🚀 Introduction: Why You NEED a Profit Strategy in Crypto

Let’s get one thing straight, my friends: you got into crypto to make money, right? To turn a few quid into a king’s ransom. But here’s the dirty little secret no one talks about at those fancy cocktail parties: making the money is only half the battle. The real war, the one that separates the kings from the peasants, is keeping it. This ain’t your grandad’s stock market. This is the Wild West of Wealth, where fortunes are made and lost faster than a blink. If you don’t have a profit strategy, you’re not an investor, you’re a gambler, and the house always wins in the end.

The Wild West of Wealth: Crypto’s Unpredictable Swings

You’ve seen it, haven’t you? That coin you bought for pennies suddenly shoots to the moon, turning your initial stake into a mountain of digital gold. Euphoria, baby! You’re dreaming of Lamborghinis and private jets. But then, just as fast as it soared, it tanks. A sudden correction, a market crash, a rug pull, whatever you want to call it. And just like that, your paper profits vanish into thin air. Poof! Gone. You’re left holding the bag, wondering what the hell just happened.

Don’t Be a Bag Holder: From Lambos to Losses

Listen, nobody wants to be a bag holder. Nobody wants to be the guy who saw their fortune evaporate because they were too greedy, too scared, or just plain clueless about when to sell. You started this journey to buy that Lambo, not to stare at a depreciated digital asset on your screen. The difference between a true crypto titan and a common schmuck is simple: a plan. A blueprint. A ruthless, unyielding strategy for when to take what’s yours.

Your Blueprint for Financial Freedom

This guide, my friends, is your blueprint. It’s the street map to navigate this chaotic market, to ensure that when those profits roll in, you don’t just stare at them, you act on them. This is about discipline, about understanding the game, and about making smart, calculated moves that ensure you walk away richer, not poorer. We’re going to turn your crypto gains into lasting wealth.

📈 The Golden Rule: Plan Your Exit Before You Enter

This is the first commandment of crypto wealth, etched in stone: YOU MUST PLAN YOUR EXIT BEFORE YOU ENTER! If you go into a trade without a clear idea of when you’re taking your profits, you’re setting yourself up for failure. It’s like jumping into the ocean without knowing how to swim. You might get lucky for a bit, but eventually, you’re gonna drown.

No Plan, No Profits: The Idiot’s Approach

I’ve seen it a million times. Guys, full of swagger, throw a few grand into some hot new altcoin. It pumps. They’re ecstatic. They tell everyone they know how smart they are. But then it dumps, and they’re left scratching their heads, wondering where it all went wrong. The answer is simple: they had no plan. No target. No exit strategy. Don’t be that idiot. Before you click “buy,” you need to know exactly when and why you’ll click “sell.”

Setting Your Targets: What’s Your Number?

This is where the rubber meets the road. What’s your profit target? Is it a 2x? A 5x? A 10x? Be realistic, but also be ambitious. Don’t just say “I’ll sell when it feels right.” That’s a surefire way to lose everything. Set a specific percentage gain, or a specific price point, where you’re going to take some of your money off the table.

For example, if you invest £1,000 in a coin at £1, you might decide you’re taking 50% of your initial investment out when it hits £2, and then letting the rest ride. Or perhaps you’re taking 25% out every time it doubles. The specific numbers are up to you, based on your goals, but have those numbers. They are your North Star in this volatile market. If you’re looking for advanced strategies to identify these numbers, explore resources like RSI Crypto Trading Strategies or Bollinger Bands Trading Strategy for technical indicators that can help.

Risk Tolerance: How Much Heat Can You Take?

Let’s be honest, crypto isn’t for the faint of heart. The volatility can be stomach-churning. You need to know your own risk tolerance. Are you the guy who can sleep soundly when his portfolio is down 50% in a week, or do you sweat every percentage point? Understanding this is crucial. It dictates how aggressive your profit-taking strategy should be. If you’re a conservative player, you’ll take profits more often, even if it means missing out on some bigger gains. If you’re a high-roller, you might let it ride longer, but you also risk a bigger fall. Know yourself, know your limits.

💸 Reinvest or Regret: The Power of Strategic Allocation

So, you’ve taken some profits. Congratulations! You’ve navigated the shark-infested waters and pulled some real cash out. Now, here’s where most people screw up. They think they’re rich, they go on a spending spree, and they buy all the depreciating assets their hearts desire. Big mistake. Huge.

The Depreciating Asset Trap: Don’t Buy a Yacht You Can’t Afford

Don’t be a fool. That brand-new car? It loses value the moment you drive it off the lot. That fancy watch? It’s a shiny piece of metal that’s not making you more money. While a small reward is fine, don’t blow your hard-earned crypto gains on trinkets that suck value like a vampire in a blood bank. Your goal isn’t to look rich, it’s to be rich. And to be rich, you need to make your money work for you.

Building an Empire: Reinvesting for Exponential Growth

This is where the real game begins. You’ve got capital. Now, deploy it like a seasoned general. Reinvesting your profits isn’t just a good idea; it’s the bedrock of building true, lasting wealth.

- Crypto Mining: ⛏️ Digging for Digital Gold

Forget picking up pennies; we’re talking about digging for gold! Crypto mining, for the savvy investor, can be a consistent source of income. Instead of just buying coins, you’re becoming a part of the network, earning new coins as a reward. It requires an upfront investment in hardware, but the long-term passive income can be immense. It’s about establishing a digital gold mine that keeps producing. - Investing in New Coins: 💎 High Risk, Higher Reward

This is where the real excitement is! With a portion of your profits, you can jump into promising new projects, early-stage altcoins, and innovative ventures. This is high risk, high reward, but if you do your due diligence and get in early, the returns can be absolutely staggering. It’s about spotting the next big thing before the masses even know it exists. But be smart, do your research, and understand that some of these bets won’t pay off. For insights into finding these opportunities, check out guides like Research Crypto Opportunities Guide. - Real Estate & Dividend Stocks: 🏡 Diversifying Your Dominance

Don’t put all your eggs in one digital basket. Once you’ve secured a substantial profit, look at traditional asset classes. Real estate, for instance, provides tangible assets and can generate consistent rental income. Dividend stocks offer regular payouts, giving you another stream of passive income. This is about diversification, about cementing your wealth, and building a multi-faceted financial fortress. It’s about having your cake and eating it too, in the most financially sound way possible. This strategy is also covered in The Wolf’s Guide to Asset Classes Crypto Wealth.

🧠 Master Your Mindset: Psychology of Profit-Taking

Listen to me, this market will play tricks on your mind. It will whisper sweet nothings in your ear when prices are soaring, telling you to hold, hold, hold! And it will scream panic when prices are crashing, telling you to sell, sell, sell! You need to have the mental fortitude of a sniper.

The Greed Monster: When Enough is Enough

Greed is the deadliest sin in crypto. It’s the reason why so many people ride their gains all the way back down to zero. You see your portfolio up 500%, and you think, “Why not 1000%?” The market doesn’t care about your greed. It will humble you. Set your profit targets, and when they hit, act. Don’t let the greed monster convince you to hold for an extra penny, because that extra penny can cost you the whole damn pot.

Fear of Missing Out (FOMO): Your Enemy, Not Your Friend

On the flip side, FOMO is a killer. You took some profits, and then the coin pumps even harder. You start thinking, “Oh god, I sold too early! I missed out!” This is the market playing games with your mind. Remember your plan. Remember your target. You locked in profit, you minimized risk. That’s a win. Don’t chase pumps. Don’t regret taking money off the table. The market will always present new opportunities. If you’re struggling with market psychology, learning about When to Sell Crypto Strategies can provide further insights.

The Art of the Exit: Knowing When to Fold ‘Em

Sometimes, the best move is no move, or a tactical retreat. Knowing when to cut your losses or take a smaller profit to avoid a bigger loss is an art form. It’s about having the conviction to stick to your strategy, even when everyone else is panicking or euphoric. This isn’t about emotion; it’s about cold, hard, logical execution.

🛠️ The Wolf’s Arsenal: Tools and Tactics for Profit-Taking

You wouldn’t go into battle without your weapons, would you? The same goes for the crypto market. You need the right tools and tactics to execute your profit-taking strategy with precision.

Setting Stop-Losses: Your Financial Parachute

This is non-negotiable. A stop-loss order is your absolute safety net. It automatically sells your asset if it drops to a certain price, limiting your potential losses. This protects your capital, ensuring that you don’t ride a losing position all the way to zero. It’s your financial parachute, and you better have it packed. Learn more about controlling your trades with tools like Master Crypto Order Types Trading.

Using Trailing Stops: Riding the Wave Up

This is a more sophisticated move for the savvy trader. A trailing stop allows you to set a stop-loss that moves up with the price of your asset. So, as your crypto pumps, your stop-loss automatically adjusts, locking in more profit while still giving the asset room to run. If the price suddenly reverses, your trailing stop will trigger, securing your gains. It’s like having an invisible hand protecting your profits as they grow.

Dollar-Cost Averaging Out: A Smart Exit Strategy

Just as dollar-cost averaging into a position can reduce your average purchase price, dollar-cost averaging out can help you maximize your exit. Instead of selling your entire position at once, you sell a fixed amount at regular intervals or at specific price points. This smooths out your exit, prevents you from missing out on further pumps, and reduces the risk of selling at the absolute bottom of a dip. It’s a disciplined approach that takes emotion out of the equation.

🌐 Beyond Selling: Alternative Ways to Profit from Your Crypto

Who said you always have to sell to make a profit? The crypto world is evolving, and there are innovative ways to generate income from your holdings without completely divesting. This is about making your money work harder for you. Dive deeper into these methods with guides like Earn Crypto Without Selling Passive Income.

Peer-to-Peer Lending: Lending Your Way to Riches

Imagine lending your crypto to other users and earning interest on it. That’s peer-to-peer (P2P) crypto lending. Platforms connect lenders with borrowers, allowing you to generate passive income from your idle assets. It’s like being your own digital bank, but with way less paperwork and a lot more upside. For a comparison, read P2P vs Centralized Crypto Exchanges Profit Guide.

Arbitrage Opportunities: Profiting from Price Gaps

This is where the truly sharp minds make their money. Arbitrage involves exploiting small price differences for the same asset across different exchanges. Buy low on one exchange, sell high on another, and boom! Instant profit. It requires speed and precision, but the consistent, low-risk gains can add up to a significant sum. It’s about being faster and smarter than the rest.

Digital Dividends & Staking: Passive Income, Active Wealth

Many newer cryptocurrencies offer “digital dividends” or staking rewards, allowing you to earn more of the coin simply by holding it or “staking” it to support the network. It’s passive income at its finest. You’re not selling your principal, you’re just enjoying the fruits of your investment, piling up more assets without lifting a finger. It’s about making your crypto work for you while you sleep.

⚖️ The Taxman Cometh: Understanding Your Obligations

Now, listen up. This is boring, but it’s crucial. You make a pile of money, the government wants its cut. Ignoring the tax implications of your crypto gains is a rookie mistake that can land you in serious hot water.

Don’t Get Caught Flat-Footed: Tax Compliance is Key

Every time you sell crypto for fiat, trade one crypto for another, or use crypto to buy goods and services, it’s generally considered a taxable event. The rules vary by jurisdiction, but the principle is the same: the taxman knows. Don’t try to hide it. Be transparent, track your transactions, and understand your capital gains obligations. It’s not about avoiding taxes; it’s about being smart and compliant.

Seeking Professional Guidance: A Smart Investment

Unless you’re a tax wizard, consult a professional. A crypto-savvy accountant or tax advisor can help you navigate the complexities, ensure you’re compliant, and potentially save you a fortune in penalties down the line. It’s an investment in your peace of mind and your financial security. Don’t be penny-wise and pound-foolish when it comes to the taxman.

🤝 Join the Pack: Leveraging a Community for Success

Listen, this journey can be a lonely one if you’re going it alone. The crypto market is a beast, and sometimes, you need a pack to hunt with. That’s where a strong, vibrant community comes in.

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating this volatile market. This isn’t just some casual chat group; this is a collective of over 100,000 like-minded individuals, all focused on one thing: making serious money.

The Power of the Collective: Over 100,000 Strong

Imagine having 100,000 eyes on the market, 100,000 brains dissecting data, and 100,000 hands ready to pounce on opportunities. That’s the power of the The Wolf Of Wall Street community. You’re not just getting tips; you’re getting shared insights, support, and a network that can give you an undeniable edge. When the market turns, when opportunities arise, you’ll hear about it first, you’ll discuss it, and you’ll be ready to act. You can join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

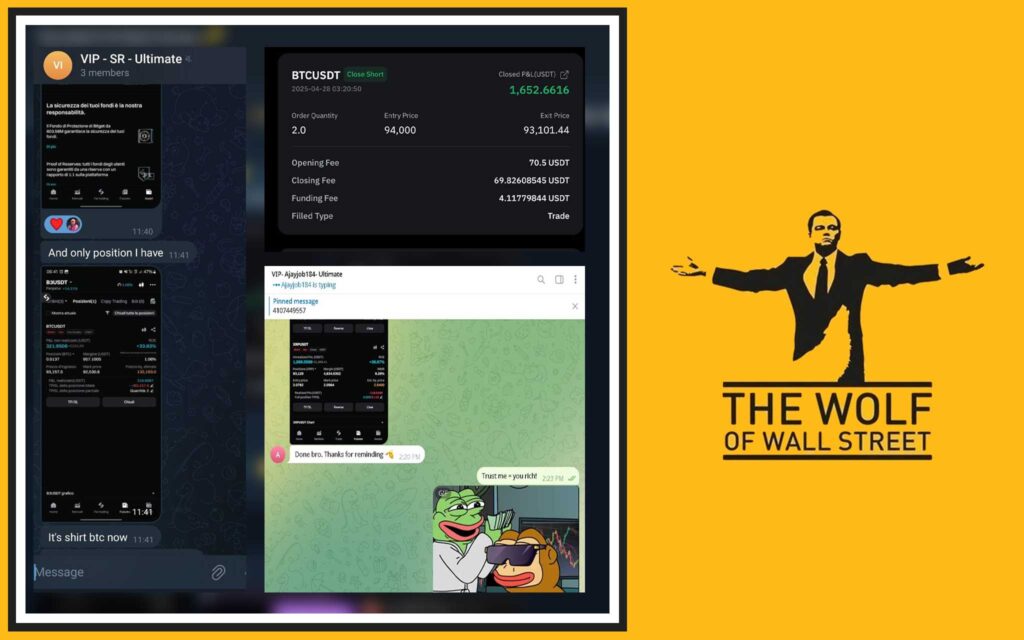

Exclusive VIP Signals: Your Edge in a Crowded Market

This is where the rubber meets the road, where the whispers turn into actionable intelligence. The Wolf Of Wall Street offers Exclusive VIP Signals. These aren’t just guesses; these are proprietary signals designed to maximize your trading profits. These are the insights that the pros use, filtered down to you, giving you a distinct advantage in a market where every millisecond counts. This is about cutting through the noise and getting straight to the profit.

Expert Market Analysis: Insights from the Trenches

You think you can outsmart the market by yourself? Maybe, for a while. But to consistently win, you need the best intel. The Wolf Of Wall Street provides Expert Market Analysis from seasoned crypto traders. These are the guys who live and breathe this market, who understand its nuances, its patterns, and its psychology. Their in-depth analysis gives you the context you need to make informed decisions, not just blind bets.

24/7 Support: We’ve Got Your Back, Always

This isn’t a 9-to-5 game. The crypto market never sleeps, and neither should your support. With The Wolf Of Wall Street, you get 24/7 Support. Questions about a trade? Need help with a tool? Our dedicated team is there for you, around the clock. Because in this market, timing is everything, and a quick answer can mean the difference between massive profit and a missed opportunity.

To truly empower your crypto trading journey and unlock your potential to profit in the crypto market, visit the The Wolf Of Wall Street website: https://tthewolfofwallstreet.com/ for detailed information.

🏆 Case Studies: Learning from the Winners (and Losers)

The best way to learn is from those who’ve walked the path before you, both the legends and the cautionary tales.

The Early Bitcoin Millionaires: HODL and Profit

We all know the stories: the guy who bought Bitcoin for pennies and held on, through bull and bear markets, until it made him a millionaire. This is the HODL strategy in its purest form. For many early adopters, simply holding onto their assets paid off handsomely. But here’s the kicker: even they eventually had to decide when to take profits. Many held through multiple peaks, only to see significant pullbacks. The lesson? HODL can be powerful, but even the strongest conviction needs an exit plan.

The Altcoin Gamblers: Boom or Bust?

Then there are the altcoin speculators. They jump into every new project, chasing the next 100x. Some hit it big, turning a few hundred quid into hundreds of thousands. But for every success story, there are a dozen busts. These are the guys who often don’t have a profit-taking strategy beyond “to the moon!” and end up losing it all when the hype dies down. Their greed blinds them, and their lack of discipline leaves them broke. It’s a classic boom or bust scenario, and mostly bust.

The Disciplined Investor: Slow and Steady Wins the Race

The real winners, the ones who build sustainable wealth, are the disciplined investors. They set their targets, take profits incrementally, and reinvest strategically. They might not hit the dizzying heights of the lucky few, but they consistently grow their wealth, weathering market storms and building a financial fortress piece by piece. They understand that patience, planning, and execution are the keys to long-term success.

❓ FAQs: Your Burning Questions Answered

Still got questions? Good. That means you’re thinking. Here are some of the most common ones I hear.

Q1: What’s the biggest mistake crypto investors make when taking profits?

The single biggest mistake is greed. Pure and simple. Investors see their portfolio up 50%, then 100%, then 200%, and they get high on the idea of limitless gains. They refuse to sell, thinking it will go higher forever. And then, without fail, the market corrects, and they watch their paper profits vanish. Don’t let greed dictate your decisions. Stick to your plan.

Q2: How do I balance risk and reward when reinvesting?

It’s all about diversification and understanding your own risk profile. Don’t throw all your profits into one new, unproven altcoin. Spread it out. Allocate a portion to stable, income-generating assets like real estate or dividend stocks. Put some into established cryptocurrencies like Bitcoin and Ethereum. Then, and only then, allocate a smaller, calculated percentage to higher-risk, higher-reward opportunities. It’s about building a balanced portfolio, not just chasing moonshots. For more on this, check out Master Crypto Dominance Trading Strategies.

Q3: What are the tax implications I really need to know?

Listen, the tax rules for crypto are complex and constantly evolving. But the basic rule of thumb is: any time you sell crypto for fiat, trade crypto for crypto, or use crypto to purchase goods/services, it’s likely a taxable event. Keep meticulous records of all your transactions – purchase prices, sale prices, dates, and what you exchanged. And for God’s sake, consult a tax professional who understands cryptocurrency. Trying to figure it out yourself or, worse, ignoring it, is a fast track to trouble.

🎉 Conclusion: Dominate Your Destiny in the Crypto Market

So there you have it, straight from the horse’s mouth. Taking profits in crypto isn’t about luck; it’s about strategy, discipline, and having the guts to execute your plan. You came into this market to get rich, and by following these principles, you can do exactly that.

Your Financial Future is in Your Hands

The crypto market is volatile, unpredictable, and ruthless. But for those with a clear head and a solid plan, it’s also the greatest wealth-generating opportunity of our lifetime. Don’t let emotion or fleeting hype dictate your financial future. Take control.

The Path to True Wealth: Discipline and Strategy

Remember the golden rules: plan your exit before you enter, set clear profit targets, and don’t let greed or fear derail you. Reinvest wisely, diversify your assets, and always be aware of your tax obligations. And for God’s sake, leverage the power of a community like The Wolf Of Wall Street to give yourself an unparalleled advantage. Visit https://tthewolfofwallstreet.com/ to learn more and join the revolution.

By applying these principles, you won’t just make money in crypto; you’ll dominate the market and build a legacy of lasting wealth. Now go out there and get what’s yours!

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”