Let me tell you something, folks. In this game, in any game, there are rules. And if you don’t know ’em, if you don’t understand ’em, you’re gonna get wiped out. Forget about Lambos, forget about private jets – you’ll be lucky to afford a bus ticket. But if you play smart, if you play by the new rules, the crypto market is still the greatest wealth-creation machine on the planet. And right now, the biggest rule you need to understand, the one that’s shaking up the entire industry, is the Crypto Travel Rule.

It’s not just a guideline anymore; it’s a mandate that demands cryptocurrency service providers—like exchanges and custodial wallet providers—collect and share detailed information on transfers above specific thresholds, putting a spotlight on personally identifiable data such as names and wallet addresses. This isn’t just about regulation; it’s about control, transparency, and ultimately, who profits in the brave new world of digital assets.

⚡ The Game Has Changed: What is the Crypto Travel Rule?

You thought crypto was the Wild West forever, didn’t you? No rules, no limits, just pure, unadulterated freedom. Well, that ship has sailed, my friends. The Crypto Travel Rule is here, and it’s a game-changer. It’s a regulation that demands cryptocurrency service providers – think exchanges, custodial wallet providers, and all those Virtual Asset Service Providers (VASPs) – to spill the beans. When you’re moving crypto above a certain threshold, they’ve got to collect and share detailed information about you, the sender, and them, the recipient. We’re talking names, wallet addresses, sometimes even your physical address or national ID.

Understanding the New Landscape: No More Wild West

This isn’t just some suggestion; it’s a mandate. It means that the days of anonymous, untraceable crypto transactions are getting tougher to pull off. The financial world is finally catching up, and they’re bringing the crypto space into the fold. For the smart money, this isn’t a problem; it’s an opportunity. It legitimises the market, attracts bigger players, and ultimately, it makes it safer for everyone to profit. But you’ve got to know how to navigate it. You need the right tools, the right insights. Just like in the old days, you need an edge.

The Masterminds Behind the Mandate: FATF Strikes Back

So, who cooked up this delicious recipe for regulation? None other than the Financial Action Task Force (FATF). These are the global watchdogs, the anti-money laundering (AML) and counter-terrorist financing (CFT) gurus. They’ve been setting the standards for traditional finance for years, and now they’ve explicitly brought crypto into their jurisdiction. This rule wasn’t born yesterday, either.

It’s been updated multiple times since 2016, with significant revisions in 2019 and 2021, showing they’re serious about reining in the digital asset sector. In fact, just this month, the FATF announced further changes to Recommendation 16, solidifying requirements for standardised information and fraud protection tools, with full implementation phased through 2030. Make no mistake, the FATF means business, and if you’re not in compliance, you’re not in the game.

🛑 Why This Rule Matters: Unmasking the Underbelly

Now, some of you might be thinking, “This is just more government overreach, more red tape!” And maybe, just maybe, there’s a grain of truth to that. But let’s get real. There are bad actors out there – money launderers, terrorists, fraudsters – and they’ve been using crypto to pull off their dirty deeds. This rule is designed to stop them dead in their tracks.

Stopping the Scammers: Protecting Your Profits

The primary objective of the Crypto Travel Rule is simple: prevent money laundering, terrorist financing, and other financial crimes. How? By bringing transparency and traceability to crypto transactions. When every significant transfer has a sender and a recipient attached to it, it becomes a lot harder for criminals to hide their tracks. And when the bad guys are pushed out, the market becomes cleaner, safer, and more attractive for legitimate investors like you. This isn’t about stifling innovation; it’s about safeguarding your investments and making sure your hard-earned crypto isn’t tainted by illicit activity.

From Cash to Crypto: Bridging the Regulatory Gap

Think of it this way: traditional banks have been under strict AML and CFT regulations for decades. If you walk into a bank and try to wire a large sum of money, they’re going to ask questions. Lots of questions. That’s the Travel Rule in action for traditional finance. The FATF is simply extending those same principles to the digital realm. This means the crypto industry is maturing.

It’s moving out of its wild adolescence and into a more regulated, institutional-friendly phase. This isn’t a step backward; it’s a massive leap forward for mass adoption and bringing serious money into the space. And for those of you who want to dive deeper into the nuts and bolts of crypto compliance and security, understanding frameworks like the one outlined in our guide on Crypto AML Guide: Compliance & Security for 2025 is absolutely essential.

📈 The Nitty-Gritty: What You Need to Know About Compliance

This isn’t some abstract concept. This is real, and it affects how you transact every single day. If you’re going to play in this market and win big, you need to know the specific details.

Thresholds: The Numbers That Define Your Moves

Here’s the deal: not every tiny transaction is going to trigger this rule. Most jurisdictions have set a threshold. The common number you’ll hear globally is $1,000 (or €1,000 in the EU). If your crypto transfer is above that, you’re in Travel Rule territory. In the U.S., it’s a bit higher, at $3,000. This means if you’re sending significant amounts, your VASP is obligated to collect and share your data. Don’t be caught off guard. Know your numbers, know your limits, and plan your moves accordingly.

Who’s Under the Microscope? VASPs and Beyond

Who exactly does this rule apply to? It’s not just a free-for-all. We’re talking about Virtual Asset Service Providers (VASPs). This includes all the big players you know:

- Crypto exchanges: Binance, Coinbase, Kraken – if they’re facilitating trades, they’re on the hook.

- Custodial wallet providers: If they’re holding your crypto, they’re part of the system.

- And yes, even some Decentralized Finance (DeFi) platforms are starting to feel the heat. While DeFi prides itself on trustless interactions, regulators are increasingly looking to apply existing AML rules to these protocols, signaling a “same risk, same rule” approach.

Now, don’t misunderstand. Direct peer-to-peer (P2P) transactions, where no regulated service provider is involved, generally aren’t covered. But the moment you touch a VASP, the rules apply. You need to understand the difference. For more insights into navigating the world of different exchanges, check out our guide on P2P vs. Centralized Crypto Exchanges: Profit Guide.

The Data Grab: What Information Are They Demanding?

This is where some people get squeamish, but if you want to play with the big boys, you’ve got to show your hand. For transfers above the threshold, VASPs are required to collect and share a treasure trove of your personal details. This includes, but is not limited to:

- Your full name

- Your wallet address

- Your physical address

- National identity number, or date and place of birth

Yeah, it’s personal. But it’s also the price of entry into a market that’s becoming more legitimate, more secure, and ultimately, more profitable. The FATF is now also requiring financial institutions to verify beneficiary information, ensuring names and account numbers match before transactions are executed.

💸 The Impact on Your Wallet: Friend or Foe?

So, what does all this mean for your bottom line? Is it a roadblock or a ramp to greater riches? It’s both, depending on how you react.

Your Privacy on the Line: Navigating the New Normal

Let’s be direct: your privacy will be impacted. You’re going to have to provide more personal information to exchanges and VASPs than ever before. This is the new normal. But here’s the flip side: while it means less anonymity, it also means greater protection against scams and illicit activities that can devalue the entire market. For those who want to understand the finer points of managing crypto in this new era, our guide on Research Crypto Opportunities Guide can help you identify legitimate projects and avoid pitfalls.

Cross-Border Hurdles: When Your Money Hits a Wall

If you’re making cross-border transfers, especially to regions that haven’t fully embraced the Travel Rule, you might run into some friction. These transfers could be subject to extra scrutiny, delays, or even outright rejection. This isn’t about penalising you; it’s about the VASPs protecting themselves from regulatory penalties. So, if you’re dealing internationally, do your homework. Know which jurisdictions are compliant and which aren’t. As of late 2024, if you’re in the EU, you might even need your own private wallet to transfer crypto between entities, as direct transfers between exchanges may be blocked.

For the Players: How Exchanges Are Adapting (Or Failing)

This rule forces VASPs to beef up their compliance departments. They need robust systems for data collection, sharing, and, crucially, privacy protection. Some are doing it well; others are dragging their feet. The ones that adapt quickly, that embrace the new regulatory environment, are the ones that will win big. They’ll attract the institutional money, the serious investors who demand compliance and security. If you’re trading, you want to be on platforms that are at the cutting edge of Crypto Travel Rule compliance. They’re the future.

🌐 Global Domination: How Countries Are Playing the Game

The Crypto Travel Rule isn’t a monolithic beast; it’s being implemented differently across the globe. It’s a patchwork, but the trend is clear: more and more countries are getting on board.

Early Adopters vs. Late Bloomers: A Patchwork of Regulations

Countries like the U.S. and Canada were quick out of the gate, adopting the rule early on. They saw the writing on the wall. Others, like the U.K., have been a bit slower, but they’re finally incorporating it into their regulatory frameworks. This creates a complex landscape. You need to be aware of where you’re trading and what the local rules are. Ignorance is not bliss in this market; it’s a recipe for disaster. Stay informed on broader policy changes affecting crypto by checking our Policies section regularly. Switzerland, for instance, has had the Travel Rule in place since 2020 with no minimum threshold, requiring data sharing for all virtual asset transfers.

The UK’s Move: A New Player Enters the Arena

The U.K.’s recent embrace of the Travel Rule (effective September 2023 for cryptoasset exchange providers and custodial wallet providers) signals a significant shift. One of the world’s major financial hubs stepping up its game means more pressure on other nations to follow suit. The UK, like many jurisdictions, applies a £1,000 threshold for full information collection, focusing on a risk-based approach. This isn’t just about local compliance; it’s about global financial integration. The crypto market is becoming truly global, and with that comes global responsibilities.

US vs. The World: Different Strokes for Different Folks

While the core principles of the Travel Rule are consistent, the implementation can vary. The U.S. has its own specific nuances, like the $3,000 threshold, which differs from the more common $1,000. Understanding these regional differences is crucial, especially for international traders. It’s not one-size-fits-all, and those who treat it that way will get burned. Other countries like South Korea and Singapore also have their own thresholds and implementation dates, further emphasising the need for diligence.

🛠️ The Solution: Tools to Triumph in a Regulated World

So, what’s a smart trader to do? You don’t just sit back and let the regulations crush you. You find the tools, the partners, the systems that allow you to thrive within the rules.

Innovate or Die: Tech Solutions for Compliance

The smart money in the VASP world isn’t fighting the Travel Rule; they’re building solutions for it. Companies are developing cutting-edge technology to help exchanges comply with these stringent requirements. We’re talking about sophisticated software that can collect, verify, and securely share the necessary data, all while protecting user privacy as much as possible.

Solutions like Notabene’s SafeTransact platform and systems from Elliptic and CodeVASP are emerging, offering secure data handling, real-time monitoring, and multi-protocol compatibility to address the “sunrise issue” (where not all VASPs are compliant simultaneously). This is where innovation truly shines – solving real-world problems for a rapidly evolving industry.

The The Wolf Of Wall Street Edge: Your Secret Weapon in the Crypto Jungle

This is where I tell you something critical. Navigating this new regulated landscape isn’t just about avoiding penalties; it’s about maximising your profits. You need to be informed, you need to be connected, and you need the best intel. That’s why the The Wolf Of Wall Street crypto trading community is not just a platform; it’s your unfair advantage.

Listen up: if you’re serious about making real money in this market, you need access to the kind of information and support that puts you leagues ahead of the pack. Here’s what you get with The Wolf Of Wall Street:

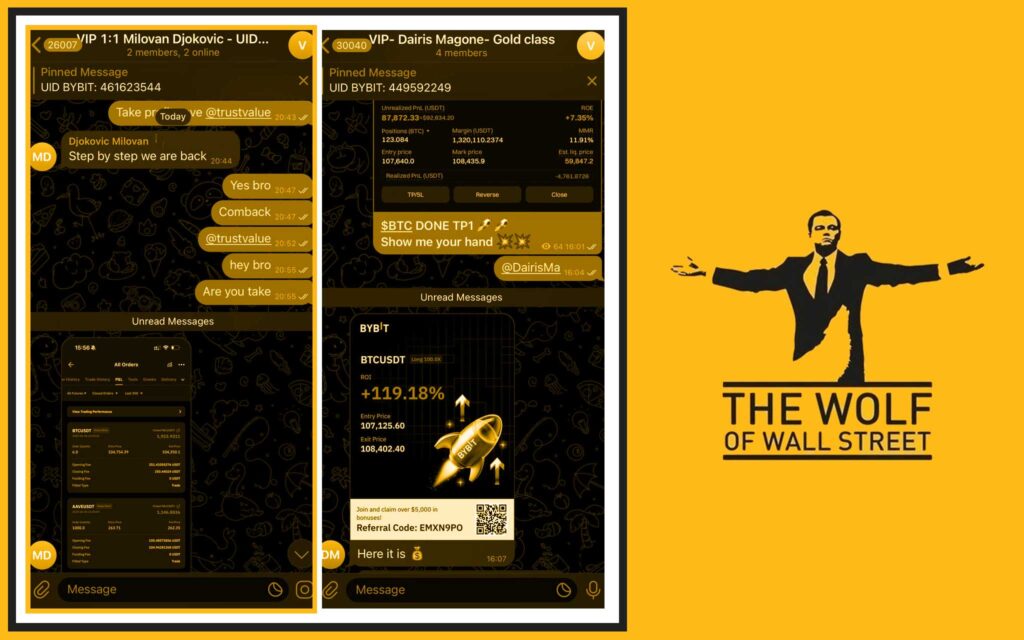

- Exclusive VIP Signals: Forget guessing. Our proprietary signals are designed to maximize your trading profits. This isn’t about hope; it’s about precision.

- Expert Market Analysis: You think you can outsmart the market alone? Get real. Benefit from in-depth analysis from seasoned crypto traders who live and breathe this game. We give you the insights you need to make informed decisions, not emotional ones.

- Private Community: You’re not alone in this. Join a network of over 100,000 like-minded individuals. Share insights, get support, and ride the waves of success together. This community is a goldmine of shared knowledge, where you can discuss everything from Trending market movements to the latest News in the crypto space.

- Essential Trading Tools: We give you the firepower. Utilize volume calculators and other crucial resources to make decisions based on data, not gut feelings. You wouldn’t go to war without your weapons, would you? Don’t trade without ours. For those looking to sharpen their trading techniques, understanding tools like RSI Crypto Trading Strategies or MACD Indicator Momentum Signals can be immensely beneficial.

- 24/7 Support: The market never sleeps, and neither do we. Receive continuous assistance from our dedicated support team. Any time, any problem, we’ve got your back.

Empower your crypto trading journey. Stop leaving money on the table. Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

This isn’t just about surviving the Travel Rule; it’s about thriving because of it.

🚀 Don’t Get Left Behind: How to Master the Travel Rule

This isn’t a drill. The Crypto Travel Rule is a reality. So, how do you not just comply, but dominate?

For the Individual Trader: Stay Ahead of the Curve

As an individual trader, your key is awareness.

- Know your VASP: Understand their compliance procedures. Make sure they’re implementing secure data handling.

- Be prepared to provide information: Don’t fight it; embrace it. This is the cost of doing legitimate business in a maturing market.

- Understand thresholds: Know when your transactions will trigger data collection. Remember the $1,000 (or $3,000 in the U.S.) mark.

- Consider self-custody for smaller amounts: If you want absolute control and anonymity for micro-transactions, a non-custodial wallet might be your play, but remember the risks involved with managing your own private keys. For deeper insights into managing your crypto, check out guides like How to Buy Crypto Guide.

- Stay informed: Regulations evolve. Keep an eye on the news, follow reliable sources. Our News and Hot sections are designed to keep you updated on the latest developments in crypto policies and market shifts.

For the Crypto Business: Adapt or Get Crushed

For VASPs and crypto businesses, this isn’t optional.

- Invest in robust compliance solutions: This isn’t an expense; it’s an investment in your future. Automated, AI-powered compliance tools are no longer a luxury but a necessity.

- Prioritise data security: You’re handling sensitive customer information. Protect it fiercely with end-to-end encryption and robust security protocols.

- Collaborate with other VASPs: Interoperability for data sharing is crucial. Solutions like TRISA (Travel Rule Information Sharing Alliance) are paving the way for secure, peer-to-peer data exchange.

- Educate your users: Transparency builds trust. Clearly communicate your compliance procedures and what users can expect.

- Engage with regulators: Be part of the solution, not the problem. Proactive engagement can help shape regulations in a way that fosters innovation.

🔥 FAQs: Your Burning Questions Answered

Let’s cut through the noise and answer some of the most common questions swirling around the Crypto Travel Rule.

Will the Travel Rule Kill Decentralisation?

Absolutely not! While the rule primarily targets centralised VASPs, it doesn’t directly kill decentralisation. DeFi platforms are a different beast, and regulators are still figuring out how to approach them. The FATF and other regulatory bodies are exploring how to apply AML laws to DeFi protocols, signaling a “same risk, same rule” approach.

This may mean increased scrutiny for DeFi front-ends or specific decentralized services that act like VASPs. However, the core spirit of decentralisation remains strong, and truly peer-to-peer interactions without VASP involvement typically fall outside the rule’s scope. For more on the future of DeFi, explore our DeFi section.

Can I Still Trade Anonymously? 👻

For significant amounts, through regulated VASPs, the answer is increasingly no. That’s the whole point of the rule. For small, truly peer-to-peer transactions that don’t touch a VASP, some level of anonymity might persist. However, the use of privacy coins and mixing services is under increasing scrutiny, and regulators are actively working to unmask illicit activities. The days of moving large sums of crypto entirely under the radar are rapidly coming to an end. It’s time to accept it and adapt.

What Happens if an Exchange Isn’t Compliant?

If a VASP isn’t compliant, they face serious consequences. We’re talking massive fines, regulatory crackdowns, and potentially being shut down. For you, the user, it means your funds could be frozen, or your transfers rejected. Don’t risk your money with non-compliant exchanges. Stick with the ones that play by the rules; they’re the ones that will be around for the long haul and offer you a secure environment for Bitcoin Spot Derivatives Trading and other opportunities. Compliance for VASPs is not just about avoiding penalties, but about building trust and fostering a healthy ecosystem.

💰 The Bottom Line: Profit in a Regulated Future

The Crypto Travel Rule is not just another piece of paper; it’s a fundamental shift in the cryptocurrency landscape. It’s the moment where the wild frontier starts to look a lot more like Wall Street – but with far greater potential for explosive growth. This is about bringing legitimacy, security, and ultimately, massive institutional money into the crypto space.

For the smart, agile investor, this isn’t a threat; it’s an opportunity to dominate. Those who understand the rules, embrace compliance, and leverage the right tools and communities will not only survive but will thrive beyond their wildest dreams. Don’t be a victim of ignorance. Be a master of the market. The money is out there, waiting for those bold enough to seize it. Now, go make some fortunes!

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”