Introduction: The Scam That Shook Trust

Let me paint you a picture: a seasoned financial adviser, trusted by clients, friends, even family, siphoning millions into a crypto black hole. Sounds like a Hollywood script? Nope. It happened, right here in Australia. We’re talking AUD 14.8 million—vanished. The mastermind? Glenda Maree Rogan. The punishment? A brutal 10-year ban slapped down by ASIC. And this isn’t just a personal fall from grace. It’s a wake-up call for the entire financial services sector.

Crypto scams are no longer fringe stories. They’re mainstream nightmares. And if you’re not paying attention, your money could be next.

Learn more about the evolving cryptocurrency ecosystem and how to protect your assets in this ever-changing space.

🚨 Meet the Mastermind: Glenda Maree Rogan

Rogan wasn’t some back-alley schemer. She wore the badge of a financial adviser, ran Fincare group companies out of Sutherland and Wollongong, and was embedded in the community. Between March 2022 and June 2023, she convinced people she was offering a golden opportunity: a high-yield fixed-interest account that sounded safer than a Swiss vault.

Spoiler alert: it was fiction. Funds were rerouted to her personal and business accounts, converted into crypto, and fired off to a sketchy UK-based platform named “Financial Centre.” ASIC had already flagged this site as a scam. And Glenda? She knew.

If you’re new to crypto and want to avoid these traps, check out our Newbie guide for essential beginner knowledge.

💸 The Scam Playbook: Fixed-Interest Illusion

Here’s the con, step by step:

- The Hook: Promise high, stable returns on a “safe” investment.

- The Lie: Claim the money goes into a legitimate fixed-income account.

- The Switch: Redirect funds to personal and business bank accounts.

- The Flip: Convert the cash into crypto (easy to hide, hard to trace).

- The Exit: Send it to an unlicensed, dodgy crypto exchange offshore.

Classic Ponzi meets modern tech.

Dive deeper into how DeFi protocols are structured to prevent these types of fraud.

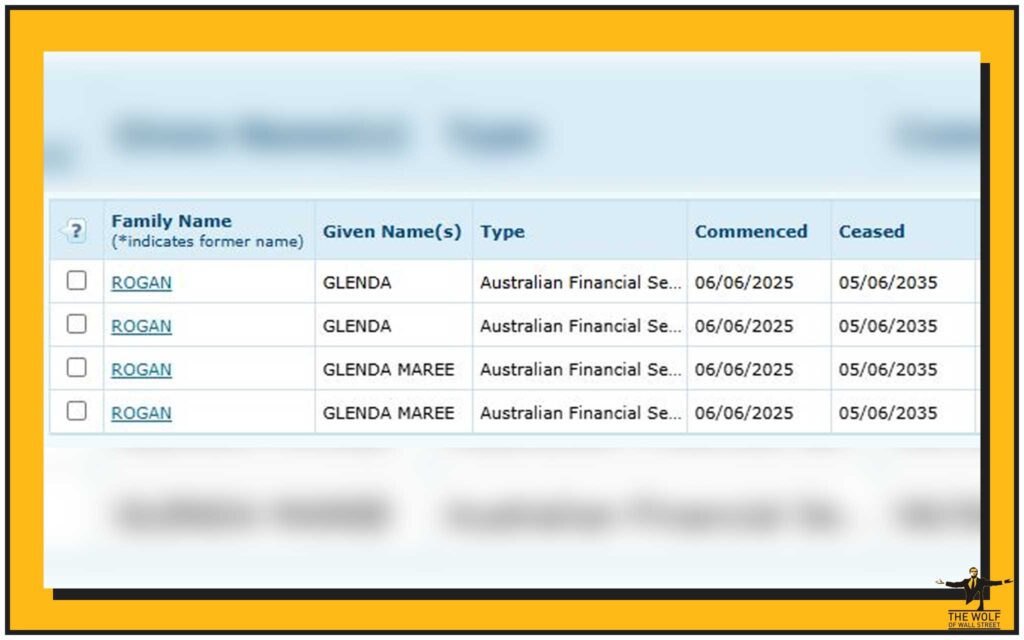

🔍 ASIC Claps Back: 10-Year Ban and Ongoing Probe

On June 6, 2025, ASIC dropped the hammer: Glenda Rogan is banned for a decade from providing financial services or controlling any financial services business. ASIC’s findings? She’s not competent, not trustworthy, and has zero business operating in this space.

But it ain’t over yet. The investigation rolls on, and Rogan can still appeal the decision. Justice may take time, but it’s hunting.

📉 The Fallout: Victims, Vulnerability, and Vanished Millions

The damage? Catastrophic. Friends. Family. Clients. People who believed in her lost savings, retirement funds, and probably a chunk of their faith in financial professionals. ASIC hasn’t disclosed whether any of the AUD 14.8 million will be recovered. And when crypto’s involved, the odds of retrieval are slim.

This wasn’t just about money. It’s about betrayal on a personal level.

⚖️ The Bigger Picture: Australia’s Crypto Crackdown

Glenda’s case is just the tip of the iceberg. Australia is turning up the heat on the crypto scene. AUSTRAC and ASIC are targeting:

- Inactive crypto exchanges

- Remittance services with weak compliance

- Crypto ATMs

Scams like this one are fuelling a regulatory firestorm. It’s all about safeguarding retail investors and eliminating bad actors.

Stay updated on crypto policy changes that impact how platforms operate in Australia.

💼 Lessons in Due Diligence: Don’t Trust, Verify

Credentials can lie. Trust alone is not a strategy. Whether it’s a family friend or someone with a framed certificate on the wall, always check:

- Licensing: Are they registered?

- Platform Legitimacy: Has the exchange been flagged by regulators?

- Fund Movement: Is your money going offshore or into wallets you can’t access?

🧠 How to Outsmart Crypto Scammers: Red Flags You Can’t Ignore

Here’s your cheat sheet to sniff out the fakes:

- Promises of consistent high returns

- Urgency and pressure tactics

- Vague or secretive platform details

- Payments to personal bank accounts

- Lack of a real community or support structure

Avoid these, and you cut your scam risk by 80%.

💪 Beating the Scam Game with Smart Tools

Here’s where you turn the tables. Knowledge is power, but applied knowledge is profit. Use tools that real traders trust:

- Volume calculators

- Technical trend indicators

- Market sentiment signals

Don’t just guess. Analyse. Plan. Execute.

🚀 The The Wolf Of Wall Street Edge: Trade Smart, Not Emotional

Forget lone wolf trading. The real money is made with a pack. The Wolf Of Wall Street crypto trading community isn’t just another chat group. It’s an all-in-one weaponised platform built for results:

- Exclusive VIP Signals that move with market momentum

- Expert insights from veterans who’ve seen it all

- Private network of 100,000+ strategic thinkers

- 24/7 support to back you when it counts

Don’t roll the dice in crypto. Play with the pros. Join The Wolf Of Wall Street on Telegram now.

📅 Related Reading You Shouldn’t Miss

If this case opened your eyes, here’s where to go deeper:

📚 FAQs: How to Handle Investment Fraud

What should I do if I suspect an investment is a scam?

Stop all transactions immediately. Report to ASIC and your financial institution.

Can I recover crypto funds lost in fraud?

Recovery is tough, but fast action with a legal team improves odds.

How can I check if a platform is licensed in Australia?

Visit ASIC’s register. If it’s not there, walk away.

🧠 Final Take: Confidence is Earned, Not Bought

This isn’t just another scandal. It’s a masterclass in what happens when you trade blind. Glenda Rogan sold smoke and mirrors. And she got burned. If you want to make real moves in the crypto game, arm yourself with strategy, tools, and a community like The Wolf Of Wall Street.

Because in this market, confidence comes from clarity, not charisma.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

• Exclusive VIP Signals to maximise profits

• Expert Market Analysis

• Private Community of 100,000+ traders

• Essential Trading Tools

• 24/7 Support

Empower your crypto journey → The Wolf Of Wall Street | Telegram