🔥 Introduction: Forget Web 3.0 – This is Capitalism 2.0

Listen up. Crypto isn’t just some shiny toy labeled “Web 3.0” for tech bros and Twitter threads. No. It’s bigger. Much bigger. We’re talking about a full-blown evolution of capitalism itself.

Think about it—capitalism has always been about access to markets, ownership of property, and the ability to trade freely. Crypto takes those pillars, throws jet fuel on them, and launches them into a 24/7, borderless financial system.

This isn’t a new internet. This is Capitalism 2.0. And if you don’t see it, you’ll get left behind.

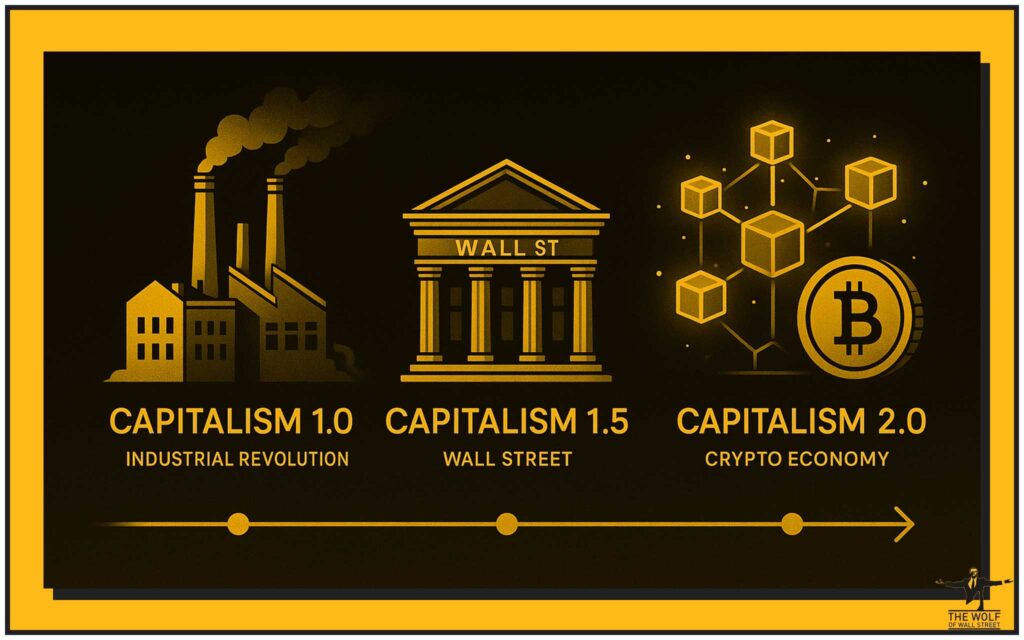

🔑 The Evolution of Capitalism

Capitalism 1.0 was the industrial era—factories, railroads, oil barons. Capitalism 1.5? That was Wall Street, with brokers, hedge funds, and banks pulling the strings.

But let’s be real. Both versions came with baggage:

- Gatekeeping: Only insiders could play.

- Inefficiency: Transactions took days.

- Centralisation: Too much power concentrated in too few hands.

Crypto blows the doors off. With blockchain, anyone—yes, anyone with a smartphone—can plug directly into a global capital market that runs 24/7, 365 days a year.

That’s capitalism without middlemen. That’s capitalism without borders. That’s Capitalism 2.0.

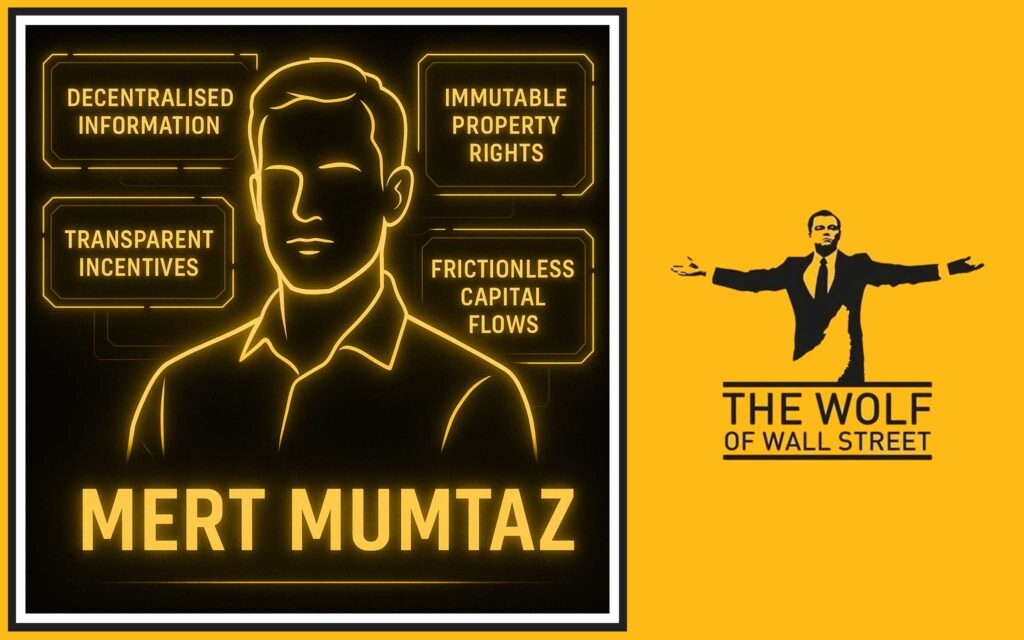

🎤 Industry Voice: Mert Mumtaz Drops the Truth

Mert Mumtaz, CEO of Helius, nails it: crypto isn’t Web 3.0—it’s an evolution of capitalism itself. Why? Because it reshapes the very foundation of how we trade, invest, and build wealth.

Here are his four pillars:

- Decentralised information flow – No single gatekeeper controls access to knowledge.

- Immutable property rights – Ownership can’t be disputed, censored, or manipulated.

- Transparent incentives – Every rule and reward is baked into code.

- Frictionless capital flows – Move money across the world in seconds, not days.

That’s not hype. That’s a system-level transformation.

⚖️ The Regulators Are Waking Up

Here’s the part that should make Wall Street sweat: even the SEC and CFTC are sniffing around this thing. They’re exploring the possibility of 24/7 regulated capital markets.

No more opening bells. No more weekends off. No waiting for Monday to trade your assets.

This isn’t just a tweak—it’s a seismic shift. When regulators start laying the groundwork for continuous, borderless markets, you know the train has already left the station.

👉 Check out the latest news and keep an eye on evolving policies because regulation will determine who wins and who gets wiped out.

🔮 Perpetual Futures & Prediction Markets

Let’s talk about the real game changers.

- Perpetual futures contracts: No expiry dates, just continuous exposure. This gives traders the ability to hold positions as long as they want, with liquidity that never sleeps.

- Event prediction markets: Imagine betting on anything—from elections to product launches—with markets dynamically pricing probabilities in real time.

With the right regulatory blessing, these tools could become the beating heart of global finance.

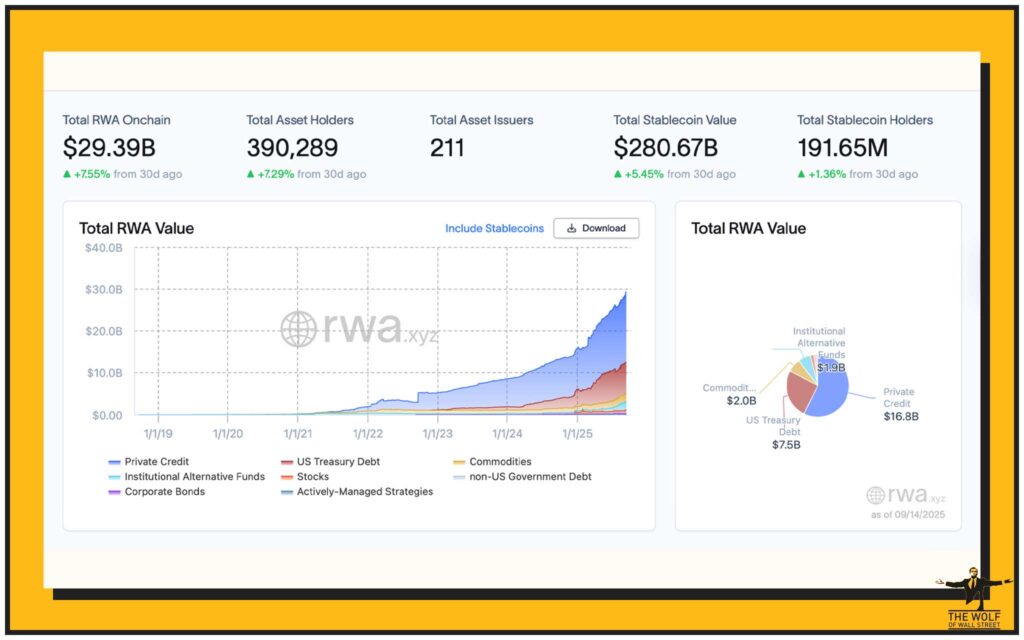

🚀 Tokenisation: Turning Real Assets into Digital Rockets

Stocks. Bonds. Real estate. Hell, even your favourite sneaker collection. All of it is getting tokenised.

Here’s why this matters:

- Fractional ownership – Buy a slice of a building or a Picasso without being a billionaire.

- Instant liquidity – Trade assets instantly, no waiting for settlement.

- Global accessibility – Anyone, anywhere, can tap into opportunities that used to be locked away.

Tokenisation is where TradFi meets DeFi. And once you see it in motion, you’ll never look at traditional markets the same again.

🌐 Solana’s 2027 Roadmap: Building Internet Capital Markets

The Solana Foundation is going all-in with a roadmap through 2027 to create what they call internet capital markets.

This means:

- Blazing fast transactions.

- Low fees at scale.

- A user experience that feels like using an app, not hacking a bank terminal.

Infrastructure like this is how you scale Capitalism 2.0 to billions of people.

📈 Brokerage Adoption: Robinhood Jumps In

Here’s the proof mainstream adoption is happening: Robinhood is already letting users trade tokenised stocks.

Why does this matter? Because it blurs the line between traditional brokerage accounts and crypto wallets. One minute you’re buying Tesla stock, the next you’re swapping into Solana—all in the same app.

It’s the bridge that gets the average investor across without them even realising they’ve stepped into the crypto future.

⏰ Capitalism Modernised: What 24/7 Crypto Markets Look Like

Picture this:

- No more downtime.

- No more waiting for Tokyo, London, or New York to “open.”

- Money moving in real time, around the clock, across the globe.

That’s a market that never sleeps. And it doesn’t just benefit hedge funds—it benefits anyone with a smartphone and ambition.

👉 Dive into trading insights and explore cryptocurrencies to see how this future is already unfolding.

🔥 The Risks and Challenges

Let’s keep it real—Capitalism 2.0 isn’t without its pitfalls:

- Regulatory uncertainty – Governments are still playing catch-up.

- Security threats – Hacks, exploits, rug pulls.

- Volatility – Double-digit swings that can wipe you out if you’re reckless.

But here’s the truth: risk has always been part of capitalism. The difference now is, the rewards are bigger, faster, and more accessible than ever.

📊 Case Study: Tokenisation in Action

Real estate projects are already being tokenised, allowing investors to buy into properties with as little as $100. Collectibles like rare art and luxury items are being fractionalised and traded on-chain.

These aren’t “what ifs.” They’re happening right now. And they’re proving that tokenisation isn’t a gimmick—it’s a paradigm shift.

💡 Why Crypto = Capitalism 2.0 (Not Web 3.0)

Web 3.0 is a weak label. It makes crypto sound like a tech upgrade—like going from 4G to 5G.

But crypto isn’t just technology. It’s a fundamental restructuring of economic systems. It changes ownership, incentives, and the flow of capital.

Web 3.0 is hype. Capitalism 2.0 is destiny.

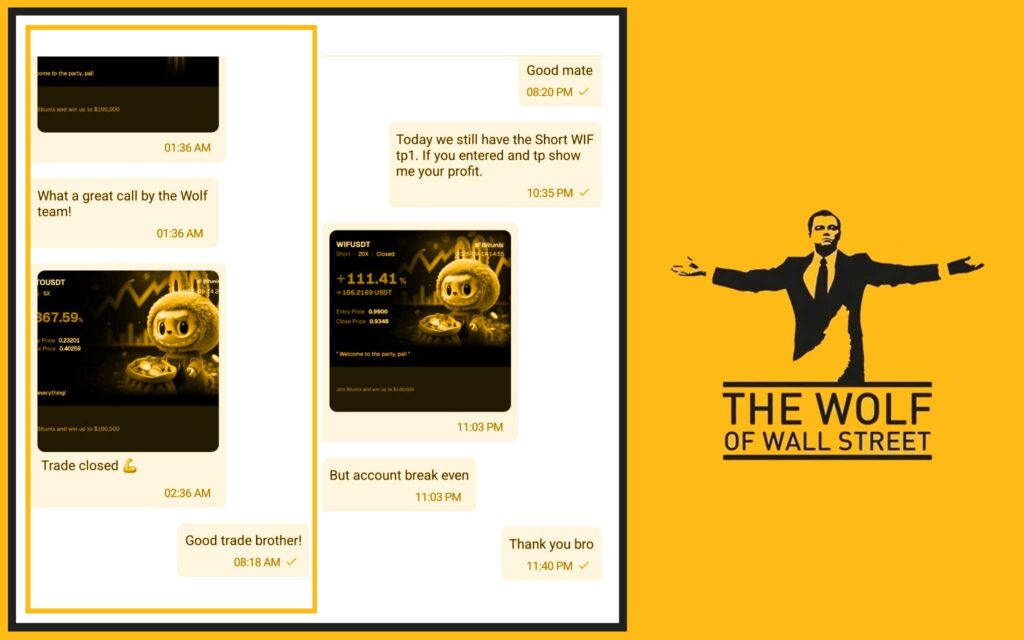

🏆 The Wolf Of Wall Street: The Insider’s Edge for Navigating Capitalism 2.0

Now let’s get practical. How do you ride this wave without drowning? You join a community that gives you an edge.

That’s where The Wolf Of Wall Street crypto trading community comes in:

- Exclusive VIP Signals – Proprietary calls to maximise profit.

- Expert Market Analysis – Learn directly from seasoned crypto traders.

- Private Community – Network with over 100,000 like-minded hustlers.

- Essential Trading Tools – From volume calculators to decision-making software.

- 24/7 Support – Because markets never sleep, and neither should your strategy.

👉 Visit The Wolf Of Wall Street Service for details.

👉 Join the Telegram for real-time updates.

That’s how you get ahead in Capitalism 2.0.

❓ FAQs: Answering the Big Questions

Q1: Will crypto replace Wall Street?

Not replace—disrupt. Wall Street will adapt or die, but the rules of the game are changing.

Q2: What are tokenised assets?

Real-world stuff like stocks, bonds, or real estate, turned into tradeable digital tokens.

Q3: Can regulators handle 24/7 markets?

They’ll have no choice. Markets will push forward regardless.

Q4: Is crypto too risky for new investors?

Only if you go in blind. With the right tools, education, and community, you stack the odds in your favour.

⏳ Conclusion: The Time Is Now

Crypto isn’t Web 3.0—it’s Capitalism 2.0. A system that’s faster, fairer, and open to anyone with the guts to play.

The regulators see it. The brokers are joining it. The innovators are building it. The only question left: are you in, or are you watching from the sidelines?

Because in this game, hesitation doesn’t just cost you money—it costs you the future.