🔥 Introduction: The Wolf’s Wake-Up Call

Wall Street’s old guard is colliding head-on with the crypto revolution, and the battleground is America’s retirement plans. Picture this: Nine lawmakers have written to SEC Chair Paul Atkins, urging him to stop dragging his feet and implement Trump’s executive order that could allow crypto into 401(k) retirement plans. That’s not just policy chatter – it’s a financial earthquake in the making.

By the time you finish reading, you’ll understand why this single regulatory shift could reshape the future of retirement for millions, and how you can position yourself before the tidal wave hits.

🏛️ The Political Power Play

Nine lawmakers – Republicans and Democrats – just pulled the trigger on a game-changing demand: let crypto into 401(k)s. They’re not whispering; they’re shouting. Trump’s executive order last August lit the fuse, instructing the SEC to adjust regulations so ordinary savers could access alternative assets, including Bitcoin.

This isn’t partisan noise. It’s bipartisan momentum. When both sides of the aisle agree, the smart money listens.

💼 Retirement Plans Meet Crypto

Let’s break this down. A 401(k) is the backbone of retirement for millions of Americans. Traditionally, these plans are loaded with stocks, bonds, and mutual funds. Solid? Yes. Exciting? Hell no.

Enter crypto. If regulators greenlight digital assets in 401(k)s, retirement savers can diversify into the fastest-growing asset class of the last decade. We’re talking about moving from a world of safe but sluggish returns to one with rocket fuel potential.

Think of it this way: yesterday’s retirement was built on Wall Street. Tomorrow’s could be powered by blockchain.

💰 The $9.3 Trillion Elephant in the Room

Here’s the number that makes Wall Street sweat: $9.3 trillion. That’s the size of the US 401(k) market. If just 1% of that allocation slides into crypto, we’re talking $93 billion in fresh inflows.

For perspective, spot Bitcoin ETFs – which have been hailed as groundbreaking – have only raked in $60.6 billion since January 2024. This potential retirement-plan allocation absolutely dwarfs that.

The Wolf’s take? We’re staring at a rocket launch pad. All it needs is ignition.

📈 Lawmakers’ Logic: Why Now?

The timing isn’t random. Around 90 million Americans are locked out of alternative assets. Meanwhile, the Department of Labor reversed its anti-crypto stance in May, opening the door wider.

Trump’s executive order took it further, targeting accredited investor rules and demanding broader access. Translation? Ordinary Americans could soon be holding Bitcoin, Ethereum, and beyond inside their retirement accounts.

This isn’t just about regulation. It’s about rewriting the rules of wealth.

⚖️ Winners and Losers: Pension Funds’ Mixed Signals

Not every institution is on the same page. Michigan’s massive pension fund is already stacking crypto ETFs like chips on a poker table. Meanwhile, Wisconsin’s system sold its positions and walked away.

That’s the beauty of this moment: conviction versus fear. The smart players are already making their bets.

🌊 Market Tsunami: If Just 1% Moves

Imagine $93 billion pouring into crypto markets. What happens to Bitcoin’s price? To Ethereum? To altcoins with solid fundamentals?

If 1% is seismic, imagine 2%, 5%, or 10% over the next decade. We’re talking trillions, not billions.

Crypto’s market cap could explode, and retirement accounts could become the Trojan horse for mainstream adoption.

🚦 The SEC’s Dilemma

Paul Atkins, SEC Chair, is sitting in the hot seat. Does he open the floodgates and let capital flow, or does he play it safe and risk being remembered as the man who held America back?

The SEC loves to talk about “protecting investors.” But here’s the truth: protecting investors also means giving them access to the opportunities of the century. And lawmakers know it.

🤐 The Missing Voices

Here’s what the mainstream article didn’t tell you: no statements from the SEC. None from the Department of Labor. No financial advisors weighing in. And certainly no critics pointing out risks.

It’s like listening to a sales pitch with only the upside. The silence is telling.

⚠️ Risks You Can’t Ignore

Let’s be straight: crypto isn’t a one-way ticket to paradise. The risks are real.

- Volatility: Bitcoin can swing 10% in a day. Retirement plans aren’t built for faint-hearted investors.

- Custody: Who’s holding the keys? Hacks and scams still haunt this space.

- Fiduciary duty: Plan sponsors will be cautious – nobody wants a lawsuit because grandma’s nest egg evaporated in a crash.

Risks don’t kill opportunity. They demand strategy.

🌍 Global Comparisons

The US isn’t alone in this. Around the world, retirement and sovereign funds are sniffing around crypto.

- Europe: Some funds already have crypto exposure through ETFs.

- Asia: Sovereign wealth funds are experimenting.

If America leads, it could set a global standard. If it lags, it risks falling behind in the next wealth revolution.

🧑💼 Investor Takeaway: What This Means for You

Here’s the bottom line: if crypto gets the 401(k) nod, every retirement saver in America suddenly has access. Younger investors, already pro-crypto, will pile in. Older investors may hedge cautiously.

But make no mistake – this changes the entire wealth-building landscape.

Imagine a retirement portfolio with stocks, bonds, and a sliver of Bitcoin. That’s diversification on steroids.

🐺 The Wolf’s Playbook: How to Position Yourself

Here’s how you get ahead of the herd:

- Start small. Allocate a percentage you can stomach.

- Arm yourself with strategy. Learn technicals like RSI trading strategies, MACD momentum signals, and Bollinger Bands.

- Stay plugged in. Follow expert trading insights and adapt.

The real risk? Waiting on the sidelines while the next wealth wave leaves you behind.

🔮 Future of Regulation

This is the fork in the road. Will accredited investor rules disappear, allowing Main Street to play like Wall Street? Or will regulators slow-walk change until the moment has passed?

The smart money says crypto in 401(k)s isn’t a matter of “if.” It’s “when.”

And when it hits, the landscape of retirement will never look the same again.

👀 Counterarguments: The Critics’ Case

Of course, not everyone’s drinking the Kool-Aid. Critics argue:

- Crypto is too volatile for retirement savers.

- Fiduciaries could face lawsuits if portfolios blow up.

- Regulation is still immature.

Valid points – but ask yourself: when has innovation ever come without risk? The railroads, the internet, and even the stock market itself were all labelled “too risky” once upon a time.

📢 Closing: The Wolf’s Call to Action

This is the moment. Retirement funds are a powder keg, and crypto is the match. $93 billion is waiting to be unleashed, and that’s just the start.

Crypto in retirement plans isn’t some far-off dream. It’s the next inevitable step.

Don’t wait for regulators to hand you permission. Get educated. Get positioned. Take action. Because when this market rips, you’ll either be on the rocket – or watching it disappear into the sky.

❓ FAQs

1. Will crypto in 401(k) plans be mandatory?

No. It will likely be offered as an option, not forced.

2. How risky is crypto compared to traditional retirement assets?

Much riskier in terms of volatility, but it also carries higher potential returns.

3. When could SEC approval realistically happen?

With political pressure mounting, we could see initial approvals within 12–18 months.

4. Which cryptos are most likely to be included first?

Bitcoin and Ethereum, given their dominance and liquidity.

5. How can individuals prepare before their retirement plan includes crypto?

Learn strategies, start small outside your 401(k), and use resources like how to buy crypto.

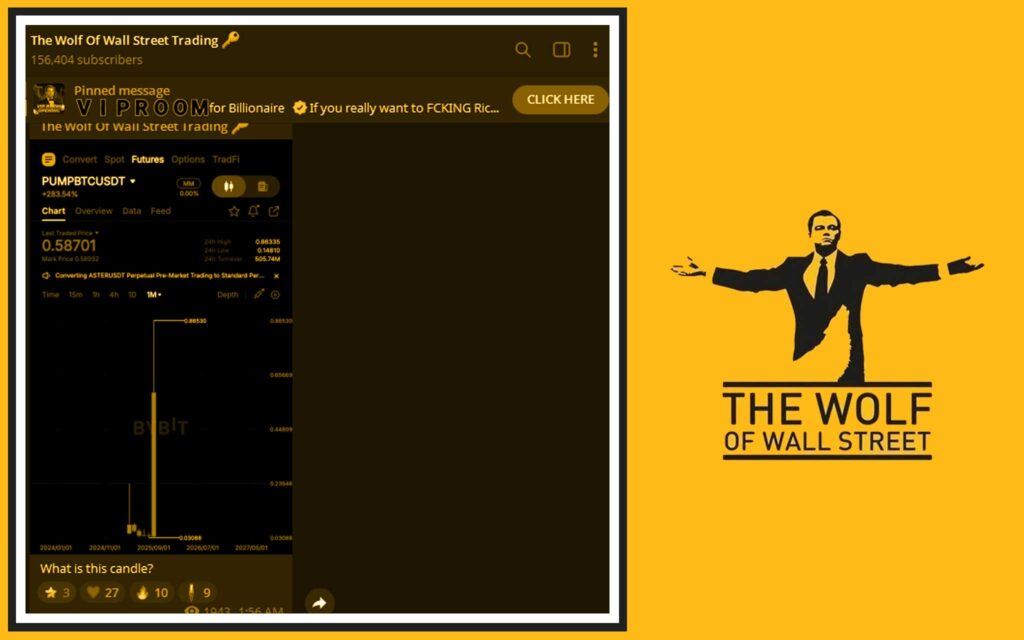

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

👉 Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.