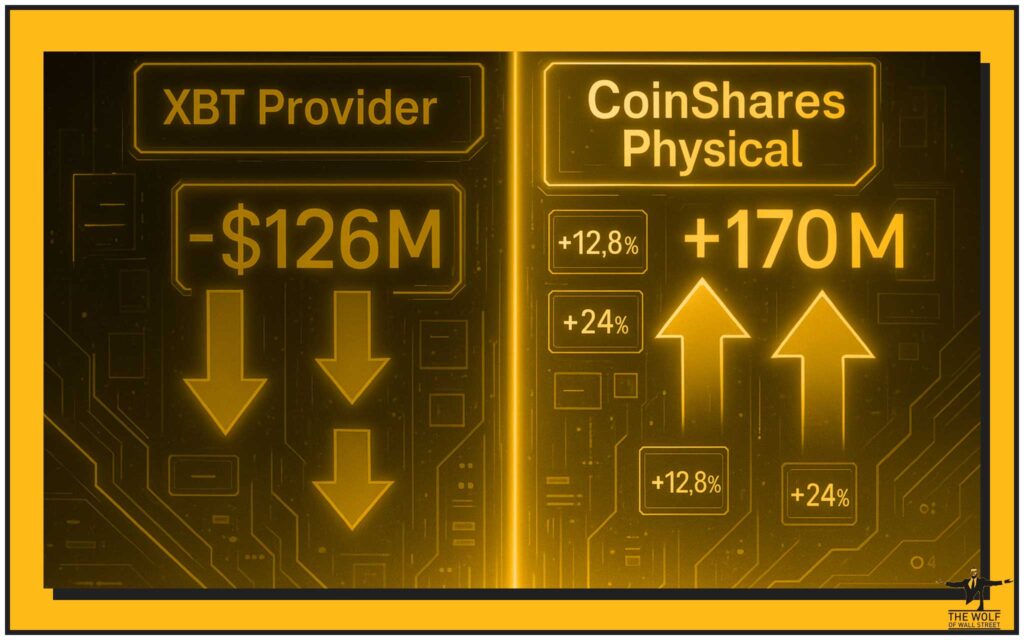

Not everything was smooth sailing. Here’s the split:

- XBT Provider ETPs: Bled $126 million in outflows. Investors are rotating away.

- CoinShares Physical: Raked in $170 million net inflows. Institutions love it.

This shows us the future: investors want real, backed, reliable products. And CoinShares is adapting fast.

🎯 CEO’s Outlook – Mognetti Calls His Shot

Jean-Marie Mognetti, CEO, isn’t playing defense. He’s going all-in on the next half of 2025. His message: this is just the beginning. Activity is high, flows are moving, and the US listing? That’s the knockout punch.

Why? Because once CoinShares lists in the States, the floodgates of institutional cash open. It’s not just growth — it’s a multiplier.

👉 For context on how news like this shapes the market, check out our insights on Cryptocurrencies and Trading Insights.

🌍 Macroeconomic Headwinds – The Bigger Battlefield

Here’s the part amateurs ignore: macroeconomic reality. Inflation, interest rate hikes, liquidity crunches — these are the real bosses of the game. CoinShares noted that macro headwinds actually outweighed pure market moves in Q2.

Translation: while others panic when the Fed sneezes, CoinShares builds strategies to profit from the storm.

🏦 The SEC and 92 Pending Crypto ETPs

This is the elephant in the room: 92 crypto exchange-traded products (ETPs) are waiting for SEC approval in the US. That’s not hype — that’s a tidal wave of adoption gearing up. CoinShares knows this. They’re setting up to be in pole position the moment those approvals hit.

Smart money plays the regulatory game before it’s mainstream. CoinShares is already there.

🚀 Strategic Positioning – Playing Offence in Volatility

CoinShares isn’t waiting for the market to calm down — they’re monetising volatility:

- ETH staking delivered $4.3M gains.

- Capital markets delivered $11.3M overall.

- Diversification between products creates resilience.

This is how you don’t just survive downturns — you make them your profit centre.

🧠 Lessons for Investors – What CoinShares’ Results Teach You

Here’s the cheat sheet:

- Flows matter. Don’t panic when one product bleeds — watch the bigger inflow trend.

- Diversify. Multiple product streams = resilience.

- Marry macro with crypto. The real winners profit where economics and blockchain collide.

These results are your case study in professional-grade portfolio management.

📌 Key Takeaways – Condensed for Action

- CoinShares’ AUM surged 26% to $3.46B.

- Net profit cracked $32.4M.

- Bitcoin and Ethereum powered the surge (+29%, +37%).

- US listing on the way = game-changing.

Remember: numbers don’t lie. This isn’t hype — it’s execution.

🏹 How Retail Investors Can Capitalise

So how do you take advantage?

- Follow institutional flows. Institutions don’t chase hype — they chase yield.

- Use ETP trends as signals. Outflows/inflows reveal where the smart money is rotating.

- Get positioned early. Once US ETPs hit, retail will pile in too late.

The key is front-running the herd — and CoinShares’ moves show you where the herd is heading.

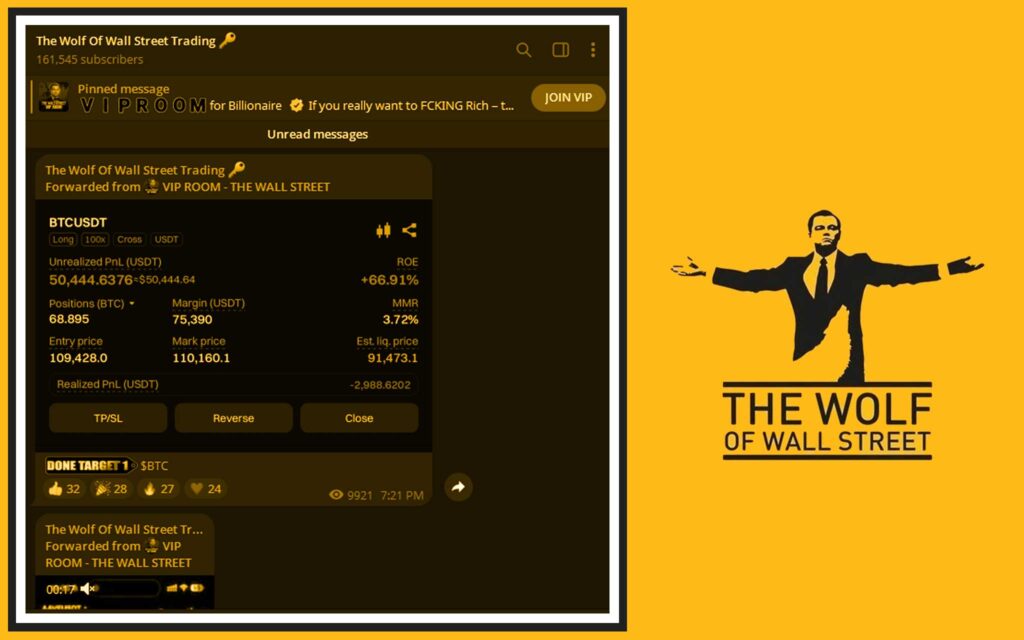

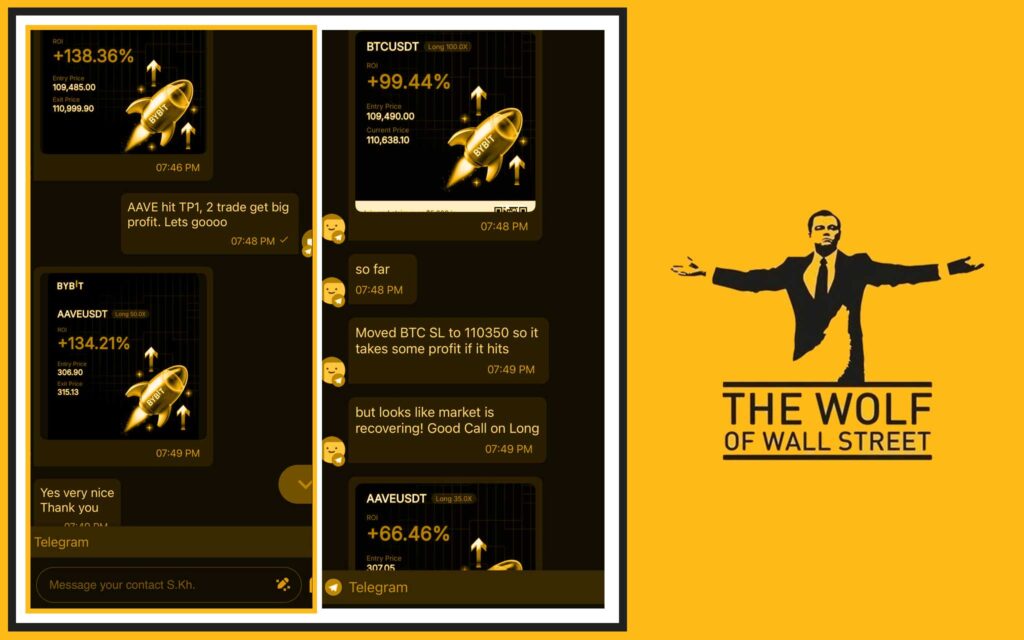

🧑🤝🧑 The Wolf Of Wall Street Community Advantage – Trade Like the Pros

Here’s the bridge: you don’t need to be CoinShares to profit like CoinShares. Retail traders can’t hire a floor of analysts, but you can plug into a network that gives you the same edge. That’s where The Wolf Of Wall Street comes in:

- Exclusive VIP Signals: Proprietary alerts built to catch profit moves.

- Expert Market Analysis: Deep dives from seasoned traders.

- Private Community: Over 100,000 sharp minds sharing strategies.

- Trading Tools: Calculators, insights, and real-time data.

- 24/7 Support: Because markets don’t sleep.

📌 Ready to level up?

📚 FAQs – Cutting Through the Noise

1. Why did CoinShares’ AUM grow despite product outflows?

Because inflows into CoinShares Physical more than offset XBT Provider outflows.

2. How do Bitcoin and Ethereum price surges impact asset managers?

They inflate AUM directly and boost fee revenue.

3. What’s the significance of the planned US listing?

It opens access to a bigger pool of institutional capital, multiplying growth.

4. How can everyday investors benefit from these institutional trends?

By tracking product flows, using trading communities, and positioning ahead of ETF approvals.

5. What role will crypto ETFs play in mass adoption?

They’re the gateway product for mainstream investors, bringing trillions into play.

🏆 Conclusion – The Bigger Picture for Crypto Investors

CoinShares just showed the market how it’s done: $3.46B AUM, $32.4M profit, strategic inflows, ETH staking gains, and a US listing on the way. That’s a playbook for building wealth in crypto, not just hype trading.

If you want to profit in this market, you’ve got two choices: watch from the sidelines or step onto the field with the right tools and community. CoinShares is already making moves. The question is — are you?

📌 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.