🚀 Introduction: The Shockwave of Crypto ATM Seizures

The crypto world thrives on innovation and risk—but nothing rattles the market like a high-profile crypto ATM seizure in the UK. Imagine walking into your local high street, only to find authorities cordoning off the flashy kiosk that just last week promised “fast, private” Bitcoin trades.

This isn’t just a headline; it’s a siren. If you’re in the game—or just crypto-curious—this is the playbook you need to survive and thrive in a market where compliance isn’t optional, and ignorance is expensive.

🔍 What Happened? A Breakdown of the UK Crypto ATM Raid

Let’s get surgical. In July 2025, seven crypto ATMs were yanked off the streets of southwest London in a coordinated strike by the Financial Conduct Authority (FCA) and the Metropolitan Police. Two individuals got an all-expenses-paid trip to police custody, suspected of running an illegal cryptocurrency exchange and laundering money.

Why the drama? Because in the UK, any crypto operation without FCA registration is playing with fire—and as of now, there are zero legal crypto ATMs in the country. That means every “Bitcoin ATM” you spot is a ticking legal time bomb.

⚖️ The Regulatory Landscape: FCA, Law, and No-Nonsense Rules

Forget the Wild West fantasy—crypto in the UK is all about rules. Since January 2021, every crypto business must register with the FCA and follow ironclad anti-money laundering protocols. No exceptions, no loopholes, no clever dodges. If you operate a crypto ATM without FCA sign-off, you’re not a disruptor—you’re a criminal.

The FCA isn’t shy about it. Their message: “If you’re unregistered, you’re unwelcome.” And trust me, the penalties aren’t just fines—they include seizures, arrests, and potentially life-changing legal consequences.

💸 Why Crypto ATMs Became a Money Laundering Magnet

Why all this heat on crypto kiosks? Simple: money laundering loves anonymity, and until now, crypto ATMs were the perfect cover. Drop in your cash, punch in a wallet address, and walk away with clean crypto—no questions asked, no paper trail, no accountability.

Criminals caught on fast, using these machines for everything from tax evasion to large-scale scams. The result? Law enforcement, regulators, and the global financial system put the hammer down. If you think the authorities are overreacting, consider the real-world costs: millions laundered, lives upended, trust shattered.

🔗 Internal Links & Navigating Your Crypto Journey

If this is your first regulatory rodeo, now’s the time to upskill and protect your hard-earned assets. Check out these sections for deeper dives and pro-level strategies:

- Trading insights: Stay ahead of market moves and regulatory shifts.

- Latest news: Get the freshest updates on crypto enforcement, innovation, and scandals.

- DeFi ecosystem updates: Discover the decentralised projects that are rewriting the crypto rulebook.

🚨 Scams, Risks & Real-World Horror Stories

The Anatomy of a Crypto ATM Scam

Here’s where things get gritty. Most crypto ATM scams follow the same script: a victim receives a call from someone posing as a government official or a utility provider. The scammer claims there’s an urgent bill, a tax issue, or a loved one in trouble. The “solution”? Deposit cash into a crypto ATM, then send the Bitcoin to a specified address—usually offshore and untraceable.

Result: The victim’s funds vanish. No refunds. No recourse. Total loss.

How Criminals Exploit Unregulated Kiosks

Unregistered ATMs don’t bother with identity checks, transaction limits, or real customer support. For criminals, that’s paradise. They exploit the lack of oversight to:

- Launder proceeds from drug sales or fraud

- Evade taxes on illicit earnings

- Funnel crypto to overseas accounts beyond the reach of UK law

This isn’t paranoia—it’s the documented reality, as highlighted by both the FCA and the FBI.

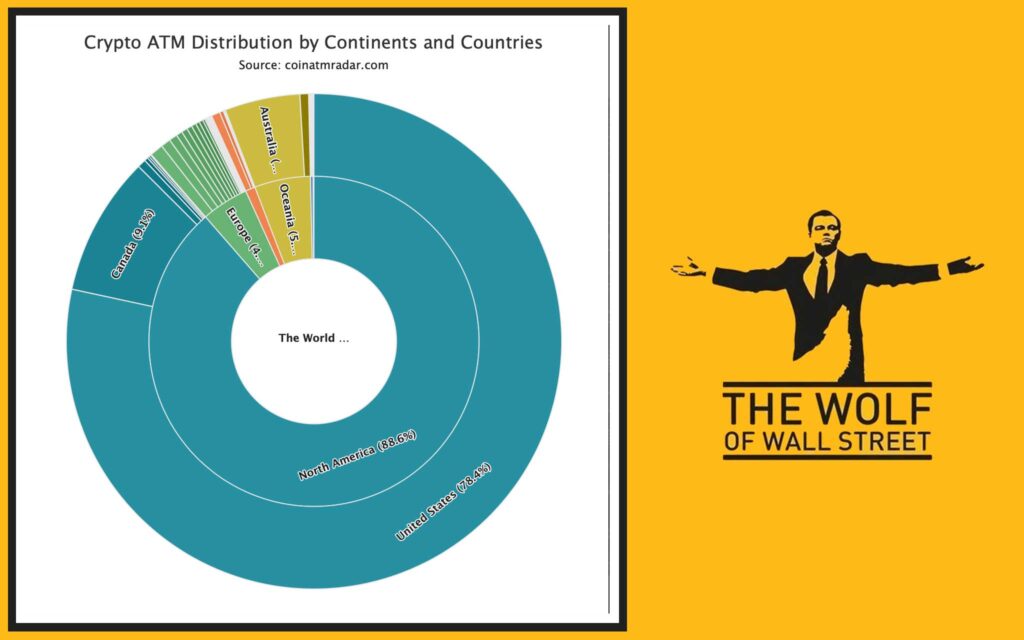

🌎 Global Perspective: UK Actions Meet US Legislation

US Crackdowns: Transparency, Warnings & Limits

It’s not just the UK tightening the screws. In the US, lawmakers are pushing for:

- Mandatory transaction limits

- Real-time price disclosures

- Prominent scam warnings at kiosks

- Automatic refunds for verified scam victims

In 2023 alone, Americans lost $247 million to crypto ATM scams, a stat that got the attention of Congress—and triggered a legislative wave aimed at shutting down scam operators for good.

What Other Countries Are Doing

From Australia to Singapore, regulators are following suit: licensing requirements, background checks, transaction reporting, and customer education are now the global standard. The Wild West is over—international enforcement is the new normal.

🧑💻 How Enforcement Unfolds: Inside the Seizures & Arrests

Who’s Getting Busted & Why

It’s not just small-time operators in the crosshairs. Authorities are targeting:

- Organised crime syndicates

- High-volume money launderers

- Fly-by-night “consultants” promising loophole-filled ATM setups

The message? If you’re not registered, you’re next.

Law Enforcement Tactics

Seizures aren’t random. The FCA and police use:

- Undercover sting operations

- Data analysis on blockchain transactions

- Tip-offs from the public and crypto community

Once an illegal ATM is identified, it’s swiftly confiscated. Operators can expect frozen assets, criminal charges, and reputational ruin.

🔐 Consumer Protection: What You Need to Know

How to Spot a Scammy Crypto ATM

- No FCA registration or compliance notice displayed

- Promises of “anonymous” or “private” transactions

- No ID verification required

- Overly high transaction limits

- Zero customer support details

If you spot these red flags, walk away—and report the ATM to authorities.

Staying Safe: Practical Steps

- Only use FCA-registered platforms (find the official list online)

- Triple-check the operator’s credentials

- Never send crypto to addresses given by cold callers or strangers

- Use peer-reviewed services with a reputation for transparency

💥 The Big Numbers: Crypto ATM Fraud by the Stats

UK and US Losses

- $247 million lost to crypto ATM scams in the US in 2023 alone

- UK figures are smaller but rising fast, prompting urgent action

Why Vulnerable Users Are Targeted

Scammers prey on the elderly, non-native English speakers, and anyone unfamiliar with crypto. The pitch is always urgent: “Pay now, or else.” The consequences are devastating—lifetime savings gone in seconds.

💬 What the Regulators Say: FCA & Official Statements

The FCA is blunt: Operating a crypto ATM without registration is a criminal offence. Enforcement isn’t negotiable, and the focus is on:

- Shutting down illegal ATMs

- Prosecuting unregistered operators

- Educating consumers about risks and red flags

Refer to the official FCA statements and UK crypto regulations for the black-and-white details.

👥 Community & Support: Smarter Trading in the Wild West

Power of Private Crypto Networks

When public infrastructure gets shaky, private communities become gold. Inside networks like The Wolf Of Wall Street Crypto Trading Community, you don’t just avoid scams—you leapfrog the competition with:

- VIP signals for smarter trades

- Expert analysis for every market move

- Private support—real people, 24/7

Where to Find Legit Guidance

Stop rolling the dice with anonymous kiosks. Instead, plug into trusted communities and resources:

- The Wolf Of Wall Street Service: For up-to-the-minute strategies and support

- Trading insights: Advanced breakdowns and market signals

📈 Level Up: Smarter, Safer Ways to Trade Crypto

Alternatives to ATMs for Buying & Selling Crypto

Ditch the shady kiosks—here’s how serious traders stay safe:

- Use regulated exchanges with ironclad KYC (Know Your Customer)

- Tap into peer-reviewed DeFi projects

- Leverage verified P2P networks

How the Pros Stay Ahead (feat. The Wolf Of Wall Street Crypto Community)

Pros don’t gamble—they calculate. By joining a platform like The Wolf Of Wall Street, you get:

- Proprietary trading tools (volume calculators, signal bots)

- Access to over 100,000 vetted members

- Instant alerts for regulatory news and scam warnings

- Ongoing support to keep you sharp, informed, and one step ahead

Ready to upgrade your game? Check out the The Wolf Of Wall Street service or join the Telegram community for live updates.

🔄 The Future of Crypto ATMs: Can Regulation Restore Trust?

Regulation isn’t the enemy—it’s the necessary antidote to chaos. With strict compliance, transparent operations, and robust oversight, the crypto ATM space could become safe for all. Until then? Treat every unregistered kiosk as radioactive. The only thing more expensive than regulation is getting burned by a scam.

📝 Conclusion: No Room for Amateurs in a Regulated Market

The era of fast-and-loose crypto kiosks is dead. The crypto ATM seizure UK headlines prove one thing: compliance is king. If you want to profit and survive in this space, you need to ditch shortcuts and play the long game. Educate yourself. Connect with experts. Make every trade count.

And if you’re serious about levelling up? Join a vetted network like The Wolf Of Wall Street Crypto Trading Community—where the smart money goes, and the rookies get left behind.

❓ FAQs: Everything You’re Still Wondering About Crypto ATM Seizure UK

Q1: Are there any legal crypto ATMs in the UK?

No—right now, there are zero FCA-registered crypto ATMs operating legally in the UK.

Q2: What’s the penalty for running an unregistered crypto ATM?

Seizure, arrest, fines, and possible jail time. The FCA and police aren’t messing around.

Q3: How can I avoid crypto ATM scams?

Only use FCA-registered services, never trust cold callers, and always double-check credentials.

Q4: What should I do if I’ve been scammed?

Report the incident to Action Fraud UK and contact the FCA for guidance. Join private crypto support communities for further advice.

Q5: What’s a safer way to trade crypto?

Use regulated exchanges, trusted peer-to-peer platforms, or private trading communities like The Wolf Of Wall Street for vetted signals and support.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street