Listen up. The crypto market isn’t just for retail anymore. The big players, the serious money – the hedge funds – they’re here, and they’re here to stay. This isn’t a sideline; it’s a full-on institutional invasion. Understanding Hedge Funds in the Crypto Market isn’t just for insiders; it’s about seeing where the smart capital is flowing, why it matters, and how it’s reshaping this entire sector. Get this breakdown, and you’ll spot the real shifts before the rest.

📈 The Institutional Influx: Why Hedge Funds Are Here

The cryptocurrency market, once seen as the wild west of finance, is undergoing a dramatic transformation. We’re witnessing a significant shift: a rapid increase in the presence of traditional financial institutions, particularly hedge funds. They’re no longer just dipping a toe in; they’re diving in with serious capital and sophisticated strategies.

Rapid Adoption: Stats on Hedge Fund Holdings.

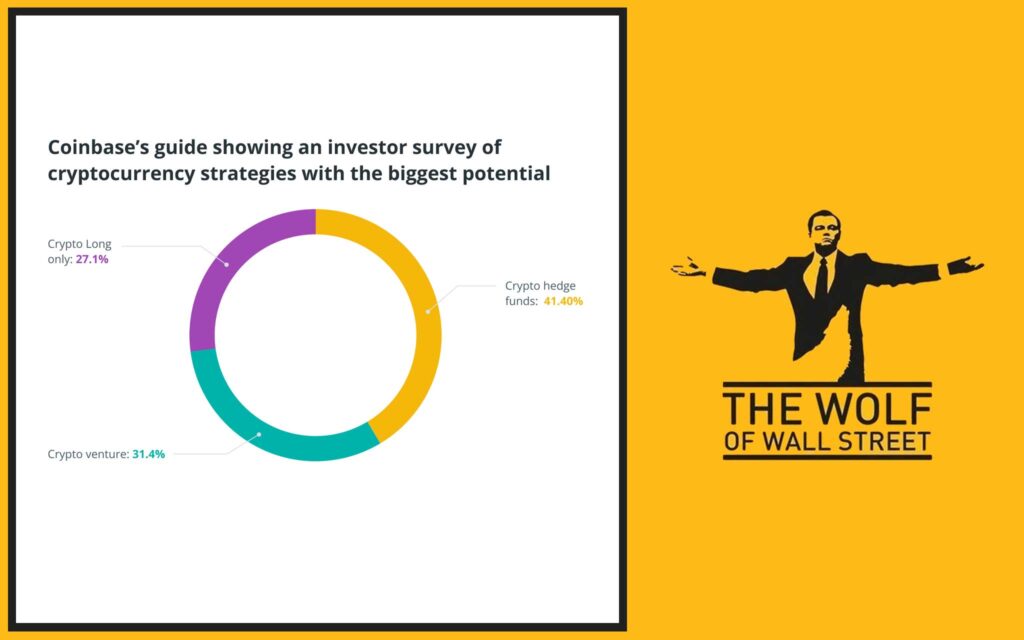

The numbers don’t lie. Data indicates a clear trend of accelerated adoption. Nearly half of traditional hedge funds now hold digital assets in their portfolios. This marks a substantial jump from figures as recent as 2022, where only around 29% of these funds had exposure to crypto. This growing allocation reflects a maturing perception of digital assets as legitimate investment vehicles.

Fueling the Shift: Clearer Regulations.

What’s driving this influx? Clearer regulatory frameworks are playing a major role. For instance, the European Union’s Markets in Crypto-Assets (MiCA) regulation has provided a comprehensive regulatory framework, offering a level of legal certainty previously absent. Similarly, the approval of spot Bitcoin ETFs in the US has been a monumental event. It has provided a regulated, accessible avenue for traditional investors to gain exposure to Bitcoin, fueling unprecedented trading activity and legitimising the asset class in the eyes of institutional players. These regulatory advancements address many of the compliance concerns that previously kept institutional capital on the sidelines.

Portfolio Diversification Goals: How crypto acts as a unique uncorrelated asset.

Hedge funds are always seeking ways to diversify their portfolios and improve risk-adjusted returns. Cryptocurrencies, particularly Bitcoin and Ethereum, have historically shown a relatively low correlation with traditional assets like stocks and bonds. This low correlation makes digital assets an attractive tool for diversification, potentially enhancing overall portfolio returns without adding proportional risk from traditional market movements. They’re seeking true portfolio diversification, and crypto offers that unique uncorrelated element.

📊 Strategies of the Smart Money: How They Play the Game

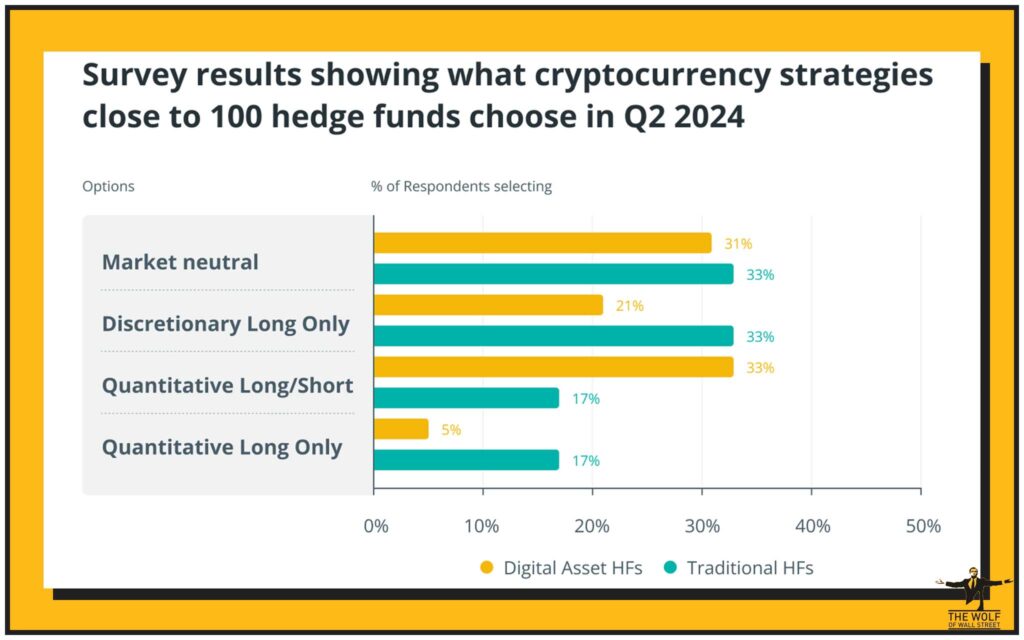

These aren’t your typical buy-and-hold retail investors. Hedge funds operate with precision, deploying complex strategies to extract profits from the crypto market. They’re applying battle-tested traditional finance tactics to the digital asset landscape.

- Arbitrage: Hedge funds exploit tiny price differences for the same cryptocurrency across different exchanges. Their high-speed systems and deep liquidity allow them to simultaneously buy low on one exchange and sell high on another, capturing small, consistent profits.

- Quantitative Trading: This involves using complex algorithms and data models to identify trading signals and execute trades automatically. These strategies often rely on statistical analysis, machine learning (linking to Trading Bots vs. AI Agents), and high-frequency trading techniques.

- Market-Making: Funds act as market makers by simultaneously placing both buy and sell orders for a cryptocurrency pair. They profit from the bid-ask spread while providing liquidity to the market, ensuring smooth trading for others.

- Long/Short Equity: This is a traditional hedge fund strategy applied to crypto. Funds take long positions in cryptocurrencies they believe will appreciate and short positions in those they expect to decline, aiming to profit from both upward and downward price movements while hedging against overall market risk.

- DeFi Activities: Many crypto hedge funds are actively involved in Decentralised Finance (DeFi) protocols. This includes strategies like yield farming, lending, and staking (linking to Earn Crypto Without Selling), where they provide liquidity or lock up assets to earn interest, governance tokens, or other rewards.

- AI-Driven Strategies: The future is now. By 2025, over 50% of crypto hedge funds are expected to use AI-driven strategies. This involves leveraging artificial intelligence and machine learning for predictive analysis, sentiment analysis (analysing news and social media), and dynamic portfolio optimisation, giving them an analytical edge.

🏆 Major Players: The Funds Dominating the Crypto Market

Several prominent hedge funds are at the forefront of institutional crypto investment, each with its own approach and focus. These are some of the names making serious waves.

- Pantera Capital: A true pioneer in the space, Pantera Capital was one of the earliest institutional investors, getting into Bitcoin as far back as 2013. They are known for their early bets on foundational crypto projects and continued investment across a wide spectrum of digital assets, from venture capital to liquid tokens. Their long-term conviction in the digital asset space is well-known.

- Galaxy Digital: Founded by Mike Novogratz, Galaxy Digital is a diversified financial services and investment management company focused on the digital asset sector. They provide actively managed funds, offer institutional trading services, and have recently shown agility by pivoting to AI for new revenue streams. They reported significant positive returns in 2024, demonstrating their capacity to generate profits in a dynamic market.

- BH Digital: This is the digital asset arm of the hedge fund giant Brevan Howard. They employ a multi-strategy approach, investing in both public (liquid) and private (venture) markets within the crypto space. They’re also known for participating in blockchain governance and staking activities, showing a deeper engagement with the underlying technology and ecosystems.

- Morgan Creek Digital: Co-founded by Anthony Pompliano, Morgan Creek Digital focuses on bringing institutional investors into the crypto space through long-term growth strategies. They offer various funds, including index funds that provide diversified exposure to top cryptocurrencies, making it easier for traditional clients to invest.

- Multicoin Capital: Multicoin Capital is known for its research-driven approach and early, high-conviction bets on disruptive blockchain protocols. They emphasize liquidity, market-making activities, and long-term investments in projects they believe will redefine the internet, such as their early support for Solana and Algorand.

⚖️ The Regulatory Landscape: Rules of the Game

The evolution of regulations is a major factor driving institutional participation. Clearer rules reduce uncertainty and compliance risks, paving the way for more capital.

MiCA and Spot Bitcoin ETFs: Major milestones for legitimacy and compliance.

The EU’s MiCA framework provides regulatory clarity for crypto-assets, which is a significant step towards institutional acceptance. The approval of spot Bitcoin ETFs in the US in early 2024 was a monumental event. These ETFs made Bitcoin accessible through traditional brokerage accounts, removing the need for direct crypto custody and significantly simplifying compliance for many institutional investors. This has been a massive legitimising force.

Global Regulatory Divergence: Navigating regional differences in crypto regulation.

While progress is being made, the regulatory landscape is still fragmented. Different jurisdictions have varying rules, creating a complex environment for global funds. Hedge funds must carefully Research Crypto Opportunities Guide related to regulatory compliance in each market they operate. For example, some countries have strict bans on crypto derivatives, while others are developing bespoke licensing regimes for digital asset businesses. Understanding these differences is critical for global operations.

How Funds Navigate Compliance: Mention operational aspects.

To operate within these evolving regulatory frameworks, crypto hedge funds employ robust compliance teams and procedures. This includes implementing stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, working with regulated custodians, and adapting their operational frameworks to meet regional legal requirements. They’re not just trading; they’re building compliant financial entities.

🚀 Market Impact: How Institutions are Reshaping Crypto

The entry of hedge funds is not just about capital; it’s transforming the very structure and behaviour of the crypto market.

Driving Liquidity and Stability: Influx of institutional capital reducing price volatility.

The sheer volume of capital managed by these funds significantly increases market liquidity. More liquidity means less volatility, as large buy or sell orders have less impact on price. With assets under management (AUM) in crypto hedge funds projected to surpass $75 billion in 2025, this influx is directly contributing to a more stable and predictable market environment.

Lending Legitimacy and Maturity: Institutional involvement legitimising the crypto market.

The participation of reputable hedge funds, alongside major financial institutions, lends an undeniable air of legitimacy to cryptocurrencies. This institutional embrace helps shed the “wild west” image, fostering the development of more mature trading infrastructure, robust financial products (ETPs vs. ETFs Guide), and responsible market practices.

Accelerating Innovation: Driving creation of new investment products.

The demand from sophisticated investors for tailored crypto products is accelerating innovation. This includes the creation of new actively managed crypto ETFs, tokenized funds, and more complex derivative products (Bitcoin Spot vs. Derivatives Trading) that cater to institutional needs.

Tokenization of RWAs: The emerging trend of tokenising real-world assets (RWAs).

A major trend gaining traction is the tokenization of real-world assets like real estate, art, or commodities on blockchains. This process converts traditional assets into digital tokens, making them more liquid and accessible. The value of tokenized assets on blockchains already exceeded $50 billion by 2024, and hedge funds are actively exploring investment strategies in this growing sector.

⚠️ Risks to Watch: What Hedge Funds Face (and You Should Know)

Even the pros face significant risks in the crypto market. These are the dangers that demand constant vigilance.

Market Volatility:

Despite increasing maturity, the crypto market remains highly volatile compared to traditional assets. Sharp price swings can impact even sophisticated strategies, requiring constant risk management and adaptive tactics.

Security Concerns:

The threat of hacking, fraud, and exploits against exchanges, DeFi protocols, or even fund operational systems persists. Large pools of institutional capital are prime targets.

Regulatory Evolution:

While clarity is improving, the regulatory landscape is still rapidly evolving. Sudden policy changes or enforcement actions can disrupt strategies or even deem certain assets un-investable.

Smart Contract Vulnerabilities:

For funds actively engaging in DeFi or investing in projects built on smart contracts, the risk of bugs or exploits in the underlying code can lead to significant losses.

Exchange-Specific Risks:

Centralised exchanges can face operational risks, liquidity issues, or even hacks. Funds must diversify their exchange exposure and consider counterparty risk.

🎯 Investor Considerations: Before You Dive In

If you’re considering investing with a crypto hedge fund, you need to do your homework. This isn’t a casual decision.

Assess Your Risk Tolerance and Goals:

Understand your own capacity for loss. Crypto hedge funds, even with diversified strategies, typically carry higher risk than traditional hedge funds. Align your investment with your personal financial objectives.

Research Fund Strategies and Management Teams:

Go beyond marketing materials. Understand precisely how the fund aims to generate returns (arbitrage, long/short, quant, DeFi). Vett the management team’s experience in both traditional finance and crypto. Look for a track record of consistent returns.

Scrutinize Fees, Transparency, and Liquidity Terms:

Hedge fund fees are typically higher than traditional funds (e.g., “2 and 20” – 2% management fee, 20% performance fee). Understand all fees, including potential hidden costs. Demand transparency on holdings and trading activity. Also, check liquidity terms – how often and how quickly can you redeem your investment? Some funds have lock-up periods.

Evaluate Regulatory Compliance and Security Measures:

Confirm the fund operates under proper regulatory licenses in relevant jurisdictions. Inquire about their custody solutions, cybersecurity protocols, and audit history. For more on general trading safety, refer to Trading Insights.

🕰️ The Evolution of Crypto Hedge Funds: A Visual Timeline

The institutional journey into crypto has been a series of milestones.

Glossary of Key Crypto Hedge Fund Terms:

To help you understand the specific language used in this sector, here are some essential terms:

- AUM (Assets Under Management): The total market value of all financial assets that a hedge fund or investment institution manages on behalf of its clients.

- Arbitrage: A strategy that profits from price differences of the same asset in different markets.

- Quantitative Trading: Trading strategies based on mathematical and statistical models, often executed by algorithms.

- Market-Making: Providing liquidity by placing both buy and sell orders to profit from the bid-ask spread.

- DeFi (Decentralised Finance): Financial services offered on public blockchains, outside traditional intermediaries.

- MiCA (Markets in Crypto-Assets): A comprehensive regulatory framework for crypto-assets in the European Union.

- Tokenization: The process of representing real-world or digital assets as tokens on a blockchain.

- RWA (Real-World Assets): Tangible or intangible assets from the traditional financial world that are converted into digital tokens on a blockchain.

- Spot Bitcoin ETF: An Exchange-Traded Fund that directly holds Bitcoin.

- Long/Short Equity: A hedge fund strategy involving holding long positions in some assets while simultaneously shorting others.

- Yield Farming: A DeFi strategy where users lock up cryptocurrency to earn rewards.

Frequently Asked Questions (FAQs)

- Why are hedge funds investing in crypto now?

Hedge funds are investing due to clearer regulations (like MiCA and spot Bitcoin ETFs), crypto’s potential for portfolio diversification, and the opportunity to apply sophisticated trading strategies to a new asset class. - What is the most common strategy used by crypto hedge funds?

Common strategies include arbitrage, quantitative trading, market-making, long/short equity, and participation in DeFi activities like yield farming. - What is a major risk when investing with a crypto hedge fund?

A major risk is market volatility, along with concerns about cybersecurity, regulatory evolution, and potential smart contract vulnerabilities if the fund engages in DeFi. - How has the approval of spot Bitcoin ETFs impacted crypto hedge funds?

Spot Bitcoin ETFs have significantly legitimised Bitcoin as an asset class, making it easier for traditional institutions to gain exposure and driving increased trading activity and liquidity for crypto hedge funds. - What should an investor consider before allocating capital to a crypto hedge fund?

Investors should assess their risk tolerance, research the fund’s specific strategies and management team, and scrutinise its fees, transparency, liquidity terms, and regulatory compliance.

The bottom line on Hedge Funds in the Crypto Market? They’re not just diversifying; they’re professionalizing, innovating, and driving this market forward. Get informed, and you’ll see the smart money plays.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””