Listen up, aspiring crypto kings and queens! You’re about to get schooled on a secret weapon that separates the true titans from the TikTok traders: funding rates. Forget the fluff, forget the noise. We’re talking about direct, actionable intelligence that puts more zeroes in your account. This isn’t some academic exercise; it’s the fundamental engine driving profit in the wild world of crypto perpetual futures. Understanding funding rates isn’t just an advantage; it’s a non-negotiable for anyone serious about unlocking your potential to profit in the crypto market.

You want to make serious coin in this market? You need to understand how the money moves. Funding rates are the invisible hand of the crypto universe, constantly rebalancing the scales, ensuring that futures prices stay locked onto the spot market. It’s a payment mechanism, pure and simple, between traders holding opposing positions. Think of it as a crucial lever that prevents the market from going completely off the rails, keeping things fair and ensuring liquidity. Without it, this whole game would be a chaotic mess.

🚀 The Raw Power of Funding Rates: Your Edge in the Perpetual Game

You think you know trading? You haven’t seen anything until you’ve mastered perpetual futures. These aren’t your grandpa’s futures contracts with expiry dates. Oh no, these are perpetual – they never expire. That’s the beauty of it, and that’s why funding rates are so damn critical. They’re the genius mechanism that keeps these contracts tethered to reality, no matter how wild the market gets.

The Foundation: Why Perpetual Futures Are Your Playground

Perpetual futures are the ultimate playground for traders who want unlimited potential. You can go long, you can go short, and you don’t have to worry about your contract expiring at the worst possible moment. This flexibility is what makes them so attractive, especially in the 24/7, high-octane crypto market. But with great power comes great responsibility – and the need to understand how these beasts are tamed. That’s where funding rates come in, like a well-oiled machine ensuring the system keeps humming.

Understanding the Core: What Exactly are Funding Rates?

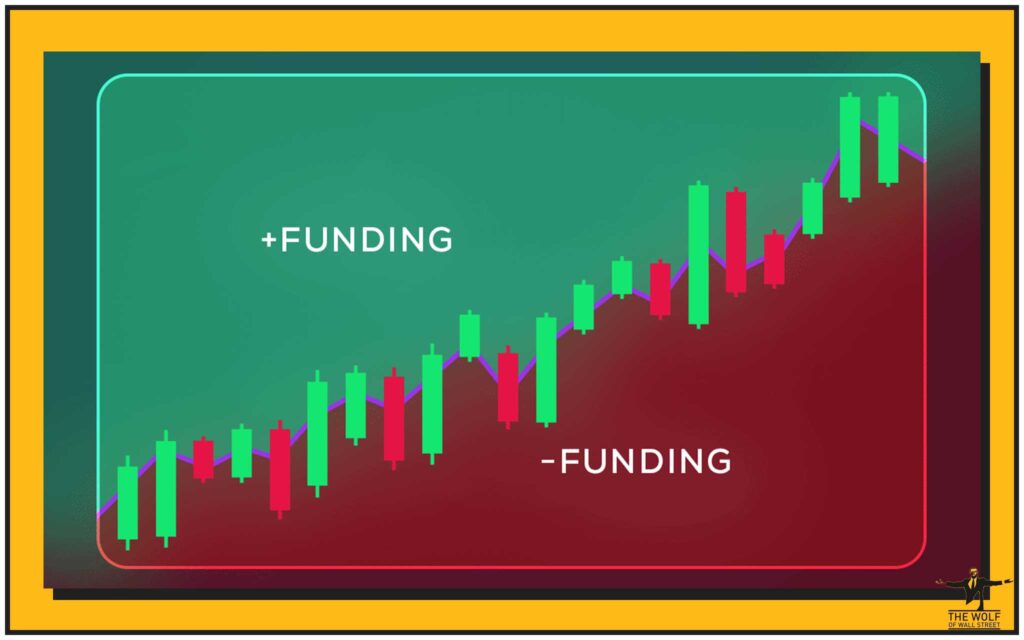

At its heart, a funding rate is a small, periodic payment made between long and short traders in the perpetual futures market. It’s designed to keep the price of the perpetual future contract closely aligned with the actual spot price of the cryptocurrency. If the futures price is consistently higher than the spot price, longs pay shorts. If the futures price is consistently lower, shorts pay longs. It’s a brilliant, self-correcting mechanism. Think of it as the market’s way of ensuring no one side gets too comfortable or too out of sync with reality. This isn’t some theoretical concept; it’s cold, hard cash changing hands every few hours.

💰 The Mechanism of Wealth Transfer: How Funding Rates Fuel Your Account

This is where the rubber meets the road, where you learn how money gets transferred directly between traders based on market sentiment. It’s a zero-sum game within the funding rate itself, but a massive opportunity for those who understand its flow.

The Apple Analogy: Making Sense of Futures vs. Spot

Let’s simplify this, because I know some of you are still thinking about your breakfast. Imagine you’re at a marketplace. You can buy a real, tangible green apple (that’s your spot market Bitcoin). Or, you can agree to buy or sell a “promise” of a green apple at a future price (that’s your Bitcoin perpetual future contract).

Now, if everyone suddenly wants to buy green apples (spot) and the “promise” of green apples (futures) is trading at a premium, something’s gotta give. The funding rate is that “something.” It’s the cost of holding that premium. Conversely, if no one wants the “promise” and it’s trading at a discount, you get paid to hold it. It’s that simple. We’re trading apples, but the stakes are a hell of a lot higher.

The Payment Flow: Who Pays Who, and When?

The payment flow is crucial. These aren’t daily payments; they happen every 8 hours on most major exchanges. That’s three times a day, baby! Three opportunities for you to be on the right side of that payment.

- If the funding rate is positive: Longs pay shorts. This means the futures price is trading at a premium to the spot price. More people are betting on price increases, driving up the futures price. To prevent this premium from getting out of control, the system incentivizes shorts by having longs pay them. It’s like a tax on bullish excess.

- If the funding rate is negative: Shorts pay longs. This means the futures price is trading at a discount to the spot price. More people are betting on price decreases, driving down the futures price. To pull that futures price back up, longs are incentivized by getting paid by the shorts. It’s a subsidy for those holding against the bearish tide.

Positive Funding Rates: When Longs Rule the Roost

When you see a persistently positive funding rate, it’s a clear signal. The market is feeling bullish, perhaps even overconfident. Longs are paying shorts, indicating strong demand for the futures contract, pushing its price above the spot. This can be a sign of exuberance, a warning that the market might be getting a little frothy. Smart traders pay attention here; it could signal an upcoming correction or a shake-out. Remember, in trading, sometimes the easiest money is made by going against the herd, but only if you know what you’re doing.

Negative Funding Rates: Riding the Short Wave

On the flip side, negative funding rates scream fear and bearish sentiment. Shorts are paying longs, meaning the futures price is trading at a discount to the spot. Everyone’s piling into short positions, expecting further declines. This is where opportunity knocks for the bold. While everyone else is panicking, a negative funding rate could signal a potential bounce or a short squeeze coming. Those who bought the dip and held long positions could be in for a nice payday, getting paid just for holding. It’s pure profit.

📈 Beyond the Basics: Why Funding Rates Are Your Crystal Ball

You want to know what the smart money is doing? You want to see the future? Funding rates are as close as you’re going to get. They’re not just fees; they’re direct reflections of market sentiment and positioning.

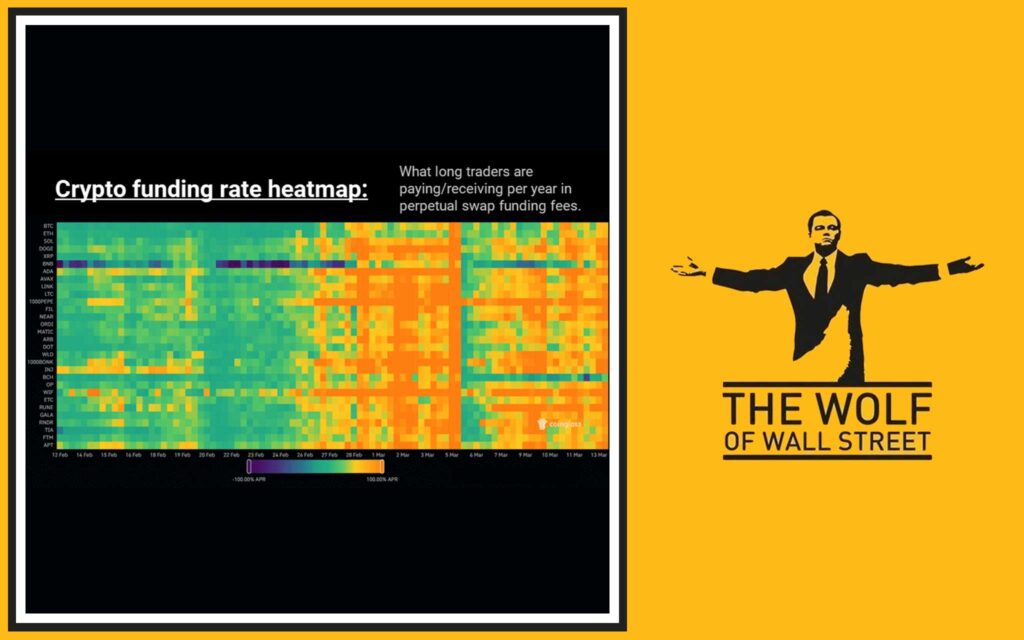

Market Sentiment Unveiled: Reading the Smart Money

High positive funding rates often coincide with peak bullishness, a sign that the market is perhaps overextended. Conversely, deeply negative funding rates can signal extreme fear, which often precedes a market bottom. By monitoring these shifts, you can gauge the collective mood of the market and potentially position yourself for counter-trend trades. It’s like having a direct line to the collective subconscious of millions of traders.

Predicting Price Swings: Using Rates to Front-Run the Crowd

When funding rates hit extreme levels, it’s a red flag. A sky-high positive rate might mean a long squeeze is imminent, where the market punishes over-leveraged long positions. A plunging negative rate could indicate a short squeeze, forcing bears to cover and driving prices up. These aren’t just whispers; they’re screams from the market, telling you where the next big move might happen. This is how you front-run the crowd and secure your bag.

Risk Management: The Unsung Hero of Perpetual Trading

Look, anyone can gamble. But true traders manage risk. Funding rates are a critical component of your risk management strategy. A high funding rate means your long position is costing you more to hold. A low funding rate (or negative) means your short position is costing you more, or your long position is earning you money. Factor these costs and earnings into your trade calculations. Don’t let a seemingly small funding payment erode your profits or turn a winning trade into a loser. This is the difference between a high-roller and a broke gambler. You can also explore various trading insights to enhance your risk management skills.

🛠️ Your Arsenal: Practical Application of Funding Rates

This is where we turn knowledge into power. These are the actionable steps you need to take.

Monitoring the Pulse: Where to Track Funding Rates

Every major crypto exchange that offers perpetual futures will display its funding rates. You can find them on platforms like Binance, Bybit, OKX, and BitMEX. Many third-party aggregators also provide real-time funding rate data across multiple exchanges. Get used to checking these regularly. It’s like checking the weather before you leave the house – you wouldn’t go trading blind, would you?

Timing Your Entry and Exit: Precision Trading with Funding Rates

Think about it: if funding rates are extremely positive, it might be a signal to lighten up on your long positions, or even consider a short. If they’re deeply negative, it might be an opportune moment to consider going long, especially if other indicators align. Use funding rates as a confirmation signal, not the only signal. Combine them with technical analysis indicators like RSI crypto trading strategies or Bollinger Bands trading strategy. This is how you make surgical entries and exits.

Adjusting Leverage: Protecting Your Capital Like a Pro

High funding rates can quickly eat into your profits, especially if you’re heavily leveraged. If you’re long and the funding rate is soaring, consider reducing your leverage to minimise the cost. Conversely, if you’re being paid to hold a long position (negative funding rate), you might strategically increase leverage, but proceed with extreme caution. Leverage is a powerful tool, but it can cut both ways. Master crypto order types to control your exposure.

When to Sell: Capitalising on Overextended Markets

A persistently high positive funding rate can signal that a market is overbought and due for a correction. It means the bullish fervor is reaching unsustainable levels, and a sharp correction or a long squeeze could be on the horizon. This is precisely when smart money starts taking profits. Understanding this dynamic is crucial for knowing when to sell crypto strategies and locking in those gains before the inevitable dip. Don’t be the last one holding the bag when the party’s over.

💥 The Variables: What Makes Funding Rates Explode (or Implode)

Funding rates aren’t static; they’re dynamic beasts, influenced by a myriad of factors. You need to understand these drivers to predict their next move.

Demand and Supply: The Fundamental Drivers

This is basic economics, but in hyper-drive. High demand for perpetual long contracts drives the futures price up relative to spot, leading to positive funding rates. High demand for perpetual short contracts does the opposite. It’s a constant tug-of-war, and the funding rate is the scoreboard.

Volatility: Riding the Wild Swings

In periods of high volatility, funding rates can swing wildly. During rapid price pumps, positive funding rates can skyrocket as everyone piles into longs. During sharp dumps, negative funding rates can plummet. These rapid shifts create both immense risk and immense opportunity for those quick enough to react. You need to be able to navigate the chaos, and for that, you need to understand how the market moves. Check out guides on trendlines charting market direction to better understand volatility.

Leverage: The Double-Edged Sword

When traders use high leverage, even small price movements can trigger liquidations. This amplifies the impact on funding rates. A cascade of long liquidations can send funding rates sharply negative, and vice versa. It’s a feedback loop: high leverage fuels extreme funding rates, which in turn can trigger more liquidations. Learn to master your leverage in crypto trading wisely.

External Events: Black Swans and Market Crashes

Unexpected news, regulatory crackdowns, major exchange hacks, or even macroeconomic shifts (like Fed rate cuts) can send shockwaves through the crypto market, drastically impacting funding rates. These “black swan” events can cause rapid shifts in sentiment and positioning, leading to extreme funding rate spikes or drops. Staying informed on crypto news is paramount.

💡 The Smart Trader’s Playbook: Advanced Funding Rate Strategies

This is where you graduate from student to master. These are the strategies that can truly separate you from the pack.

Arbitrage Opportunities: Profiting from Price Discrepancies

Because funding rates can differ across exchanges, astute traders can spot arbitrage opportunities. For example, if the funding rate for Bitcoin perpetuals is significantly higher on Exchange A than on Exchange B, you might consider going long on Exchange B and short on Exchange A (or vice versa), earning the funding rate differential while being market-neutral. It’s not risk-free, but it’s about exploiting inefficiencies, and that’s where the real money is made.

Hedging Your Bets: Mitigating Risk with Funding Rates

Funding rates can be used as a hedging tool. If you hold a substantial spot position in a cryptocurrency and anticipate a short-term downturn but don’t want to sell your spot holdings, you could open a small, leveraged short perpetual futures position. If funding rates become negative, you’ll actually get paid to hold that hedge, further offsetting potential losses on your spot holding. This is how you protect your assets like a pro.

Exploiting Extremes: When Funding Rates Go Wild

When funding rates reach historical extremes (either very high positive or very low negative), they often signal a potential reversal. These are the moments when the market is most imbalanced, and the potential for a snap-back is highest. Identifying these extreme readings and combining them with other technical indicators can lead to highly profitable, albeit higher-risk, contrarian trades. This is where you make the kind of money that turns heads.

🌐 The Exchange Factor: Navigating Different Funding Rate Rules

Don’t be a rookie and assume all exchanges are the same. They’re not. Each platform has its own quirks when it comes to funding rates.

Binance, BitMEX, Coinbase: Know Their Game

While the core concept is universal, the exact calculation methodologies, update frequencies, and even the “base” interest rates can vary between exchanges like Binance, BitMEX, Bybit, and OKX. Some might adjust more frequently, others might have slightly different formulas. You need to understand the nuances of the platform you’re trading on. Don’t get caught off guard.

Calculation Methodologies: The Devil’s in the Details

Some exchanges use a simple average of the premium index over a period, while others might incorporate an interest rate component. These subtle differences can impact the exact funding rate you pay or receive. Ignorance is not bliss; it’s lost money. Dive deep into the documentation of your chosen exchange.

Update Frequencies: Staying Ahead of the Curve

Most exchanges update funding rates every eight hours, but some might have different schedules. Knowing when the next funding payment is due is crucial for managing your positions, especially if you’re planning to open or close trades right before or after a funding interval to either avoid a payment or capture one. This is about precision timing, and precision timing makes fortunes.

🚨 The Fine Print: Risks, Limitations, and What NOT to Do

Look, I’m not here to tell you it’s all sunshine and rainbows. There are risks. Ignore them at your peril.

Funding Rates Aren’t a Solo Act: Combine Your Tools

Never, EVER, rely solely on funding rates for your trading decisions. They are a powerful indicator, but they are just one indicator. Combine them with other technical analysis tools – think MACD indicator momentum signals, Moving Averages market trends, or even the basic Dow Theory market trend analysis. The more confluence you have, the higher your probability of success. A true wolf uses every tool in his arsenal.

The Danger of Over-Leverage: Don’t Get Wrecked

Funding rates, particularly high positive ones, can rapidly deplete your margin if you’re over-leveraged. What seems like a small percentage payment can quickly become a significant drain on your capital, especially in volatile markets. Manage your leverage responsibly. Don’t be greedy. One bad liquidation can wipe out weeks of hard work. For more on managing risk, explore research crypto opportunities.

Market Manipulation: Keep Your Eyes Peeled

While less common on major, highly liquid pairs, smaller altcoin perpetual markets can sometimes be subject to manipulation, including the manipulation of funding rates. Be aware of unusually extreme or persistent funding rates that don’t seem to align with broader market sentiment. Always be sceptical, always be vigilant.

💎 Maximising Your Edge with The Wolf Of Wall Street: The Ultimate Crypto Trading Community

Now, you’ve got the knowledge, but knowledge alone isn’t enough. You need the tools, the support, and the community to truly dominate. That’s where the The Wolf Of Wall Street crypto trading community comes into play. This isn’t just another platform; it’s your unfair advantage in this wild market.

We offer a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Forget guesswork. Access proprietary signals designed to maximize your trading profits. These are insights born from expert analysis, delivered straight to you.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders. This isn’t theoretical nonsense; it’s actionable intelligence from people who live and breathe these markets.

- Private Community: Join a network of over 100,000 like-minded individuals. Share insights, get support, and learn from the best. This is your wolf pack, where everyone is striving for financial freedom.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions. We give you the instruments to navigate the market with precision.

- 24/7 Support: Never trade alone. Receive continuous assistance from our dedicated support team, whenever you need it.

This is your chance to stop guessing and start earning. Empower your crypto trading journey. We’ve built the infrastructure for your success.

🚀 The Future is Now: Your Next Steps to Dominating Crypto

You’ve got the blueprint. Now, it’s time to build your empire.

Continuous Learning: Never Stop Grinding

The crypto market evolves at warp speed. What worked yesterday might not work tomorrow. Stay hungry, stay foolish, stay learning. Dive deeper into topics like day trading vs. hodling crypto or master crypto dominance trading strategies. Read, research, analyse. The market rewards those who put in the work.

Practice Makes Perfect: Get in the Game

Don’t just read about it; do it. Start small, experiment, and get comfortable with funding rates in real-time. Use paper trading accounts if you need to, but eventually, you need to put real money on the line to feel the pressure and truly learn. There’s no substitute for experience.

Join the Elite: Unlock Your Potential with The Wolf Of Wall Street

This isn’t just about understanding funding rates; it’s about leveraging every tool at your disposal to achieve financial mastery. Visit our website: https://tthewolfofwallstreet.com/ for detailed information. Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

The time for hesitation is over. The market is calling. Are you ready to answer?

❓ FAQs: Your Burning Questions, Answered.

Q: What is the primary purpose of funding rates in crypto perpetual futures?

A: The primary purpose is to keep the price of perpetual futures contracts closely anchored to the spot market price of the underlying cryptocurrency, preventing market imbalances and ensuring fairness by balancing long and short positions.

Q: Do funding rates apply to spot trading?

A: No, funding rates apply exclusively to perpetual futures contracts, not to direct spot market trading where you buy or sell the actual cryptocurrency.

Q: How often are funding rates typically paid or received?

A: On most major exchanges, funding rates are calculated and exchanged every eight hours, though this frequency can vary between platforms.

Q: What does a high positive funding rate indicate?

A: A high positive funding rate generally indicates a strong bullish sentiment in the market, with longs dominating and paying shorts, and can sometimes suggest an overbought market ripe for a correction.

Q: How can I use funding rates in my trading strategy?

A: You can use funding rates to gauge market sentiment, time your entries and exits, adjust your leverage, and even identify potential arbitrage opportunities across different exchanges. However, always combine them with other technical indicators for robust decision-making.